Bitcoin hits $55K for first time since May; ‘It’s gone mainstream,’ says Soros Fund Management

A 55-themed Bitcoin metaphor steps on the gas (Getty Images)

Bitcoin has changed up a gear, passing US$55K for the first time since May, becoming a trillion-dollar asset once more, and causing moon-mentioning mouths to foam with excitement all across the cryptoverse.

There are plenty of other tokens and digital assets that frequently and consistently grab Crypto Twitter’s attention, of course. But on days like these, Bitcoin’s still got it.

Twitter CEO and Bitcoin maxi Jack Dorsey certainly thinks so…

Bitcoin.

— jack (@jack) October 6, 2021

It’s still generally the first mover and the coin the entire space uses to gauge what could happen next for the 9,500 or so other coins and, far more indirectly, infinite number of NFTs.

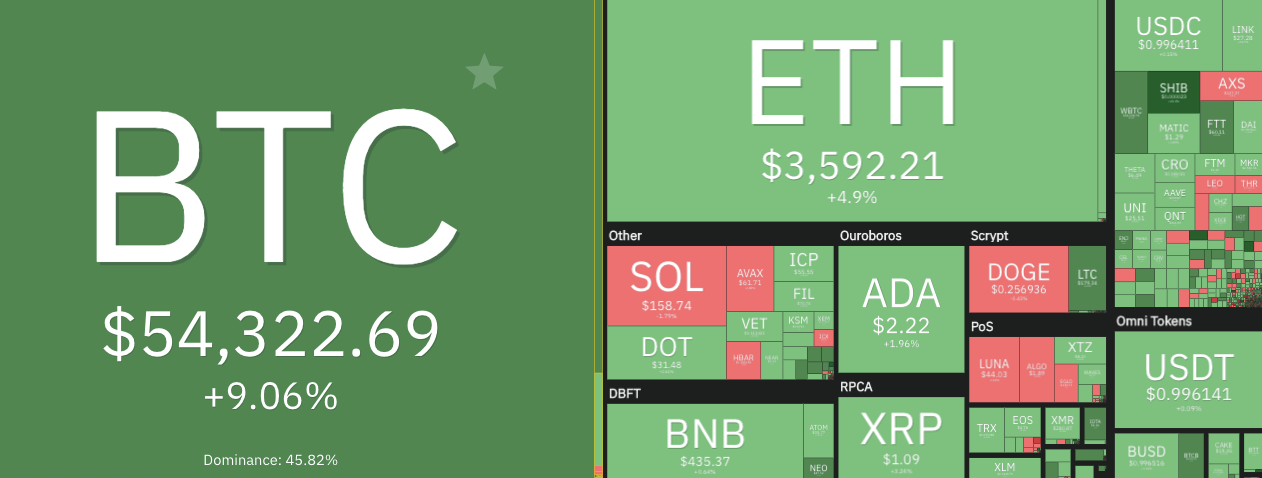

A couple of hours ago, the OG crypto stepped on the gas, surging from the low 50K level, to US$55,530. It’s since pulled in for a pit stop and is changing hands for about US$54,300, up more than 9 per cent since this time yesterday, with a market cap of $US1.02 trillion.

The entire crypto market cap, meanwhile, stands at US$2.37 trillion, up 3.8 per cent. There are some decent gainers in the alts here and there, not least of all several dog meme coins, but it’s mainly Bitcoin’s show for now.

Reckon Crypto Twitter might be feeling a little bullish? Here are reactions from three of the more prominent bulls in the space and their followers…

— paleobit ⚡️∞/21M 🥩🏋🏻♀️🐂 #bitcoin Argentina (@paleobit) October 6, 2021

https://twitter.com/naiiveclub/status/1445751295311159306

— Carnivorous Icarus (@nokeys_nocheese) October 6, 2021

How about some of the well-known technical analysts? They’ll be a little more circumspect, right?

Matter of time before all-time high #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) October 6, 2021

The #BTC downtrend is over$BTC #Crypto #Bitcoin pic.twitter.com/Ztljij4zW6

— Rekt Capital (@rektcapital) October 6, 2021

$BTC Next Target!#Bitcoin on an absolute tear this morning.

