Mooners and Shakers: Bitcoin sinks below $19k; Ethereum and other layer 1s dump

Meanwhile, in Cryptocurrency's head office… (Photo: Getty Images)

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Don’t open your crypto portfolio* today, unless you enjoy a morbid sense of fascination with tanking valuations. Bitcoin has dipped below US$19k, Ethereum is in danger of losing US$1k and there’s blood just about everywhere you turn.

(*Yeah, as if.)

In all fairness to crypto, stock markets right across the globe (Dow and S&P 500: -1.15%; Nasdaq: -1.5%; FTSE 100: -2.2%; Nikkei 225: -1.54%… yada yada) are having a pretty dim opening today as well, not to mention the worst first half in 52 years, apparently…

Worst first half for stocks in 52 years. pic.twitter.com/mOYvbJ6pvo

— zerohedge (@zerohedge) June 30, 2022

Anyhoo, we’ll steel ourselves and wade into the crypto price action in a sec, but first a glimpse at some news bites…

Crypto news: Grayscale, 3AC, OpenSea, eBay

• As we reported earlier, the largest Bitcoin fund manager in existence, Grayscale, has been rejected yet again for a Bitcoin spot ETF. And while this isn’t overly surprising, it still stings.

It’s clearly hurting Grayscale’s feelings, which now intends to sue the US Securities and Exchange Commission on the grounds the SEC is essentially being “arbitrary and capricious” by approving BTC futures ETFs and eschewing BTC spot ETFs. Something about ignoring the Administrative Procedure Act as well.

• Three Arrows Capital (3AC), the Singaporean-based VC/hedge fund in boiling hot water due to the unravelling “crypto contagion“, has now been rebuked by the Monetary Authority of Singapore (MAS). From bad, to super, super bad, then.

The MAS claims that 3AC filed false information to them regarding the fund’s assets under management, as well as other matters related to ownership and shareholdings.

This smackdown comes just a day or so after 3AC was slapped with a liquidation order from a British Virgin Islands court, with instruction to pay back its creditors.

• OpenSea, the industry’s most widely used NFT-trading platform, has suffered an unfortunate data breach. Yippee.

According to an OpenSea announcement, an employee at an outside contractor tasked with managing OpenSea email newsletters copied the list of customer emails and shared it with an outside party.

NFT trader? Stay extra vigilant, and watch out for those phishing emails.

https://twitter.com/TheAscendant3/status/1542348280104755201

opensea should airdrop us a DAO token for leaking all our emails 🙄 it would spark a new bull run 📈 and we'll forgive all ♥️🤞

— artchick.eth 🔥👠 (@digitalartchick) June 30, 2022

• Blimey, is there any encouraging crypto-related news lately? Yeah, here’s one… According to various reports and US trademark attorney Mike Kondoudis, the e-commerce giant eBay has filed two trademark applications covering a wide range of products and services relating to the metaverse and NFTs.

eBay Inc. is coming to the Metaverse!

On June 23, the company filed trademarks indicating plans for:

▶️ NFTs, NFT exchanges, NFT trading

▶️ NFT + Virtual good marketplaces

▶️ Online retail stores with actual and virtual goods#NFT #Metaverse #Web3 #Ebay #NFTCommunity pic.twitter.com/IELMNjaoUJ— Mike Kondoudis (@KondoudisLaw) June 28, 2022

Hey, it’s something, right? The interest in this space from big players, big entities, is still there.

Prices are down the toilet at the moment, sure, and possibly heading further round the S bend. But even some of the most bearish crypto analysts we can think of right now are viewing all this pain as a potential golden opportunity… for the extremely patient, that is.

In the next 1-2 years you will be presented with one of the largest opportunities of life changing gains the world has ever seen.

How you strategize around it will impact your life forever.

