Chain Reactions: A BlackRock ETF ‘would be the best thing’ for Bitcoin, reckons Mr Novogratz

BlackRock, eh? Be careful what you wish for? (Getty Images)

“Mr Novogratz say”… a “BlackRock BTC ETF would be the best thing that could happen to BTC”. Fair enough, but has it “baaaaatooooommm-ed out“?

The crypto world’s biggest news of the day/week is the BlackRock Bitcoin ETF filing, and, even though it still seems unlikely to gain approval from the SEC any time soon, Crypto Twitter can’t stop talking about it.

One thing regarding it that’s caught our eyes today on the Cryptoverse’s message board (that’d be Twitter) is this, from Republican Congressman Patrick McHenry, who was one of the chief Gensler grillers at a recent, strangely entertaining US House Financial Services Committee hearing…

Your move, @GaryGensler.

The @SECGov must not pick winners and losers based on inconsistent factors. I'll be watching this closely. https://t.co/iKPiQgPwQU

— Patrick McHenry (@PatrickMcHenry) June 15, 2023

And then there was this from Galaxy Digital’s Mike Novogratz – a notable Wall Street player with Goldman Sachs and others, turned institutional-focused crypto-investment firm bigwig…

Fun being on @LizClaman show!! And yes, @BlackRock getting a $BTC ETF through would be the best thing that could happen to $BTC. https://t.co/2fFBeB9eyo

— Mike Novogratz (@novogratz) June 16, 2023

The response to this tweet caught our attention, too…

https://twitter.com/CryptoEntj/status/1669500171552710656

Because on that point about institutional involvement in the crypto space, we were only just now reading about this, on the US crypto-media Cointelegraph site…

And the institutional survey says…

Which highlighted a recent study on the topic conducted by Japan’s largest investment bank, Nomura.

As the media outlet notes, in Nomura’s Laser Digital Investor Survey, conducted in April, “90% of professional investors polled said that it was important to have the backing of a ‘large traditional financial institution’ for any crypto asset fund or investment vehicle before they or their clients would consider putting money into it.”

The survey polled more than 300 institutional investors with collective assets worth $4.9 trillion across 21 countries in Europe, the Middle East, Asia, South Africa and Latin America.

A couple more key points:

• 96% of those polled consider digital assets as “representing an investment diversification opportunity”.

• 82% expressed they were optimistic about crypto, emphasising Bitcoin and Ethereum, as an asset class over the next 12 months.

