Mooners and Shakers: 2022 Bitcoin bear market most brutal on record – Glassnode; BTC and ETH hit a wall

Getty Images

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

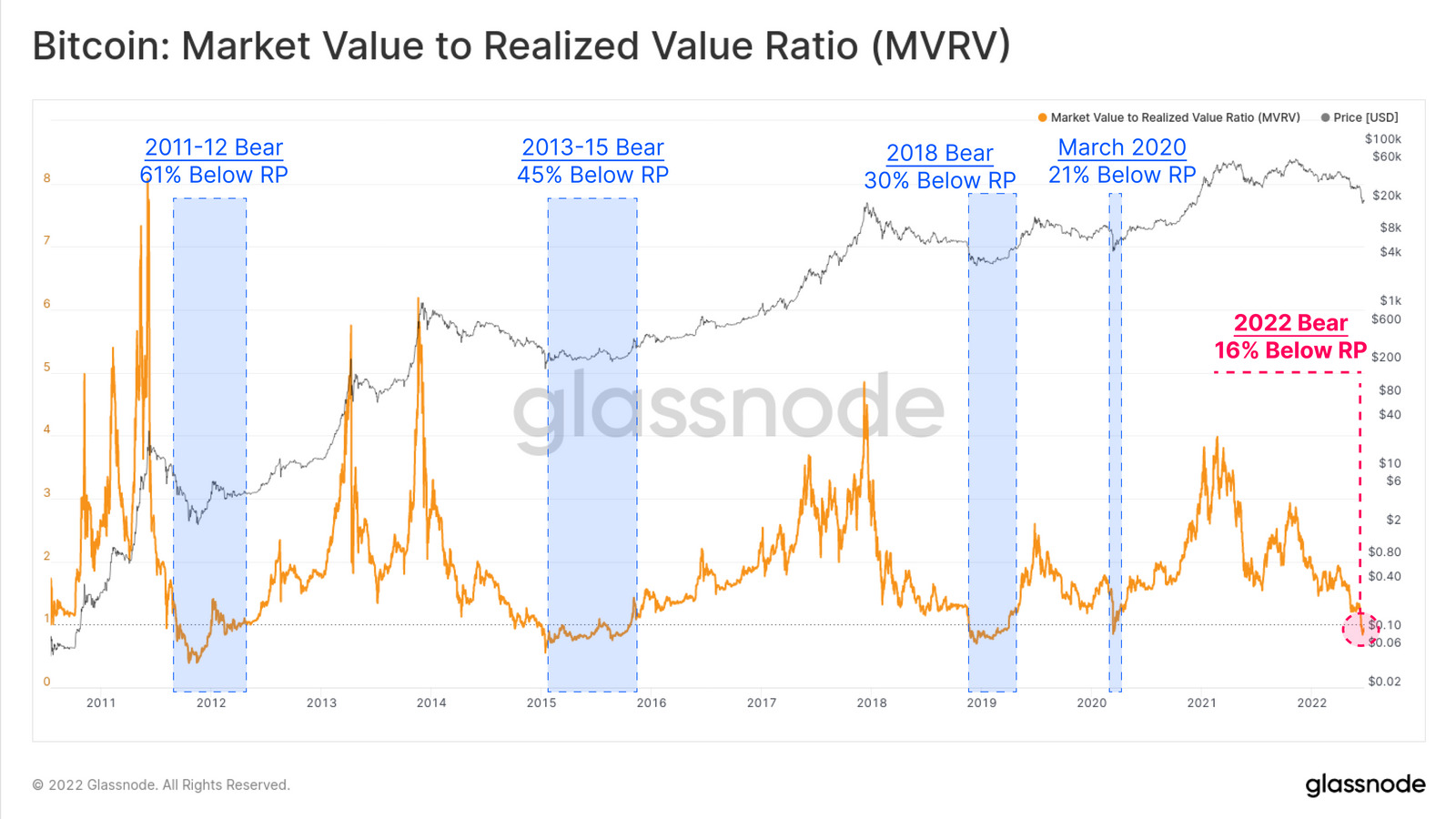

Well, it’s official… according to Glassnode, at least – this is the most savage Bitcoin bear market yet. And by extension, that means the worst crypto bear market overall, too.

The respected on-chain crypto analytics firm released a report titled ‘A Bear of Historic Proportions‘ on the weekend, breaking down several broken-down metrics related to the latest blockchain-investment mauling.

And some of those, focusing on the market’s pace setter – Bitcoin (BTC) – include:

• Bitcoin languishing below its 200-day moving average. (When prices trade below the 200DMA, it’s often considered a bear market. It’s also trading below its 200-week MA for the third week in a row, for that matter – another particularly bearish trend.)

• A substantial (about -16%) drop under BTC’s realised price, “signifying that the average market participant is now underwater on their position”.

• Investors have been locking in some of the biggest losses in Bitcoin’s timeline, including the “largest USD-denominated realised loss in [its] history”: -US$4.234 billion in a single day.

• The ratio between Transfer Volume in Loss vs Profit “has reached historically high levels, synonymous with a deeply distressed investor base”.