Start preparing yourself now.#bitcoin #stocks #cryptocurrency

— Roman (@Roman_Trading) June 30, 2022

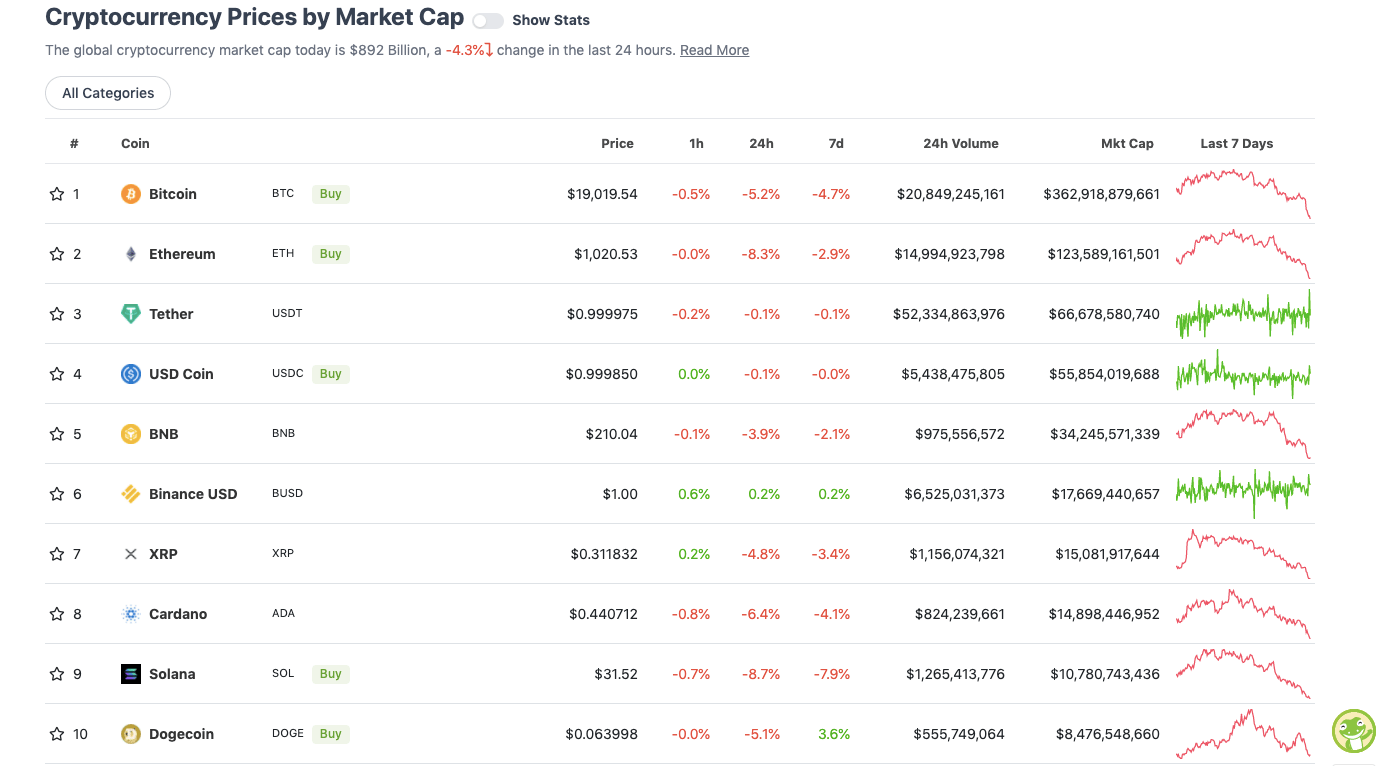

Top 10 overview

With the overall crypto market cap at roughly US$892 billion, down 4.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Despite the headline of this article, at the time of writing, Bitcoin has clawed its way back above US$19k again – by the skin of its teeth. It was floundering at a daily and 10-day low of US$18,917 a couple of hours ago, though.

As Cointelegraph reported today, if Bitcoin closes the day at this current level, BTC would confirm monthly losses against the price of USD of more than 40% for June 2022. And that’d register as the worst June ever for the popular asset and the heaviest monthly losses since September 2011 (per data from TradingView and Coinglass).

As the clearly dominant crypto asset, Bitcoin leads the market action, of course, along with Ethereum (ETH), which must hate being referred to as “the no.2 crypto” by now. Bitcoin maxis might refer to it as a sh*tcoin, but Ethereum’s smart-contract network effect is pretty hard to deny.

It, along with other major “layer 1” platforms, however, is copping a price pasting again, pretty much continuing yesterday’s form.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.8 billion to about US$376 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Amp (AMP), (market cap: US$597 million) +46%

• Shiba Inu (SHIB), (mc: US$6 billion) +6%

• Arweave (AR), (mc: US$455 billion) +3%

• OKB (OKB), (mc: US$3 billion) +2%

• Algorand (ALGO), (mc: US$2.1 billion) +1%

DAILY SLUMPERS

• TerraClasicUSD (USTC), (market cap: US$509 million) -133%

• Synthetix Network (SNX), (mc: US$503 million) -14%

• TitanSwap (TITAN), (mc: US$458 million) -10%

• ZCash (ZEC), (mc: US$673 million) -10%

• Stacks (STX), (mc: US$535 million) -9%

Around the blocks

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse.

https://twitter.com/Pentosh1/status/1542500364842401793

💥JUST IN: Short #Bitcoin ETF by ProShares is now the second-largest Bitcoin fund in the U.S. 🤨

Thanks SEC…

— Bitcoin Archive (@BTC_Archive) June 30, 2022

Some good news for $XRP holders. Now the only uncertainty is what happens with the SEC case. pic.twitter.com/euTSuQrImN

— Coin Bureau (@coinbureau) June 30, 2022

Unfortunately, too many impulsive and inexperienced #Bitcoin warriors will not survive prolonged bear markets, while patient and more seasoned hunters in no rush to take their shot, live to fight another day. pic.twitter.com/J1EDvp0oqB

— John (@getwhatugive) June 30, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.