ASX Small Caps Lunch Wrap: Who’s been busted making cheap Chinese knock-offs this week?

News

News

Local markets were lower this morning, having spent the first hour of the session veering wildly between “not great” and “observably worse”, while investors struggled for traction ahead of tonight’s super-exciting Federal Budget.

A regular who’s who of finance journalists are currently locked in a room together, finding out that the great Budget Night rite of passage is nowhere near as fun as the old-school journos of yore made it out to be.

That might be because some of the more heinous things that happened when 100 journalists were locked in together for 12 hours are now fireable offences, rather than just “horseplay”.

But, it’s also highly likely that this budget is unlikely to contain any massive surprises, as federal treasurer Jim “Supernintendo” Chalmers has already been leaking all over Canberra.

He’s also been on the news a bit, too.

I’ll get into the details of the market shortly, but first, we’re off to China – because I’m probably already on several lists there, and I’ve genuinely given up any hope of ever travelling there and making it home again, without a seven-year stint being re-educated in a solitary prison cell.

China is globally famous for its ability to produce cheap, inferior knock-offs of genuine products. As a nation, its a manufacturing powerhouse that exists today standing on the shoulders of wholesale IP theft and a government that cares little for international law.

So, it should come as precisely zero surprise that there’s a zoo in China in trouble for apparently offering up a cheap knock-off of the nation’s most famous critter, the Panda.

Pandas are world-renowned for being the Paris Hilton of the animal kingdom – pleasant to look at, dumber than a box of hammers and famous for being famous.

They serve precisely zero purpose in nature, other than being exquisitely bad at their two roles in life: keeping the bamboo down, and making more pandas.

It’s the second part of that which gives pandas their cache among zookeepers – there are so few of them left on the planet, that even getting one or two in to show curious onlookers is beyond the reach of most zoological parks.

Which is probably why the Taizhou Zoo in Jiangsu Province stooped as low as it did, promising pandas and delivering what is clearly a pair of Chow Chows painted to look like pandas.

When harassed by local media, a spokesperson for the zoo told Qilu Evening News: “Normal people dye their hair. Dogs can dye their hair, too. It’s the same as hair.”

To which the only reasonable response is “Sure, no they can’t, and no it is not.”

The best part of this cheap Chinese knock-off story is that it’s a cheap Chinese knock-off of a previous cheap Chinese knock-off.

NBC News reported that in 2019, “a dog cafe in the southwestern province of Sichuan raised animal rights concerns with its six Chow Chows that were also dyed to look like the bears”.

A year later, in the same province, social media went ballistic when a video of a woman walking a panda also turned out to be a Chow Chow with a bad dye job.

I shouldn’t be surprised, then, that this latest counterfeit Panda scandal has erupted, because Chinese zoos aren’t the paragons of integrity that one might expect them to be.

I know this because I went to a Chinese zoo once, paid US$65 to get in and, upon entering the exhibit, I was dismayed to find just a single dog inside.

It was a Shi-tzu.

Thank you, and good night.

Local markets were tipped to open flat this morning, but didn’t. Instead, they sagged like the elastic in my inexpensive Kmart boxer briefs, and I would like to take this opportunity to once again apologise to Steven, and the patrons of his cafe, for my unexpected “display” this morning.

Sorry, mate. I promise it won’t happen again.

Anyhoo… the ASX 200 benchmark is lower this morning, ahead of tonight’s federal budget, which we already know the broad strokes outcome of, since Jim Chalmers has been on the telly to say we’re going to get a $9.3 billion surplus this year.

That’s down from last year’s whopping $22 billion surplus, and an apparent portent of three years’ worth of deficit, which Labor is blaming on rising unemployment and falling exports, and everyone else is blaming on Labor.

The rising unemployment will no doubt have the RBA board happy to some extent, as that’s a necessary ingredient for interest rate relief, and the board is clearly getting hungry for some happier press around that topic, as the inflation fight reaches new heights of stagnation.

The rest of the budget, from what I can see, is going to revolve around the treasurer promising to ease cost of living pressures, and yet another feeble attempt to kick-start the heart of Australia’s already clearly dead manufacturing base.

As Earlybird Eddy Sunarto reported this morning, “an extra $50 billion is earmarked for defence over the next decade, while $1 billion will be spent to alleviate the housing crisis”.

That $1 billion should be able to get the treasurer a modest three-bedder on the outskirts of Parramatta – but he’s gonna need to be able to show that he’s put aside at least $300 million over the past five years in savings.

The banner headline news from the market has been BHP’s knock-back in its almost comically quixotic quest to purchase Anglo American, after the takeover target issued the Big Australian with a “lol. no.” response to its latest, even richer, offer.