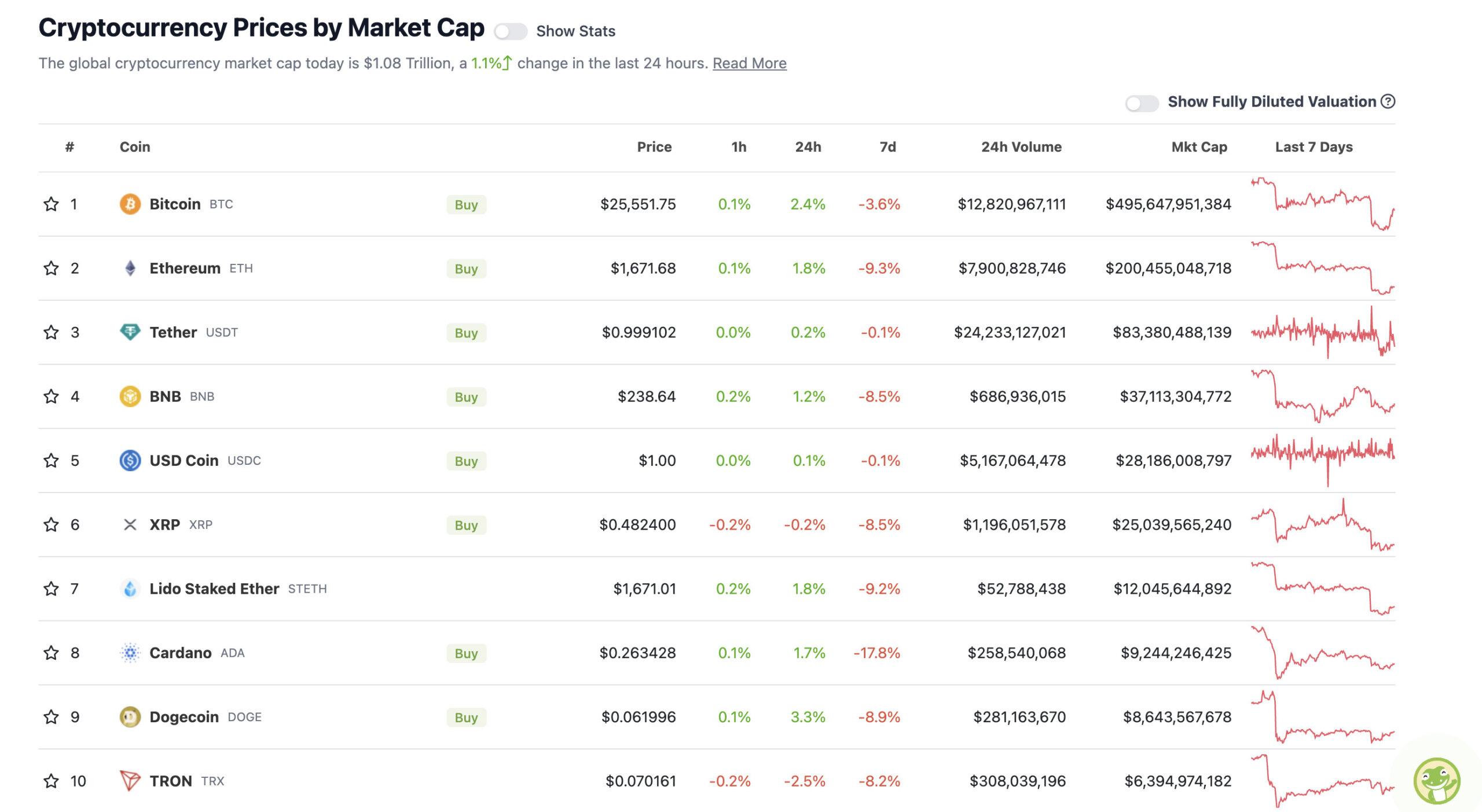

Top 10 overview

With the overall crypto market cap at US$1.06 trillion, up 1.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Better than this time yesterday, slightly better than this morning, that’s where the overall crypto market is at, and specifically the majors.

It’s also particularly relieving to see the no.1 stablecoin asset, Tether (USDT), regain its 0.99912 peg to the US dollar. Last night, there was a fair amount of FUD floating about Crypto Twitter after a massive and sudden selloff of USDT on the decentralised exchanges Curve and Uniswap.

Think we’re all good on that front for now, though… until the next scare over the weekend or next week, that is.

Alright over the past week, we’ve had:

✅ US Regulatory FUD

✅ Binance Insolvency FUD

✅ Tether FUD

✅ DeFi FUDJust need:

☑️ China Banning Bitcoin

☑️ US Government Selling BitcoinAnd we’ll have checked all of the boxes.

— K A L E O (@CryptoKaleo) June 15, 2023

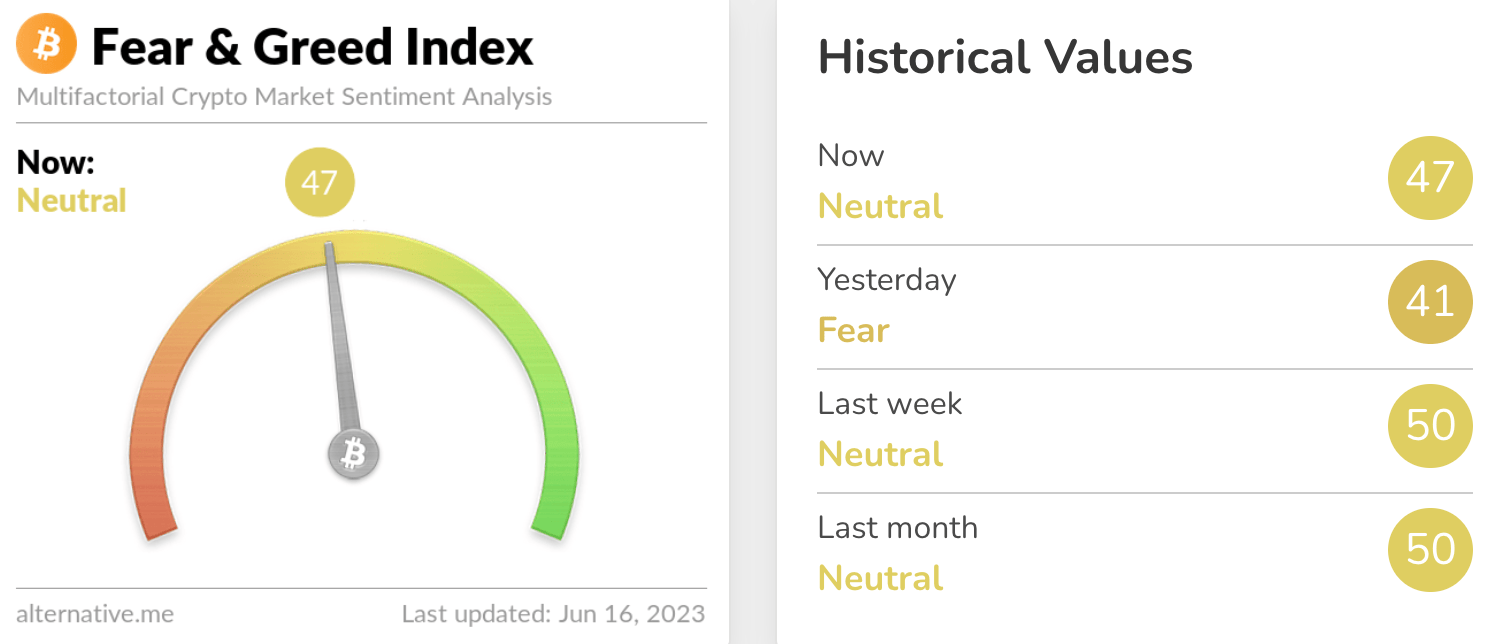

Speaking of fear, how are we tracking on the good ol’ Crypto Fear & Greed Index? Hmm, it’s actually ticked up a fraction since we last checked.

A bit more news such as the BlackRock ETF push and the Hong Kong crypto hub narrative, and who knows, maybe the dial can hit the “Meh” level around 50 once again.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.