Crypto Espresso: Sentiment is looking sentimental on a chirpy Friday morning

Coinhead

Coinhead

Mornin’ Coinheads.

It’s not been a huge 24 hours for the majors, but they’ve weathered a small shudder caused by news that Tesla showed the world what cubic zirconia hands look like, when it dumped 75% of its BTC holding.

People weren’t happy about Tesla doing that, and Twitter got predictably shouty about it – but Tesla appears to have had the last laugh. It says that whoever’s been shorting their stock is down US$1.55 billion for the past 30 days.

Turns out the only guaranteed way to short Tesla is to drive one into a lake.

Anyway… BTC is pretty much flat this morning, ETH is up +4.5%, XRP is up 2.6% and Cardano and Solana up 2.0% and 3.0% apiece. Curve was the big winner with a 21% jump, and Klatyn clattered into last place with a 2.5% dribble.

Trading platform eToro reckons things are looking better for crypto again, based on some encouraging stats from its market analyst Josh Gilbert.

Gilbert says the number of newly opened crypto positions on the platform is up 79% since last week, the total value of newly opened positions has also increased 129% over the same period, and the average trade value for a newly opened position was the highest it has been since April 8 this year.

Decrypt says high-profile investor Mike Novogratz has made the stunning claim that astronomical gains on crypto investments are “not normal”, during an appearance at the Christie’s Art+Tech summit in New York.

Novogratz quite famously made an absolute fortune and then lost most of it by going 150% bullish on Terra, going so far as to have a massive tattoo inked on his arm to pledge his undying loyalty to the asset.

https://twitter.com/novogratz/status/1478535972560195585?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1478535972560195585%7Ctwgr%5E%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fdecrypt.co%2F105697%2Fnovogratz-its-not-normal-to-earn-200x-in-crypto

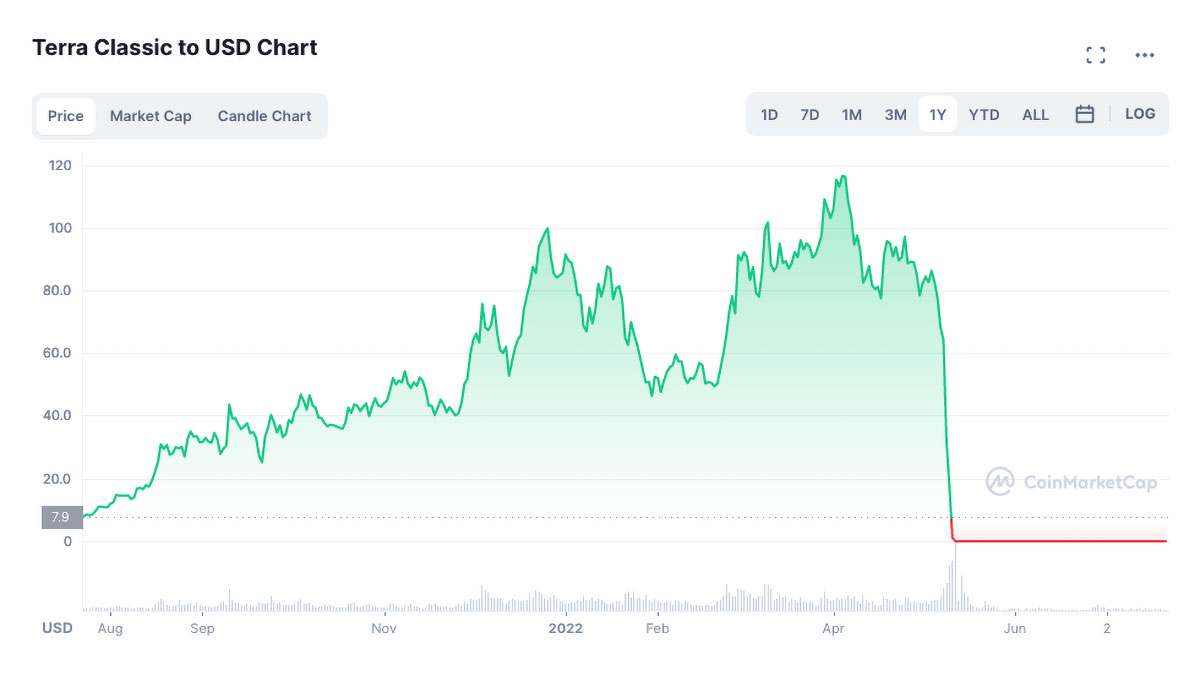

And here’s a reminder of Terra’s performance over the past 12 months. See if you can spot why Novogratz might not be the crypto oracle he reckons he is.

Over at Coindesk, and the big news Stateside is that the US Securities and Exchange Commission (SEC) has used an insider-trading case to formally declare nine digital tokens as “securities”.

“While the SEC has identified cryptocurrencies as securities in the past, typically it did so in enforcement actions or settlements with the issuer. But Thursday’s complaint is the first time the SEC identified several cryptocurrencies as securities without charging the issuers,” Coindesk says.

The SEC is chasing former Coinbase product manager Ishan Wahi, his brother Nikhil Wahi and Sameer Ramani on allegations of wire fraud and insider trading, saying the trio stood to profit up to US$1.1 million from advance knowledge of assets due to be listed on the platform.

And, over at Coin Telegraph, the news for South Korean crypto enthusiasts is pretty good, after the government revealed that it would postpone its proposed 20% “crypto tax” until at least 2025.

This is the second time the tax has been put on ice, since it was first announced in January 2021, and it’s reportedly because chairman of South Korea’s Tax Subcommittee, Kim Young-jin, wants to focus on industry regulation as a priority.

Last on the list is a Picard-level facepalm moment from NFT whale and would-be troll “Franklin” who has made a $230,000 fumble after a joke Ethereum Name Service wallet listing backfired, according to CNET.

Franklin listed “stop-doing-fake-bids-its-honestly-lame-my-guy.eth”, for sale – and put in a fake bid of his own at 100ETH to get the market-watching Twitter bots to tweet about it.

Some wag offered Frankling 1.891 ETH for it – which he accepted, calling it “the most surprising 1.891 ETH I’ve ever made” – then forgot to cancel his own dummy bid of 100 ETH. When the sale expired, Franklin’s dummy bid was accepted – and the new owner of the wallet pocketed the coin. Oopsies.