Mooners and Shakers: Crypto lending firm BlockFi files for bankruptcy; Bitcoin and Ethereum steady-ish

Coinhead

Coinhead

Major crypto lending firm BlockFi has filed for bankruptcy, making it another crypto contagion casualty in the wake of the FTX implosion.

The firm has officially filed for Chapter 11 bankruptcy protection according to a press release circulated overnight (AEDT). It encompasses Blockfi and eight of its affiliates.

BlockFi joins the growing list of major (and smaller) crypto firms affected by this year’s crypto contagion that began with the collapse of the Terra Luna blockchain and ecosystem in May. Some of these include Celsius, Voyager, Three Arrows Capital and, of course, FTX, with other large entities seemingly facing difficulties, notably Genesis Global Capital.

Not looking good for BlockFi. ~$1.3bn unsecured claims outstanding with a $275mm loan from FTX U.S. ~$250mm client funds locked on platform according to today's filing pic.twitter.com/0I9MyhHZVg

— Greg (@B1ockGreg) November 28, 2022

The BlockFi news comes in a week when civil unrest is boiling over in China amid strict Covid policies, which has sent US stocks tumbling over potential, wider global economic implications. And that includes Apple (-2.63%) – for which there are concerns about a hit to its iPhone production.

Shares in publicly listed crypto and blockchain firms, including Coinbase, Riot Blockchain and Marathon Digital Holdings have fallen about 4 per cent since BlockFi made its announcement.

And here’s something… according to The Washington Post and other sources, Chinese Twitter accounts have been flooded with posts about porn and escorts in what seems to be an attempt to block or distract from news about the Chinese Covid protesting.

Yep, this is the world we live in.

Thread: Search for Beijing/Shanghai/other cities in Chinese on Twitter and you'll mostly see ads for escorts/porn/gambling, drowning out legitimate search results.

Data analysis in this thread suggests that there has been a *significant* uptick in these spam tweets. pic.twitter.com/Ao46g2ILzf— Air-Moving Device (@AirMovingDevice) November 28, 2022

So, how’s the cryptocurrency market faring, then? Let’s take a look.

