Mooners and Shakers: Turns out altcoins, like God, just move in mysterious ways

Coinhead

Coinhead

A happy Monday morning to you all. Well… it’s kind of a happy Monday morning, after a weekend of ups and downs that have left more than a few people scratching their heads. Let’s dive in and see what’s what…

A quick look at the majors this morning, and things were largely ‘steady as she goes’ for the past 48 hours for BTC and ETH, until a small-ish plunge this morning took some of the wind out of their sales.

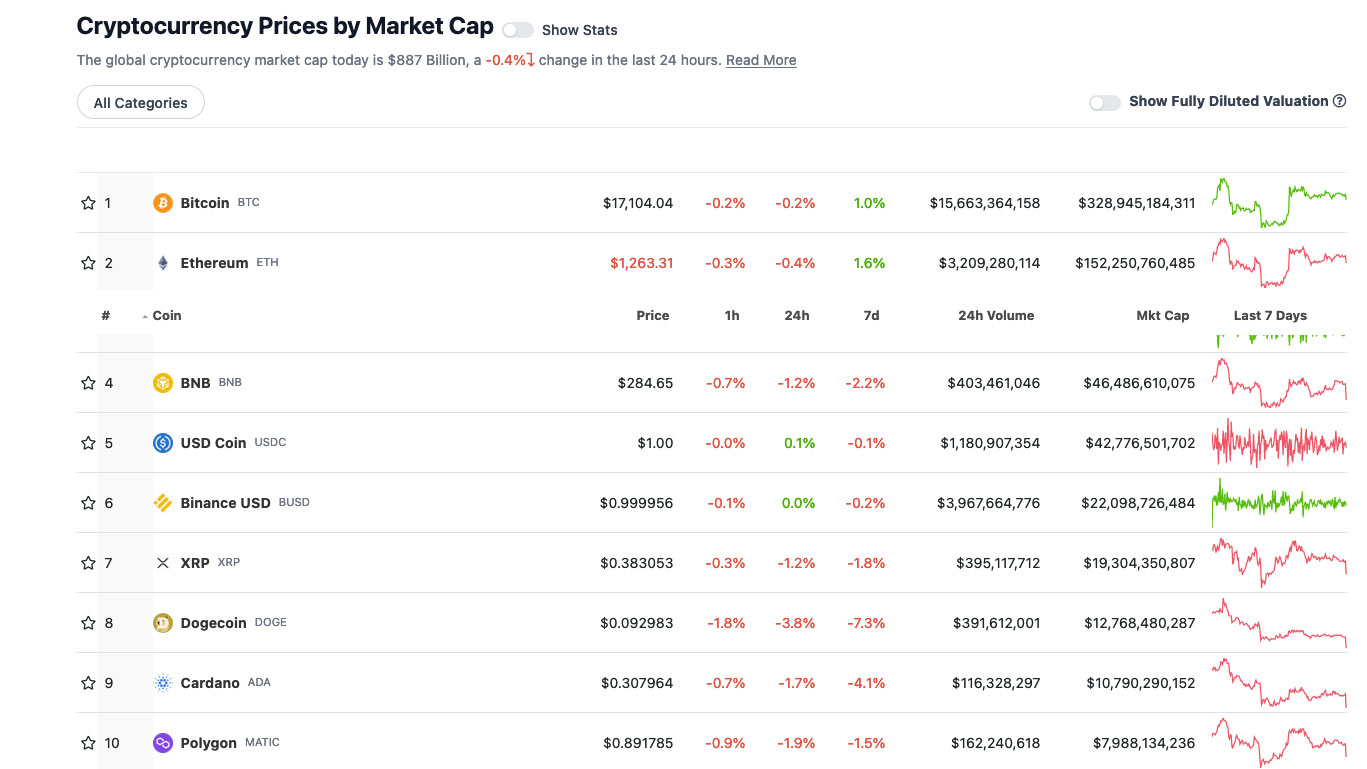

Over the past 24 hours, Bitcoin is trading 0.2% down, Ethereum is -0.6%, BNB is -1.3% and XRP is down 1.3% as well.

At the time of writing, most of the majors are tracking lower, by around 0.1-0.2% for the past hour.

There’s been some interesting news in the crypto space over the past couple of days, so let’s get into that and then we’ll do Charts and Numbers until it’s time to break for recess.

