Mooners and Shakers: FTX contagion spreads to Genesis’ crypto lending unit and Gemini’s yield service

Coinhead

Coinhead

Bitcoin and the total crypto market is holding on to a level of support or two for the moment, as the FTX fallout today continues to keep everyone on edge.

Especially those with exposure to Genesis Global Trading’s lending platform – and crypto exchange Gemini’s yield program, too.

The crypto contagion is spreading and we’re slowly seeing who’s left butt naked with Costanza-like shrinkage as the tide rolls out, or whatever it was that Warren Buffett said.

Buffett’s offsider Charlie Munger incidentally compared Bitcoin with child trafficking earlier this week. Er, righto, Mr Munger – probably not one of your best. (He’s 98 – we have to call him that.)

“It takes control, and slowly tears you apart,” wrote Genesis. The band – in 1986.

Following on from crypto lenders BlockFi and SALT halting customer withdrawals this week, along with the Japanese exchange Liquid Global, this morning’s news is that Genesis Global is the latest to catch the disease.

Specifically, the lending unit of the Genesis Trading arm, which has now also suspended withdrawals from that part of the platform.

Citing “extreme market dislocation” caused by FTX’s collapse, the Genesis Global Capital lending entity is “pausing new loan originations and redemptions” – per a series of tweets from the Genesis firm overnight (AEDT).

The firm maintains that other parts of the company are still in a solid state, including its spot and derivatives trading services, which remain fully operational.

The default of 3AC negatively impacted the liquidity and duration profiles of our lending entity Genesis Global Capital. Since then, we have been de-risking the book and shoring up our liquidity profile and the quality of our collateral.

— Genesis (@GenesisTrading) November 16, 2022

Our #1 priority is to serve our clients and preserve their assets. Therefore, in consultation with our professional financial advisors and counsel, we have taken the difficult decision to temporarily suspend redemptions and new loan originations in the lending business.

— Genesis (@GenesisTrading) November 16, 2022

While everyone in the crypto industry must surely be getting a bit numb to this sort of news by now, it’s potentially a bit of a big deal this one.

As the Blockworks news site’s founder Jason Yanowitz tweets, it’s significant because Genesis operates crypto’s largest lending desk and is part of Digital Currency Group (DCG), which, like FTX has far-reaching tentacles across the industry.

2/ At the height of the market, Genesis was moving SIZE.

Check out these Q4 2021 numbers:

– $50B in loan originations

– $12.5B active loans

– $31B spot volume traded

– $21B derivatives traded pic.twitter.com/AiW8uLPcwt— Yano 🟪 (@JasonYanowitz) November 16, 2022

Blockworks’ Yanowitz goes on to further explain in his thread why the Genesis news is so bad.

And it’s because “dozens of companies like Gemini [the big Winklevoss twins-owned crypto exchange] use Genesis to help their consumers earn yield. If you’re a CeFi platform that offers yield, you probably use Genesis,” he writes.

In other words, it’s potentially a lot of companies with a lot of exposure to another big player in a lending and borrowing system to create yield, that could all be unravelling behind the scenes.

And what about Gemini, then – not Genesis – Gemini?

As a result of Genesis pausing its lending business, the Gemini exchange has now halted its Earn program, which is a way for its customers to earn yields of up to 8% annually on their deposited crypto.

Assets in that program are supposed to be available within five business days of customer request, according to Gemini.

1/6 We are aware that Genesis Global Capital, LLC (Genesis) — the lending partner of the Earn program — has paused withdrawals and will not be able to meet customer redemptions within the service-level agreement (SLA) of 5 business days. https://t.co/9e48pF3Ymn

— Gemini (@Gemini) November 16, 2022

5/6 We will continue to work with them on behalf of all Earn customers. This is our highest priority. We greatly appreciate your patience.