The stalemate, in a nutshell, is this: BHP wants Anglo to spin off two of its listed South African groups before the purchase goes ahead, and Anglo wants BHP to f–k off until it’s ready to buy the whole package, and do the hard work itself.

So you can see where the problem is, and why BHP throwing more money at the problem isn’t likely to fix it anytime soon.

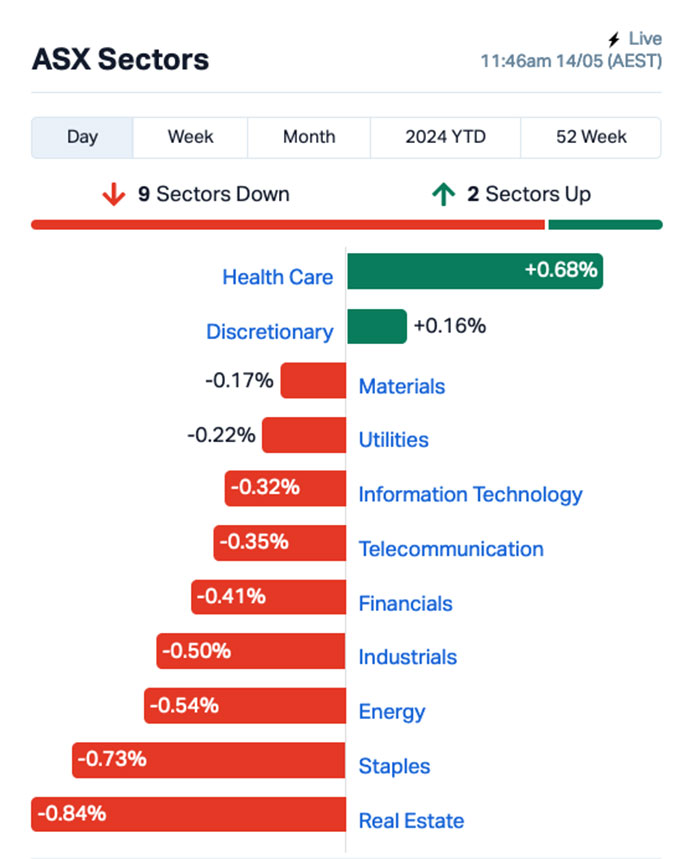

At a more granular level, the local market sectors looked like this, with only Health Care and Consumer Discretionary out in front of the game.

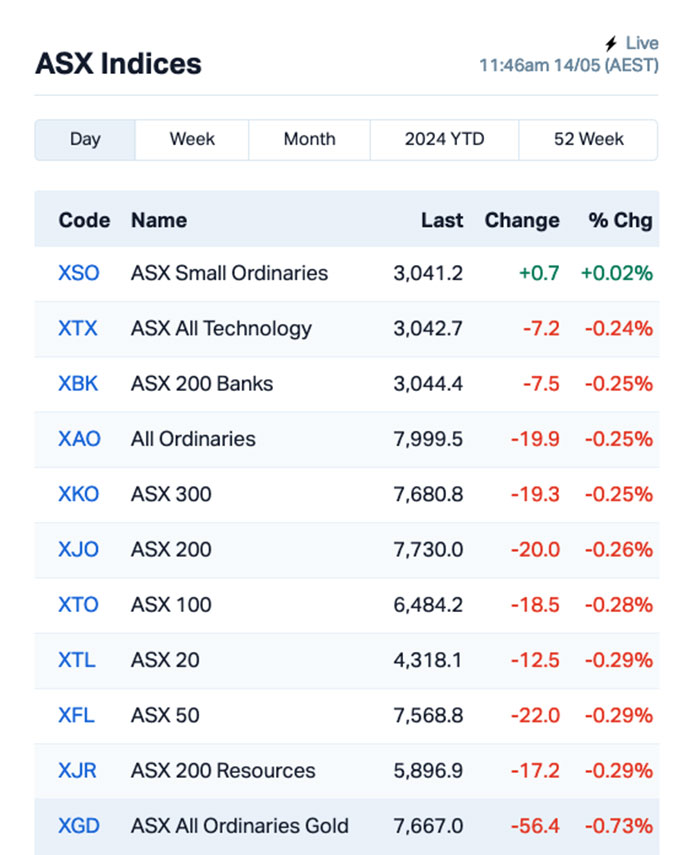

A quick look at the ASX indices highlighted that it’s the Small Caps that were doing the heavy lifting on Tuesday morning, with the XSO ASX Small Ordinaries index the only one in positive territory, and even that was a pyrrhic victory at best.

