Mithril hits bonanza 7m at 144g/t gold, 1162g/t silver ahead of Copalquin resource upgrade

- Mithril Silver and Gold intersects best ever intersection of 7m at 144g/t gold and 1162g/t silver at Copalquin

- Result sits right at the Target 1 area where the company seeks to double the current 520,000oz at 6.81g/t gold equivalent resource

- Further drill assays pending including the follow-up CDH-161 hole

Special Report: Mithril Silver and Gold has knocked the ball out of the park with a stunning drill intersection of 7m grading 144g/t gold and 1162g/t silver at its Copalquin project in Mexico.

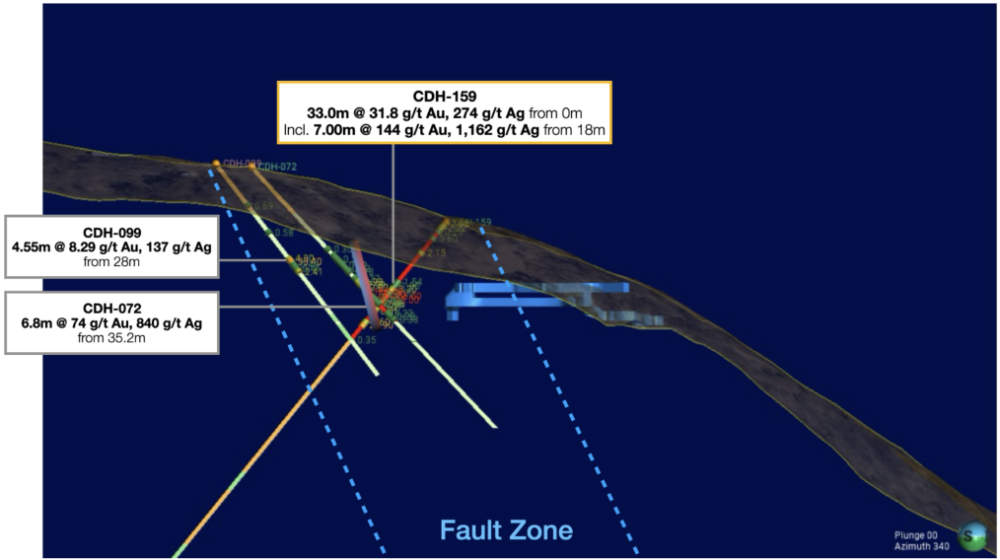

The interval from a down-hole depth of just 18m is part of a broader 33m intersection at 31.8g/t gold and 274g/t silver from surface in hole CDH-159 and at 1180 grams gold equivalent times metres (AuEq x m), it’s the best intercept seen at the project to date.

CDH-159 was designed to test the recently mapped and channel sampled structure that had been previously intersected by CDH-072 (6.8m at 74g/t gold and 840g/t silver from 35.2m) from a different orientation.

Using this data, Mithril Silver and Gold (ASX:MTH) also moved to drill a second hole (CDH-161) along strike with assays pending.

“Hole CDH-159 is a globally significant >1,000 g/t AuEq1 x metre drill hole at the maiden resource Target 1 area where we aim to 2x the (529,000oz at 6.81 g/t gold equivalent) resource in Q1 2025,” managing director John Skeet said.

“The intercept includes a zone of lower grade material from surface plus a very high-grade zone from 16 metres down hole, including the typical bonanza gold and silver grades that are a hallmark of this important mining district.

“With the exceptional dill results combined with our recent LiDAR survey, district access road upgrade works and development of the district geologic model, Copalquin continues to progress as another significant gold-silver district in Mexico’s prolific Sierra Madre Trend.”

Copalquin an emerging gem

With 100 historical underground gold-silver mines and workings plus 198 surface workings/pits throughout 70km2 of the mining concession area, MTH believes that Copalquin has the potential to develop into a significant gold-silver district.

It could measure up in time to other districts in the prolific Sierra Madre gold silver trend, which can host deposits containing 1-5Moz of gold and 50-100+ Moz silver.

While the company has already defined a pretty snazzy maiden resource of 2.4Mt grading 4.8g/t gold and 141g/t silver, or contained precious metal of 373,000oz gold plus 10,953,000oz silver, at the El Refugio and La Soledad areas, it has also been very clear about its goal to double this resource by Q1 2025.

Drilling carried out since the maiden resource was defined has returned significant gold-silver hits and there are numerous other mineralised areas with MTH noting that despite widespread gold and silver occurrences, less than 5% of the project has been systematically explored to date.

On top of that, there is a growing body of evidence that Copalquin hosts a large epithermal gold-silver system.

Further activity

Besides results from drilling at the Target 1 area at El Refugio, MTH is also awaiting assays from three holes drilled downdip of the historical Refugio mine workings, where extensive mapping and channel sampling was completed earlier this year.

The company also plans to drill at the Cometa area after analysis of rock chips from the historical underground workings indicated that gold and silver values tend to be enriched by north-west trending and near vertical structures.

This drilling will establish the vertical and horizontal continuity with Refugio and define high-grade zone previously drilled and test if the high-grade is associated to this high angle faulting.

This article was developed in collaboration with Mithril Silver and Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.