Mooners and Shakers: Bitcoin crabs through Septem-meh. Will it rally into Uptober?

Pic via Getty Images

- Bitcoin in the green (just) so far in September, a traditionally bad month for crypto

- Faces heavy resistance around US$60k and 100-day moving average at US$61k

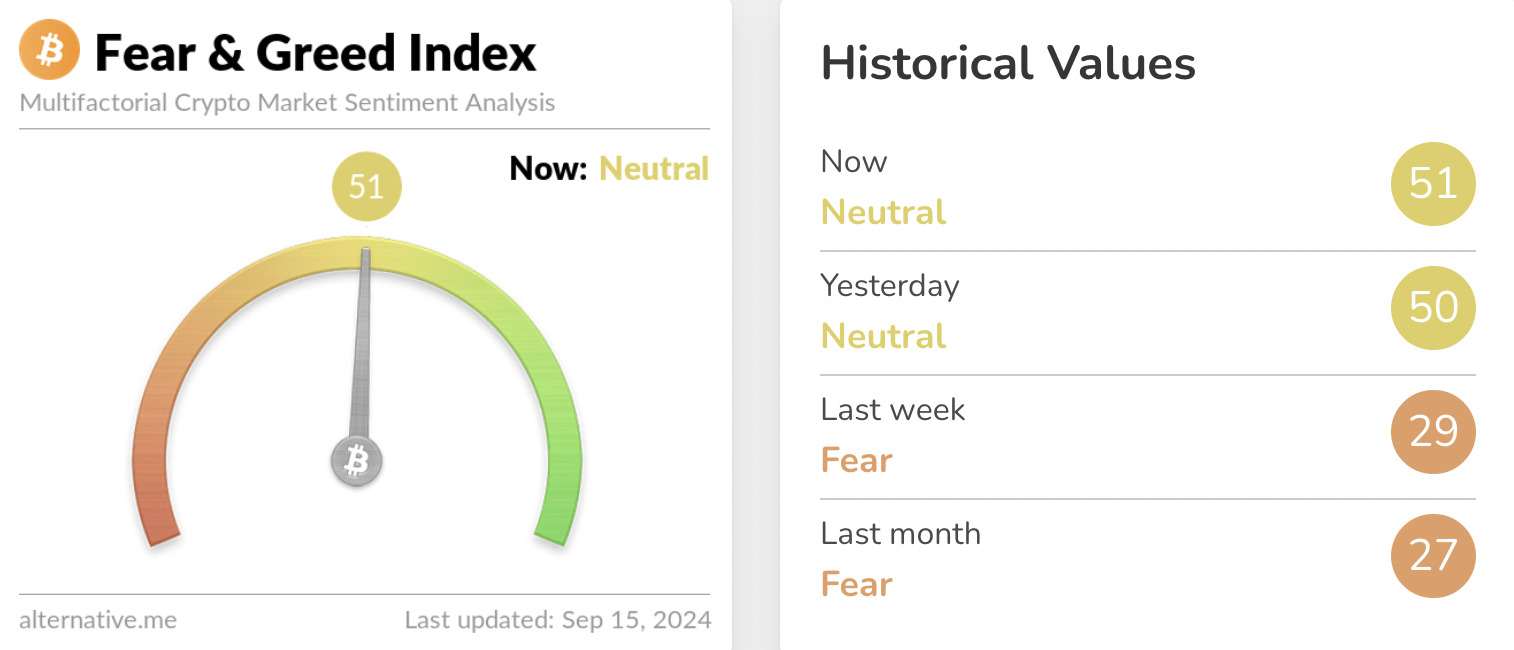

- Fear and Greed Index moves to ‘Neutral’

It’s been a while since we dusted off this column. Things, frankly, haven’t been too exciting for the casual toe-dipper in this corner of the pool for some time. That could be about to change very soon.

Where’s the crypto market at right now, then? Are the bears winning in September, also known in crypto circles as ‘Rektember’? Actually, Bitcoin’s holding its head above water for the moment in what’s a traditionally bloody month for digital assets.

In the Bitcoin monthly returns chart from Coinglass below, you can see that on average September is one of only two regular negative months for Bitcoin (-4.24%) and yet so far it’s performing a fair bit better than the fear-filled August we just endured, with a +1.6% performance at the time of writing.

No, it’s not spectacular, but we’ll take a Septem-meh.

And, ooh… how about those October (‘Uptober’) average gains, eh? Not to mention Moonvember. Yes, yes, we know – past moon missions are no indicator of future Lambos.

Just tell me the Bitcoin price, already

At the time of checking crypto portfolio, with a faint re-emerging sense of suppressed hopium, Bitcoin has inched its way back over the US$60k wall: US$60,233 (+0.86%)

It’s been struggling to get back above that level since losing it about 16 days or so ago, but this relief rally has now seen it rise more than 20% above its August low point of about $49,580.

