Monsters of Rock: Who’s gearing up for the Evergrande finale?

Pic: Chris Hyde/Getty Images Sport via Getty Images.

The Panthers are the kings of the NRL and the Dees did the business in the Australian game.

But markets are gawkily awaiting the results of a gripping tussle in the business world — with an uncertain and potentially significant impact on the big mining houses — between Evergrande and its lenders.

If this were Netflix’s Squid Game, we’d be getting financially distressed Evergrande to duke it out in kids games with Lehman Brothers and Enron to see who survives to win back their losses.

Experts are currently predicting China’s highly organised government could be looking to help it to more of a ‘controlled explosion’ – like it’s been doing quite literally to unfinished apartment blocks in boom time ‘ghost cities’ – letting the air seep slowly from a ripped balloon.

The obvious potential flow-on effect from the collapse of Evergrande – which appears closer now that it has been halted from trade in Hong Kong after missing key debt repayments – is fairly obvious.

A meltdown in the Chinese property market could see a big crimp on demand for steel and other infrastructure, flowing onto the metals that supply those downstream industries.

That said, analysts largely view government policy around environmental restrictions on steel production as the main driver for iron ore prices, and the big miners were largely oblivious to Evergrande’s peril today.

BHP (ASX:BHP), Rio (ASX:RIO) and Mt Gibson Iron (ASX:MGX) all reversed into the green after sinking into the red early in today’s trade, while Mineral Resources (ASX:MIN) was one of the best large-cap performers with a ~3% gain.

The Materials sector pivoted in kind, shifting gears to close the day more than 0.4% up.

Yancoal’s (ASX:YAL) gains have been somewhat outlandish on no news, aside from rapidly climbing coal prices.

It was up 18% at the close, having already risen ~10% on Friday. Coronado Global Resources (ASX:CRN), which owns coal operations in Australia and North America was up almost 6% to a market cap of ~$2.3 billion.

Alumina (ASX:AWC), a beneficiary of Alcoa’s deal to help develop FYI Resources’ (ASX:FYI) high purity alumina operation in WA via its 40% holding in the Alcoa World Alumina and Chemicals business, was also up ~6%.

Aluminium prices have been rising amid smelter shutdowns in China and civil unrest in Guinea, one of the world’s largest suppliers of alumina feedstock bauxite.

OM HOLDINGS (ASX:OMH)

And now for something completely different … ferrosilicone.

Ferrosilicone, used in steel refining, ductile iron production, electronic circuit boards and magnesium refining, is one of a number of rare commodities seeing unprecedented price increases amid China’s power crisis.

Much like magnesium, prices of the industrial commodity are getting out of hand as power rationing has resulted in smelter closures at ferroalloy plants in China.

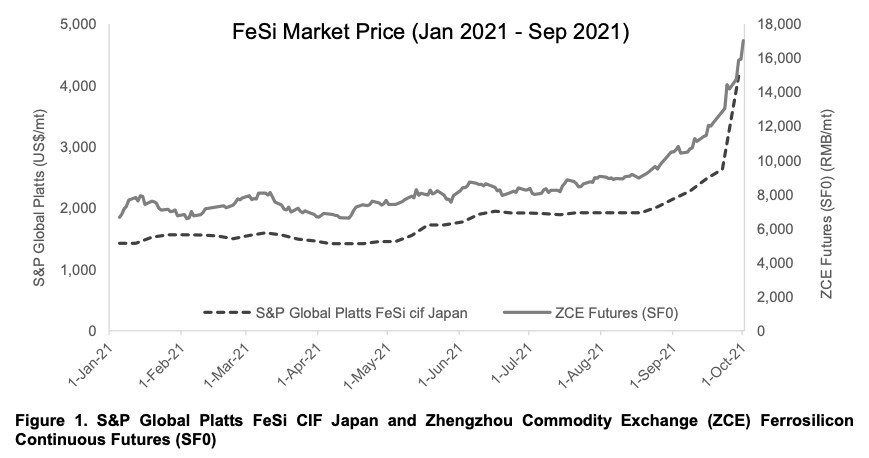

According to S&P Global Platts, product shipped to Japan in the first half of 2021 averaged US$1,582 per metric tonne, closing at US$1,920/mt.

As of September 29, you’re talking a 116% increase to US$4,150/mt.

Where do you go looking for exposure to this product? OM Holdings, a Malaysian manganese producer and downstream processor that is also facing pressures of its own due to the Covid-19 pandemic around its Sarawak smelter.

OM was up more than 8% today after reporting the recent price increases, although the forward sold nature of its contracts means OM may not see the full benefit of these spikes just yet.

“It is important to note that the financial impact to OMH of the recent price changes will continue to be modulated by the forward delivery nature of ferroalloy sales, where newly contracted prices will be reflected in OMH’s financial results with a lag of several months, subject to previously committed sales,” the $700 million capped company said in a market update today.

“The Company sells the ferroalloys it produces using a blend of formula (index based) and fixed price contracts.

“The recent surge in global prices is due in part to government policies in China relating to the on-going power shortage, with power rationing being imposed on energy-intensive industries thus limiting ferroalloy production and causing Chinese ferroalloy futures to surge to historical highs.

“These factors, in conjunction with record high ocean freight rates and uncertainty in global ferroalloy production have substantially supported prices for FeSi for the better part of 2021.”

OM Holdings share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.