Apollo’s Moonshots: Strength in Maker, Convex opportunity and LUNA-crash silver linings

Moonshot? Terra not-so firma? Maybe somewhere in between this week. (Getty Images)

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Capital, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

The Terra LUNA implosion sent shockwaves right across the crypto landscape, and if you hold digital assets of any kind, your portfolio’s definitely felt it.

While Apollo Capital’s funds didn’t go unaffected, the firm says its risk-management framework was at least able to contain the losses and successfully limit the damage. That, and the fact that the vast majority of its DeFi based investments are centred around Ethereum, with not so much placed into rival networks.

In a blog post, Apollo recently shared its perspective on exactly what happened with the UST dollar-depegging and the fall of LUNA, as well as details about how they swiftly moved into damage control.

Moving beyond this “Black Swan event”, David Angliss confirms the Apollo team has de-risked its exposure in its market-neutral funds and have exited other stablecoins that might be considered to carry similar risks to UST.

“We’ve increased our positions in fiat-backed stablecoins and Dai, away from the more experimental undercollateralised algorithmic stablecoins,” Angliss told Stockhead in a chat late last week.

Return of the DeFi king: MakerDAO

“One thing the Terra event has shown is that Dai (DAI), the longest-running decentralised stablecoin, is still the strongest,” Angliss emphasised.

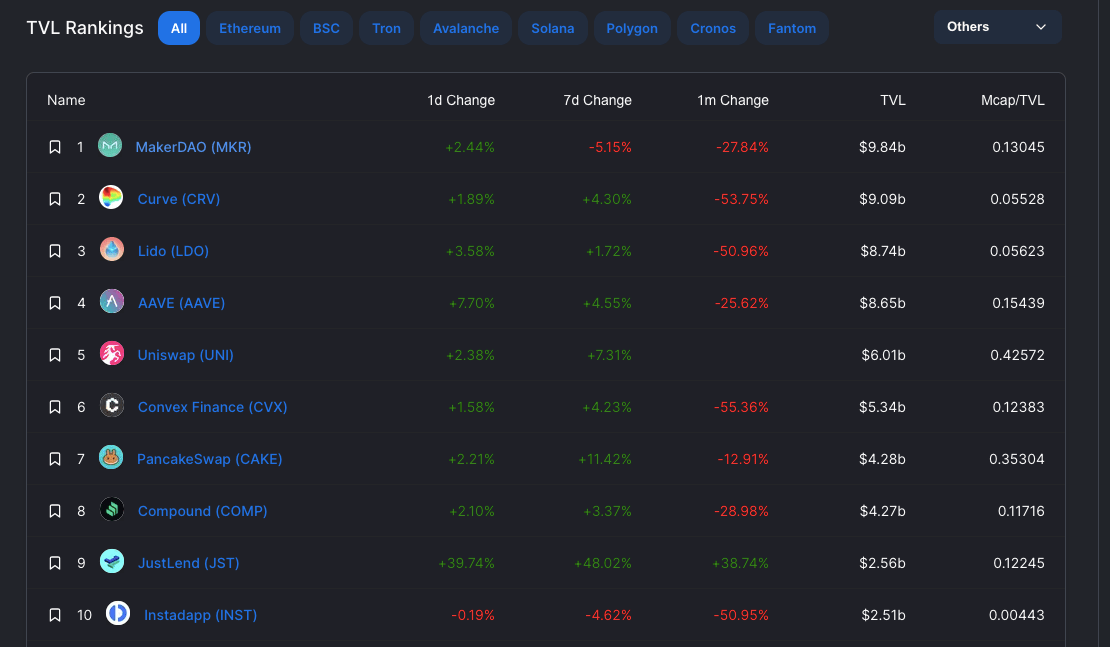

In the midst of the widespread fallout, in which some other stablecoins (briefly including Tether) also managed to depeg, Angliss said that MakerDAO (MKR) has managed to turn crisis into opportunity, returning to the top of the TVL (total value locked) rankings for DeFi systems.

Based on Ethereum, MakerDAO is the protocol that issues the Dai stablecoin and facilitates non-middleman collateral-backed loans (in the form of ETH and other tokens), which is a system that serves to back the value of the token and maintain its US dollar pegging.

“It’s not completely without fiat backing,” points out Angliss, “as a large part of its collateral is in the form of USDC [about 34% at the time of writing]”.

That said, collateralised debt is a very different system from the likes of the centralised, fiat-backed USDC and USDT, and also very different from Terra’s collapsed LUNA/UST protocol.

As Angliss says, MakerDAO’s return as the DeFi king is very much “a case of time in the market beats timing the market”.

“Moonshot” opportunity? Like just about every cryptocurrency, the MKR governance token is a very long way down (-77%) from its all-time high. It’s currently changing hands for US$1,434 and peaked around US$6,292 about a year ago.

But maybe it’s more of a down-to-earth shot. Angliss believes what’s happened represents “a reality check moment” for the industry and that Maker’s strong return to favour proves that “sound fundamentals matter in the long run”.

Post Terra terror silver linings?

So, are there any positives to be drawn from the Terra ecosystem crypto crash? Angliss says Apollo have found some silver linings…

• “People talk about Anchor Protocol [Terra’s yield-generating lending and borrowing platform] being the main reason for the crash, because they were offering an APY that was unsustainable, but that’s not necessarily true.

“Anchor’s higher-than-average APY can be considered marketing spend by Terraform Labs to attract users, similar to protocols that offer liquidity-mining incentives.

“The main reason for the crash was the breakdown of the algorithmic backing mechanism that ultimately caused the UST depegging, confidence loss and death spiral.”

• “And it’s lucky that it happened earlier than later. An ecosystem crash of US$50 billion is bad but something like US$100 billion would have been way more catastrophic.”

• “The other thing is, it’s been a year since Bitcoin peaked at around US$68k… yes it hit US$69k in November, but only stayed there a day or two. It’s a silver lining that this has happened at a stage that’s more likely nearer the bottom than not.”

• “And to that point, I can tell you that with our directional long funds, we’re definitely accumulating our favourite assets right now… I think the Ethereum Merge [from a proof-of-work protocol to proof-of-stake] will be the catalyst that could turn things around – it’s a consensus we’re fully in a bear market and have been for a while.”

Convex – another potential bear-market DeFi play

We also asked Angliss if he had any good crypto-investing strategies at this time – and he emphasised the power of staking, specifically staking assets in robust protocols that offer reliable yield.

It’s clear that Convex Finance (CVX), which is is tied to the Curve (CRV) exchange liquidity pool on Ethereum, is one he has plenty of interest in.

“Convex and Curve are definitely ones that users will be incorporating in their strategies in bear-market conditions. And that’s because they’re tokens that provide good, reliable yield, with a proven ‘flywheel’-economic token mechanism.

“Like I said earlier, in relation to Maker… people are looking for strong fundamentals and reliability, especially in the market we’re in right now. And when it comes to staking, for me that’s Convex.”

We’ll aim to cover the Convex protocol in a bit more depth with Apollo in the future.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.