The total crypto market cap, too, has been making a decent recovery over the past week, regaining the US$2 trillion mark it recently lost.

How’s the go-to sentiment tracker… tracking? It’s looking decidedly less fearful than just one week ago…

What are the fundamentals telling us?

This columnist is no technical analyst, hence that subhead. For TA, we’ll have to lean on a few scraps from one or two selected sources (see further below). But, what we can tell you is this.

If you’re a believer in the Bitcoin four-year cycle of halving-based bull runs, then you should probably be salivating right now.

If you don’t know what the Bitcoin halving is, here’s a very quick refresher, per the Coinhead Cryptionary of yore:

It’s an event scheduled into a blockchain protocol that serves to halve the reward of Proof-of-Work miners that operate in the network. Halvings reduce the rate at which new coins are created, effectively reducing the supply. The most notable “halving” event is Bitcoin’s and occurs every 210,000 blocks, or roughly every four years. In the past, Bitcoin halvings have subsequently resulted in price surges.

Halving fans know that the latest one occurred this year, on about April 18. Halving fans who really pay attention, will also know that bullruns past have kicked in right around about 150-160 days after the halving date.

And wouldn’t you know it, as we type this, it’s exactly 150 days post halving. Wait, what? Yep.

AND… what else is kinda special about this 150-160 days post-halving time period? Is there something significant about to happen that potentially ties in very neatly?

That’s right… The US Federal Reserve is about to hold its next meeting of minds on September 18, and the very strong feeling from the market indicates it’s AT LONG LAST about to pull out the scissors and give interest rates a much needed trim. Maybe just a bit off the sides and back – a tidy up with a serviceable 25 bps cut.

Or will it go further and opt for a number 0.50%? If so, the prospect of a ‘hard landing’ and recession fears could override what’s anticipated to be a likely rate-cut bump. All ears will be tilted towards Jerome Powell later this week. It’s only the most important FOMC meeting in the past FOUR years.

Exciting times potentially just around the corner, then, with the heavy caveat that there is also a massive sense of uncertainty pervading regarding the health of the US economy.

What else has been happening in crypto lately?

In brief, this:

• MicroStrategy, the Bitcoin-hoarding software solutions company helmed by Bitcoin Bull in Chief Michael Saylor, has added ANOTHER 18,300 Bitcoin to its treasury. It now holds $14.14B worth of BTC.

MicroStrategy has acquired 18,300 BTC for ~$1.11 billion at ~$60,408 per #bitcoin and has achieved BTC Yield of 4.4% QTD and 17.0% YTD. As of 9/12/2024, we hodl 244,800 $BTC acquired for ~$9.45 billion at ~$38,585 per bitcoin. $MSTR https://t.co/WBBRSKxA1U

— Michael Saylor⚡️ (@saylor) September 13, 2024

• The SEC – the US Securities and Exchange Commision – a major pain in the butt for much of the US crypto industry over the past couple of years, has made a startling admission. The agency has admitted faults in its use of the term “crypto asset security”, the regulator saying it won’t be using the term in future, in order to avoid confusion.

The admission came from an amended complaint filed against Binance on Sept 12, marking a head-turning concession for the SEC, which has previously asserted that the vast majority of crypto assets should be classified as securities.

Completely justifiable derision within the Cryptoverse ensues:

I genuinely can’t get over how insane this is.

The SEC used the term “crypto asset securities” eight times in the eToro settlement order they issued on THE SAME DAY they told a federal court that they wouldn’t use it to avoid confusion.

The SEC has officially jumped the shark. pic.twitter.com/mdKqVIDpQ6

— Jake Chervinsky (@jchervinsky) September 13, 2024

Expect SEC-targeted crypto entities such as Ripple, Coinbase and Kraken to pipe up pretty quick smart about this.

• Donald Trump continues to embrace the world of crypto. Whether or not you believe this is the embrace crypto needs, it’s happening anyway. The former US president, a business opportunist at heart, which is probably putting it kindly, has revealed he has plans to launch a cryptocurrency project called World Liberty Financial.

The project will reportedly feature a digital wallet, a credit account system, and stablecoin-based lending options.

No, this is not a joke.

.@WorldLibertyFi pic.twitter.com/rHEGQXl4jL

— Donald J. Trump (@realDonaldTrump) September 12, 2024

Will the Trump campaign’s positivity towards crypto prove to be an election… trump card? Time will shortly tell.

• And speaking of which, here’s a little reminder about how Bitcoin and crypto tends to perform during and just after US presidential elections…

#Bitcoin is continuing to do what it always does & I’m pretty exited about this next phase!

