Mooners and Shakers: Synthetix surges; Bitcoin, Ethereum and other cryptos lick wounds

Getty Images

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

The crypto market has a sore tongue licking its wounds since being bear-mauled on Saturday harder than Leo DiCaprio’s character in The Revenant. That said, BTC, ETH and pals, especially Synthetix, have bounced back into the new week.

If you’re still here, still invested in crypto in some way, you’re hopefully not too “REKT” by one of the very worst sell-offs in crypto history. Apparently only May 2021’s major dumpage was heavier than the latest chapter in all this carnage.

But if you’re a true believer, then maybe, hopefully, you’re in a position to see it all as an averaging-in opportunity over time.

#bitcoin OGs during the crash pic.twitter.com/YqPhWe6L1a

— Lark Davis (@TheCryptoLark) June 20, 2022

The past 24 hours have reportedly seen more than US$250 million liquidated in the market. Interestingly, the majority (more than 63% of those losing their positions) have been traders shorting Bitcoin and Ethereum.

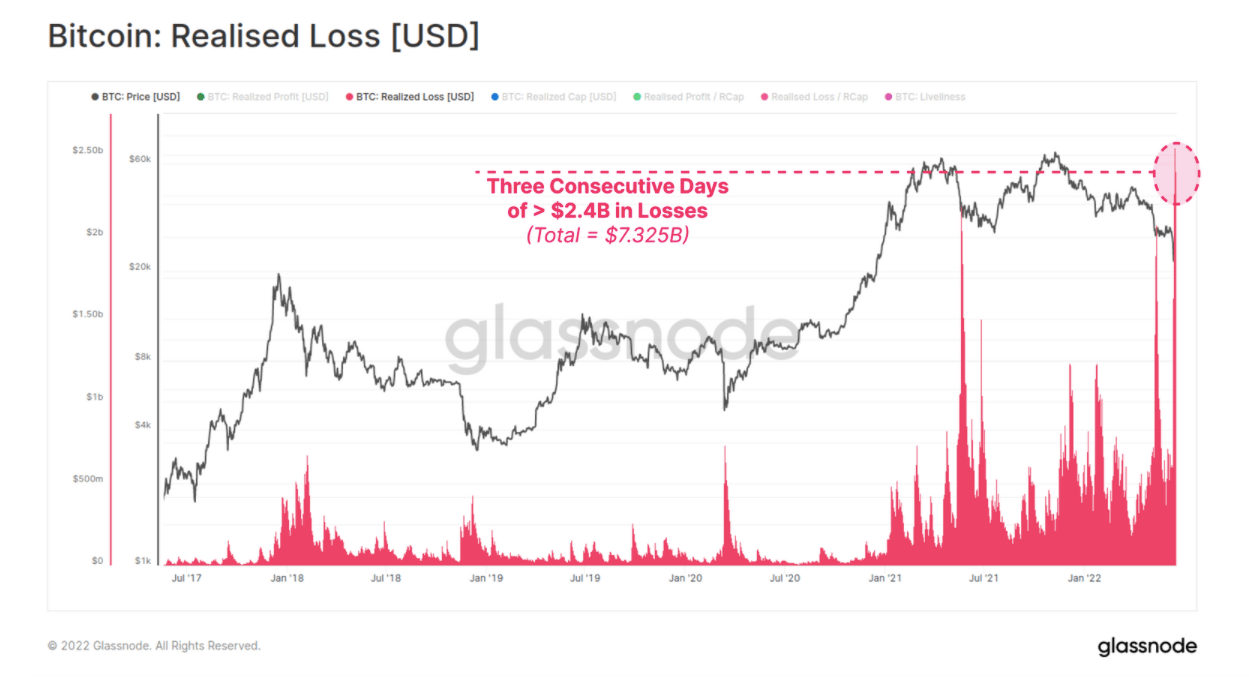

Longing or shorting aside, though, as the YouTuber, investor and analyst Lark Davis points out, the total realised BTC losses over the past three days “are staggering”. It amounts to more than US$7.3 billion in BTC losses notched up in that time.

On-chain analytics firm Glassnode has all the brutalisation neatly recorded for you in pretty charts here…

But what about all those bottoming out signals analysts have been pointing out? In theory, you’d think much of them would still apply, such as the now lowest-ever Bitcoin relative strength index (RSI) reading.

They probably do need to be taken with an extra grain of salt at this point, though, as the macro-bearish elements continue to push not only crypto, but stonks, into unchartered territory.

More than 90% of stocks in the S&P 500 declined today.

It's the 5th time in the past 7 days.

Since 1928, there have been exactly 0 precedents. This is the most overwhelming display of selling in history.

— Jason Goepfert (@jasongoepfert) June 16, 2022

And that’s territory for crypto that’s seen some Bitcoin miners forced to sell off their holdings (about 9,000 of their BTC sold in the past seven days), plus all-time highs from previous bull cycles breached – for both Bitcoin and Ethereum – although BTC is currently back above its near US$20k level from 2017.

