Closing Bell: ASX dips on war tensions; fingers firmly crossed ahead of Nvidia’s latest earnings

All eyes are on Nvidia’s latest earnings. Picture via Getty Images

- ASX dips as energy stocks lead losses

- Global tensions weigh on markets, gold stocks rise

- China holds rates steady, Nvidia’s earnings later tonight

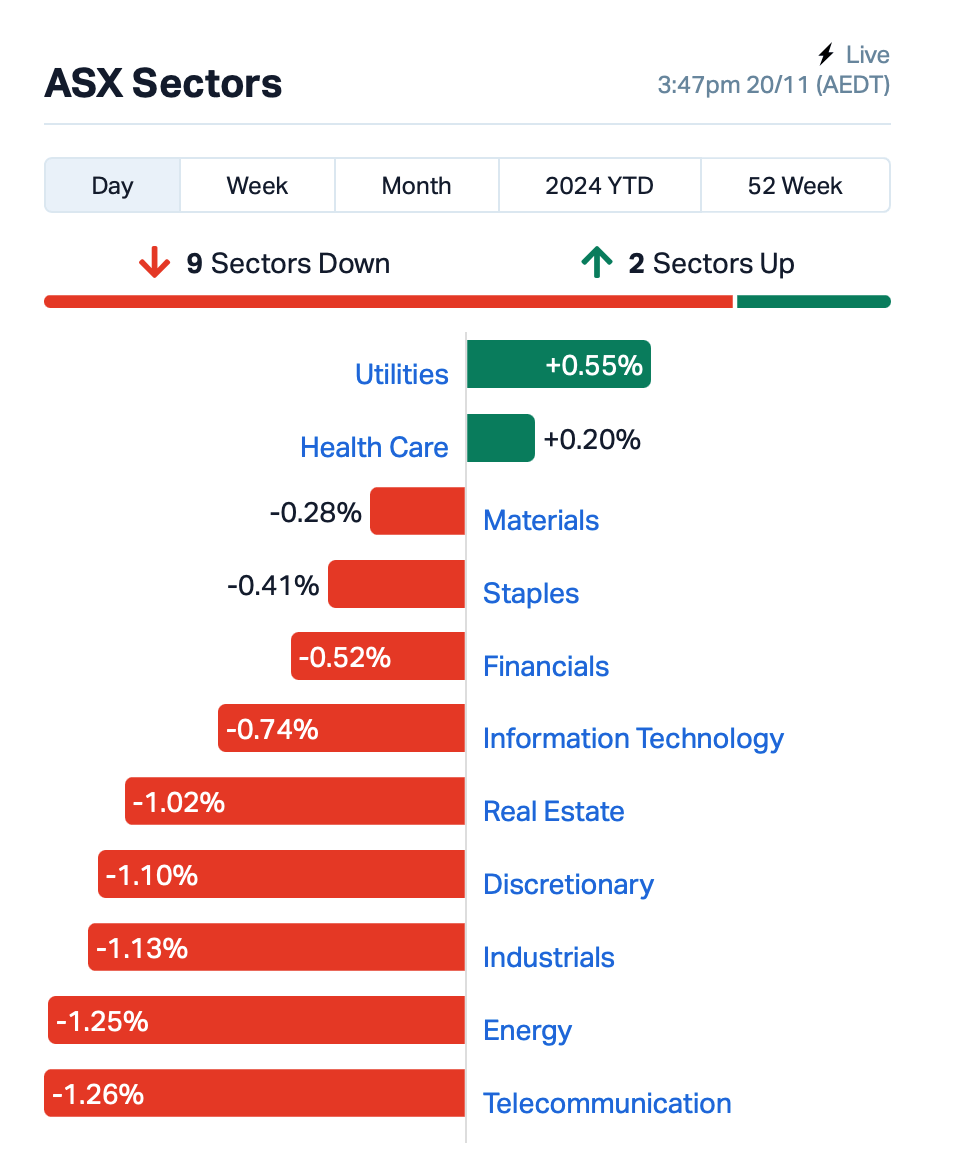

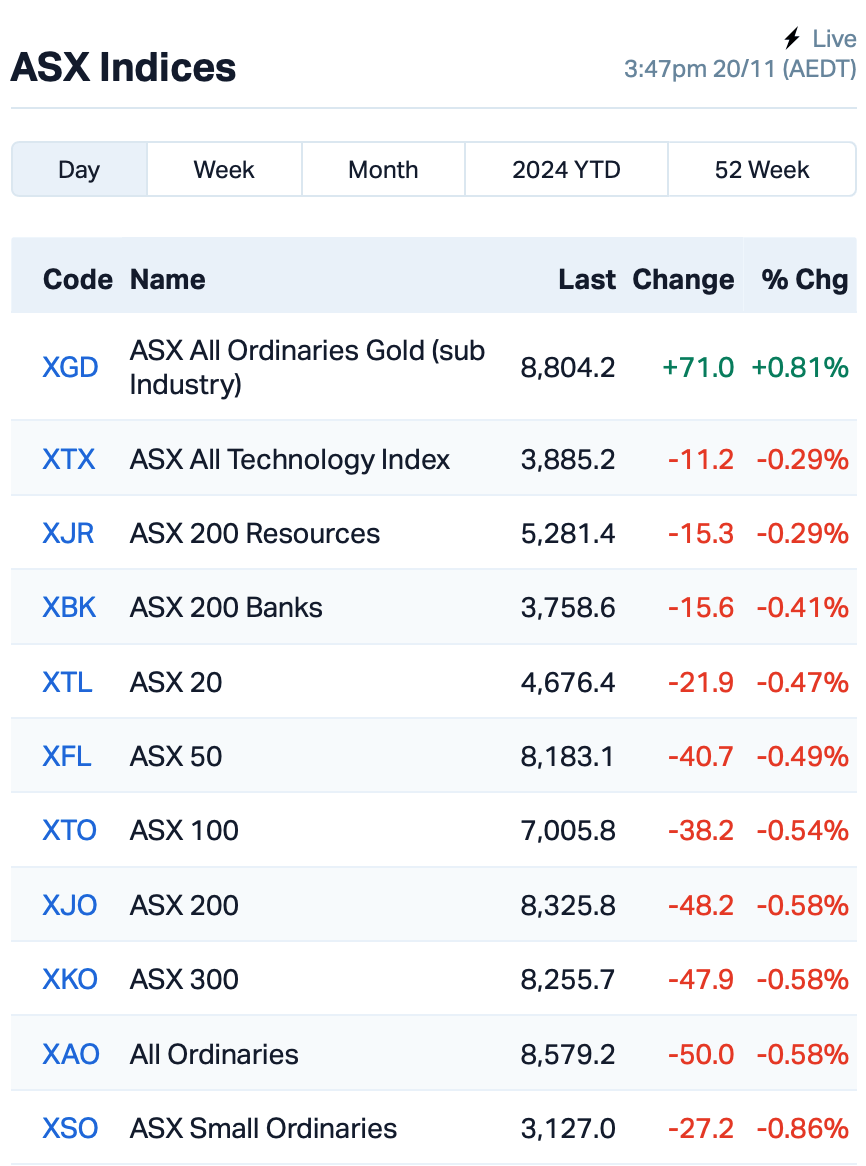

The ASX slipped from Tuesday’s high, closing lower by 0.57% on Wednesday.

Global worries are weighing on investor sentiment midweek, as the ongoing Russia-Ukraine conflict keep markets on edge.

Energy stocks were feeling the heat the most on Wednesday, with oil and gas giant Santos (ASX:STO) leading the charge downward with a 1% dip.

Overnight, tensions flared when Ukraine launched a missile attack on Russian soil, which pushed global stocks lower, especially in Europe.

Amidst the chaos, gold remained resilient, reinforcing its reputation as a safe haven. ASX gold stocks continued to make inroads today.

Amcor (ASX:AMC), the packaging giant, fell by 1.5% after announcing a big buyout deal in the US worth $13 billion.

Automotive parts maker PWR (ASX:PWH) cratered by 26% after it warned profits would be much lower than last year.

And Nick Scali (ASX:NCK), the furniture retailer, saw its shares fall by 2% as it faced a potential setback from a freight forwarder going bust.

Over in China, the central bank has decided to hold steady on interest rates, giving the country’s economy a bit of stability after big cuts last month.

Across the region, most Asian stock markets eased as traders remained on the sidelines waiting for Nvidia Corp’s results later on Wednesday (US time).

