Mooners and Shakers: Why is the crypto market down today? You know why… but here’s why

The crypto market got itself a bad haircut this morning. (Getty Images)

The “truly most important FOMC” Fed meeting of our lives happened overnight (AEST). “Until the next one“, that is. Subsequently, Bitcoin and the crypto market scrambled for the first aid kit.

Inside, it found an empty roll of tape, a couple of those small circular Band-Aids, a leaky, capless tube of Betadine and a UNO card it didn’t know was missing.

Bitcoin initially pumped a bit on the news the US Federal Reserve is indeed pressing the pause button (for one month anyway) on its rate-hiking epic. But then Fed chair Jerome Powell gave his presser and things predictably fell off a cliff for crypto.

With Powell indicating the likelihood of at least a further couple of inflation-combatting interest rate hikes this year as well as pretty much zero chance of any cuts, what we have is the “hawkish pause” some/many market observers and analysts have been predicting.

So, the upshot is:

• No rate hike from the Fed in June.

• But about as much chance of rate cuts this year as Rolf Harris making a comeback album.

• The Fed’s goal is still a 2% inflation figure (it’s currently 4%).

• At least a couple more 25% rate hikes this year are likely.

• Bitcoin has lost significant technically analytical support levels (the 200 weekly MA is at about US$26.4k), but US$25k shapes as (another) line in the sand.

• Hey, China might come to the rescue with a burst of stimmies. Our very own non-fungible “Cheds” has more about that possible sugar rush here.

• You really should’ve sold out of that frog memecoin when you had the chance.

Meanwhile, over in the happier land of stonks right now, Eddy “Market Highlights” Sunarto reports that Wall Street lifted on the Fed June pause news, with the ASX likely following suit. Unless it doesn’t.

This line from Eddy’s article caught our eye:

“The bond market tells us that traders are pricing in just one more 25bp rate hike this year, despite the two rate increases that the Fed has penciled in.”

Look, we’ll take whatever crumbs we’re thrown at this point.

