Mooners and Shakers: Bitcoin hits $30k, then plunges 7pc on Mt Gox false alarm… then pumps again

Coinhead

Coinhead

It’s been a crazy, bumpy old ride in crypto over the past 12 hours or so. If you were after gut-churning volatility with your risk-asset investment portfolio, Bitcoin and co obliged last night (AEST).

BTC took a nice surge up from about the US$28.3k range to around US$30k, only to dump heavily below US$28k again in less than an hour – about a 7% plunge.

What happened? Arkham did. Not the fictional Gotham City hospital that houses the criminally insane, a blockchain analytics firm that evidently sent out a tweet (in error according to reports) that spread some alarming information. Misinformation, as it turns out. Or was it? It’s actually an evolving and slightly confusing situation, this.

The now-deleted tweet, as reported by crypto media outlet Decrypt, had noted that crypto wallets linked to the long-defunct exchange Mt. Gox, along with crypto wallets in possession of the US government, had moved a large amount of Bitcoin. The implication being an impending dump of those particular BTC tokens on the market.

It didn’t play out exactly like that, but the market dumped anyway, purely on fears around the news.

What a strange day in crypto.

1. $BTC pumps on strong earnings + banking contagion fears

2. Arkham issues alert indicating US Gov + Mt. Gox selling

3. $BTC dumps, $200m liquidated in 4 hours

4. Alert turns out to be false— Miles Deutscher (@milesdeutscher) April 26, 2023

Today we fixed a bug related to Bitcoin alerts that caused us to no longer under-send alerts to a small subset of user’s private labels. This was one of them. This fix won’t affect any additional users, and was unrelated to labels generated by Arkham — we understand the impact… https://t.co/VqbX04J2bM

— Arkham (@ArkhamIntel) April 26, 2023

Okay, bummer. Right then, where’s the “phew, false alarm pump” to US$60k?

Hang on a sec, news just in – Arkham now claims that the alerts were “sent accurately”? And that:

“No one received inaccurate alerts, they simply began receiving the alerts they had previously set.”

“Neither the alert nor the tweet could have caused the sharp BTC price drop today,” added Arkham, noting that the BTC dump occurred between 19:17 and 20:01 UTC, and the alerts and its following tweet were sent after those times.

hey bro can u do us a favor and send db some alerts that US govt is buying 1 billion $$ of ETH

— GREEN JEFF (@jeffthedunker) April 26, 2023

It’s tough work making sense of that full tweet, but the upshot, we believe, is that a sell-off of Bitcoin related to Mt. Gox asset holders and the US government’s large haul of seized Silk Road-era BTC, is a false alarm for now.

🛑FAKE NEWS🛑about MT Gox wallets making transactions.

No activity there✅ https://t.co/IbZKrK7BJ9 pic.twitter.com/mdOZv4nzI4

— IT Tech (@IT_Tech_PL) April 26, 2023

That’s not to say that selling events related to these two factors won’t occur in the fairly near future. The Biden government has stated it plans to liquidate more than 41,000 of the BTC it holds in four batches over the course of this year. At least it won’t all dump at the one time.

The Mt. Gox Bitcoin payout to creditors (worth in total 142,000 BTC) is also being staggered, with it all due to be settled by the end of October this year. And that’s not to say that all creditors will simply just sell their newly regained Bitcoin, mind.