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NYM | Narryer Metals | 0.036 | 80% | 4,977,645 | $2,650,122 |

| CR9 | Corellares | 0.006 | 50% | 1,330,712 | $1,860,370 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 56,544 | $1,163,016 |

| TD1 | Tali Digital Limited | 0.002 | 50% | 10,002,001 | $3,295,156 |

| 1TT | Thrive Tribe Tech | 0.004 | 33% | 56,838,183 | $2,110,085 |

| FAU | First Au Ltd | 0.002 | 33% | 2,837,250 | $2,717,990 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 454,000 | $8,888,849 |

| SHG | Singular Health | 0.120 | 32% | 4,146,986 | $18,815,097 |

| IS3 | I Synergy Group Ltd | 0.005 | 25% | 400,443 | $1,424,871 |

| NAE | New Age Exploration | 0.005 | 25% | 1,182,688 | $8,575,596 |

| VML | Vital Metals Limited | 0.003 | 25% | 2,997,109 | $11,790,134 |

| TKM | Trek Metals Ltd | 0.028 | 22% | 199,354 | $11,819,076 |

| LML | Lincoln Minerals | 0.006 | 20% | 348,957 | $10,281,298 |

| LAT | Latitude 66 Limited | 0.077 | 18% | 720,555 | $9,270,045 |

| E25 | Element 25 Ltd | 0.295 | 18% | 719,451 | $54,978,100 |

| T3D | 333D Limited | 0.007 | 17% | 2 | $1,057,101 |

| TEG | Triangle Energy Ltd | 0.007 | 17% | 200,141 | $12,535,404 |

| KP2 | Kore Potash PLC | 0.071 | 16% | 2,807,363 | $41,604,316 |

| MM8 | Medallion Metals. | 0.093 | 16% | 1,916,265 | $32,639,604 |

| L1M | Lightning Minerals | 0.081 | 16% | 1,186,842 | $6,698,254 |

| DVL | Dorsavi Ltd | 0.015 | 15% | 32,940,491 | $9,506,093 |

| AAJ | Aruma Resources Ltd | 0.016 | 14% | 89,338 | $3,108,814 |

| AL8 | Alderan Resource Ltd | 0.004 | 14% | 3,283,703 | $6,682,522 |

| CXU | Cauldron Energy Ltd | 0.016 | 14% | 10,326,183 | $20,448,387 |

| C29 | C29Metalslimited | 0.120 | 14% | 2,239,103 | $18,289,765 |

Canadian dual-listed stock, NexGen Energy (ASX:NXG) has completed the final technical review for its Rook I Project by the Canadian Nuclear Safety Commission (CNSC), a key step towards scheduling a Federal Commission Hearing and obtaining project approval. With Provincial Environmental Assessment (EA) approval already secured, the company said this milestone positions the project to become one of the world’s largest and most environmentally conscious mining operations.

Kore Potash (ASX:KP2) has signed a fixed-price Engineering, Procurement, and Construction (EPC) contract worth US$1.929 billion for its Kola Project in the Republic of Congo. The contract with PowerChina includes a 43-month construction timeline and provisions for penalties if delayed. The project aims to become a low-cost potash producer.

Narryer Metals (ASX:NYM) surged 80% after making a discovery at its Rocky Gully project in Western Australia, revealing high-grade scandium, rare earth elements (REE), vanadium and gallium.

Recent drilling identified mineralisation over a 1,400m strike and 800m width, with scandium oxide grades up to 518 ppm and rare earth oxide assays exceeding 1% TREO, including valuable magnet rare earths. Gallium mineralisation has also been detected. The company said these findings suggest a large-scale carbonatite system beneath the surface.

Singular Health Group Ltd (ASX:SHG) has signed an MOU with Provider Network Solutions (PNS) to pilot and possibly roll out its 3Dicom software across PNS’s network, covering 3.7 million member plans. The partnership aims to reduce duplicate medical imaging costs in the US, estimated at USD$30 billion annually. PNS will invest $500k in Singular Health, and the latter has raised $3.7m to support software development and the pilot program.

Dorsavi (ASX:DVL), a motion analysis device tech company, is planning to integrate blockchain technology into its core data platform to enhance data security and compliance, particularly for its enterprise clients in healthcare and workplace settings. The move aims to ensure secure, tamper-proof data transfers and align with strict regulations like HIPAA.

Medallion Metals (ASX:MM8) has confirmed the continuity of high-grade lodes at the Kundip Gem deposit, with key results including 26m at 3.4g/t Au, 0.2% Cu, and 3.7g/t Ag from 145m, including 4m at 15.6g/t Au. The drilling has exceeded expectations, and the results will inform an updated Mineral Resource Estimate (MRE) and support the development of the nearby sulphide project.