What’s been causing the sell-off? Aside from the much-discussed macro/inflation/war/recession/Fed factors, the “crypto contagion” brought about by the Terra LUNA implosion is still playing out. Celsius, Three Arrows Capital… what/who next?

Former BitMEX (crypto exchange) CEO Arthur Hayes actually thinks a large institutional entity – Canada’s Bitcoin Purpose Exchange Traded Fund (ETF) – triggered the latest selling pressure through its own forced liquidations…

1/

BTCC – Purpose ETF puked 24,500 $BTC into the North American Friday close. I'm not sure how they execute redemptions but that's a lot of physical BTC to sell in a small time frame. pic.twitter.com/BY7foKdPjY

— Arthur Hayes (@CryptoHayes) June 19, 2022

Do take anything Hayes says with a grain of salt, however. It probably shouldn’t be forgotten he was sentenced in May to two years’ probation with six months’ home detention after pleading guilty to a lack of anti-money laundering compliance at BitMEX.

Top 10 overview

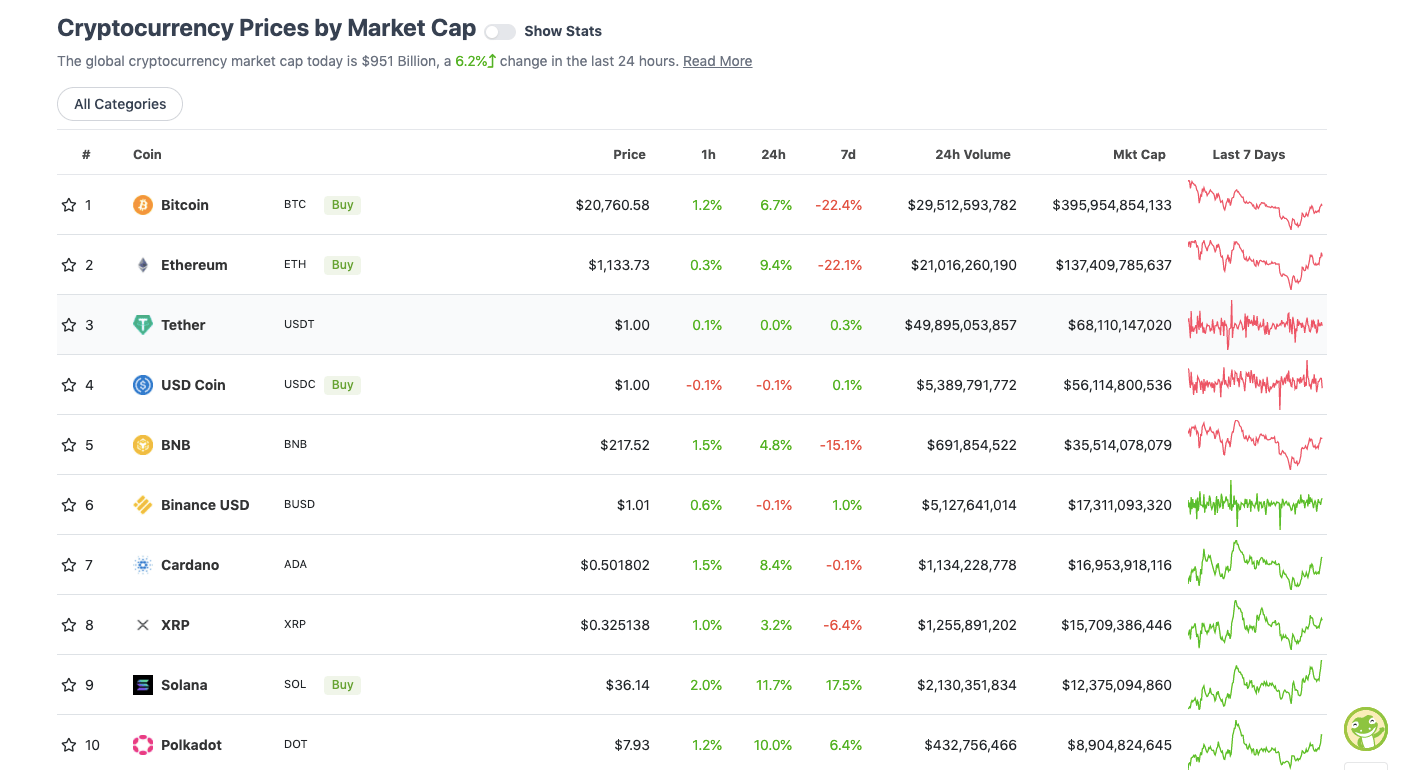

With the overall crypto market cap at roughly US$951 billion, up a relieving 6.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s nice to see the Band-Aids stemming at least some of the blood, with most of the majors over the past 24 hours recovering some losses. That said, it’s also kinda funny how much of the market was seemingly freaking out about Bitcoin’s price at this level a week ago, calling for US$13k or lower, but is today in a much better mood at pretty much the same spot.

