Mooner and Shakers: Bitcoin surges past $24k as crypto market surprises, rising in tandem with US dollar

Let's hope current crypto bulls don't turn out to be bear-market clowns. (Getty Images)

Wait, what’s happened to the inverse correlation with the US dollar? Shouldn’t Bitcoin and the crypto market be plummeting right about now?

As the US Dollar Index (DXY) has something of a pump (well, it’s up 0.58%), the crypto market is surprising many as it takes the ball and bursts hard up the sideline.

https://twitter.com/SerLondonCrypto/status/1625956807825932289

So… what the FTX is going on? This time it’s different? It’s got a few traders feeling a little nervy about a potential “bull trap”…

https://twitter.com/Matthew76197677/status/1625951312054726656

$BTC – i'd still be cautious around here. Keeping open mind of things…both btc and eth below jan high still. …dxy pushing up. wouldnt get too optimistic just yet pic.twitter.com/JOBZUAta3I

— TraderSZ (@trader1sz) February 15, 2023

It’s not just Bitcoin and crypto, though. Wall Street closed quite positively in the green overnight, with the S&P 500 up by 0.14% and Nasdaq by 0.68%.

Stockhead’s Eddy Sunarto has some ideas about what’s potentially playing out, as he details in his Market Highlights wrap this morning.

“Instead of a recession, it looks like the US economy will have a solid first quarter as retail sales jumped the most in two years in January,” wrote our resident macro/markets guru.

Meanwhile, delving further into the Cryptoverse, it’s not long before you stumble across those emanating high-octane optimism.

Bullish vibes🔥

This is the most bullish setup we've seen in the past year for $BTC.

Just got to beat that high from last August, and then on to attack the resistance level at $30,000. pic.twitter.com/vRPxNhK26m— Glen Goodman (@glengoodman) February 15, 2023

And yes, it could well be for engagement purposes, but here’s Crypto Zombie, who thinks Bitcoin might be ready to “truly shock the world”…

🚨 #Bitcoin shocks everyone as $DXY also pumps!

SEC FUD can't hold $BTC back as Circle clarifies $USDC rumors FALSE!!

THIS could be the biggest hint yet! Why #BTC might be on track to truly shock the world!

