Big trouble? China steps up its crypto ban (again), knocking wind from market

Basket cases: a scene from 1986 film Big Trouble in Little China (Getty Images)

They’re ba-aaaaack… Chinese regulators, that is, throwing another crypto-crackdown firecracker, spreading FUD across the cryptoverse and tanking the market.

As if the fears about China’s wobbly property situation wasn’t enough price-shaking news for one week, we’re now forced to take another spin on the hamster wheel of relentless Chinese crypto bans and crackdowns.

We’d just like to point out, though, that Bitcoin, Ethereum and the wider market has recovered strongly from this sort of news from the Eastern powerhouse in the past. Many more times than seems necessary, in fact.

That said, the crypto market is firmly, and suddenly, back in Dip City as we head into the weekend.

Exactly this! #bitcoin https://t.co/yLM1yPz9wy

— Lark Davis (@TheCryptoLark) September 24, 2021

So, what’s happening?

China’s central bank, the People’s Bank of China (PBoC), has announced (actually reiterated) it deems all cryptocurrency trading activities illegal and that it plans to take further action to enforce its existing stance.

At this stage, actual possession of cryptocurrencies seems to be the only crypto-related activity that remains legal. Just don’t buy any more or trade. Got that, Chinese citizens? Holding a bag of tanking sh*tcoins you need to urgently move into stablecoins? Yeah, tough luck.

In a public statement, the PBoC revealed that it, along with a group of 10 Chinese government regulators and agencies, are banding together to broadly tackle cryptocurrency.

These authorities have apparently established a “coordination mechanism” to prevent financial players from participating in any cryptocurrency transactions.

This is on top of the country’s crypto-mining ban enacted in June, and, of course, its ban on crypto exchanges, which was actually first put forward for the consideration of global news editors five years ago.

The Chinese regulators have, according to the announcement, improved their monitoring platforms to identify illegal cryptocurrency transactions and mining activities more efficiently.

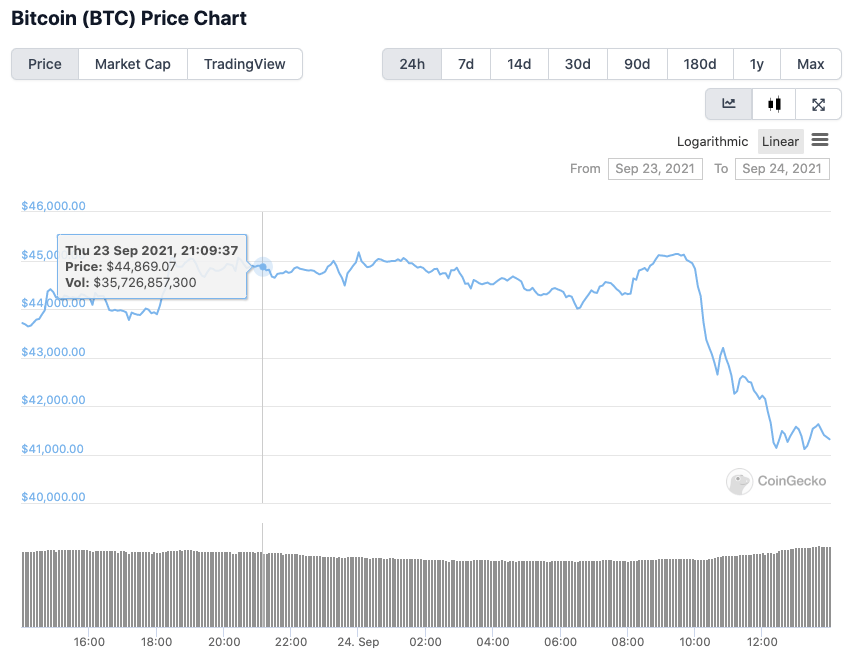

At the time of writing, the “fresh” China news has completely knocked the wind out of the crypto market’s sails. The entire market cap is now at a wobbly US$1.91 trillion, down 5.7 per cent since this time yesterday.

Bitcoin (BTC) has lost a at least a couple zones of crucial support, plummeting through US$44K and $42,500 to where it is right now – US$41,070. A dip into the mid-high $30Ks wouldn’t be completely unexpected.

Ethereum (ETH), meanwhile has sunk 9 per cent at press time, and is changing hands for US$2,800. It’s still trading above its 200-day moving average bullish support line, though. For now.

Is anyone is wondering if news is recycled to spread FUD when convenient?

See below. $btc #bitcoin $eth #ETH https://t.co/COVIzs1G4K

— SHELDON EVANS (@SheldonEvans) September 24, 2021

While the PBoC bombshell is certainly hitting the market hard, it seems that it’s not actually fresh news – at least not in China. The Chinese central bank’s notice is actually dated September 3.

According to reports, a coordinated effort to circulate the PBoC update via Chinese social media (WeChat and Weibo) has been taking place today. It’s subsequently been picked up and spread elsewhere and onto Western media outlets.

https://twitter.com/CanteringClark/status/1441388106649796620

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.