Mooners and Shakers: Jerome ‘Very Premature’ Powell deflates stocks ‘n’ crypto; DOGE has a rest

Premature issues: Federal Reserve chief Jerome Powell tongue lashes the markets. (Getty Images)

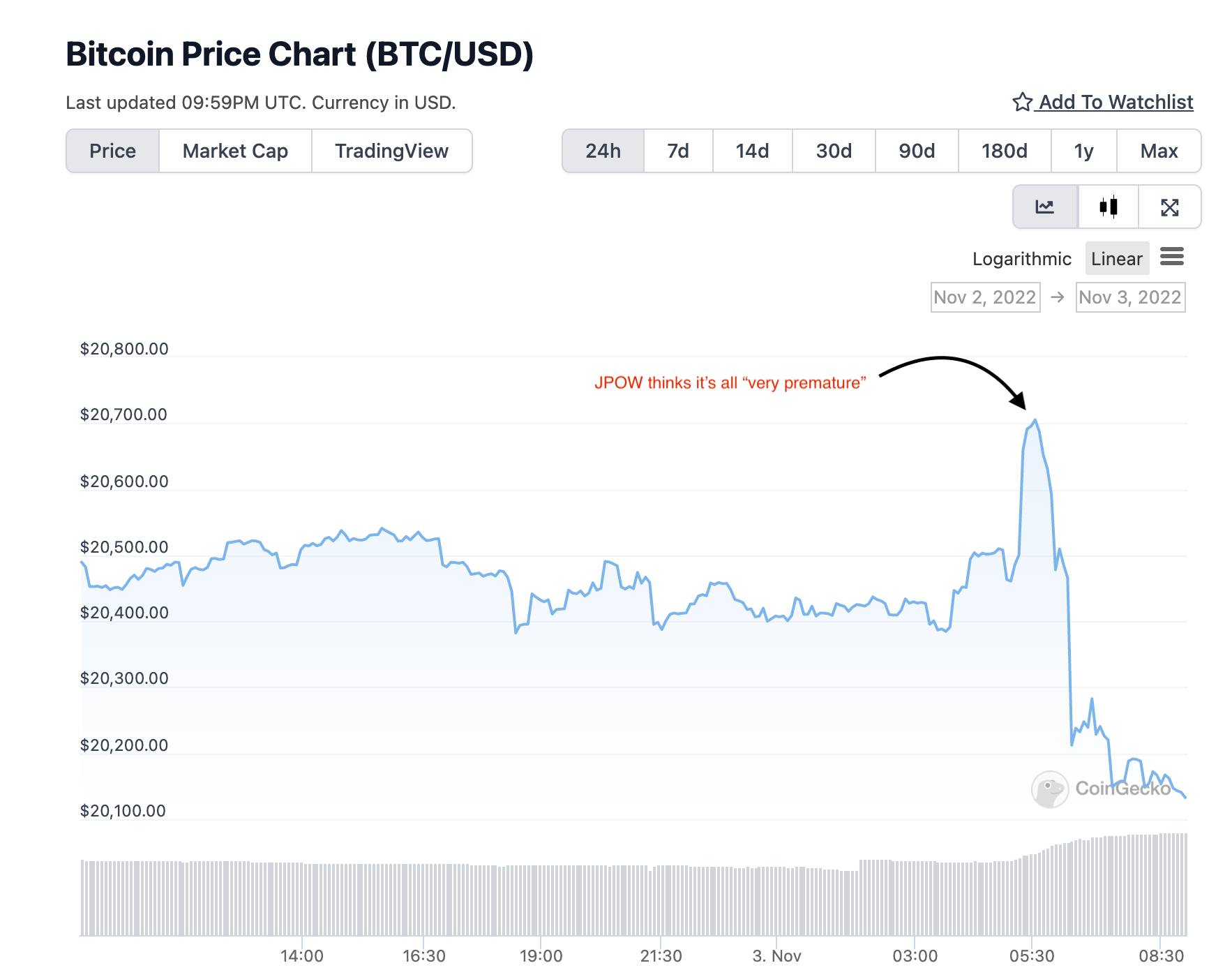

It’s not the greatest of news out of Washington, D.C. today, particularly from Fed boss Jerome Powell’s mouth. Markets have slumped as a result, very much including Bitcoin and crypto more broadly.