— Gemini (@Gemini) November 16, 2022

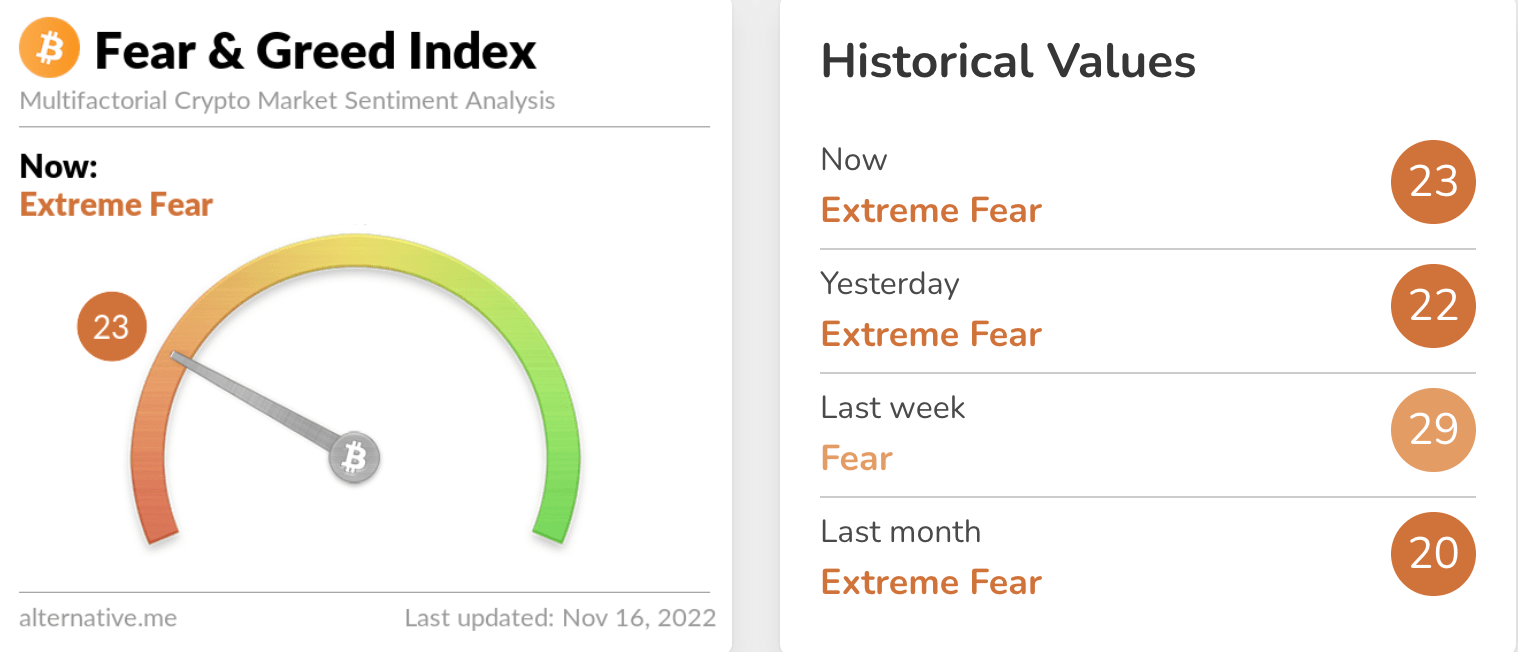

Hey, Crypto Industry, can we get a mood check right now, please?

Yep, pretty much as we thought. Seen worse, though. Let’s check in with some price action.