For reference, Bitcoin (BTC) crashed to as low as US$17,760 on Saturday, whereas no. 2 crypto Ethereum (ETH) staggered to US$897 – both levels not seen in around 18 months.

Is that it, then? Sideways and up only now? As Hayes points out, the potential for the market to experience similar “pockets of forced selling”, ie. more price pain, still remains pretty high.

“Given the poor state of risk management by cryptocurrency lenders and over generous lending terms, expect more pockets of forced selling of $BTC and $ETH as the market figures out who is swimming naked,” wrote the former BitMEX man.

4/

Is it over yet … idk. But for those skilled knife catchers, there may yet be additional opportunities to buy coin from those who must whack every bid no matter the price.

— Arthur Hayes (@CryptoHayes) June 19, 2022

Meanwhile, regarding Bitcoin’s bottom, crypto’s favourite topic at the moment, here’s some non-professional financial advice from the analyst Rekt Capital…

Trying to time the absolute #BTC bottom will make you lose sight of the fact that BTC is already in the generational bottoming out phase of this cycle$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) June 20, 2022

Many #BTC indicators are suggesting that we are close to an absolute bottom in this macro bottoming period

But the more confluence we get, the more there is an emotional urge to focus on the one or two metrics that suggest that $BTC could go lower

Dollar-Cost Averaging helps

— Rekt Capital (@rektcapital) June 20, 2022

Aside from some strong recovery on various top coins today, one other thing catching our eye in the “crypto majors” is the battle of the two top stablecoins – Tether (USDT) and USD Coin (USDC), with the latter consistently gaining market share just lately…

https://twitter.com/Pentosh1/status/1538909375288553475

Uppers and downers: 11–100 – Synthetix surges

Sweeping a market-cap range of about US$7.9 billion to about US$341 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Synthetix Network (SNX), (market cap: US$607 million) +58%

• ApeCoin (APE), (mc: US$1.39 billion) +22%

• STEPN (GMT), (mc: US$467 billion) +21%

• Aave (AAVE), (mc: US$833 million) +17%

• Elrond (EGLD), (mc: US$1.3 billion) 16%

Synthetix (SNX), one of DeFi’s OGs, is having a particularly green day today, on the back of it becoming the third-largest protocol in crypto by trading-fee consumption.

The platform, founded by Sydney’s Kain Warwick (elder brother to Illuvium’s Kieran, Grant and Aaron) has seen a big rise in trading volumes and revenues over the past seven days or so.

.@synthetix_io has been doing $100M+ volume daily, why the sudden increase in volume you ask?

Here's a thread on Synthetix atomic swaps⚛️🧵

— ΔLΞXΔNDΞR (@0x_____________) June 19, 2022

Is it making a comeback, then? Like much of the decentralised finance sector, the platform, which mints and trades synthetic assets (a combo of cryptos and traditional derivative assets), is well down from its all-time high – 90% down, in fact.

According to Crypto Briefing, the spike in trading-fee usage translates to a surge in profits for SNX stakers, which has sent the token’s staking yield soaring to 60.2% APY.

I’m not going to bet we flip Ethereum but this is a pretty ludicrous table. pic.twitter.com/absBhqhdCS

— kain (@kaiynne) June 20, 2022

DAILY SLUMPERS

• FLEX Coin (FLEX), (market cap: US$465 million) -2%

• Chain (LEO), (mc: US$1.78 billion) -2%

• TRON (TRX), (mc: US$5.67 billion) -2%

• Helium (HNT), (mc: US$1.16 billion) -1%

Around the blocks

To finish, a selection of randomness that stuck with us on our journey through the Crypto Twitterverse over the past few days…

“Bitcoin will never go below 20k again in my lifetime”

Bitcoin: “hold my drink” pic.twitter.com/15i98SjnPz

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) June 18, 2022

#bitcoin Fear & Greed

LOWEST rating EVER 🔥😱🔥 pic.twitter.com/uRzlXA7m7r— Tom Crown (@TomCrownCrypto) June 18, 2022

New investors seeing a bear for the first time pic.twitter.com/WTrCYwqH2w

— Sven Henrich (@NorthmanTrader) June 18, 2022

YES pic.twitter.com/nk4bvadDZ8

— ₿itcoin Meme Hub 🔞 (@BitcoinMemeHub) June 18, 2022

For the record, from my inception trading cryptos I have stated my belief there is a 50% chance $BTC goes to $100k, $500K, $1MM, you name it; and, a 50% chance it becomes basically worthless.

My opinion has not changed— Peter Brandt (@PeterLBrandt) June 18, 2022

It is with pride that I declare myself as agnostic on markets that I trade

— Peter Brandt (@PeterLBrandt) June 18, 2022

As @saylor says, #bitcoin is energy. https://t.co/gFlEeM7FXA

— ₿ Raider (@BitcoinRaider) June 20, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.