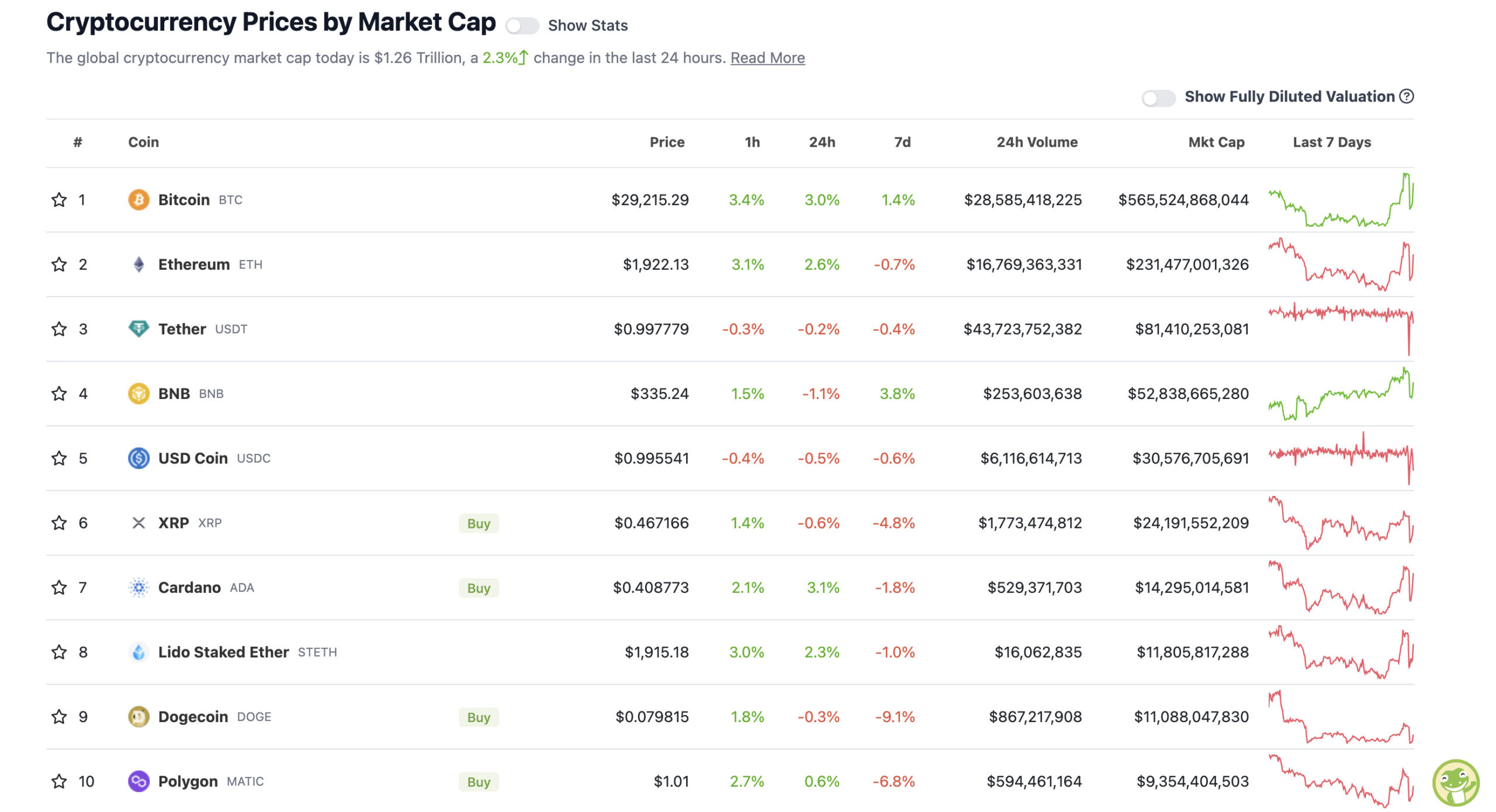

With the overall crypto market cap at US$1.26 trillion, up about 2.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

And speaking of upshots, when we were first about to publish this article, the crypto market had pretty much levelled out to where it was this time yesterday, despite the BTC surge and purge… but, in the past 10 minutes, the no.1 crypto asset has just pumped again above US$29k.

You didn’t come here for pleasant, serene sailing, presumably.

Don't let the short-term #BTC volatility distract you from the longer-term perspective$BTC #Crypto #Bitcoin pic.twitter.com/cHPumA9D59

— Rekt Capital (@rektcapital) April 26, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Kaspa (KAS), (market cap: US$569 million) +18%

• Render (RNDR), (market cap: US$834 million) +16%

• MultiversX (EGLD), (market cap: US$1.06 billion) +12%

• Casper Network (CSPR), (market cap: US$599 million) +8%

• Injective (INJ), (market cap: US$674 million) +6%

PUMPERS (lower caps)

• Step App (FITFI), (market cap: US$13.5 million) +25%

• Pendle (PENDLE), (market cap: US$46 million) +12%

• QuickSwap (QUICK), (market cap: US$36 million) +11%

SLUMPERS

• Pancake Swap (CAKE), (market cap: US$513 million) -4%

• Algorand (ALGO), (mc: US$1.3 billion) -2%

• NEAR protocol (NEAR), (mc: US$1.69 billion) -2%

• Fantom (FTM), (mc: US$1.17 billion) -1.5%

• Chainlink (LINK), (mc: US$3.64 billion) -1.5%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

BREAKING: 🇨🇳 Chinese Yuan overtakes US dollar as most-used currency in China's cross-border payments for the first time ever – Reuters pic.twitter.com/NahcjwkWrj

— Radar🚨 (@RadarHits) April 26, 2023

The US Gov should just keep the Silk Road $BTC.

Not sure why they’d want to sell hard money into a depreciating sh*tcoin (USD).

The smart thing to do would be to accumulate MORE #Bitcoin, and try and reintroduce (some) kind of monetary standard after screwing things up in 1971.

— Miles Deutscher (@milesdeutscher) April 26, 2023

You guys do realize this will not pass in the Senate right? https://t.co/g38vVvd3Mr

— Benjamin Cowen (@intocryptoverse) April 26, 2023

NEW: #Bitcoin is the most battle-tested and robust network out there – PayPal's ex-President, David Marcus 💪

— Bitcoin Archive (@BTC_Archive) April 26, 2023

Meanwhile, fancy some AI-generated pizza… from, er. “Pepperoni Hug Spot”?

Pizza TV ad made with ai for Pepperoni Hug Spot 🤣#ai #pizza #funny #family pic.twitter.com/ftJVMGgu1x

— Mike D Sayre 🤠 (@mikedsayre) April 25, 2023