It’s the second biggest crypto-market puke in history as Bitcoin ‘kisses’ $24k realised price

Glass a bit full? (Getty Images)

Crypto’s bottom-squeaking week continued with another large dump on Thursday morning (evening AEDT), with Bitcoin sinking lower into the HODLer’s toilet of despair.

Side note, Bitcoin (BTC) is actually in the middle of crawling back above US$28k as this is typed, but you know how it goes – that news could be redundant by the time you stop reading this sentence. (Checks portfolio for the 500th time today.)

But here’s what we do know… because it already happened… plus we read it on Checkmate’s Twitter feed.

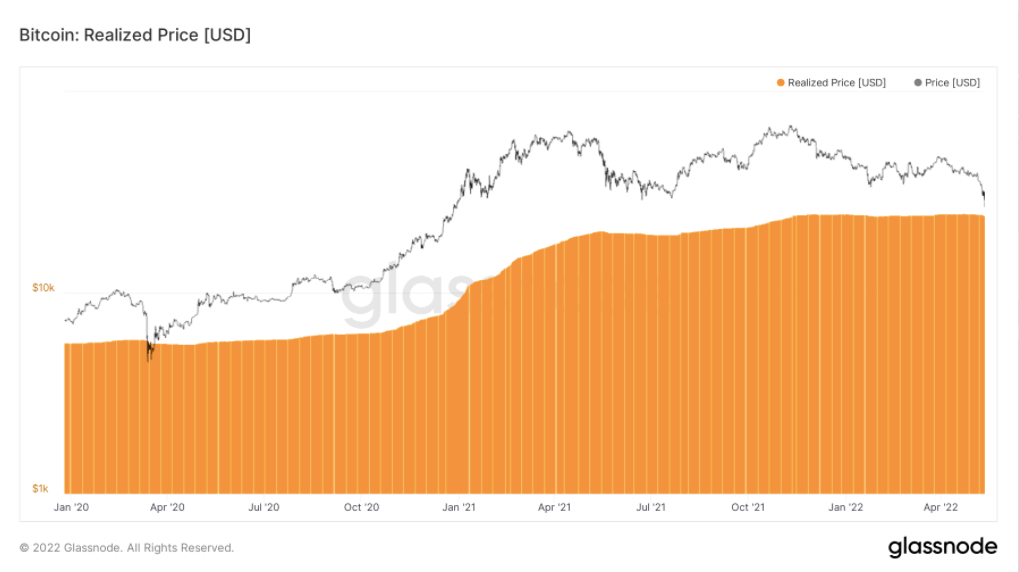

Checkmate is the well-respected lead on-chain and insights analyst at blockchain analytics firm Glassnode, and according to him, “Bitcoin basically kissed” its realised price earlier today, which is down around US$24k.

Market carnage, this is my personal read:

– $USDT will be back at $1 before long. Tether truthers will bang on about this 'depeg' for weeks.

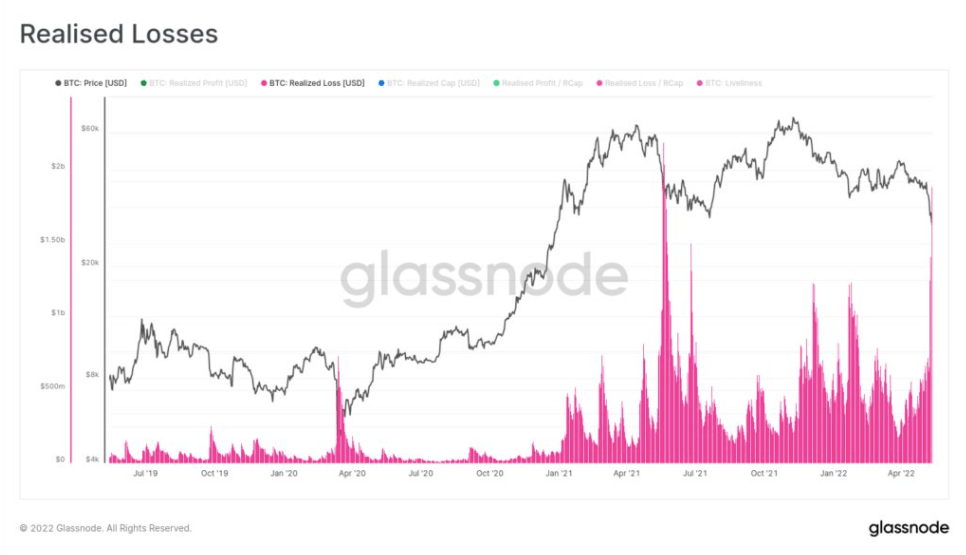

– Realized losses 2nd heaviest in history, looks like capitulation

– #Bitcoin basically kissed the realized price ($24k). $BTC is cheap pic.twitter.com/BTZeYiG6dV

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) May 12, 2022

What’s realised price, you might be asking? According to stats.buybitcoinworldwide.com and bgeometrics.com, it’s the realised market cap (the value of all the coins at the price that were bought) divided by total amount of generated coins – the amount of BTC in circulation.

Glassnode further explains the realised capitalisation as “a variation of market capitalisation, which values each UXTO [unspent transaction outputs] based on the price when it was last moved.”

Checkmate also noted that realised losses (selling BTC for a loss compared with cost price) also hit its second-highest daily levels ever – around US$2 billion at the time of writing, per Cointelegraph.

Anyway, the upshot is, Bitcoin dumped hard. Again. And so hard, in fact, that this week’s sell-off is now the second-largest in BTC’s history. To date, only the May 2021 crash caused more short-term pain.

That said, and not to get ahead of ourselves here, but the current bounce back off that realised-price level seems promising. The last time BTC/USD tested realised price was during the COVID-19 crypto crash of March 2020.

And what occurred just a few months after that? One of the most epic bullruns crypto has yet seen. History never repeats, but it often rhymes? Maybe.

Touching the realised price is apparently a rarity and is viewed by some as an indication that things are closer to the end of a bear market than the beginning. Now, where did we stash our hopium pipe?

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.