Mooners and Shakers: Binance-fuelled concerns over FTX cool Bitcoin and crypto market surge

Getty Images

Well, it was a nice weekend for holders of Bitcoin and many other crypto assets. But it’s Monday, and fresh FUD (fear, uncertainty and doubt) has surfaced. This time about crypto exchange FTX and its FTT token.

How serious is that? It’s not completely clear yet – it’s an unfolding story that we’ll touch on in a sec, but fingers crossed it’s not another Terra LUNA or Celsius-like crypto-crashing event.

The total crypto market cap surged by more than 7% over the weekend, but has since cooled off a bit. At the time of writing, it’s still holding onto some gains there, however, with Bitcoin hovering back above US$21k for the first time in almost two months.

Binance vs FTX

But what’s all this FTX noise, then? A lot of it is actually coming from the Binance CEO Changpeng Zhao, aka “CZ”. We’ll try to nutshell what we know so far.

• Binance, via CZ on Twitter, has announced it’s selling more than US$584 million in holdings of the FTX exchange/utility token FTT.

• CZ revealed that he will then liquidate its entire position of FTT gradually to reduce any market impact. He stressed that this is not an attempt to hurt FTX.

We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete. 2/4

— CZ 🔶 BNB (@cz_binance) November 6, 2022

• FTX is owned by another crypto billionaire – Sam Bankman-Fried, who also owns trading firm Alameda Research. The Binance announcement comes a few days after rumours regarding Alameda Research’s financial health. The trading firm (assets totalling US$14.6 billion) is closely tied to FTX and has huge exposure (US$3.6 billion) to the FTT token, according to crypto-media outlet CoinDesk. It’s sparked doubt from crypto-industry commentators about the financial stability of Alameda Research and FTX more broadly.

• CZ has also said this, claiming FTX has been secretly lobbying against other industry players:

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 BNB (@cz_binance) November 6, 2022

• There’s more to the story, which the FT covers here. Meanwhile, would an exchange-giant spat between Binance and FTX hurt the crypto market? It certainly isn’t the most helpful narrative right now, so here’s hoping it blows over quickly.

Not a war or battle. We do some house cleaning and then move forward.

— CZ 🔶 BNB (@cz_binance) November 6, 2022

Two coins that typically trade in lockstep are now heading in opposite directions.