It wasn’t so much the fourth 75 basis points interest-rate hike in a row that did it – that was pretty much baked in and widely expected. In fact, stocks and Bitcoin had a little pump on that reveal.

But then Powell stepped up to the podium for his presser. As Stockhead‘s Eddy Sunarto sums up extremely well here, all it took was two words. “Very” and “premature”, in reference to chatter about pivoting and pausing rate hikes.

Ba-bowwwww… denied.

Ah well, could be worse. Crypto kingpin Bitcoin doesn’t seem to have tumbled too drastically just yet. Although the day/night is still young (depending on time zone) for the market that never sleeps.

Also catching our eye are the following few Twitter-based takes on FOMC meeting revelations. Things still seem very macro dim for the forseeable, and that’s the headline, really. Despite that, we’re still seeing the thinnest of slivers of analyst-led positivity here and there.

They’re winging it.

— Sven Henrich (@NorthmanTrader) November 2, 2022

My FOMC takes after the dust settled

The Fed raised rates by 75bps as expected. More importantly, it confirmed what the Fed's leaker in chief (WSJ's Tsimiraos) had said: slower hiking pace going forward.

— Alex Krüger (@krugermacro) November 2, 2022

#FOMC press conference just wrapped up, and it was certainly more hawkish than dovish.

That makes the bull case more difficult. But ultimately, it's up to how markets digest this information in the coming days.

— Justin Bennett (@JustinBennettFX) November 2, 2022

Onto some price action.