Surefire Resources (ASX:SRN) has received a formal Expression of Interest from German commodities group HMS Bergbau for vanadium and titanium offtake from its Victory Bore project. HMS Bergbau, with a global presence, is interested in a long-term partnership, including offtake and potential funding for processing facilities in Saudi Arabia.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADX | ADX Energy Ltd | 0.057 | -43% | 1,982,771 | $57,284,925 |

| NRZ | Neurizer Ltd | 0.003 | -38% | 12,643,580 | $8,724,477 |

| CDE | Codeifai Limited | 0.002 | -33% | 6,857,105 | $7,923,884 |

| MTB | Mount Burgess Mining | 0.001 | -33% | 774,782 | $1,947,220 |

| QEM | QEM Limited | 0.032 | -30% | 504,426 | $8,778,350 |

| PWH | Pwr Holdings Limited | 6.570 | -28% | 3,185,989 | $913,120,303 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 5,151,084 | $11,649,361 |

| LNU | Linius Tech Limited | 0.002 | -25% | 411,318 | $12,302,431 |

| MTL | Mantle Minerals Ltd | 0.002 | -25% | 19,647,000 | $12,394,892 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 330,987 | $9,673,198 |

| OLL | Openlearning | 0.022 | -21% | 65,606 | $11,845,925 |

| QXR | Qx Resources Limited | 0.004 | -20% | 150,420 | $6,400,389 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 37,500 | $4,026,248 |

| CRR | Critical Resources | 0.007 | -19% | 8,488,945 | $15,709,469 |

| SVY | Stavely Minerals Ltd | 0.024 | -17% | 4,390,366 | $13,964,672 |

| ERW | Errawarra Resources | 0.060 | -17% | 55,040 | $6,906,288 |

| HRE | Heavy Rare Earths | 0.030 | -17% | 15,000 | $3,033,905 |

| IND | Industrialminerals | 0.150 | -17% | 374,613 | $14,458,050 |

| AOK | Australian Oil. | 0.003 | -17% | 7,072,733 | $3,005,349 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 5,999 | $9,507,891 |

| BP8 | Bph Global Ltd | 0.003 | -17% | 1,100 | $1,189,924 |

| M24 | Mamba Exploration | 0.010 | -17% | 247,999 | $2,256,987 |

| MOH | Moho Resources | 0.005 | -17% | 166,666 | $4,043,836 |

| IMI | Infinitymining | 0.016 | -16% | 365,768 | $6,517,139 |

IN CASE YOU MISSED IT

Bevis Yeo reported that:

Greenvale Energy (ASX:GRV) has entered into a binding heads of agreement with Gempart to acquire an 80% interest in the Elkedra project, 300km northeast of Alice Springs, its fourth uranium project in the Northern Territory.

Bulk sampling at Mt Malcolm Mines’ (ASX:M2M) Golden Crown prospect has advanced to a depth of 12m and is poised to start extraction of material from the ultra-high-grade zone. The program also continues to generate revenue from gold sales.

As mentioned further above, but in case you missed that, Singular Health (ASX:SHG) has signed a memorandum of understanding with Provider Network Solutions (PNS) to collaborate on a technical proof of concept and commercial pilot and has locked in a $3.7 million capital raise.

Dimerix (ASX:DXB) has concluded the fifth review of the ACTION3 phase III clinical trial safety data which evaluated available study data for participant safety, study conduct and progress.

The independent data monitoring committee (IDMC) successfully concluded the ACTION3 trial continue unchanged with no changes to design or safety monitoring, noting that no safety concerns have been noted to date, which is consistent with prior reviews and the existing and growing safety profile for DMX-200.

“This encouraging recommendation of the IDMC confirms the strong emerging safety profile of DMX-200 and suggests that DMX-200 does not add a burden of side effects to patients, compared to commonly used treatments such as high dose steroids and immunosuppressants,” chief medical officer Dr David Fuller said.

“DMX-200 offers real hope for the many patients suffering from FSGS kidney disease who currently have limited treatment options.”

Impact Minerals (ASX:IPT) has received a $512,000 tax incentive cash rebate from the Australian Taxation Office under the research and development tax incentive scheme for the spending in the financial year ending June 2024.

Proceeds from the rebate will be used to continue the pre-feasibility study on the company’s Lake Hope high purity alumina project, which is scheduled for completion in 1Q 2025.

It will also contribute to the accelerated start of a research and development project with CPC Engineering and Edith Cowan University to construct a pilot plant for Lake Hope, which is also the receipt of a $2.87m grant under the federal government’s CRC-P program.

“The unique mineralogy and patented and proprietary processing techniques for the Lake Hope high purity alumina project have allowed us to claim back a significant proportion of our expenditures on it through the R&D tax incentive program and this will be the case moving forwards,” managing director Dr Mike Jones said.

At Stockhead, we tell it like it is. While Codeifai, Impact Minerals, Javelin Minerals, Legacy Minerals, Singular Health, Octava Minerals, Perpetual Resources, Petratherm and Spartan Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.