DeFi tokens soar, with derivatives trading platforms dYdX and FutureSwap rising 50%

Getty Images

DeFi tokens are surging this morning following a weekend in which Bitcoin tested support at US$40,000 for the fourth time in six days.

The dYdX token for the leveraged trading exchange on Arbitrum surged 48.7 per cent to a fresh all-time high of $20.51, making it the No. 98 coin on Coingecko, overtaking rival Perpetual Protocol. PERP was up 26.8 per cent to $14.91, making it the No. 118 token.

Ok I’m here to collect my clout, $dYdX is up 100% (2x) since I posted this. Let’s go https://t.co/iJIidqptVI

— Skibtc ⚡️ (@Skibtc) September 27, 2021

$DYDX doing more than 2X the volume of Uniswap at 1/13th the market cap!

— Lark Davis (@TheCryptoLark) September 27, 2021

FutureSwap, a smaller leveraged trading platform, rocketed 55.8 per cent to US$13.79. It’s the No. 479 token on Coingecko. No. 200 coin Mango Markets, which offers perpetual and spot trading on Solana, had gained 14 per cent to US30.8c.

Ethereum-based decentralised exchanges were also on fire, with Uniswap gaining 33 per cent to US$25.26, Sushi climbing 26.2 per cent to $11.72, and the Curve DAO coin rising 17.5 per cent to $2.65.

On Avalanche, the decentralised exchange Trader Joe was up 16.2 per cent to US$16.2, although the Solana-based DEX Raydium was having a quiet day.

Borrowing and lending protocols Aave and Compound were both up around 11 per cent.

DeFi has had a quiet few weeks lately, with layer 1 blockchain projects like Avalanche and Solana stealing the show. Those tokens were up a more subdued 3.4 per cent and 5.1 per cent, respectively.

Bitcoin back over US$44k

The original cryptocurrency meanwhile was up 4.8 per cent to US$44,346, after bouncing off US$40,000 around 6pm AEST on Sunday. BTC slid from over $45,000 to $40,000 Friday night on word of another crypto-crackdown in China.

But Bitcoin chartist Mick Krypto posted that he was slightly more bearish than bullish, based on BTC losing its 21-week exponential moving average on the weekly chart.

“Can we still see much higher levels? Definitely. But with how the technicals stand right now, I’m very concerned,” he wrote. Today’s price action is in “near-perfect alignment” with a weekly fractal in April that led to a mega dump.

“It’s not about what happens today, it’s about what happens this week. It’s easy to get caught up in the hype,” he added.

I agree. It’s either the bottom is in, or we’re going much lower than the 35-38k level that literally everyone is calling for

— Bitcoin Trading with Mick (@MICKrypto) September 27, 2021

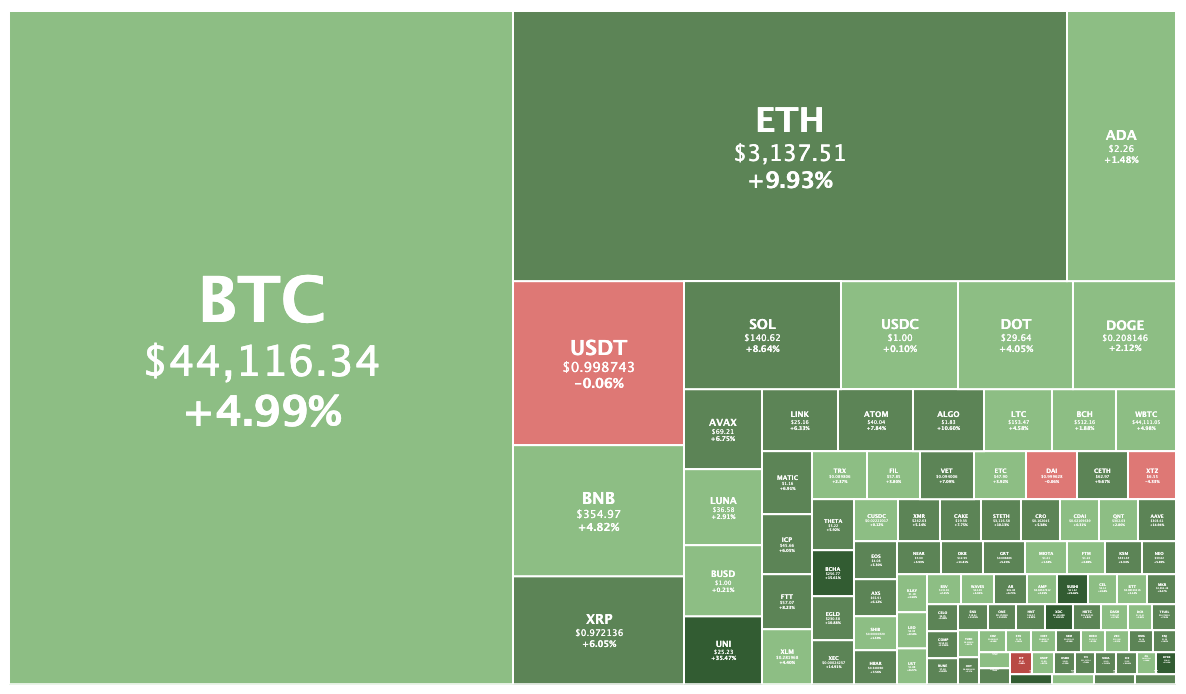

Overall the total market was up 5.3 per cent to US$1.96 trillion, with Ethereum rising 9.6 per cent to US$3,138.

Just three of the top coins were in the red, with Huobi Token the biggest loser, falling 11.9 per cent. The No. 80 crypto, the coin is the native token of the Huobi Global exchange, which was founded in China but is now based in Seychelles.

Huobi Global said in a statement issued overnight that it had ceased account registrations for Chinese users on Friday and would gradually retire existing mainland China accounts by year-end, “to comply with local laws and regulations.”

“Huobi Global has always been dedicated to offering digital asset trading services and ensuring the safety of customer assets, while following all applicable laws,” the exchange said. “We apologize for any inconvenience caused and thank you for your understanding and support!”

Revain and Tezos were the other losers, both down a little under six per cent.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.