Top 10 overview

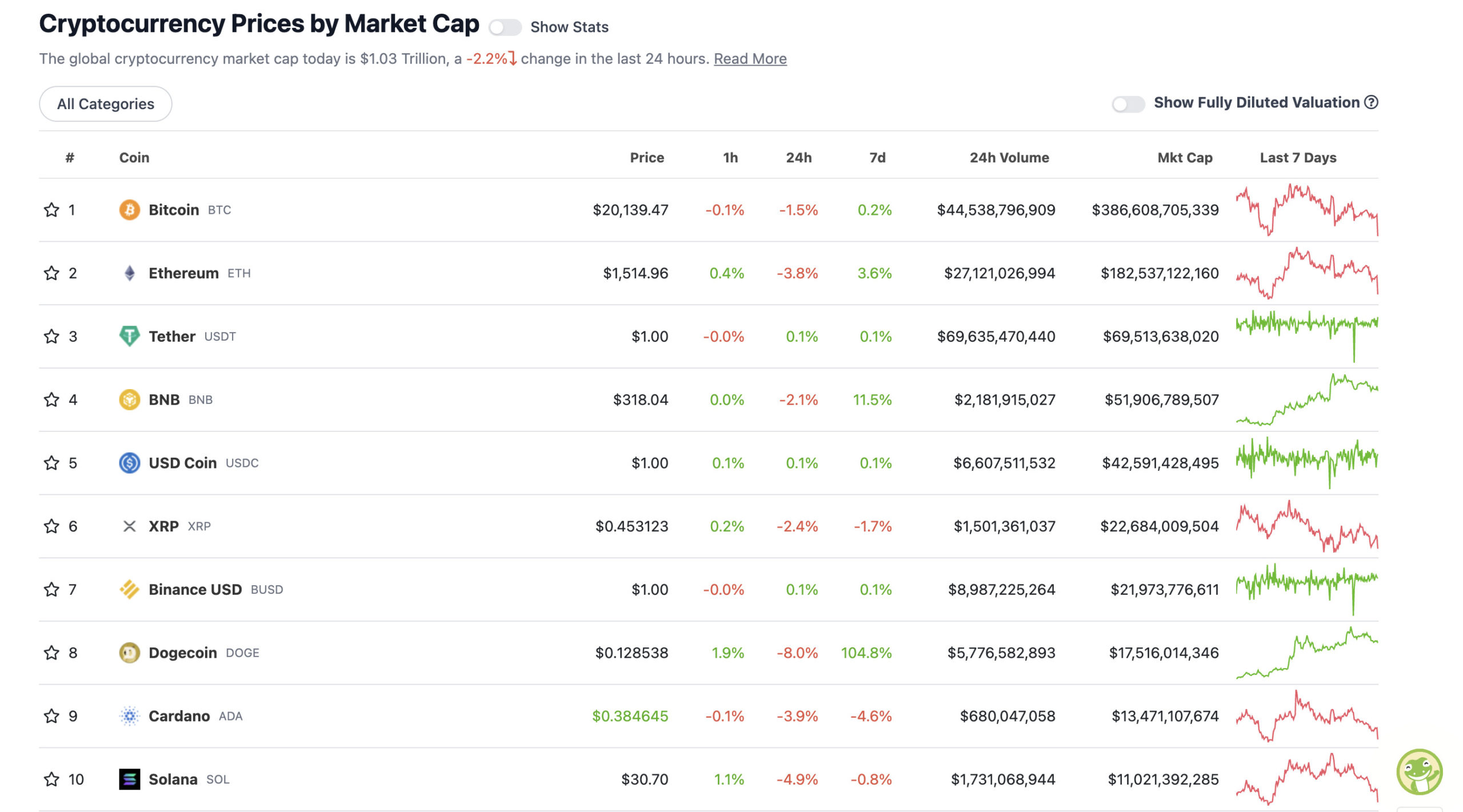

With the overall crypto market cap at US$1.03 trillion, down a bit over 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Like we said, it’s not a bloodbath. Yet. The market is still sitting above the fabled US$1 trillion mark and Bitcoin is clinging to the psychological support of US$20k. (At the time of writing, and subject to extremely rapid change, naturally.)

The market’s 2iC, Ethereum has taken a bit more of a hit with a -3.8% decline on the 24-hour timeframe. Dogecoin, after recent “much wowness”, is the biggest daily deflater, however.

DOGE has let out one of those “I’m pissed off you’re not walking me right now” doggy sighs, and is curled up again in its bed with a slightly dodgy tummy that could precursor an unpleasant dump in the back yard.

Then again, who knows what treats its favourite alpha, Elon Musk, has in store for it coming up?

And just on Elon Musk, actually, US investor/analyst Mark Moss posted a pretty interesting Twitter thread today regarding the Tesla CEO’s potential motivations for buying Twitter and how it could involve the “PayPal mafia”.

See “Around the Blocks”, further below.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.56 billion to about US$413 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Tokenize XChange (TKX), (market cap: US$1.48 billion) +9%

• Litecoin (LTC), (mc: US$4.23 billion) +7%

• Chiliz (CHZ), (mc: US$1.28 billion) +5%

• Huobi (HT), (mc: US$1.14 billion) +3%

• Mina Protocol (MINA), (mc: US$507 million) +3%

DAILY SLUMPERS

• Chain (XCN), (market cap: US$1.16 billion) -17%

• Evmos (EVMOS), (mc: US$593 million) -13%

• Aptos (APT), (mc: US$947 million) -12%

• Shiba Inu (SHIB), (mc: US$6.9 billion) -9%

• ApeCoin (APE), (mc: US$1.3 billion) -8%

Lower-cap wrap

There’s some definite chaff down here. Occasional wheat, too. Remember to DYOR.

• Xen Crypto (XEN), (market cap: US$12.2 million) +195%

• TitanSwap (TITAN), (mc: US$13.7 million) 78%

• Mask Network (MASK), (mc: US$189 million) +74%

• Litentry (LIT), (mc: US$40 million) +13%

• Render (RNDR), (mc: US$221 million) +11%

DAILY SLUMPERS

• DogeChain (DC), (market cap: US$24 million) -19%

• Phala Network (PHA), (mc: US$72 million) -17%

• Rarible (RARI), (mc: US$40 million) -16%

• X2Y2 (X2Y2), (mc: US$7.2 million) -13%

• Rocket Pool (RPL), (mc: US$394 million) -11%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

The REAL reason Musk bought Twitter is SO MUCH BIGGER than we’ve all been told.

Has this been a plan that's been in the making for over 2 decades?

Time for a thread🧵investigating the PayPal Mafias next revolutionary technological invention in the 21st century👇

— Mark Moss (@1MarkMoss) November 2, 2022

“#Bitcoin is very slow”

Reality:⚡️ pic.twitter.com/hUTcI3N9KX— Lightning Ventures (@ltngventures) November 2, 2022

The Fed meeting summarized: pic.twitter.com/FBSt68zFCU

— Alf (@MacroAlf) November 2, 2022

"tools" is code for rate cuts and QE btw.

— Sven Henrich (@NorthmanTrader) November 2, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.