• Bitcoin is currently down about 70% from its US$69k November all-time high, trading at roughly US$20,750 at the time of writing.

The 2022 bear market has been brutal for #Bitcoin and #Ethereum investors, realizing massive capital losses.

In our latest research, we quantify the severity of this bear, and makes a case for it being the most significant in history.

Read more👇https://t.co/FlSehPo3FB

— glassnode (@glassnode) June 24, 2022

And despite some market participants regularly calling for a bottom, this Bitcoin bear market might be in for some further mauling yet.

That said, one of the latest bottom speculators (at a tad under $20k) appears to be the renowned financial analyst John “Bollinger Bands” Bollinger…

Picture perfect double (M-type) top in BTCUSD on the monthly chart complete with confirmation by BandWidth and %b leads to a tag of the lower Bollinger Band. No sign of one yet, but this would be a logical place to put in a bottom.https://t.co/KsDyQsCO1F

— John Bollinger (@bbands) June 27, 2022

‘Crypto contagion’ news…

We’ll get to some of the latest price action in a minute, but first a relevant news bite or three…

• Crypto brokerage Voyager Digital is no longer playing softball regarding its hefty loan to the VC hedge fund Three Arrows Capital (3AC). It’s now issued 3AC with a default notice in an attempt to recover its funds. Voyager had reportedly lent 3AC US$350 million in USDC and 15,250 Bitcoin, all up totalling more than US$673 million.

Wow, looks like more volatility ahead. Put on your seatbelts guys, things are going to be even wilder soon!

— Bitcoin Realm ₿ (@bitcoin_realm) June 27, 2022

The fact this “crypto contagion” subplot now reached the default-notice stage certainly adds fuel to the fiery notion that 3AC is indeed insolvent.

• Meanwhile… the “hacktivist” group Anonymous has vowed to make sure Terra co-founder Do Kwon is “brought to justice as soon as possible” for his alleged part in the collapse of the Terra (LUNA) and TerraUSD (UST) tokens in May…

🚨Anonymous send message to $LUNA founder Do Kwon🚨 pic.twitter.com/kbr3grQKRs

— Crypto Crib (@Crypto_Crib_) June 27, 2022

• AND, the Celsius plot thickens… Goldman Sachs is reportedly (per CoinDesk) in the hunt to swoop on Celsius’ “distressed assets” in the event of said bankruptcy. The investment banking titan is apparently aiming to raise US$2 billion from investors to snap up a bargain.

Vague silver-lining time… guess this at least confirms that one of the world’s biggest, most influential financial institutions is still long-term bullish on crypto… right?