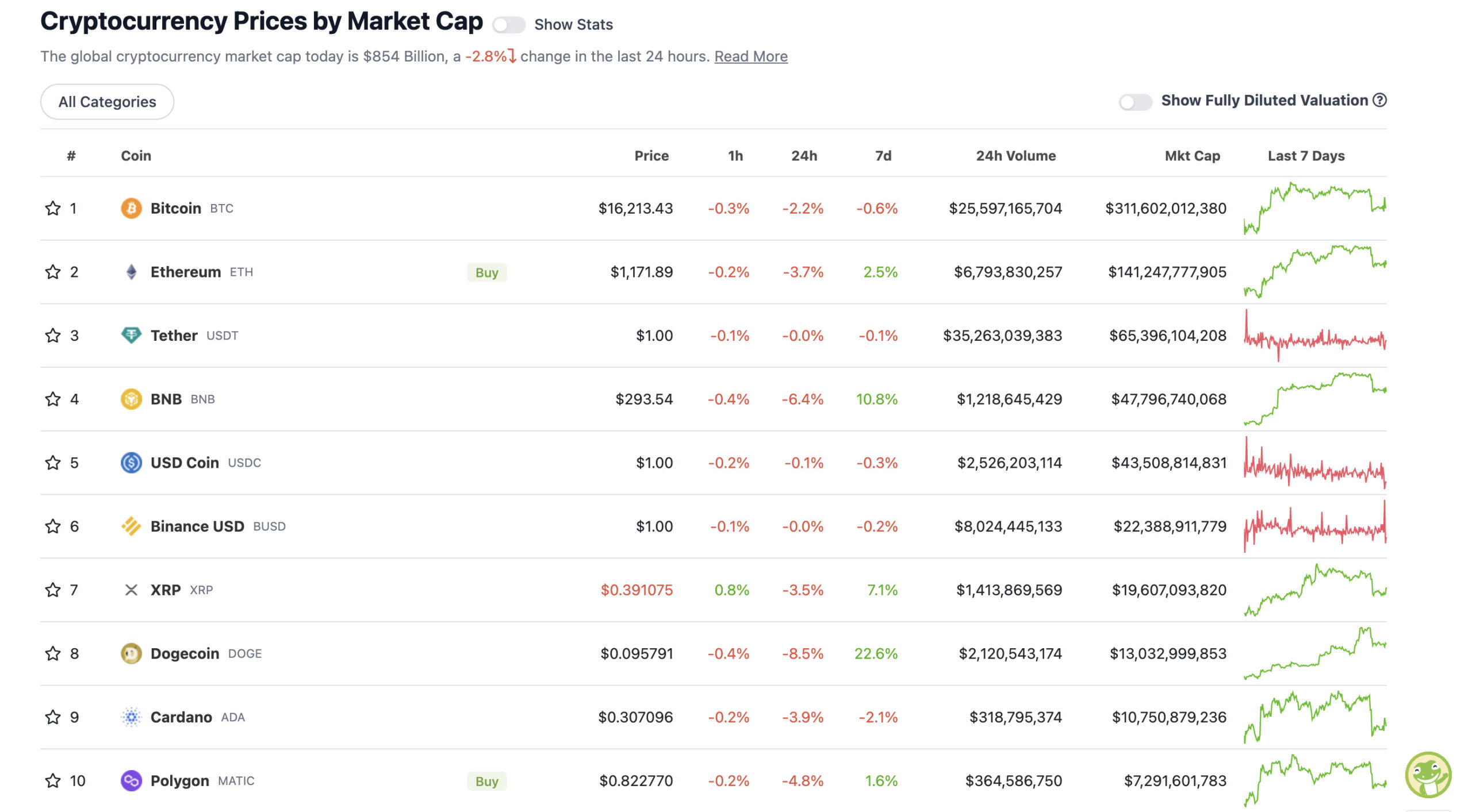

With the overall crypto market cap at US$854 billion, down 2.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Considering the mayhem in the industry and beyond right now, this chart could be worse, we feel.

Dogecoin has backed off from the exuberance it showed yesterday based on speculation around Twitter payments integration (again), although it’s still holding onto some of the strong gains it made, reflected in its seven-day +22% figure.

Time for some Bitcoin/crypto market bottom speculation. Are we there yet? Over the past year Bitcoin and Ethereum are down more than 76% from all-time highs.

Previous bear markets have seen more than 80% drawdowns in these leading crypto assets, so based on this alone, there might be some more tanking to come. That said – simple maths tells us we’re a lot closer to the bottom than the top.

US crypto analyst and trader Justin Bennett believes there’s a bit more carnage in store, but believes in another bull market after “peak fear” is reached.

We have yet to reach peak fear, IMO. That's especially true for stocks.

I don't see a macro bottom for risk assets until that happens.

You'll know when it comes.

— Justin Bennett (@JustinBennettFX) November 28, 2022

Sweeping a market-cap range of about US$6 billion to about US$319 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• ApeCoin (APE), (market cap: US$1.48 billion) +7%

• Fantom (FTM), (mc: US$513 million) +7%

• Bitcoin BSV (BSV), (mc: US$811 million) +5%

• Stacks (STX), (mc: US$341 million) +4%

• Chainlink (LINK), (mc: US$3.54 billion) +4%

DAILY SLUMPERS

• Huobi (HT), (market cap: US$829 million) -9%

• LEO Token (LEO), (market cap: US$3.55 billion) -9%

• GMX (GMX), (mc: US$355 million) -7%

• Curve DAO (CRV), (mc: US$419 million) -6%

• Aptos (APT), (mc: US$581 million) -6%

• Solana (SOL), (mc: US$4.85 billion) -5%

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Somewhat popular influencer bloke Gabriel Haines is now, like Ben “Bitboy” Armstrong, over in the Bahamas trying to rustle up FTX founder Sam Bankman-Fried for some click-inducing content. Oh, and to get some answers.

Haines received US$10,000 in a crowd-funding effort to send him, and his family, over there.

Do you think he can hear me??? pic.twitter.com/KodFyXadHN

— Gabriel Haines.eth (@gabrielhaines) November 28, 2022

Meanwhile, Bitboy says he has a Twitter spaces lined up with SBF within the next two weeks.

Breaking News:@SBF_FTX and I have agreed to do a Twitter Spaces within the next two weeks.

He has unblocked me on Twitter now so you can confirm we have spoken.

I look forward to getting the answers to the questions the community must have to move forward.

— Ben Armstrong (@Bitboy_Crypto) November 28, 2022

Righto, anyway, moving on…

JUST IN: BlockFi sues Sam Bankman-Fried to seize his $575 million stake in Robinhood, Financial Times reports.

— Watcher.Guru (@WatcherGuru) November 28, 2022

BREAKING❗️Fidelity officially started #Bitcoin trading for retail accounts – commission-free!

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) November 28, 2022

2 more days to go😬😬😬🥺 pic.twitter.com/sk3n9qXTdu

— Stockrocker (@Stockrocker_ASX) November 28, 2022

Gm

The more you know about how things actually work the more sense crypto makes. 🤣#wake #web3 pic.twitter.com/8PHkGlx0GG

— darrenrogan.ΞTH (@darrenrogan) November 28, 2022