Apollo’s Moonshots: Want DeFi yield while managing liquidation risk? Backd Protocol could be the way

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Capital, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

With the bear market in full ravage mode over the weekend, even cryptos with solid fundamentals might be described as “moonshots” right now, with many top coins down close to, or more than, 90 per cent from all-time highs. Nevertheless, this column will aim to keep identifying possible great opportunities.

And one of those, according to Apollo’s David Angliss, could be Backd Protocol.

Backd – DeFi loans, yield and protection

So what is Backd Protocol and what makes it different and potentially robust in a bear market like this one?

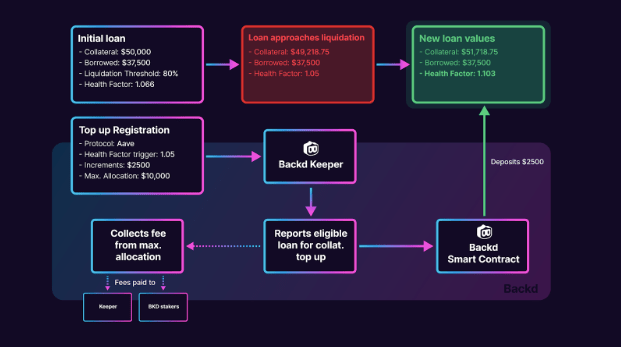

“Essentially Backd is a DeFi protocol that gives people peace of mind when they’re using something like Aave [a DeFi liquidity protocol ‘blue chip’],” says Angliss. “It’s a way of protecting yourself from getting liquidated and earning yield at the same time.”

And how that works, he explains, is if you’re taking a collateralised lending position… for example, depositing some stablecoin assets on Aave, and borrowing some ETH… what you can do is deposit into Backd and earn yield on the stable tokens you’ve deposited.

“But the thing is, it also picks up that you’ve entered a position in Aave, and it lets you configure parameters to protect you from getting liquidated,” adds the Apollo analyst. “So you can set a health-rating trigger. If it drops to a certain level you can elect to use all of those stable tokens that you’ve deposited, earning yield, to protect your loan – or you could use 50%, for example.”

The Aave connection

Angliss is enthusiastic about Backd’s strong connection with Aave (AAVE), which he also believes is another potential great buy at bear-market prices.

“While alternative layer 1 protocols have become popular and did very well last year, people might be overlooking the fact that Aave, for instance, is one powerful application that expands across multiple chains,” notes Angliss.

“And there’s a lot of value in that. It’s been dubbed the ‘fat application thesis’, which is a kind of counter narrative to over-investing in multiple different L1 protocols.”

Sometime in the next 1-2 years, there will be a flippening from "fat protocol thesis" to "fat application thesis". The space is way overinvested in L1 copycats https://t.co/gR1bV3qpgP

— Hasu⚡️🤖 (@hasufl) May 30, 2022

So Backd Protocol is supported by Aave… and who else?

“It’s supported by Aave and Curve,” says Angliss. “The project made an announcement just recently about its latest raise, which was US$3.5 million, and included VC names such as Spartan and Maven 11. We’re in there, too, with about a ticket size of US$250k-US$300k.

“We filter our projects hard, but we feel this one fits really well in our DeFi assets category.”

Today we are excited to announce that Backd has raised over $3.5 million in our latest round 🏦

The round was led by @BlockchainAG and also included @TheSpartanGroup, @Maven11Capital, @StruckCapital, @ApolloCapitalAU, and Divergence Ventures 👏https://t.co/j4Juiu2qJ6

— Mero (@merofinance) June 7, 2022

But DeFi’s a risky play in general in this market, right?

Angliss definitely concedes that DeFi on the whole is pretty risky, particuarly at this time…

“This bear market is pretty savage, so on the whole, we’re not topping up our DeFi positions just yet, but we’re still actively buying the majors – Ethereum and Bitcoin.

“ETH being below its all-time high from the previous bull cycle, and Bitcoin dipping under its old ATH, too – it’s pretty much unprecedented. That’s never happened in full crypto cycles before. Obviously there are a lot more macro bearish economic factors at play.

“Our focus is on Bitcoin and ETH for now. But there are still good opportunities elsewhere in the market, with the caveat that not all of DeFi will make it.

“But I think if you can survive and just keep dollar-cost averaging into the very good opportunities… the most fundamentally sound crypto assets, then that could play out well.”

And Backd Protocol is in that category?

“Yes, although it doesn’t actually have a token to buy as yet.”

If a Backd token is of interest to you, you’ll need to keep an eye out on the project’s Discord, Twitter and/or website for a token-sale whitelist or public-sale announcement when they happen. And in the meantime, more info on the project can be found here.

Apollo’s thoughts on Celsius and the bear market

Apollo Capital steers clear of investing into “CeFi” (centralised finance) crypto protocols, such as the lending platform Celsius. Like Terra LUNA before it, and now the major crypto hedge fund Three Arrows Capital (3AC), Celsius appears to still be in major financial/liquidation hot water, having recently suspended withdrawals, swaps and transfers for all users.

Apollo’s CIO Henrik Andersson recently reiterated the firm’s stance on CeFi:

“Our investment thesis is a strong proponent of the Decentralised Finance (DeFi) values. These are transparency, self-custody of funds and trusting code. Because of these values, we are reluctant ever to use or invest in CeFi assets.”

Andersson said that the recent actions of Celsius and the “opacity” of its CeFi infrastructure have caused uncertainty for its users and pointed to centralisation risks outlined in Apollo’s Yield in Crypto Report, in the ‘How Does CeFi Lending Work?’ section.

As for investment firm’s health and bear-market investing thesis, Andersson noted:

“This is not the first time we have invested in a bear market at Apollo. Our cash reserves are at very healthy levels, and we are well prepared to take advantage of opportunities. We have found that the best approach to these kinds of markets is to average into positions when fear is at its maximum, focusing on high-quality assets.

“We know that the high-quality assets with strong fundamentals will survive and thrive once the storm blows over. This is an important point; not all assets will survive a bear market, and it is more important than ever to be an active manager. Even though we can’t be sure about the timing, we know that the market will recover.”

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.