Mooners and Shakers: Bitcoin struggles to hold $20k; Solana and Avalanche tumble; Fed’s Jerome Powell speaks

Getty Images

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Hodling various cryptos? Then it’s a mixed-bag day for you. Bitcoin, Ethereum, Solana, Avalanche and most other top cryptos are delving lower… although there are some things bucking the daily trend.

And that pretty much describes how the market’s generally rolling so far this year.

Meanwhile, the overly influential US Federal Reserve chairman Jerome Powell said a few things of some interest for all markets at the European Central Bank policy conference in beautiful* Sintra, Portugal. (*Been there – it really is.)

The Fed boss noted that while there is “no guarantee” of a soft landing for the US economy, he thinks there are, erm, “pathways for us to achieve the path” back to 2% inflation, while retaining US labour-market strength.

He also described the US economy as being in “strong shape” more generally. The overall Fed priority, though, as reported by the Wall Street Journal, remains stamping out high inflation, even at risk of rolling into recession.

“Is there a risk we would go too far? Certainly there’s a risk,” said Powell. “The bigger mistake to make – let’s put it that way – would be to fail to restore price stability.”

The Fed engineering a soft landing pic.twitter.com/iwZqcacRNZ

— Sven Henrich (@NorthmanTrader) June 28, 2022

The rising US and global inflation rates and the central bank measures to curb them remain the controlling bear-market narrative for markets, with other macro factors obviously feeding into that. As far as crypto’s concerned, the greedier elements of this industry have also exacerbated things, of course.

But… for crypto investors hanging in there and surviving (and perhaps that means playing defence with a healthy amount in reserve in solid stablecoins and fiat, perhaps slowly DCAing over time) is there any ray of hopium for a turnaround any time soon, or this year even?

Michael “Big Short” Burry is at least one prominent analyst who thinks the Fed could switch the gearstick to reverse by the end of 2022, possibly signalling a change in fortune at that time for stonks, bonds and the crypto market.

Hey, it’s not much, but it’s something – Burry’s been known to make few good calls…

💥JUST IN: US economy is in pretty strong shape, says Fed Chair Jerome Powell 🤦🏻♂️

— Bitcoin Archive (@BTC_Archive) June 29, 2022

Ok, got it. https://t.co/D8wBDIIDqh

— Anthony Pompliano 🌪 (@APompliano) June 29, 2022

Inflation looks to be hitting central bankers pretty hard. pic.twitter.com/axtfBzxi3d