Top 10 overview

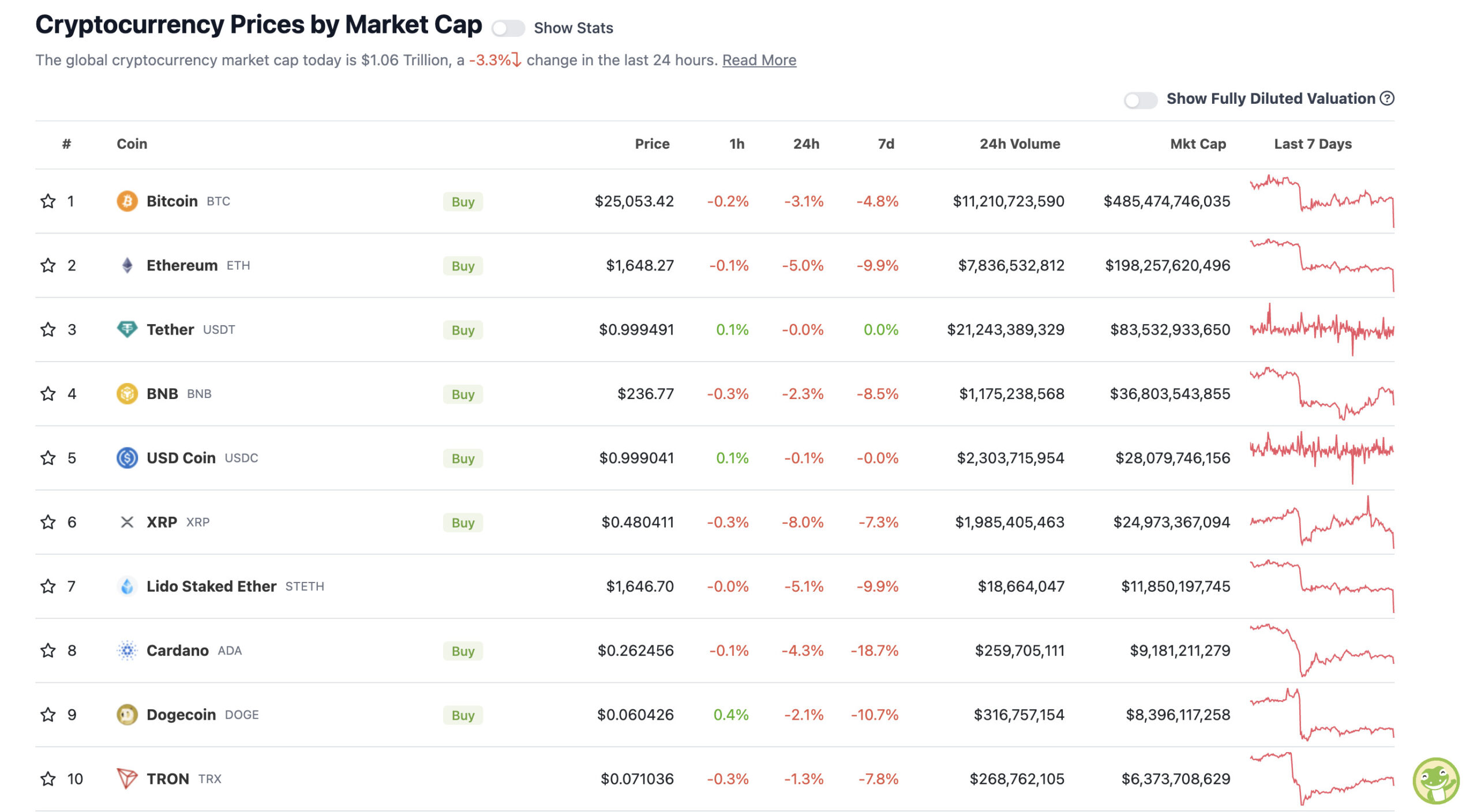

With the overall crypto market cap at US$1.06 trillion, down 3.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

There you are, then. Not one for fans of verdant charts.

XRP is the biggest daily loser today. The holders, buyers and sellers of that particular asset are likely still digesting the release of the Hinman emails, that have bearing on the ongoing SEC vs Ripple case.

What’s clear at this point, however, is that the regulatory stance around crypto assets as securities or otherwise, remains as murky as the Murray River.

The Hinman emails have been released and they largely prove up what everyone already knew: There is a regulatory gap and Congress must act. Not only that, but some of the emails make it clear that the @SECGov is more concerned about maintaining and expanding its turf than in its… https://t.co/EqIowwZRKa

— exlawyer.eth/tez (@exlawyernft) June 13, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Trust Wallet (TWT), (market cap: US$347 million) +12%

• Uniswap (UNI), (market cap: US$3.3 billion) +3%

SLUMPERS

• Curve DAO (CRV), (market cap: US$486 million) -12%

• Toncoin (TON), (mc: US$2 billion) -8%

• ApeCoin (APE), (mc: US$751 million) -8%

• Radix (XRD), (mc: US$562 million) -8%

• Stacks (STX), (mc: US$687 million) -8%

• Sui (SUI), (mc: US$344 million) -7%

• ImmutableX (IMX), (mc: US$575 million) -7%

• Litecoin (LTC), (mc: US$5.3 billion) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Regulatory clarity is going to drive #Bitcoin adoption by eliminating the confusion & anxiety that has been holding back institutional investors. Bitcoin dominance will continue to grow as the #Crypto industry rationalizes around $BTC and goes mainstream. pic.twitter.com/Foq4lpderj

— Michael Saylor⚡️ (@saylor) June 13, 2023

$BTC 1D

We’ve finally entered support. This is where a reversal will form if we get one.

My notes are volume is low which is generally a bullish indication for a reversal.$SPX & $DXY providing lots of macro bull confluence as well.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/4NlVweMOWp

— Roman (@Roman_Trading) June 14, 2023

#BTC is up 60% this year.

Bitcoiner:

https://t.co/xCkTdYgc3l— naiive (@naiivememe) June 13, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.