Chain Reactions: Never mind the US b*llocks, the UK wants the global crypto hub mantle

Getty Images

While Gazza Gensler’s SEC continues its crackdown on US crypto firms and Senator Warren keeps scheming in her anti-crypto war room, far more embracing language is emerging from institutions in the United Kingdom and Hong Kong.

In a blog post entitled “The UK as a Web3 innovation hub” earlier this week, crypto-exchange giant Coinbase noted that it’s working “seriously” in the UK and Europe.

“The UK has been one of our fastest-growing user markets,” reads the exchange’s post, adding that “the EU is this week set to adopt the Markets in Crypto Assets (MiCA) regulation, which will bring in a new licensing regime across the 27 member states.

“In short, things are happening in Europe that are edging the region ahead and, when it comes to embracing the digital economy, the region is preparing for a seismic change in how it uses and thinks about money,” it continued.

Coinbase CEO Brian Armstrong is currently in the UK and is set to speak at a London FinTech conference at which he’ll provide recommendations on how the UK can “cement its place” as a Web3 hub.

More here: https://t.co/IRCNiyNiyb

— Brian Armstrong (@brian_armstrong) April 17, 2023

Additionally, according to a Sky News report, the UK Treasury appears to have plans to revive its Asset Management Taskforce, which will include the development of crypto regulations in collaboration with the private sector.

Hear that Gensler and co? In collaboration with the private sector.

The US is closed for most crypto business. Move to the UK, they actually want you there.

— Preston Byrne (@prestonjbyrne) April 17, 2023

Meanwhile, over in Hong Kong

The Hong Kong crypto hub narrative continues to gain steam, too, with more state-affiliated Chinese banks showing interest in helping to onboard crypto/blockchain-related firms in the special administrative region.

Yep, there’s still a ban in mainland China on crypto trading and crypto mining, but even the most bearish crypto watcher would have to admit this is at least half hopeful for a turnaround on that stance in the future.

According to Wall Street Journal and Cointelegraph reports, the Hong Kong division of major Chinese financial institution the Bank of Communications is teaming up with numerous regulated crypto firms in the region.

Hong Kong “virtual bank” ZA Bank will act as the settlement bank for the crypto firms.

It's quite crazy how quickly Hong Kong is starting to embrace crypto. Banks are now lining up to offer fiat on/off ramp services to digital asset businesses.

What the West loses, the East gains 🇭🇰https://t.co/OjaoUom0HX

— Coin Bureau (@coinbureau) April 12, 2023

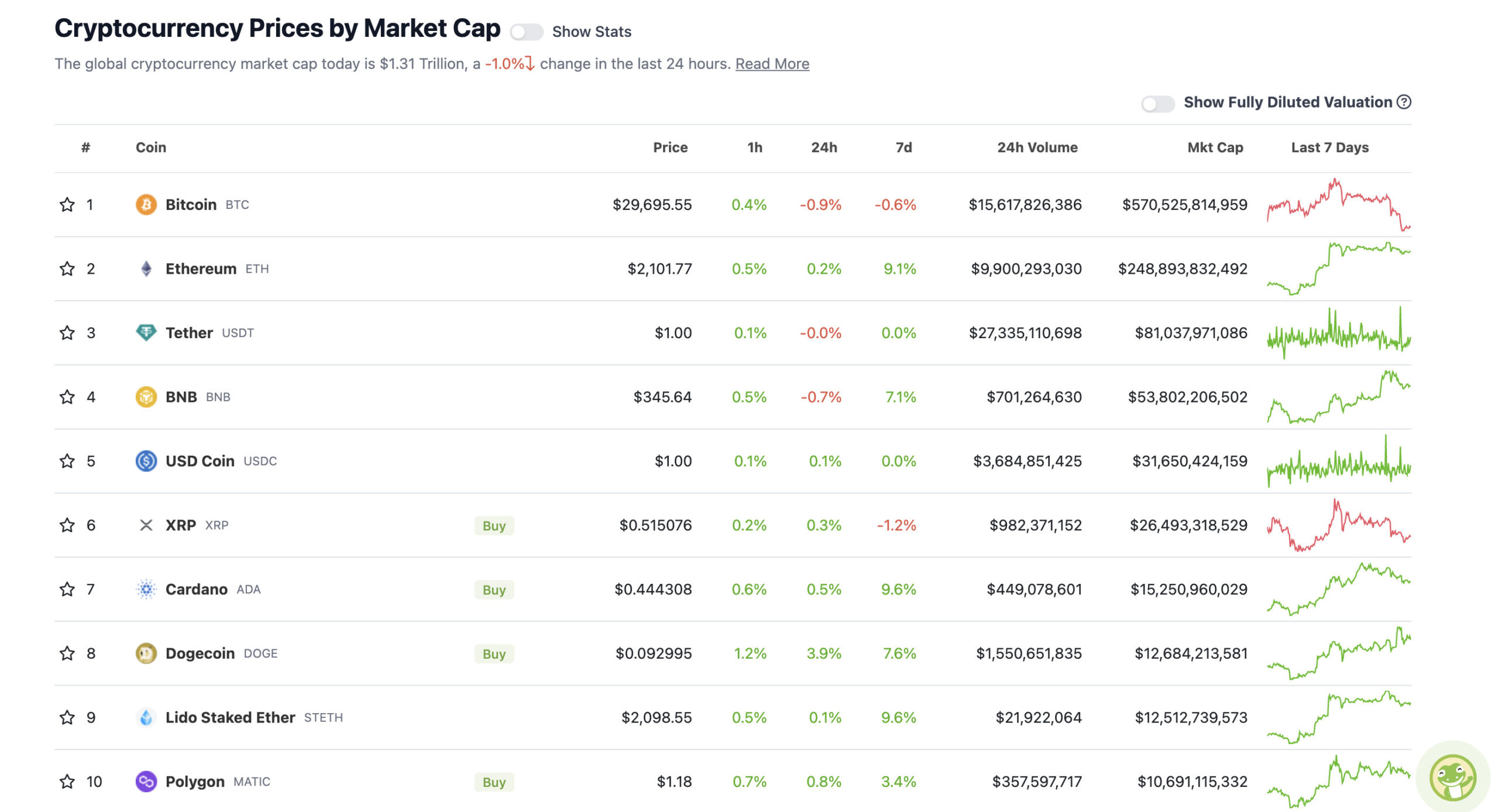

A quick check-in on the crypto majors price action since we last looked this morning. (Well, in truth we’ve been checking it every 10* minutes, like a true crypto tragic.)

*5

Top 10 overview

With the overall crypto market cap at US$1.3 trillion, down 2.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Hmm, looks like Bitcoin is in the process of getting that “retest” and bounce certain analysts have been calling for in order to see some rally continuation. Might need to push a bit higher for full confirmation of that, however.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.