— Jevi (@jevidon) June 29, 2022

Top 10 overview

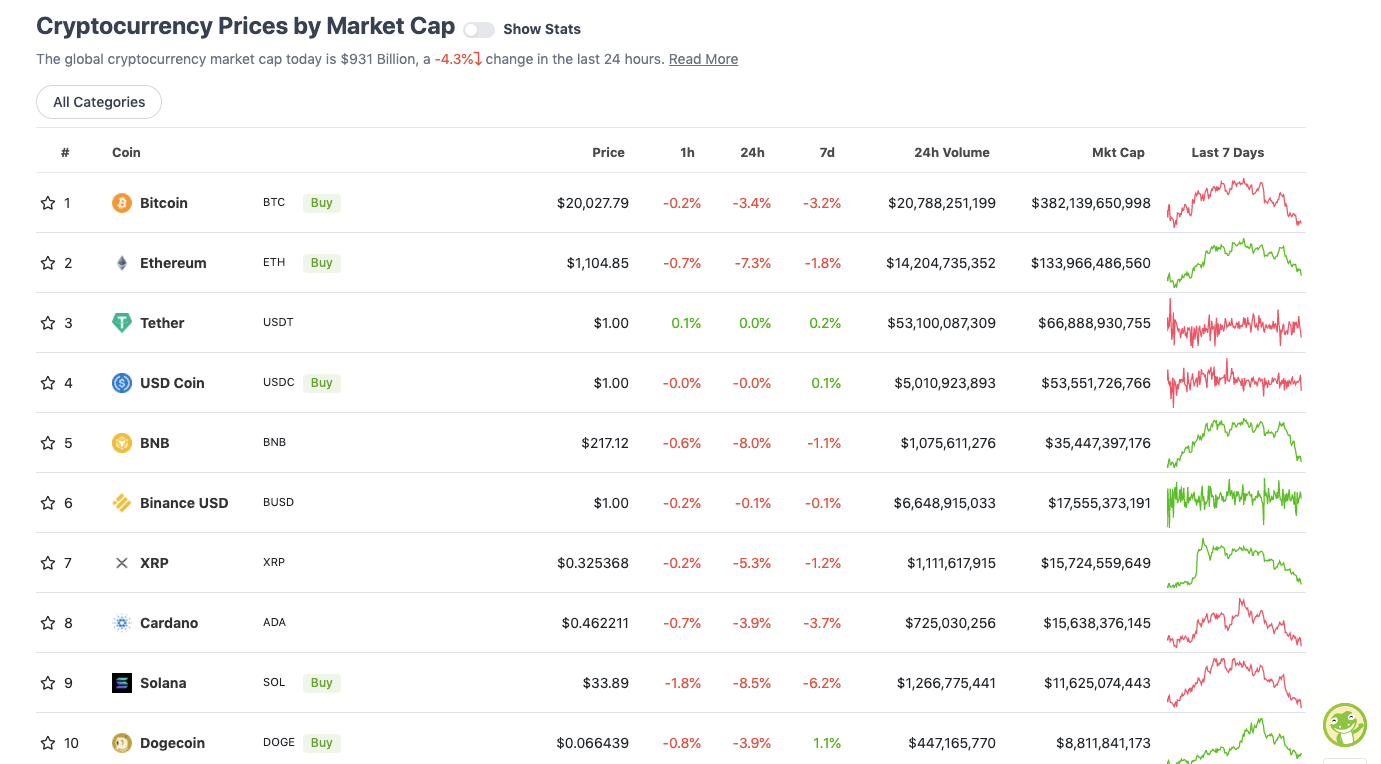

With the overall crypto market cap at roughly US$931 billion, down 4.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Layer 1s Ethereum (ETH), Solana (SOL), Binance Smart Chain (BNB) and, just outside the top 10, Avalanche (AVAX) (-10%) are the daily losers in the crypto majors today. Polkadot (DOT), another layer 1 big gun, is down about 7% over the past 24 hours.

Over the past 30 days, it’s actually ETH that’s been leading the descent among this top smart-contract-platform lot (-39%), whereas AVAX has plummeted 33% and SOL has discounted about 25%. Cardano (ADA), is currently by far the steadiest, strongest performer in this timeframe – down just 3.7% on the month.

Bitcoin (BTC), meanwhile is down 32% over 30 days, and is only just hanging on to US$20k by a thread at the time of writing. It wouldn’t be surprising to see it back down at the low $19k levels Dutch analyst Michaël van de Poppe is envisioning here…

#Bitcoin is giving that correction, was anticipating a potential low at $20.3K.

We get $20.1K as that's the second important one (see chart).

Would like to see it hold here and see additional confirmation on LTF.

If it doesn't, $19.3-19.5K next for support. pic.twitter.com/cbmuHP9G8I

— Michaël van de Poppe (@CryptoMichNL) June 29, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.9 billion to about US$384 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• TerraClassicUSD (USTC), (market cap: US$759 million) +80%

• Tenset (10SET), (mc: US$715 million) +9%

• Synthetix Network (SNX), (mc: US$577 billion) +8%

• LEO Token (LEO), (mc: US$5.5 billion) +2%

• Chain (XCN), (mc: US$1.84 billion) +1%

DAILY SLUMPERS

• Helium (HNT), (market cap: US$1 billion) -10%

• Flow (FLOW), (mc: US$1.6 billion) -10%

• BitTorrent (BTT), (mc: US$788 million) -10%

• ApeCoin (APE), (mc: US$1.4 billion) -9%

• PancakeSwap (CAKE), (mc: US$455 million) -9%

Around the blocks

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse.

💥FTX CEO: Some crypto exchanges are "secretly insolvent.” 🤔

— Bitcoin Archive (@BTC_Archive) June 29, 2022

Is everyone on #Bitcoin twitter ok? Feels like way too many of you got rekt using leverage. Its fully unhinged out here. I’ve had to block some people I know in real life cause they are totally losing their minds.

— Dennis Porter (@Dennis_Porter_) June 29, 2022

Bear market advice 😭 😂 pic.twitter.com/7jhntqoIYh

— Bitcoin Archive (@BTC_Archive) June 29, 2022

https://twitter.com/Murfski_/status/1542110527404613633

If it’s a scam you need to go back to rug school. You’ve way overshot. The other scammers are never going to take you seriously if you accidentally release a AAA game.

— Aeywyn (@aeywyn) June 29, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.