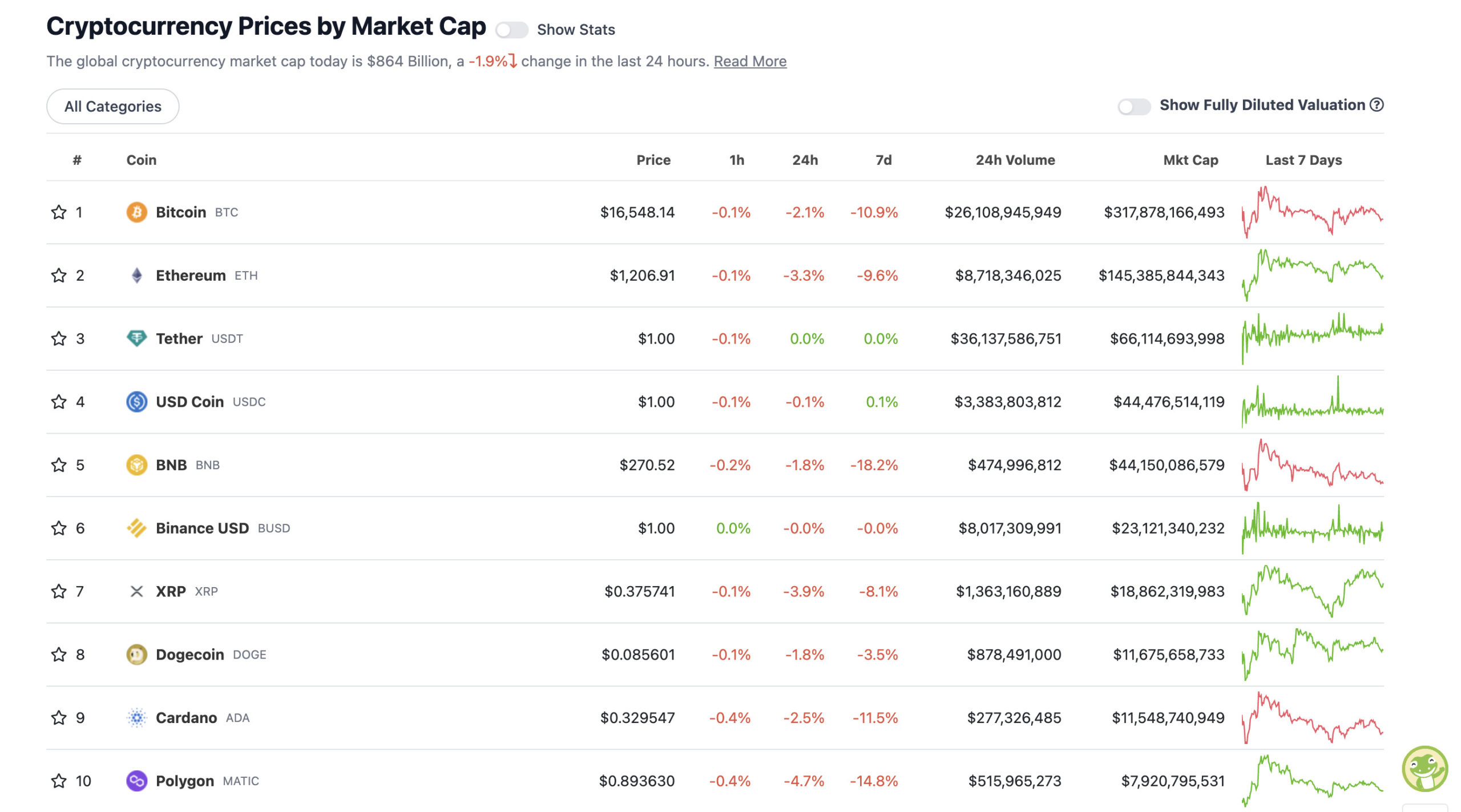

With the overall crypto market cap at US$883 billion, up 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Redness. But like the “extremely fearful” crypto market sentiment, above, it could be worse. Maybe it will be soon.

Let’s check in with some of the better known crypto-trading analysts to get their vibe. Over to you, Justin Bennett:

Heavy things drop. pic.twitter.com/HTDA5JElIF

— Justin Bennett (@JustinBennettFX) November 16, 2022

Okay. How about Roman Trading…

I’ll continue to DCA but everything I buy immediately goes to a hardware wallet.

— Roman (@Roman_Trading) November 16, 2022

Blimey. He appears to be slowly dollar-cost averaging in, though. So there’s that.

How about you, Rekt Capital?

People doubting if #BTC will experience another Bull Market is exactly what is needed for one to happen$BTC Bull Markets are built on FOMO

To FOMO into an uptrend, you need to feel you are missing out

And strong bearish convinctions will make you miss out#Crypto #Bitcoin

— Rekt Capital (@rektcapital) November 16, 2022

Sweeping a market-cap range of about US$6.67 billion to about US$320 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Aptos (APT), (market cap: US$611 million) +10%

• Trust Wallet (TWT), (mc: US$902 million) +9%

• Chiliz (CHZ), (mc: US$1.2 billion) +5%

• OKB (OKB), (mc: US$4.8 billion) +3%

• Monero (XMR), (mc: US$2.4 billion) +2%

DAILY SLUMPERS

• Tokenize Xchange (TKX), (market cap: US$577 million) -17%

• Kava (KAVA), (market cap: US$338 million) -10%

• Radix (XRD), (mc: US$476 million) -10%

• Maker (MKR), (mc: US$552 million) -7%

• Huobi (HT), (mc: US$612 million) -7%

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Yesterday, this column incorrectly assumed former FTX CEO had wrapped up his lengthy stream-of-consciousness Twitter thread. Check back in with the embattled FTX founder’s thoughts here if you can bear it.

31) And in the future, I'm going to care less about the dumb, contentless, "good actor" framework.

What matters is what you do–is *actually* doing good or bad, not just *talking* about doing good or *using ESG language*.

— SBF (@SBF_FTX) November 16, 2022

?

— Michael Saylor⚡️ (@saylor) November 16, 2022

Genesis, A subsidiary of DCG (owners of Grayscale #bitcoin Trust), has halted withdrawals!

They were the biggest $BTC OTC desk and lender in #crypto.

The impact of this could be HUGE!

— Lark Davis (@TheCryptoLark) November 16, 2022

"Man, this whole FTX fiasco really needs its own theme song."

(said no one ever)https://t.co/oCKV4VmBpH

(bid on the NFT👆) pic.twitter.com/HkftDsinRT— 16 years of song a day (@songadaymann) November 16, 2022

Oh, and there’s this:

Looks like NFL legend Tom Brady, Giselle Bundchen, NBA stars Stephen Curry and Shaquille O’Neal and about eight other high-profile celebrity endorsers are being sued in a class action lawsuit filed in the US for their part in promoting FTX.

You can read more here.

Tom Brady, Steph Curry, and Shaq are among those being named in a class action lawsuit after the collapse of FTX 😳 pic.twitter.com/TXQfZikFMT

— Guru (@DrGuru_) November 16, 2022