***NEW VIDEO***

📺👉 https://t.co/usYziEZ9kI 👈👀

***WATCH NOW*** pic.twitter.com/7fqQPZSTvT— Crypto Zombie (@TheCryptoZombie) February 15, 2023

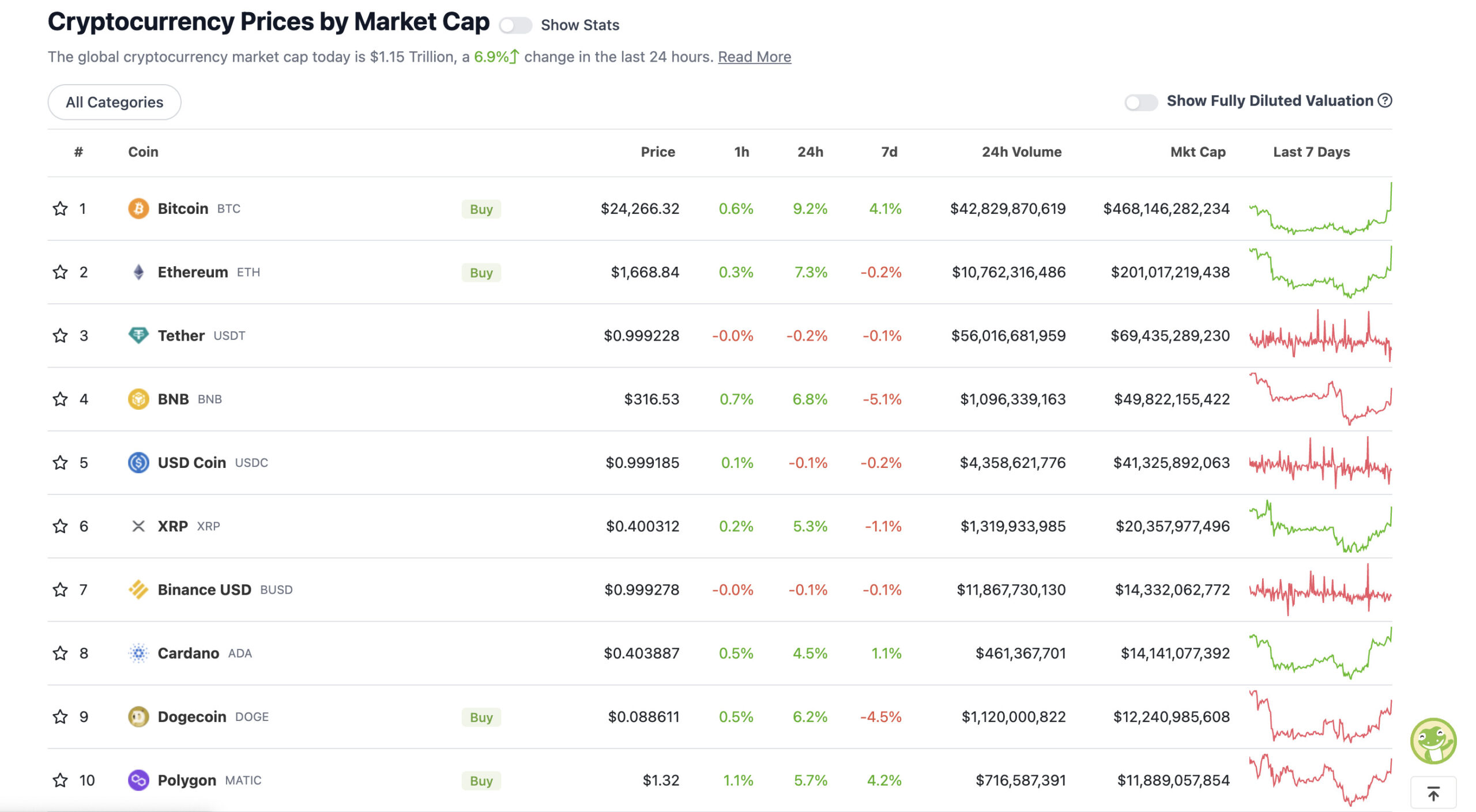

Top 10 overview

With the overall crypto market cap at US$1.15 trillion, up about 7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Well look at that, Bitcoin (BTC) is actually leading the majors for daily gains today, which is pleasing. In bullish surges of yore, an altcoin pump would often follow Bitcoin’s initial lead.

Tempering that statement somewhat… while Wells Fargo has come out and said that “the bear market is over” in stocks (which crypto is tightly correlated to), that doesn’t necessarily mean the bull market is immediately back on.

Here’s another prominent trader calling for caution – Gareth Soloway, speaking here with Aussie crypto YouTube and Twitter content creator Miles Deutscher. Soloway believes Bitcoin still has a ways to go before it truly bottoms out this year, but he’s bullish on it for 2024, while gold is his asset for 2023.

3. $BTC will bottom in H2 2023, but we see a recovery heading into 2024.

"I do think #Bitcoin bottoms out in 2023, towards the end of the year."

"I think $BTC starts to rebound [into the halving] – but before that we go down." pic.twitter.com/l2HCZpG8Nx

— Miles Deutscher (@milesdeutscher) February 15, 2023

Continuing our flagging of wild swings of opinion spotted on Crypto Twitter, though, here’s another popular trader, who goes by the name of “Moustache”. In his view, BTC might have a “god candle” in its near future.

#Bitcoin (W)

As long as $BTC holds the 0.236 line🔴, things look good.

I expect a GOD-Candle to ~$28.000, IF $BTC breaks the black line.