There were a couple of Large Caps making headway, though. Mining behemoth Alumina (ASX:AWC) spiked more than +6.5%, Neuren Pharmaceuticals (ASX:NEU) jumped just over +6.0% and aftermarket auto parts supplier GUD Holdings (ASX:GUD) surged more than +9.0%, after dropping its quarterly after hours yesterday, showing that that Group FY24 underlying EBITA “is in line with expectations and is forecast to be at least $193.5m”.

Wall Street took on a decidedly Tokyo feel in its latest session, drifting sideways amid the stench of burning rubber and the sound of sirens tearing the night in two.

The S&P 500 fell by -0.02%, the blue chips Dow Jones index was down by -0.21%, but the tech-heavy Nasdaq lifted by +0.29%, when US traders began Wall Street’s week on a cautious note as they prepared for the key inflation report on Wednesday.

In US stock news, Anglo American has rejected a second takeover bid price from BHP, which valued the London-listed mining company at $64.4 billion.

BHP said Anglo’s board did not engage with the latest proposal, which followed an initial $60 billion offer that was also rejected last month.

Apple rose +1.76% as it neared an agreement with OpenAI to incorporate the startup’s technology into the iPhone.

Meme stock GameStop is back, soaring +74% after Keith Gill, known as “Roaring Kitty” and a former insurance firm marketer, posted on X for the first time since 2021. He shared a sketch of a gamer leaning forward intently, followed by a series of movie and TV show clips.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

Users over at Reddit’s /r/wallstreetbets lost their minds, because they’re an excitable bunch of goofballs who really need to go outside once in a while.

Meanwhile, Asian markets are definitely still there. I just haven’t looked at them yet today. Here’s why:

In international tech news, all eyes should be on Melbourne today, for what is arguably the most boring Fortnite livestream you’ll ever see.

Apple and Google are in court, up against Epic Games (the makers of the perennial source of way too much swearing in my house, Fortnite) and a bunch of other app developers, that are asking the Australian court to decide on whether Apple and Google’s heavily-defended app stores are, in fact, egregious monopolies.

It’s being livestreamed, because of course it is… and You can watch it here, in case you’re having difficulty falling asleep at your desk today – consider that a fair warning, as the 20 minutes of it that I watched this morning put me into a spiralling coma faster than a fistful of ketamine.

Here are the best performing ASX small cap stocks for 14 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap AVW Avira Resources Ltd 0.002 100% 1,000,000 $2,663,790 JTL Jayex Technology Ltd 0.002 100% 1,327,978 $281,279 JAV Javelin Minerals Ltd 0.0015 50% 550,894 $2,176,231 MRQ MRG Metals Limited 0.0015 50% 514,275 $2,525,119 MTL Mantle Minerals Ltd 0.003 50% 637,412 $12,394,892 JPR Jupiter Energy 0.026 44% 169,844 $22,925,739 CCZ Castillo Copper Ltd 0.007 40% 8,626,486 $6,497,527 FAU First Au Ltd 0.0055 38% 129,875,129 $6,647,973 IPB IPB Petroleum Ltd 0.008 33% 2,068,700 $3,390,735 LSR Lodestar Minerals 0.002 33% 1,442,500 $3,035,096 VML Vital Metals Limited 0.004 33% 500,413 $17,685,201 NKL Nickelx 0.023 28% 156,169 $1,580,673 TG1 Techgen Metals Ltd 0.051 28% 13,087,657 $5,125,303 1MC Morella Corporation 0.0025 25% 18,200,887 $12,357,599 AOA Ausmon Resorces 0.0025 25% 200,000 $2,117,999 CUF Cufe Ltd 0.02 25% 12,911,883 $18,337,798 MHC Manhattan Corp Ltd 0.0025 25% 362,358 $5,873,960 PUA Peak Minerals Ltd 0.005 25% 8,791,412 $4,165,506 ROG Red Sky Energy 0.005 25% 10,345,145 $21,688,909 TMR Tempus Resources Ltd 0.005 25% 230,169 $2,923,995 SVY Stavely Minerals Ltd 0.03 20% 1,222,879 $9,548,502 AER Aeeris Ltd 0.078 20% 32,797 $4,745,901 WGR Western Gold Resources 0.037 19% 170,594 $4,764,340 OSX Osteopore Limited 0.093 19% 20,786,240 $8,498,477 BFC Beston Global Ltd 0.0035 17% 1,765,549 $5,991,141

TechGen Metals (ASX:TG1) was out in front on Tuesday morning, on news that the company has expanded its portfolio to include “a highly prospective copper and gold project in Western Australia”.