Off the bat, there were some elevated heart rates at Binance over the weekend, where a handful of altcoins started doing weird things – so weird, in fact, that Bitcoin CEO “CZ” (it’s jewellery industry code for Cubic Zirconia… make of that what you will) took to Twitter to announce he had Top Men looking into things.

We are aware of the abnormal price movements for certain trading pairs on #Binance, involving assets such as $SUN, $ARDR, $OSMO, $FUN and $GLM.

Our team is investigating and taking appropriate actions in regards to the suspicious accounts.

— Binance (@binance) December 11, 2022

But, in much the same way that things work out when it’s left to the police to investigate when things go horribly wrong in the US, a few hours later the industry got the reassurance it needs in the form of a “we have investigated ourselves and found that we’ve done nothing wrong” message.

Based on our investigations so far, this appears to be just market behavior. One guy deposited funds and started buying. (Hackers don’t deposit). Other guys followed. Can’t see linkage between the accounts. 1/3 https://t.co/QlB1VnlHVs

— CZ 🔶 Binance (@cz_binance) December 11, 2022

So… yeah. Sudden 1000% swings in trading volume are “just normal trading activity” – good to know.

But at least it’s a couple of positive-ish signs that – for now – Binance hasn’t been hacked and there are still punters willing to drive random altcoin values through the roof for “normal trading” purposes.

Meanwhile, over at Decrypt, there’s news that crypto is on the nose among certain US Senators, at a time when faith in the entire system is clearly at an all time low thanks to the FTX debacle (which we’ll get to in a moment).

And that’s all thanks to Senator Jon Tester, who appeared on the highly influential Meet the Press on Sunday to essentially say that crypto shouldn’t be regulated, because that would make people think it was actually a thing.

Senator Tester – a former teacher and farmer from Montana – serves on the hugely important Senate Banking, Housing, and Urban Affairs Committee, and had been invited on the program to talk about why one of his Democratic Party colleagues has abandoned the party to sit as an independent.

But Tester took the opportunity to basically out himself as utterly unqualified to talk about crypto – even though he’s on a committee that could, if it wanted to, turn the entire apple cart over.

When the host asked about Tester’s view on crypto – “Should the government be regulating it or banning it?” – the Senator replied with an emphatic “One or the other”.

“I’m not a regulator and I’m not a financial person that does regulation,” Tester said, staking a real claim on his Banking, Housing, and Urban Affairs Committee seat.

EXCLUSIVE: Cryptocurrency has not “been able to pass the smell test” for Senator Jon Tester (D-Mont.).@SenatorTester: “If we regulate it, it may give it the ability for people to think it’s real.” pic.twitter.com/E2OwQsJ9R3

— Meet the Press (@MeetThePress) December 11, 2022

“I see no reason why this stuff should exist. I really don’t,” he said, because crypto “doesn’t pass the smell test”.

“If we regulate it, it may give it the ability for people to think it’s real.”

I’ll let that comment sit with you for a moment.

And, speaking of doomed, Chinese authorities have reported that they’ve broken up a money laundering operation in Mongolia, and 63 people have been rounded up and are now, officially, up to their eyebrows in doo-doo.

The Block, citing a China News article, says: “Following an investigation into unusual money flows from construction firm Shi Mouyuan, authorities reportedly discovered a wide network that operated internationally and ‘converted funds suspected of online pyramid schemes, fraud, gambling and other crimes into virtual digital currency’.”

Chinese authorities say the gang managed to launder 12 billion yuan (US$1.7 billion), but things went wrong when the unusually high quantities of cash (a sudden 10 million yuan spike) running through a construction company caught the eye of local police.

The penalty for being involved in a crime like this in China is steep – a mandatory 10 years in a Chinese slammer, which is every bit as horrendous as you imagine it could be, plus massive fines that you’d never be able to pay, plus seizure of all the money that the cops reckon you laundered.

Given the size of the booty the gang allegedly laundered, you can bet your bottom Bitcoin that they’re gonna throw the book at them – all except for the man thought responsible for the operation, Zhang Mou, who has reportedly fled to Bangkok.

With the overall crypto market cap at US$887 billion, down 0.4%% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Sweeping a market-cap range of about US$6.1 billion to about US$329 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

DAILY SLUMPERS