Binance 📈

FTX 📉 pic.twitter.com/tBmXV2IzVc— Luke Martin (@VentureCoinist) November 6, 2022

Top 10 overview

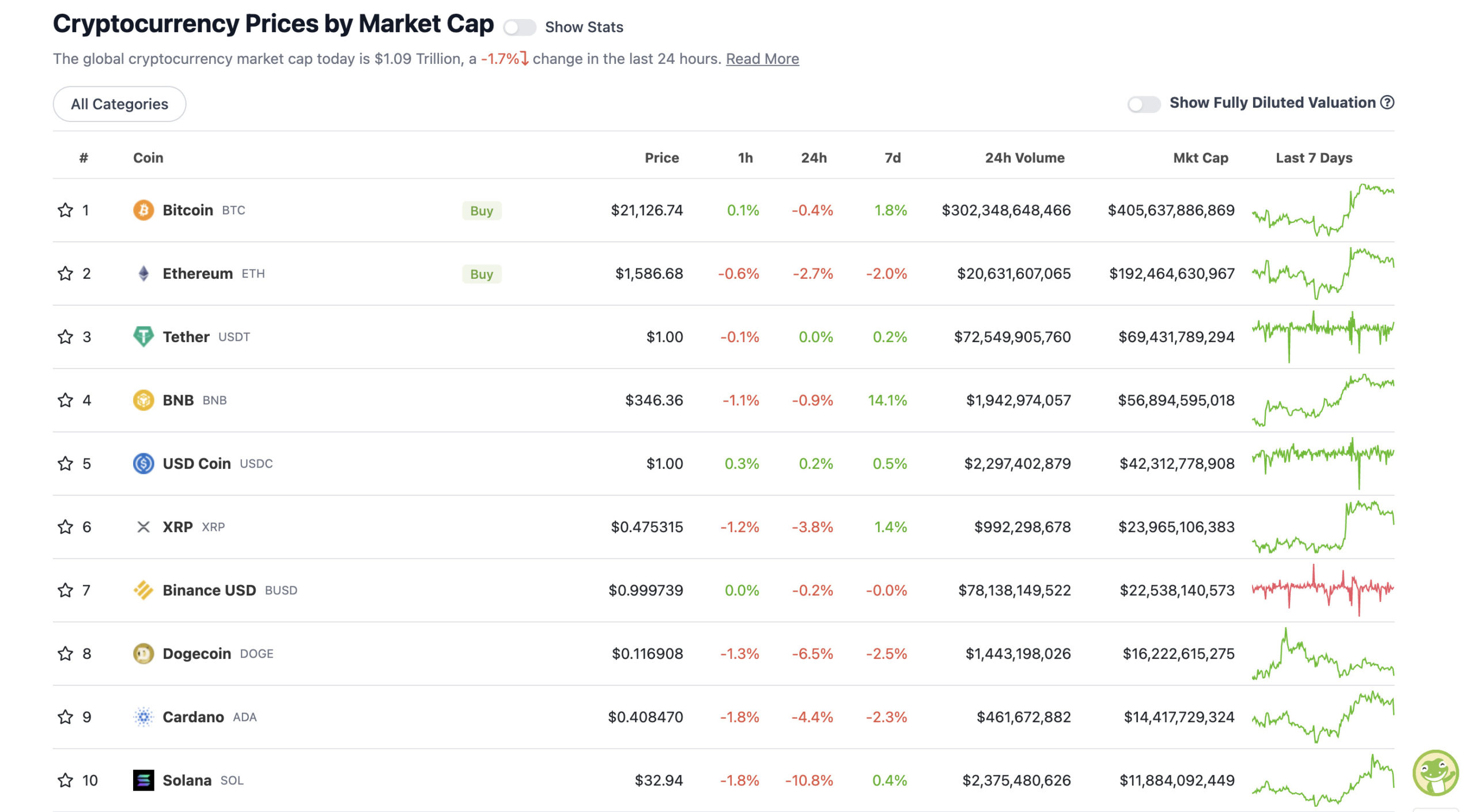

With the overall crypto market cap at US$1.09 trillion, down about 1.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Over the weekend, Bitcoin (BTC) peaked up just above US$21,400, while Ethereum (ETH) also rallied, trading above US$1,600 for the majority of the past couple of days.

Tell me why, I don’t like Mondays? Partly because it so often shows up exuberant weekend crypto trading to be completely unreliable for the week ahead. As mentioned, though, at present, some gains have been retained, so we’ll see.

What’s coming up this week that could affect the narrative? US Consumer Price Index inflation data for the month of October. Set to land on November 10.

Big week coming week with the Midterms coming up. Probably not going to move markets that much, but CPI at the end of the week will.

Volatility a lot.

Will be in the mountains, so that's going to be fun to watch markets in between haha.

— Michaël van de Poppe (@CryptoMichNL) November 6, 2022

Thanks, Michaël. Perhaps the crypto market can join you in the mountains.

Other things to note in the top 10 by market cap… yep, the Binance token BNB is up 14% over the past week, Dogegoin (DOGE) continues to slide after its Twitter/Musk-fuelled recent run, and Solana’s SOL token is the big daily loser (-10.8%).

What’s up with SOL? Clearly not much in price action, which is perhaps strange, as it had a pretty positive announcement (a Google-related partnership) over the weekend at its large, well-attended Breakpoint event in Lisbon, Portugal.

Yesterday Solana’s price surged as Google confirmed a partnership with the L1 blockchain.

Here’s the scoop. 👇 pic.twitter.com/w7AOPx1dbR

— Lite (@LitecoinYagami) November 6, 2022

Google Cloud has announced a plan to become a validator on the Solana network, similar to its recent Ethereum node announcement. Validator nodes effectively verify, vote on and maintain a record of transactions on a blockchain network.

And Google’s kind of a big deal, we hear.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.1 billion to about US$427 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• BTSE Token (BTSE), (market cap: US$637 million) +2%

• Chiliz (CHZ), (mc: US$1.46 billion) +2%

• WhiteBit Token (WBT), (mc: US$977 million) +1%

• Chain (XCN), (mc: US$1.1 billion) +1%

DAILY SLUMPERS

• Tokenize XChange (TKX), (market cap: US$1.22 billion) -11%

• Aave (AAVE), (mc: US$1.23 billion) -10%

• The Graph (GRT), (mc: US$670 million) -9%

• Evmos (EVMOS), (mc: US$610 million) -8%

• Fantom (FTM), (mc: US$678 million) -7%

Lower-cap wrap

There’s a lot of chaff the further you delve down the market cap list. Occasional grains of wheat, too, though. Remember to DYOR.

• Goldfinch (GFI), (market cap: US$29 million) +54%

• Phala Network (PHA), (mc: US$113 million) 53%

• Rarible (RARI), (mc: US$44 million) +14%

• Ocean Protocol (OCEAN), (mc: US$98 million) +32%

• Mask Network (MASK), (mc: US$244 million) +23%

DAILY SLUMPERS

• OriginTrail (TRAC), (market cap: US$88 million) -14%

• Ethereum Name Service (ENS), (mc: US$423 million) -9%

• ImmutableX (IMX), (mc: US$343 million) -9%

• LooksRare (LOOKS), (mc: US$118 million) -9%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Lots of FTX FUD going around today.

Reminder, exchanges are not banks, your crypto should be stored on a hardware wallet. #bitcoin #crypto

— Lark Davis (@TheCryptoLark) November 6, 2022

Quick bounce to 21500 and 1700 is still likely.

— il Capo Of Crypto (@CryptoCapo_) November 6, 2022

BREAKING – CZ on selling $500m of FTX token FTT:

We won't support people who lobby against other industry players behind their backs.

What has Sam been up to? 🤔

— Bitcoin Archive (@BTC_Archive) November 6, 2022

You are way smarter than me, bro. I don’t think that much. 😂

— CZ 🔶 BNB (@cz_binance) November 6, 2022

World cup is in 2 weeks. World cup fan tokens are one of the few narratives to play right now and CHZ is the most liquid fan token for degens to ape into. IF this weekly breaks out I'm in. pic.twitter.com/lJ1RjRUbHp

— Will (@WClementeIII) November 5, 2022

If @saylor had bought $ETH instead of #Bitcoin, Microstrategy would be up $1.8b vs down $1.2b. pic.twitter.com/NWDdDkalGi

— Miles Deutscher (@milesdeutscher) November 5, 2022

https://twitter.com/BTC_Archive/status/1589198821636329479

FUN FACT: 9 years ago today, someone paid to store all the lyrics to "Never Gonna Give You Up" on the #Bitcoin blockchain for all time ✨ pic.twitter.com/8aP0PfTZNr

— The Bitcoin Historian (@pete_rizzo_) November 5, 2022

https://twitter.com/buitengebieden/status/1589285975033016322

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.