Techgen has snapped up the Blue Devil project, located 45km east northeast of Halls Creek in Western Australia and accessible through station and exploration tracks, for “minimal outlay”, after previous exploration at the site by Spartan Exploration returned some promising rock chip samples, above 1% Cu with a peak of 50.5% Cu.

It’s a timely purchase, as copper prices ticked back over US$10,000 a tonne overnight – which was also great news for Castillo Copper (ASX:CCZ) , which was up on news of plans to develop its Big One deposit in the Mt Isa copper belt.

Located within CCZ’s prime NWQ Copper Project, the Big One Deposit has a JORC compliant Mineral Resource Estimate of 2.1Mt @ 1.1% Cu for 21,886t contained metal2, including 40m @ 1.64% from surface incl: 11m @ 4.40% from 24m, 5m @ 7.34% from 28m & 1m @ 16.65% from 29m, and 44m @ 1.19% Cu from surface incl: 14m @ 3.55% from 27m, 3m @ 10.88% from 37m & 1m @ 12.6% from 37m.

In more copper news, Stavely Minerals (ASX:SVY) was up this morning after announcing that re-interpretation of historic and more recent drilling at the company’s Junction prospect has identified an immediate shallow discovery opportunity.

Stavely says copper-gold-silver lode-style mineralisation intersected previously at Junction includes chalcopyrite, bornite and covellite and is very similar to the mineralisation at its 9.3Mt at 1.23% Cu, 0.23g/t Au, 7g/t Ag Cayley Lode.

Here are the most-worst performing ASX small cap stocks for 14 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap APC Aust Potash Ltd 0.001 -33% 240,000 $6,000,284 LNR Lanthanein Resources 0.0045 -25% 26,217,659 $11,729,453 AL8 Alderan Resource Ltd 0.004 -20% 1,230,000 $5,534,307 CRB Carbine Resources 0.004 -20% 2,292 $2,758,689 EXL Elixinol Wellness 0.004 -20% 573,099 $6,505,370 RML Resolution Minerals 0.002 -20% 7,790 $4,025,055 TIG Tigers Realm Coal 0.004 -20% 313,695 $65,333,512 HPR High Peak Royalties 0.045 -17% 60,000 $11,235,225 PVW PVW Res Ltd 0.025 -17% 1,150,004 $3,042,143 AEV Avenira Limited 0.005 -17% 21,206,994 $14,094,204 ERL Empire Resources 0.0025 -17% 5,857,516 $4,451,740 G88 Golden Mile Res Ltd 0.01 -17% 868,558 $4,934,674 ME1 Melodiol Glb Health 0.0025 -17% 1,601,655 $2,140,462 PRX Prodigy Gold NL 0.0025 -17% 218,999 $6,041,322 M4M Macro Metals Limited 0.036 -16% 22,491,563 $138,978,871 HTA Hutchison 0.031 -16% 1,151 $502,182,817 EMS Eastern Metals 0.027 -16% 207,531 $2,637,640 GSM Golden State Mining 0.011 -15% 1,125,097 $3,631,818 ALM Alma Metals Ltd 0.0085 -15% 1,794,750 $14,178,789 TRU Truscreen 0.017 -15% 215,566 $11,051,822 WEC White Energy Company 0.035 -15% 400,000 $4,642,694 ALY Alchemy Resource Ltd 0.006 -14% 700,003 $8,246,534 E25 Element 25 Ltd 0.295 -13% 1,373,314 $73,960,314 CCM Cadoux Limited 0.061 -13% 691,426 $25,964,231

Fatfish Group (ASX:FFG) has completed its due diligence of AI Gaming Co. (AIGC) and has progressed towards executing a share subscription agreement that confirms its intention to invest in AIGC.

The agreement envisages a series of investments by FFG of up to $2.8m to secure a 51% interest in AIGC.

AIGC is a start-up harnessing advanced AI to forge immersive, dynamic gaming experiences.

Impact Minerals (ASX:IPT) baseline environmental surveys have found that there are no threatened or priority species of flora and fauna on the Lake Hope salt pan that hosts its high purity alumina project of the same name. This paves the way for the company to proceed with securing a mining lease application.

Spartan Resources (ASX:SPR) has completed the retail component of its 1-for-17 fully underwritten pro rata non-renounceable entitlement offer, raising $4m after receiving applications for ~7.4 million shares priced at 58c each.

The remaining 12 million shares totalling $7m will be issued to the underwriters of the offer.

Proceeds will be combined with the earlier placement that raised ~$47m to underpin a significantly expanded exploration campaign at Dalgaranga in 2024/25.

At Stockhead, we tell it like it is. While Fatfish Group and Spartan Resources are Stockhead advertisers, they did not sponsor this article.