Bitcoin, Ethereum dip as crypto rally loses steam, but Avalanche gains another 20%

Getty Images

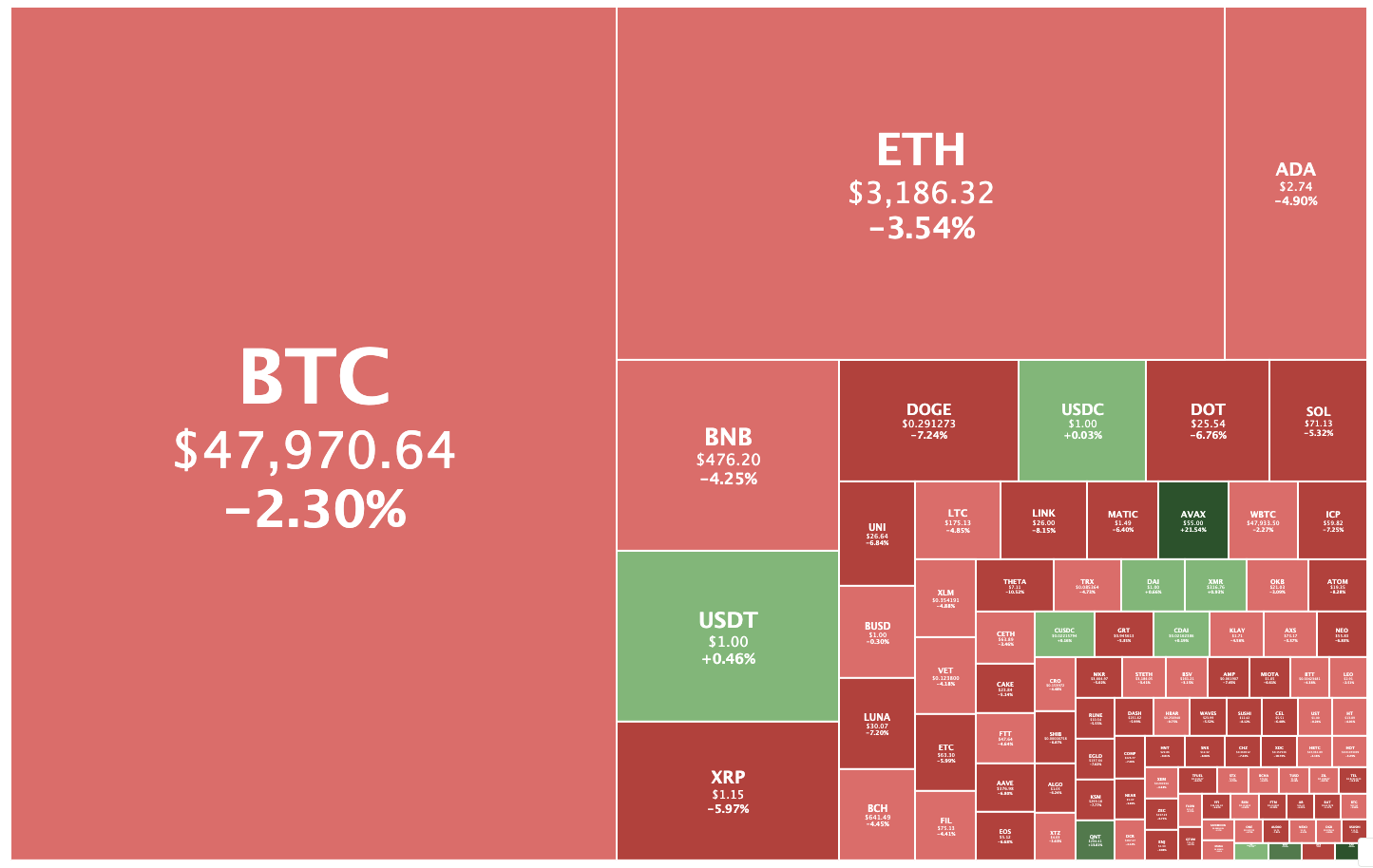

Cryptocurrencies are edging lower this morning, with 24 of the top 25 coins losing ground, as the month-long rally shows signs of exhaustion.

Bitcoin was trading at US$47,817, down 2.2 per cent from 24 hours ago. Ethereum was changing hands for US$3,174, down 3.5 per cent. The overall market was down 2.7 per cent to US$2.08 trillion.

Bitcoin analyst Bitcoin Charts posted that BTC had seen its first bearish engulfing candle on the daily charts in over a month, and it was imperative that bulls reclaim US$48,000.

“With what I’m seeing in the charts right now, it is looking like we may see a larger pullback in the days and weeks to come,” they wrote. “If we do see one, it could be healthy as we haven’t seen any significant pullbacks since this bullish rise began over a month ago.”

The original crypto could find support at US$45,300 to $US45,500, but that could change if and when there’s a break to the downside, they said.

Sydney-based market analyst Tony Sycamore with City Index saw it similarly. He wrote in his morning brief that unless BTC can push through a strong band of resistance at US$50,000 to US$53,500, traders should allow for a pullback towards support at US$46,000, or possibly even as deep as US$42,000/US$40,000.

In the 35 days since July 21, Bitcoin has gained 61 per cent.

AVAX pump continues

Avalanche was the biggest gainer in the top 100, rising 20 per cent to US$54 at lunchtime, Sydney time, and trading as high as US$58.98 earlier this morning on a pair of bullish announcements.

The third-generation crypto set an all-time high of $59.94 back on February 10, in the year’s first big altcoin rally.

The Avalanche Foundation announced overnight that Sushi would join its US$180 million DeFi incentive program, Avalanche Rush, with US$7.5 million in liquidity mining incentives. The decentralised exchange formerly known as SushiSwap has been deployed on Avalanche since March, but hasn’t really gained too much traction there, with trading dominated by Pangolin and Trader Joe.

“Combining Sushi’s community-driven protocol with Avalanche’s high-performance capabilities will enhance the overall experience for DeFi users across the ecosystem,” Avalanche founder Emin Gün Sirer said in the announcement.

Sushi tokens didn’t join the rally, falling 6.9 per cent to US$12.56.

Also overnight, Avalanche announced that phase 3 of its “Apricot upgrade” had gone live as scheduled on its C-Chain, Avalanche’s blockchain that’s compatible with Ethereum. The upgrade introduces dynamic gas fees, which should lower transaction costs by up to two-thirds. Transactions on Avalanche currently cost around US25c.

AVAX is now listed as the No. 19 crypto on Coinmarketcap and the No. 18 on Coingecko. Its US$9.5 billion market cap puts Avalanche neck-and-neck with Polygon.

On the flip side, XDC Network has been the biggest loser among top 100 coins, falling 10.7 per cent to US15.6c.

Quant had hit an all-time high of US$209.76. Other tokens setting fresh records this morning included Coin98 and Avalanche ecosystem tokens Avaware, Avalaunch, and Benqi Finance.

Luna had also set a new all-time high yesterday afternoon.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.