Mooners and Shakers: Huobi pumps harder on acquisition news; Bitcoin steady as inflation data looms

"CPI prediction? Dunno, you tell me." (Getty Images)

The crypto analysis we’re seeing is pretty mixed today as investors and traders await the latest US inflation data – the CPI reading. Meanwhile, Bitcoin is steady above US$19k at the time of writing and Huobi (HT) is surging.

The first clue as to how the big-picture inflation data might spew out has already arrived, with the Producer Price Index (PPI) figures. They’re a little “hot”, although a bit conflicting as well (see tweets below).

The critical inflation test will be the Consumer Price Index (CPI) report, though, as that will have the largest bearing on the size of the Fed’s upcoming rate hikes. That report circulates late this evening (AEDT), some time around 11.30pm.

🔥 – BREAKING:

US Core PPI comes in at 8.5%, forecast 8.4% and previous 8.7%.

MoM is 0.4%, 0.2% higher than forecasted.

Core PPI comes in at 7.2%, lower than forecasted at 7.3%.

Conflicting numbers.

— Michaël van de Poppe (@CryptoMichNL) October 12, 2022

Heads up!

We have US Consumer Price Index (CPI) on Thursday at 8:30 am EST. It usually triggers more volatility than PPI, so keep that in mind.

The forecast is 8.1% YoY. Above forecast is bearish, below is bullish.

8-8.2% and we probably get volatility in both directions.

— Justin Bennett (@JustinBennettFX) October 12, 2022

We could get “volatility in both directions”, according to analyst Justin Bennett, who is watching the S&P 500’s tentative support right now as well as Bitcoin, with both just about hanging in there for the moment.

This is the S&P 500 support to watch. 👀 Compliments of @TAWithMichael, one of our Discord mods. 🔥

Not difficult to imagine a relief rally from here, but a lot is riding on Thursday's #CPI.

3,575 is the level to hold.$SPY $SPX #stocks #crypto pic.twitter.com/nccuBHYBgK

— Justin Bennett (@JustinBennettFX) October 12, 2022

Onto some general daily crypto price action.

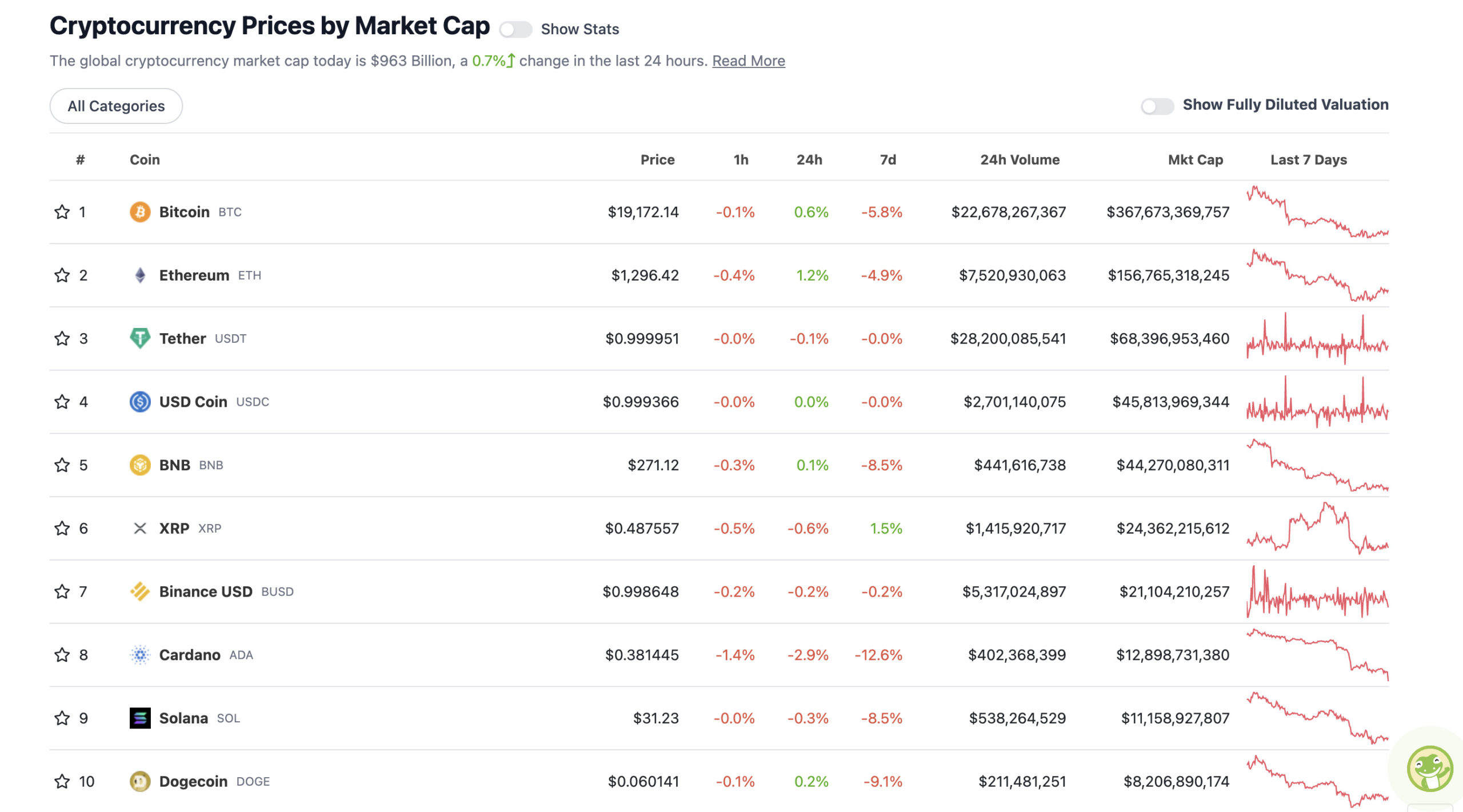

Top 10 overview

With the overall crypto market cap at US$963 billion, up a fraction of a percentage point since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Crypto market bellweathers Bitcoin and Ethereum are both barely in the daily green, however, the top layer 1 protocols BNB, Cardano, Solana are having a bit of a rough week price-wise.