= $BTC Halving

= US Presidential ElectionIn each of the 3 cycles shown, #BTC rallies into the halving, chops/bleeds for a few months, moves up into the election, then moons.… pic.twitter.com/a522lahi2k

— Max (@MaxBecauseBTC) August 24, 2024

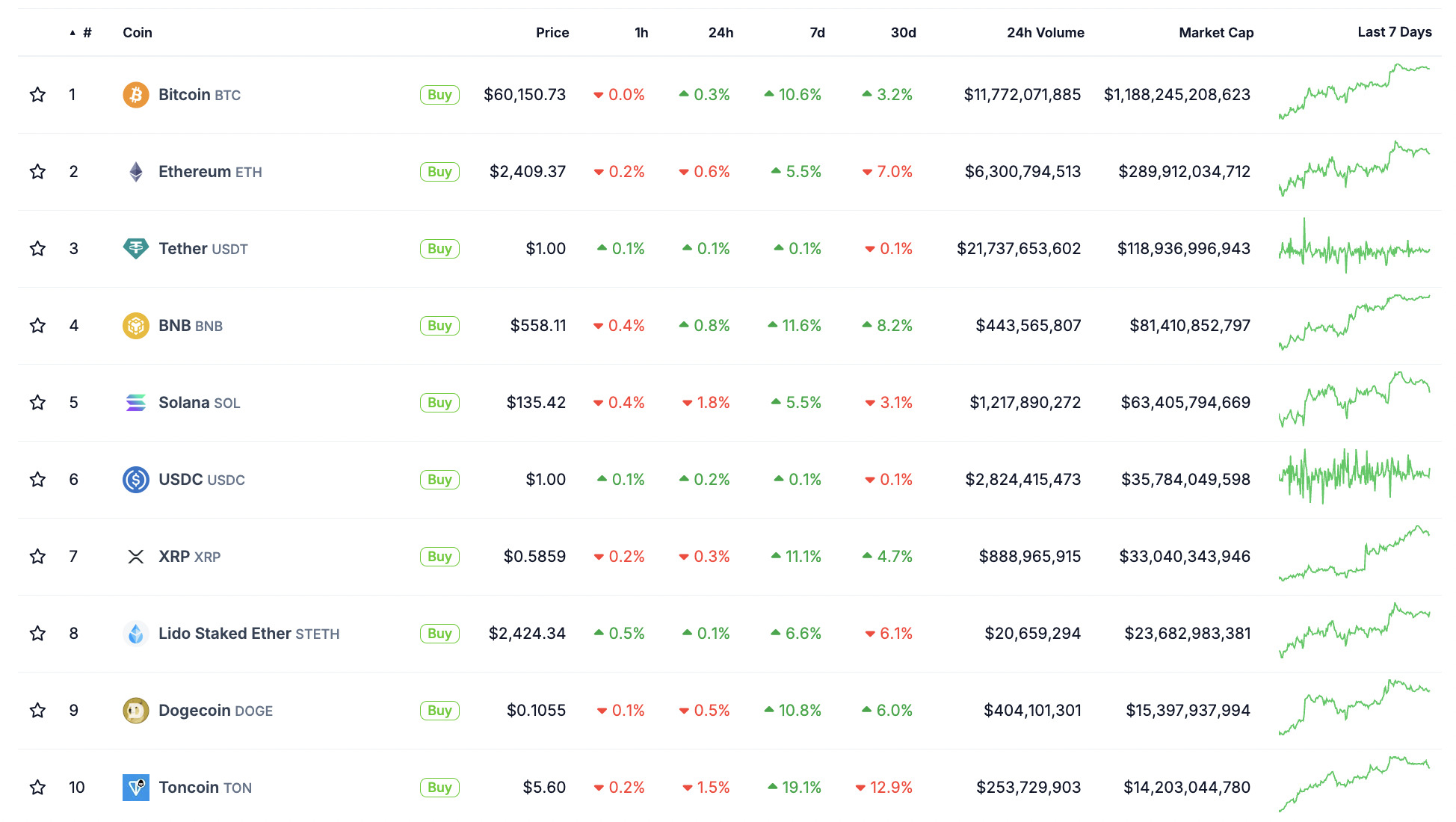

Crypto top 10

Courtesy of CoinGecko…

At the time of writing, the BTC price is trending up. Can it maintain this course this time? All other recent relief rallies have drooped pretty fast.

Bitcoin faces heavy resistance at about the US$61k mark – around the 100-Day Moving Average. Let’s hope it can bust through that level early this week.

We’ll leave you with a couple of other bullish thoughts. Have a good week.

#Bitcoin Rally Imminent?

In previous cycles, when the price retested the 50-week simple moving average , it bounced at least 40%.

On average, the bounce was 71%. If #BTC rallies 71% from here, it could reach $92,000. pic.twitter.com/e3ghGxn3NS

— Titan of Crypto (@Washigorira) September 13, 2024

Answer for yourself…

September in bull markets is

… the last buying opportunity before takeoff?

… the end of the bull run?Q4 has always been STRONG.#Bitcoin pic.twitter.com/mkkQ483cwd

— Stockmoney Lizards (@StockmoneyL) August 31, 2024

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.