There is nothing but air, between 24k-28k.That would hurt most bears out there tbh.🎯 pic.twitter.com/4TKqqNv7FC

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) February 15, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$11 billion to about US$475 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Bitget Token (BGB), (market cap: US$646 million) +20%

• Render (RNDR), (mc: US$609 million) +17%

• Optimism (OP), (mc: US$604 million) +16%

• Mina Protocol (MINA), (mc: US$1 billion) +15%

• Rocket Pool (RPL), (mc: US$894 million) +10%

Not much slumping in the top 100 by market cap today. In fact, the only thing even slightly in the red at the time of writing is meme coin Baby Doge Coin (BABYDOGE), which is down a fraction of a percentage point.

Let’s take a look further down the market cap list to see what’s mooning right now – a place where only the boldest of crypto traders in this nervy market tend to tread…

• Conflux (CFX), (market cap: US$203 million) +64%

• Floki (FLOKI), (mc: US$360 million) +58%

• Blur (BLUR), (mc: US$331 million) +45%

• Lyra Finance (LYRA), (mc: US$64 million) +16%

Little-known project Conflux (CFX), which is a layer 1 blockchain that pitches itself as a kind of bridge between Western and Asian markets, has big partnership news. Conflux is reportedly a regulatory-compliant blockchain in China, and has apparently inked a significant partnership deal with China Telecom, according to the following tweet…

China Telecom, 2nd largest wireless carrier in China 🇨🇳 (390+ million mobile subscribers), has partnered with Conflux to develop Blockchain-enabled SIM cards – BSIM! pic.twitter.com/LQxz34L432

— Conflux Network Official (@Conflux_Network) February 15, 2023

Meanwhile, Floki (FLOKI) is possibly still well up on this silly Elon Musk news from yesterday. And as for BLUR and LYRA, you can read about those on Stockhead in recent articles, too. Top Aussie fundie Apollo Crypto is particularly bullish on Lyra Finance.

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Part of me hopes $BTC rips through 30k & never sees the 20k area ever again. Even if that means consolidating between 30-50 for the next 2 years.

You had half a years worth of time to buy below 19k and you blew it thinking an asset that already corrected 80% would go lower.…

— Roman (@Roman_Trading) February 15, 2023

#COIN +17% overnight while #BTC +8.7% to $24132.

$25.5k the key topside level that #Bitcoin needs to break to confirm a rounded bottom in place at the $15.5k low from November #Crypto #cryptocurrency pic.twitter.com/NaB1kbofrf

— Tony Sycamore_IG (@Tony_Sycamore) February 15, 2023

The SEC is working on a draft proposal that would make it difficult for crypto companies to act as "qualified crypto custodians " on behalf of their clients.

— Crypto Crib (@Crypto_Crib_) February 15, 2023

My statement on today's custody proposal. Looking forward to comments from the public. This one affects crypto, among many other issues: https://t.co/1eWT6P45Ya

— Hester Peirce (@HesterPeirce) February 15, 2023

TLDR on SEC Commissioner Peirce’s statement on the SEC’s latest move on crypto – amending institutional crypto custody rulings: she doesn’t support it. It’s not as black and white as that, of course, but here’s a snippet from her long rationale:

“Significant aspects of the proposed approach and its implementation timeline, however, raise such great questions about the rule’s workability and breadth that I cannot support today’s proposal.”

Anyhoo… moving back to lighter subject matter…

#Bitcoin 24 https://t.co/pFXXZTfCFB

— naiive (@naiivememe) February 15, 2023

#Bitcoin having it's biggest single day PUMP in 159 days. 🚀 pic.twitter.com/BrfOlrW5Pt

— Bitcoin Archive (@BTC_Archive) February 15, 2023

And here’s “Ulti Crypto”, who spoke with Stockhead recently about his NFT short-selling project Dyve. Maybe he won’t be looking to short-sell Ethlizards NFTs any time soon?

I bought an @ethlizards a few weeks ago as my first real NFT purchase this year.

They caught my attention because of their high transparency, strong leadership, deal access, and understanding of web3 and gamefi, with a community second to none (except @WolvesDAO but I'm biased!)

— Ulti (@UltiCrypto) February 15, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.