Mooners and Shakers: Bitcoin flat as Solana nudges back into top 10 cryptos

Coinhead

Concerned about the short-term price action of Bitcoin and crypto? Then those worries are, for the moment, in the hands of the US Bureau of Labor Statistics, which is set to release the latest US inflation data – the Consumer Price Index.

Is it as cut and dried as that? No, but it could be influential if the data for April’s inflation comes in hot (a higher percentage than expected), or cool (lower).

And that data will be hitting the airwaves, Twitter wires and the portfolio tracker on your phone that you check every five minutes at about 10.30pm this evening (AEST), which is 8.30am over in eastern states of the U S of A (EDT).

What’s the expectation? It’s not hugely promising tbh, with Morningstar reporting consensus from US financial data firm FactSet that “progress toward reducing inflation is stalling”.

And, as Eddy’s Market Highlights highlighted:

“The Fed won’t be raising rates on a hot report, but it will justify calls that rates will stay higher for longer,” said Oanda analyst, Edward Moya.

In the meantime, though, Bitcoin is reasonably chilled out for the moment in the mid US$27k range, having dipped over the past few days as investors and traders tread cautiously for now.

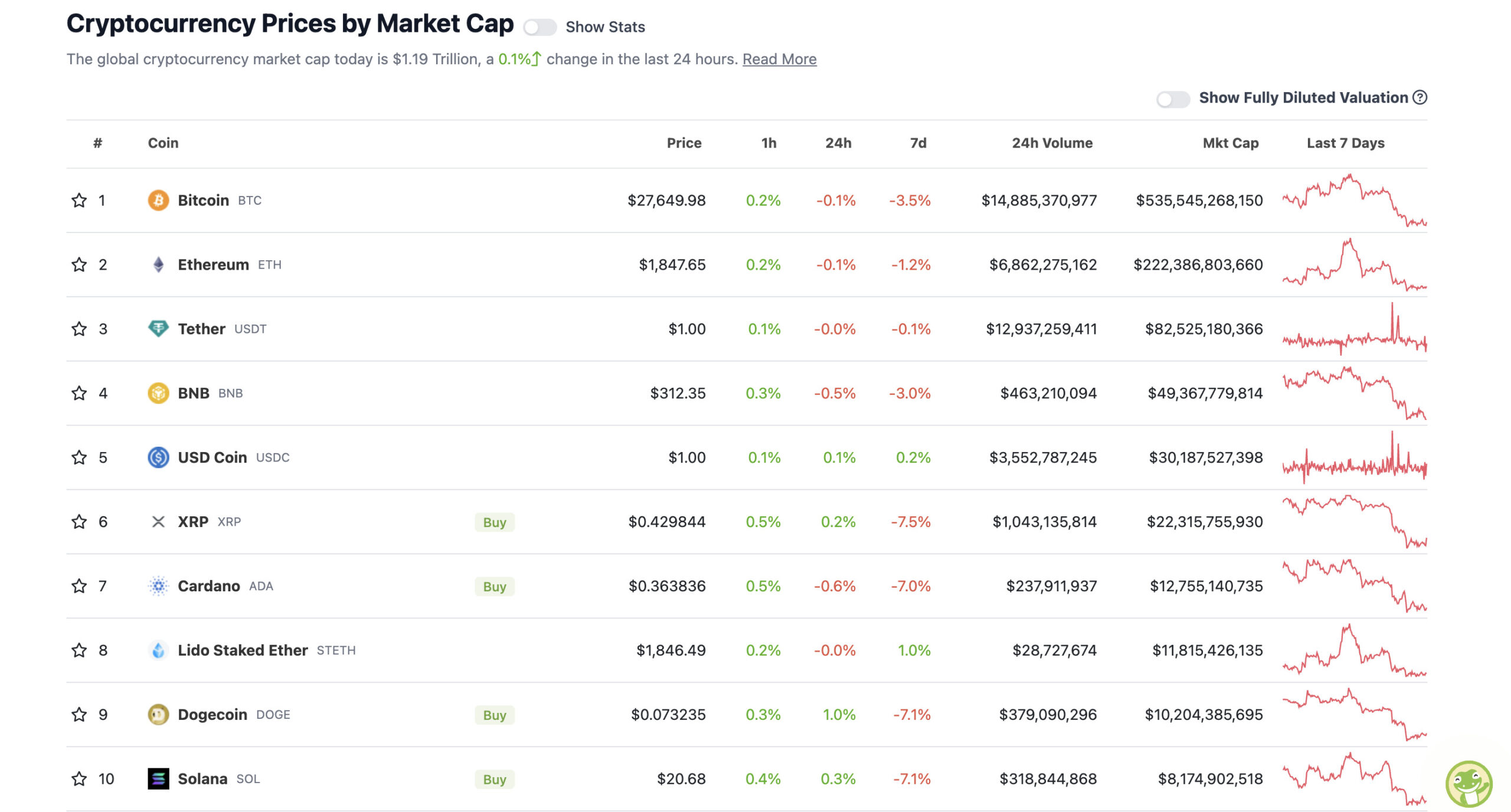

With the overall crypto market cap at US$1.19 trillion, down about 0.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin has found some support for now after taking a succession of unpleasant paper cuts since Saturday. However, the short-term bears are circling and licking slobbering, prehensile lips.

Popular trader/analyst DonAlt, for instance has been telling his 484k or so followers that Bitcoin could be in line for a hefty correction.

$BTC update:

Slow bleed has been very accurate.

Every bounce so far has simply been forcing shorts out of their over-eager positioningA beautiful display of maximum pain for leverage traders

I doubt it'll stop anytime soon but would love to be surprised pic.twitter.com/6tNj5LusZw— DonAlt (@CryptoDonAlt) May 9, 2023

He does add, however, that he is still “team bottom is in, and anything close to $20k is an amazing buy.”

