Mooners and Shakers: US senator Elizabeth Warren is building an ‘anti-crypto army’; Michael Burry says he was wrong to sell

Getty Images

US Democratic senator Elizabeth “I Don’t Much Care For Young Americans Opting Out of the Crumbling US Financial System Where I Make a Lot of Money” Warren is reportedly building an “anti-crypto army”.

Of undead Boomers. Ash Williams (aka Bruce Campbell) – you out there, buddy? You might be needed for this fight.

Things have been heating up, you’ve probably noticed. So far this year we’ve seen the US Securities and Exchange Commission crack down on US-based crypto exchanges including Kraken and Coinbase, fellow regulator the CFTC sue the biggest one of all – Binance, and Joe Biden’s government pretty much dismiss the crypto industry as having no value.

And now Elizabeth “Probs Not Known as Rabs But Should Be” Warren, the most hatey of all crypto haters and a presidential hopeful, has tweeted out this as part of her re-election campaign, embracing a quote from a recent Politico profile piece:

If this woman does ever become the US president, kiss goodbye to the crypto industry in America.

Seems like an unlikely thought at this stage, seeing as some 50 million Americans, at least, own crypto – according to ARK Invest CEO Cathie Wood. That’s about 15% of the population. Okay, it’s quite possible that maybe the other 85% couldn’t give a rat’s about the price of Bitcoin, Ethereum and CumRocket (yep, that’s a crypto) potentially going to the moon.

In any case, unfortunately it does seem that Warren has one of the loudest and most influential voices in Washington.

Here’s how Billy Markus, aka Shibetoshi Nakamoto, responded…

Markus is the self-described “doofus who made dogecoin in 2013 and now has a lot of Twitter followers for some reason”.

Meanwhile, this week, Coin Center, a Washington-based collective of crypto experts focused on public-policy issues facing the industry, gave a stark warning about a newly introduced tech-controlling bill called the Restrict Act.

“Although the primary targets of this legislation are companies like TikTok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open-source tools or protocols like bitcoin,” wrote Coin Center in a blog.

Meanwhile, meanwhile, though, in slightly more encouraging news for markets (ahem, unless he really has become the new Jim Cramer), here’s Michael “The Big Short Bloke Who Predicted the GFC Pretty Accurately” Burry. With an “I was wrong to say sell” tweet.

Predictably, crypto bulls latched right onto it almost immediately.