The next #bullish target to look out for 👇#BTC pic.twitter.com/oUPwF0Y1it

— The Thrive Index. (@TheThriveIndex) October 6, 2021

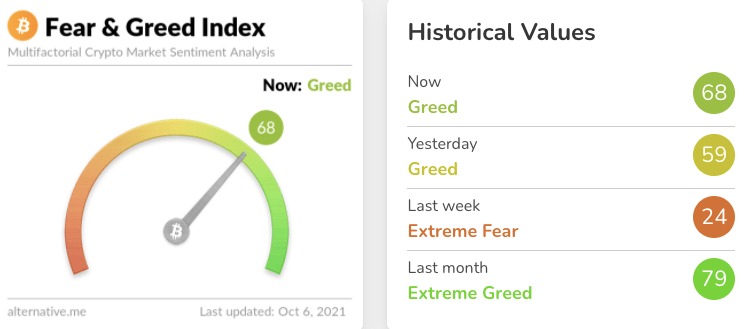

Guess it’s hard to keep the bears in play when the technicals are looking as positive as the overall sentiment.

And, speaking of sentiment, predictably, the Fear & Greed Index has had an excitable upsurge.

Soros Fund Management says bullish things

In yet more institutional-adoption news, the family office of mega moneybags fat cat US investor George Soros was talking up Bitcoin big time before today’s pump. (Adopts Richie Benaud voice: “Super timing, that…”)

Dawn Fitzpatrick, the CFO of Soros Fund Management, was speaking with Bloomberg Invest, stating: “I’m not sure Bitcoin is only viewed as an inflation hedge here. I think it’s crossed the chasm to mainstream.”

On $BTC at $50K, "(Bitcoin) has crossed the chasm to the mainstream. The coins themselves are less interesting than the use cases like DeFi." Soros Fund Management's Dawn Fitzpatrick tells @ErikSchatzker #BloombergInvest pic.twitter.com/ziUfhmDHf3

— Bloomberg Live (@BloombergLive) October 5, 2021

Fitzpatrick also highlighted the US$2 trillion crypto market cap and more than 200 million digital asset users globally, calling it more than an asset class – a “booming industry”.

“The coins themselves are less interesting than the use cases of DeFi and things like that,” she said, adding that the Soros fund does own some cryptocurrencies. Although “not a lot”, apparently.

Her organisation is doing “more than just kicking the tyres”, she assured the Bloomberg host.

Something for the bears

In the name of at least some attempt at balance in this article, let’s remind ourselves about some potentially dark forces at play.

Evergrande. There, we said it. Right… back to the moon-Lambo stuff?

Not so fast. There are still regulatory rumblings surrounding stablecoins and DeFi going on in the US, which may yet provide possible headwinds or roadblocks for the Uptober and Moonvember crypto prophecy.

It’s just something to keep in mind, although the US Securities and Exchange Commission chair Gary Gensler did at least reportedly say during a House Committee on Financial Services yesterday that the SEC won’t (and can’t) ban crypto.

Yesssss. Win.

He then added: “That would be up to Congress.”

Oh… Boo.

— KingChaos (@kingchaos0385) October 6, 2021

In the hearing, as reported by Cointelegraph, Representative Patrick McHenry took umbrage with Gensler’s recent stance and comments regarding digital assets in the US.

McHenry accused Gensler and the SEC of failing to act in accordance with the agency’s “long-held practice of noticing comment on rulemaking and procedures”.

“Some of those comments you have made have raised questions in the marketplace and made things less than clear,” said McHenry. “You’ve made seemingly off-the-cuff remarks that move markets, you’ve disregarded rule-making by putting a statement out without due process, and you’ve essentially run roughshod over American investors.”

An unruffled Gensler simply responded that the SEC follows the Administrative Procedures Act. Plays a straight bat, that GG.

Mooners and shakers

A look at some of the top movers today, at press time…

Apart from Bitcoin (BTC) +9.06%; Ethereum (ETH) +4.9% and Polkadot (DOT) +4.7%, the main action today is well outside the top 10.

Some altcoins that haven’t had their petrol siphoned away by the OG crypto today include several dog-meme coins, as reported earlier today. Raging-hot ones right now include: Kuma Inu (KUMA) +323%; Dogelon Mars (ELON) +61%; Feisty Doge NFT (NFD) +59%; and Shiba Inu (SHIB) +26%.

And other notably hot gainers here and there include: Badger DAO (BADGER) +50%; micro-cap Coldstack (CLS) +42%; and the gaming-meets-DeFi RPG world Illuvium (ILV) +16%.

Coldstack, a “decentralised cloud aggregator”, is building in the same sector as Filecoin and Siacoin and has been pumping on the back of a mention from the influential YouTube and Twitter personality, Alex Becker.

Illuvium aims to be the first AAA game in the play-to-earn crypto sector. Its Sydney-based founder Kieran Warwick gave Stockhead the scoop on a world-first NFT revenue-share deal it’s formed with another developing, metaversal crypto game – Death Road.

ILV cracked an all-time high of US$689.95 about an hour ago, and is up 48.74 per cent since this time last week.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.