Top 10 overview

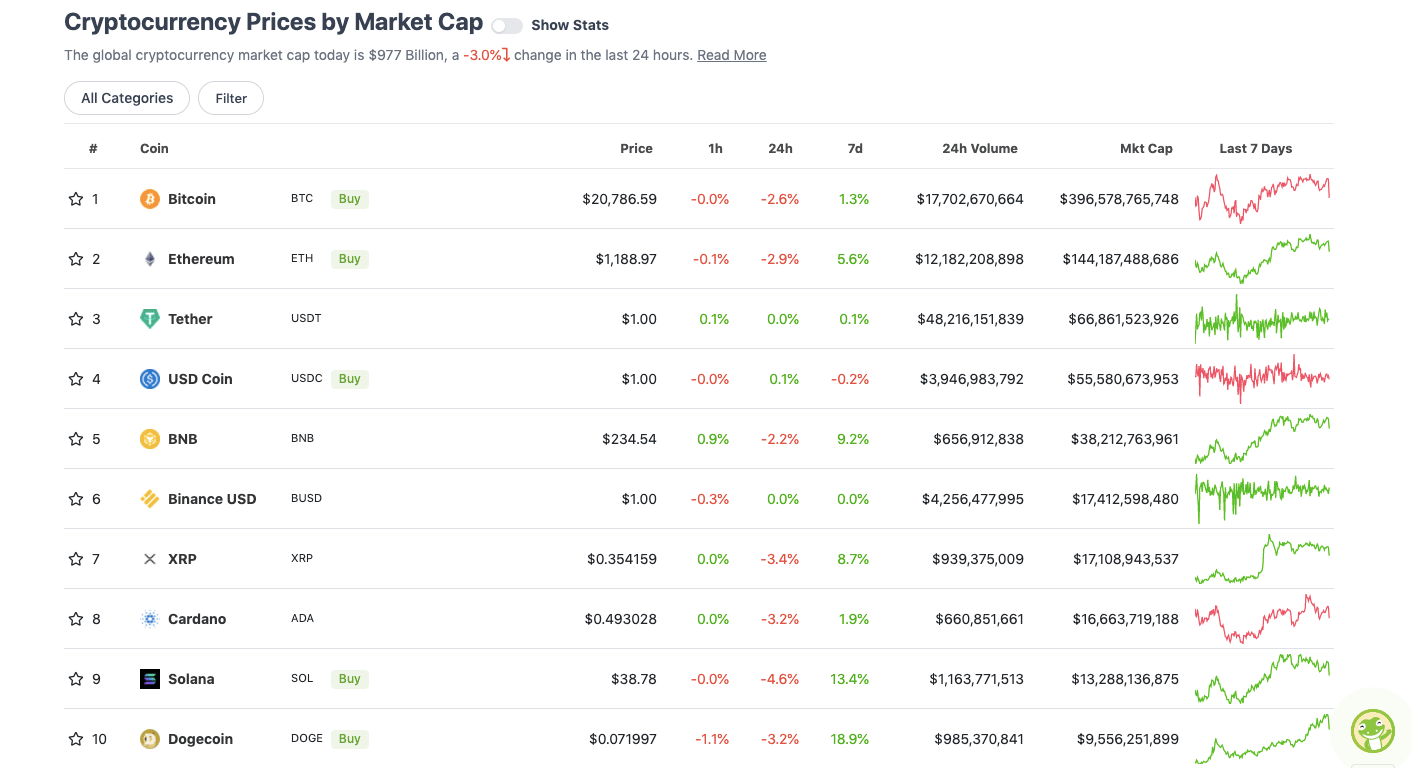

With the overall crypto market cap at roughly US$977 billion, down 3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

While Bitcoin continues to trade below key moving-average levels, it (and the market on the whole) held up reasonably well over the weekend. BTC managed to stay above US$21k in at least some effort to establish a decent level of support since the sub-$18k lows of June 18.

But… at the time of writing, that vague plotline appears to be thinning out. Let’s see if the OG crypto can hold on to the round-numbered, psychological level of US$20k – roughly the 2017 bull market’s all-time-high.

Likewise, for Ethereum (ETH), the US$1,200 level appears to be its version of BTC’s $21k, and $1k, its impression of the orange coin’s $20k.

Important area for me on $ETH is the area between $1,140-1,170.

Would like to see it hold if we want to see further upwards momentum.

If not -> $1,060 area next to me. pic.twitter.com/d5ILDSfUxf

— Michaël van de Poppe (@CryptoMichNL) June 27, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.9 billion to about US$399 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Stacks (STX), (market cap: US$474 million) +6%

• TRON (TRX), (mc: US$6.25 billion) +5%

• Chiliz (CHZ), (mc: US$576 million) +5%

• Ethereum Classic (ETC), (mc: US$2.26 billion) +2%

• Evmos (EVMOS), (mc: US$401 million) +2%

DAILY SLUMPERS

• Synthetix Network (SNX), (market cap: US$558 million) -13%

• Polygon (MATIC), (mc: US$4.27 billion) -10%

• Tenset (10SET), (mc: US$642 million) -10%

• THORChain (RUNE), (mc: US$624 million) -10%

• NEAR Protocol (NEAR), (mc: US$2.7 billion) -8%

Around the blocks

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto Twitterverse. (And let’s find some light amid all the Bitcoin bear market/crypto gloom…)

Looking pretty poss that the launch of the long and short bitcoin ETFs marked both the exact top and bottom respectively pic.twitter.com/6kHxAeGtZX

— Eric Balchunas (@EricBalchunas) June 27, 2022

"Bitcoin is the only one I'm willing to say is a commodity" – @GaryGensler on CNBC this morning.

— Preston Pysh (@PrestonPysh) June 27, 2022

Everyone is always extreme in their words for the movements of a market.

At this point, many #altcoins are just having a consolidative move after a breakout end of last week.

Good retest on $XRP here.

Would be my area for a potential long. https://t.co/OUSfdwMj96 pic.twitter.com/2xz0JlKRpi

— Michaël van de Poppe (@CryptoMichNL) June 27, 2022

#BITCOIN WHALES ARE STILL BUYING!!!! 🔥👇

DON'T GET DILUTED BY THE PRICE DROPS! pic.twitter.com/u0scdXzh2b

— Crypto Rover (@rovercrc) June 27, 2022

I thought I was late to #bitcoin, but apparently not.

— Michael Saylor⚡️ (@saylor) June 27, 2022

Bitcoin

— Saifedean Ammous (@saifedean) June 26, 2022

Illuvium co-founder Kieran Warwick spoke with Jonathon Miller, managing director of Kraken Australia, on Stockhead’s latest Crypto Frontier Podcast the other day. ‘Twas a good chat, covering, among other things, sibling rivalry and Illuvium’s grand ambition to bring AAA quality to blockchain gaming.

And here’s another NFT project Kieran’s pumped up for… Ethlizards – a collection of lizard-themed non-fungibles that focuses on bringing GameFi investment utility to holders.

Three games reached out to me about investment from Ethlizards today.

Organic deal-flow pre-launch? Don't mind if we do.

Soon the Ethlizard logo will be a badge of honour in cap tables.

"Sir, look, they even got investment from the Lizard people! 👀"

It begins…

— Kieran.eth (@KieranWarwick) June 27, 2022

Not financial advice, of course, but the author has some investment in Bitcoin, Ethereum and other crypto assets, including Illuvium and that one right there, Ethlizards.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.