BULLISH 🚀👀 pic.twitter.com/HI7YbcpwcY

— Satoshi Club (@esatoshiclub) March 30, 2023

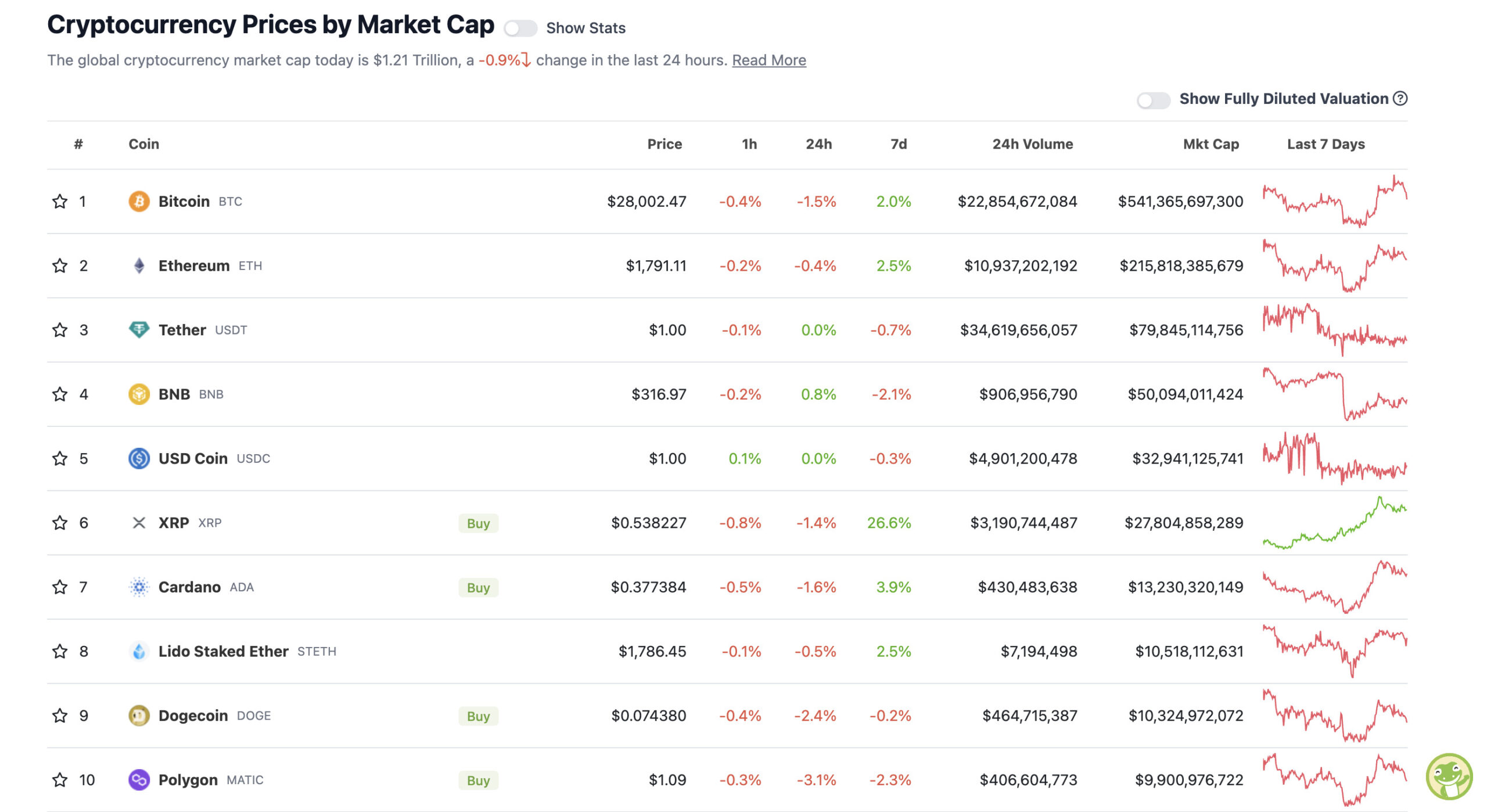

Top 10 overview

With the overall crypto market cap at US$1.21 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The overall crypto market has dipped a tad overnight but Bitcoin is hanging on to its US$28k round-number psychological level of support for the moment.

More than one prominent Crypto Twittering analyst believes the US$29k level is the most important milestone to crack.

$BTC Pivot Point

As discussed 29.1k is THE most important level to break. I've compared this point to the 10.5k level back in 2019-2020 as it was the "pivot" point acting as bull market confirmation.

Break it & the bear market structure ends.#bitcoin #cryptocurrency pic.twitter.com/53RFiYRVuG

— Roman (@Roman_Trading) March 30, 2023

Meanwhile, Rekt Capital is eyeing a lower target than that for bullish momentum, and believes BTC is well on track for confirmation of a market rally to the upside.

The worst is behind us already

The best still lays ahead$BTC #Crypto #Bitcoin pic.twitter.com/AOW7zht4Dv

— Rekt Capital (@rektcapital) March 30, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.92 billion to about US$430 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Arbitrum (ARB), (market cap: US$1.75 billion) +12%

• 1inch (1INCH), (mc: US$475 million) +10%

• Kaspa (KAS), (mc: US$514 million) +3%

• Stellar (XLM), (mc: US$2.83 billion) +5%

• Optimism (OP), (mc: US$725 million) +4%

SLUMPERS

• Mask Network (MASK), (market cap: US$479 million) -7%

• Flare (FLR), (mc: US$440 million) -7%

• Conflux (CFX), (mc: US$847 million) -7%

• Rocket Pool (RPL), (mc: US$829 million) -6%

• SingularityNET (AGIX), (mc: US$502 million) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

#Bitcoin is up 73% in 2023 — so far! 🤑 pic.twitter.com/OdpLy4nBHE

— Bitcoin Archive (@BTC_Archive) March 30, 2023

it becomes sentient and decides to start calling everything a security

— Psycho (@AltcoinPsycho) March 30, 2023

Big #btc day tomorrow – will we see the juggernaut of the monthly MACD re-crossing its signal line [technically bullish]? pic.twitter.com/wffL9ji5BY

— dave the wave🌊🌓 (@davthewave) March 30, 2023

One crypto sector is estimated to reach $16 Trillion by 2030:

Real World Assets.

This will be the CATALYST for mainstream Crypto adoption.

Here's your 2023 guide to RWAs (and the top protocols): pic.twitter.com/bGudNQX0zq

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) March 30, 2023

‼️BREAKING: 🇨🇳🇧🇷 China and Brazil strike deal to ditch U.S. dollar and trade in their own currencies for trade.

BIG moves… 🧐 pic.twitter.com/zaiOHQxLyn

— Radar🚨 (@RadarHits) March 30, 2023

‼️Huge #BITCOIN sign projected onto European Central Bank building. 😂 👌

h/t: @Bitman_bob pic.twitter.com/OkeNcoqnKr

— Bitcoin Archive (@BTC_Archive) March 30, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.