Meanwhile Nicholas Merten, aka the YouTuber DataDash, tells his 511k or so regular viewers that they should be watching the latest move from famed investor Warren Buffett with extreme caution.

The “Oracle of Omaha” has just sold off more than US$13 billion worth of stocks, according to reports, and has increased exposure to cash and US Treasuries.

The implication there is that Buffett appears to be preparing for a severe stock market tumble.

“Warren Buffett, Berkshire Hathaway as a whole, his company, is sitting on a massive pile of cash, one of the biggest piles it’s ever had before,” notes Merten. “And you would think that they’re going out on a buying spree. Nope, over the last quarter, Berkshire Hathaway sold billions in stocks.”

Of course, not everyone’s so bearish right now. And this wouldn’t be crypto if they were. Here’s good old Michaël van de Poppe with a few slightly weak rays of sunshine to deflect your way. He’ll need that “bullish divergence” to form tout suite, though.

#Bitcoin still chopping around and rejected the level at $27,800 again.

A sweep of the lows would potentially create a bullish divergence and long arguments. #altcoins getting sold off massively. pic.twitter.com/fB8rDlj4XM

— Michaël van de Poppe (@CryptoMichNL) May 9, 2023

We're getting close now on #altcoins.

First level reached.

Starting accumulation here and sell in 1-2 years makes a lot of sense. pic.twitter.com/IuKXTY1Pdq

— Michaël van de Poppe (@CryptoMichNL) May 9, 2023

As for altcoins, hello Ethereum, we see you, but we’re looking right past today, to the bottom of the 10 crypto majors.

Solana has usurped Ethereum Layer 2 blockchain Polygon (MATIC), and has cracked the top 10 again, where it used to frequently reside in the bull market of 2021.

Interestingly, the latest CoinShares report shared with Stockhead this morning, which tracks inflows and outflows of institutional investors, shows that Solana was the only altcoin to see any investment from institutional players over the past week – with inflows of US$3.4m.

But it was a pretty dismal one for big-money inflows in this category overall…

“Digital asset investment products saw outflows totaling US $54million last week, representing the 3rd consecutive week of negative sentiment for the asset class,” reads the report.

“Regionally, the majority of outflows were from Germany and Canada with US $27million and US $20million respectively.”

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Bitcoin SV (BSV), (market cap: US$819 million) +41%

• Bitcoin Cash (BCH), (market cap: US$2.36 billion) +10%

• Sui (SUI), (market cap: US$642 million) +8%

• Kava (KAVA), (market cap: US$417 million) +8%

• Pepe (PEPE), (market cap: US$842 million) +6%

Interesting to see those Bitcoin fork cryptos BCH and BSV surging today. It will be partly, or wholly, down to the narrative being pushed by proponents of both projects that each is a superior Bitcoin to the no.1 Bitcoin (BTC) and leading cryptocurrency.

The latter has been faced with high transaction fees and network congestion due to increased activity on the blockchain from Ordinals and BRC-20 tokens, which you can read more about in the latest Apollo’s Alpha.

https://twitter.com/WhaleWire/status/1655926989553901572

So, yes, the forks are forking loving it, but we wouldn’t be fading the bull goose crypto over this. Not financial advice, of course.

Meanwhile, has PEPE bottomed its post-Binance-listing dippage? As ever, we turn to Twitter to find a quickfire thesis with some charting thrown in for good measure. Trader Eunice Wong does the honours…

$PEPE bottomed.

Now we need it to range sideways

Will time for entry and load up 🚀 https://t.co/B2d9oyH5oh pic.twitter.com/n8fKUsbXFW

— Eunice D Wong 🦄 (@Eunicedwong) May 9, 2023

PUMPERS (lower, lower caps)

• Ben (BEN), (market cap: US$55 million) +241%

• Turbo (TURBO), (market cap: US$83 million) +27%

• ArbDoge AI (AIDOGE), (market cap: US$74 million) +24%

SLUMPERS

• Radix (XRD), (market cap: US$771 million) -8%

• Render (RNDR), (mc: US$624 million) -7%

• Injective (INJ), (mc: US$498 million) -6%

• Stacks (STX), (mc: US$946 million) -5%

• GMX (GMX), (mc: US$532 million) -3%

SLUMPERS (lower, lower caps)

• DinoLFG (DINO), (market cap: US$25 million) -13%

• Pendle (PENDLE), (market cap: US$30 million) -11%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Hmm, is another exchange gearing up for a Pepe-listing launch? This tweet from the Winklevoss-twins-owned Gemini would suggest so…

— Gemini (@Gemini) May 9, 2023

#Bitcoin 1st STOP (M) 💥

The 38.2% Fibonacci retracement level 🔵 also known as the "1st Stop" will give you a hint on whether a trend is over or not. Usually when price closes above it, the trend can be considered over & a new trend can start.#BTC has closed above the 38.2%… pic.twitter.com/uTFt3DiGtQ

— Titan of Crypto (@Washigorira) May 9, 2023

JUST IN‼️ 32% of family offices hold #Bitcoin or crypto – Goldman Sachs survey pic.twitter.com/O7OeRjZQas

— Radar🚨 (@RadarHits) May 9, 2023

WhatsApp cannot be trusted https://t.co/3gdNxZOLLy

— Elon Musk (@elonmusk) May 9, 2023

The empire of debt has no choice but extend the debt ceiling or everything collapses.

The pretense of sound & responsible budgets is just that, a pretense.

Reality is none of it can be sustained with current rates as ever more debt is required.

Jay knows it. Janet knows it.— Sven Henrich (@NorthmanTrader) May 9, 2023