The BNB Chain, as reported last week, suffered a large bridging hack and has been looking to recover and move on as best it can ever since.

The blockchain has actually now implemented a hard fork upgrade in an attempt to fix the cross-chain vulnerability that drained more than US$100m worth of funds from the platform.

Following the large hack with over $100M stolen from #BNB chain last week, @bnbchain has done a hard fork upgrade.💥

This upgrade called Moran is an attempt to recover and further secure the infrastructure.👌

Quite a good move by #Binance. What do you think about this upgrade?

— Bonsai (@bonsai_trade) October 12, 2022

Uppers and downers: 11–100: Huobi’s HT token surges

Sweeping a market-cap range of about US$7.1 billion to about US$398 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Huobi (HT),(market cap: US$928 million) +33%

• Terra (LUNA), (mc: US$466 million) +17%

• Celsius (CEL), (mc: US$429 million) +14%

• Hedera (HBAR), (mc: US$1.6 billion) +8%

• OKB (OKB), (mc: US$4.1 billion) +6%

The Huobi crypto exchange’s HT token continues to tear its way up. It’s made a 33%+ charge over the past 24 hours and is up 73% on the week.

Its acquisition news seems to have sent the token into overdrive, with a new controlling shareholder – Hong Kong’s About Capital Management – about to make itself comfy at the head of the Huobi boardroom table.

Huobi founder Leon Li has sold his entire 60% stake in the company, with some reports suggesting for as much as US$3 billion.

Founder of the TRON (TRX) blockchain Justin Sun was rumoured to be the major buyer in this change of hands, but has since clarified that his involvement with the exchange is as an adviser.

Will China allow cryptocurrency? @justinsuntron, founder of @trondao and now adviser for @HuobiGlobal, joined “First Mover” to discuss why he’s “optimistic” the country could end its ban and his plans for the exchange. @_franvela reportshttps://t.co/vQbyBn7lE3

— CoinDesk (@CoinDesk) October 11, 2022

Sun, however, told CoinDesk that he isn’t ruling out the possibility of one day owning the exchange himself and expressed optimism that it, and the crypto industry at large, could one day make a triumphant return to mainland China.

Crypto is in a “world trend”, said Sun, adding: “That’s why China [will] definitely be one of the most stronger (sic) players in the blockchain industry… even [if] we might have some setback or regulation hurdle in the short term. In the long term, I’m highly optimistic.”

DAILY SLUMPERS

• TerraClassicUSD (USTC), (market cap: US$432 million) -25%

• Evmos (EVMOS), (mc: US$457 million) -8%

• Maker (MKR), (mc: US$826 million) -6%

• Lido DAO (LDO), (mc: US$862 million) -5%

• Klaytn (KLAY), (mc: US$510 million) -4%

Around the blocks: 21Shares launches BTC ETP in Dubai

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

We’ve seen some pretty decent news for the crypto industry this week (e.g. Google, BNY Mellon) and this isn’t bad, either. The Middle East has been shaping as a potentially major player in the adoption of crypto, including at an institutional level.

According to a Reuters report, the major crypto investment products firm 21Shares has now listed a Bitcoin exchange-traded product on the Nasdaq Dubai, making it the Middle East’s first physically-backed Bitcoin ETP. And that requires the firm to take custody of the actual BTC asset as opposed to providing exposure through derivatives or swaps.

📍The Middle East has welcomed #Dubais 🇦🇪 first #Bitcoin Exchange Traded Product (ETP) on #Nasdaq Dubai by the prominent crypto investment firm 21Shares.

Just another step for Dubai paving the way as being the central hub for World #Crypto. pic.twitter.com/kAAjv9mmWU

— Crypto Rand (@crypto_rand) October 12, 2022

Look who's bullish: Corporate insiders are buying their company stock again in size during this latest sell-off. As the saying goes, insiders sell for all kinds of reasons, but they only buy for one. Given the historical accuracy of their timing, it’s a glass-half-full sign. pic.twitter.com/Z3YcJUn9Rs

— Jurrien Timmer (@TimmerFidelity) October 12, 2022

Did @CaitlinLong_ just hint at a conspiracy at the Federal Reserve? Doesn't she know that this is not allowed even if she backs it up with facts? 👀👀👀👀👀👀👀👀👀👀👀👀👀👀👀👀👀👀 pic.twitter.com/A6Kvy37qHW

— Digital Asset Investor (@digitalassetbuy) October 11, 2022

The underlying bitcoin bull case remains unchanged: adoption, as better gold. It will just take much longer to get there. pic.twitter.com/GYyOlPKTU6

— Alex Krüger (@krugermacro) October 12, 2022

this was the top pic.twitter.com/WjtV5UFtyl

— LilMoonLambo (@LilMoonLambo) October 12, 2022

Meanwhile, on Reddit… Judging by this, I’ve probably “hurt” a lot of people in my time.

Gen-Zers say they feel attacked whenever they see a 'passive aggressive' thumbs-up emoji

+ A 24-year-old on Reddit summed up the Gen-Z argument, saying it is best 'never used in any situation' as it is 'hurtful' pic.twitter.com/Jh7xiK0zC8

— Daily Mail Online (@MailOnline) October 12, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.