Resources Top 5: Junior rockets 100pc on promising Julimar nearology, 3 near term copper and vanadium producers catch a bid

Mining

Mining

Here are the biggest small cap resources winners in early trade, Thursday June 29.

(Up on no news)

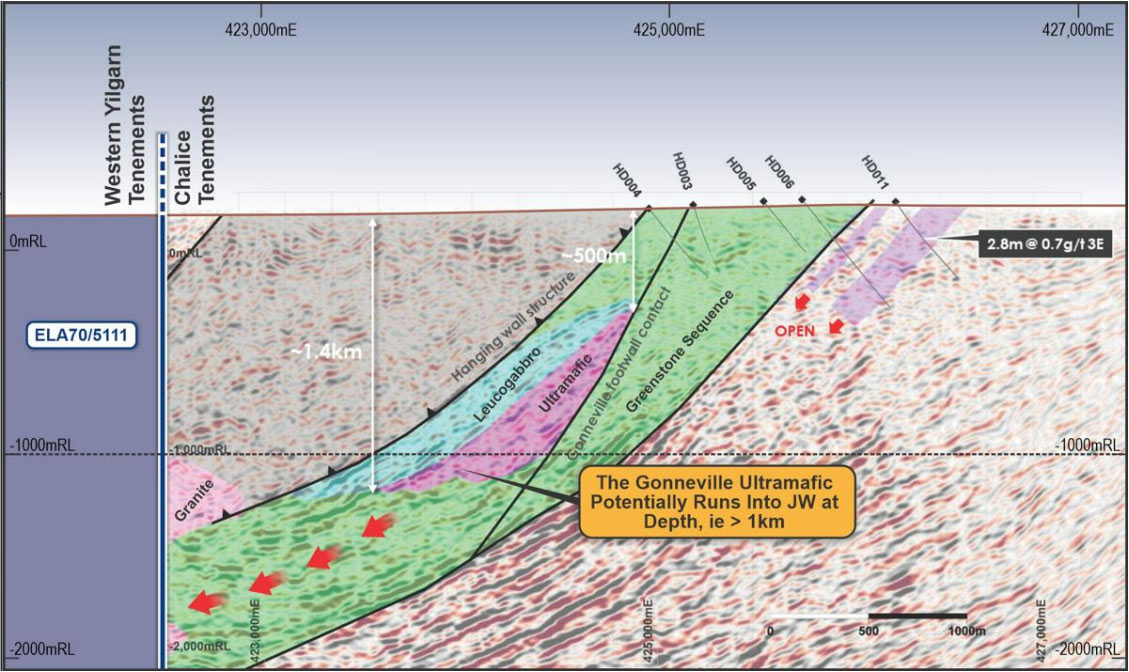

The stock is now up +100% since Wednesday morning after uncovering a bunch of targets at its ‘Julimar West’ project, right next door to Chalice Mining’s (ASX:CHN) 3Mt NiEq Julimar project in WA.

There’s potential for CHN’s Gonneville intrusion – which hosts the monster resource – to continue onto WYX’s ground, the company says:

Additionally, old grab sampling across Julimar West returned significant tin, niobium and tantalum results along with anomalous lithium.

Field reconnaissance by the company has also identified outcropping pegmatites, which are rocks that can contain lithium.

WYX’s application over the tenure should be granted shortly, it says. Following that, a staged exploration program will kick off.

“Julimar West targets probably the most exciting new battery metals discovery zone in the world, namely the 3MT NiEQ Chalice Mining Gonneville discovery,” WYX chairman Pete Lewis says.

“Despite the long delay in DMIRS processing our application, we are expecting the grant of our EL 70/5111 application to be completed soon after the removal of an FNA from our application area, by the end of June 2023.

“The grant of our application will enable Western Yilgarn to immediately commence a staged exploration program targeting several exciting opportunities in a world class mineralised zone recently established by Chalice Mining.”

The exploration stock formerly known as Pacific Bauxite was reinstated to the ASX in May 2022 following a $4.5m, 20c per share recapitalisation process.

It had ~$2.8m in the bank at the end of March.

(Up on no news)

Diversified PNG-based MRL says it is close to development and first cashflows.

Its ‘Central Cement and Lime’ project would be a vertically integrated manufacturing facility with the ability to meet 100% of PNG’s cement, clinker and quicklime requirement.

The co-located quarry, plant site and deep draft wharf will enable very low operating costs, it says.

Phase 1 of the project (capex of US$91m, estimated annual EBITDA of US$25m across 30 years) is fully permitted and construction ready, with early works now underway.

First revenue from aggregates and quicklime is pencilled in for the second half of 2023 and 2024, respectively. MRL is now looking to bed down the remainder of the financing.

It is also building the Orokolo Bay vanadium, iron, and industrial sands project, where a mining lease was recently granted.

This was followed by the signing of a magnetite offtake agreement with a large Japanese trading house and a cornerstone investment deal.

The spin-out and IPO of Ortus Resources on the ASX to raise capital for Orokolo Bay remains on hold due to prevailing market conditions.

Discussions and due diligence with potential strategic partners to fund the project privately continues, with MRL pencilling in first revenues for Q4 this year.

The $46m capped stock is down 14% year-to-date.

(Up on no news)

HOR is busy on a couple of promising gold and copper projects.

There are a bunch of targets in the crosshairs at the Glenloth goldfield project, near Barton Gold’s 1Moz Tunkillia project in the Gawler Craton of South Australia.

Meanwhile drilling results from its historical Horseshoe Lights project, ~60km from Sandfire Resources’ (ASX:SFR) DeGrussa mine, have pulled up thick and shallow copper.

Highlights from the late 2022 program included 55m @ 0.88% Cu from 22m incl. 3m @ 4.33% Cu from 56m.

More drilling is expected in Q3.

Horseshoe Lights has already produced ~316,000oz gold and 55,000t copper metal in two phases of mining. It contains a current resource of 128,000t copper metal @ 1.0% (0.5% cut-off) and 36,000oz gold.

The $15m capped stock is down 15% year-to-date. It had $2.1m in the bank at the end of March.

(Up on no news)

Commodity analysts CRU Group expects global vanadium demand to double over the next decade – from ~110,000tpa in 2022 – largely thanks to growth in the nascent vanadium battery (VRFBs) sector.

One of the frontrunners to enter production is TMT, which is developing the Murchison Technology Metals Project (MTMP) in Western Australia’s Midwest region.

It says the project could produce 6% of the world’s vanadium when it comes online.

The company recently produced high-grade vanadium electrolyte feedstock from the MTMP with its Japanese technology partner, LE System Co.

In April, TMT executed an MoU with fast-growing Indian VRFB maker Delectrik Systems for the potential sale of vanadium raw material from the MTMP as well as supply of vanadium electrolyte by vLYTE to Delectrik within Australia.

An $11.5 million placement at $0.28 per share last month is expected to progress development of the MTMP, including early works.

This will enable the smooth transition into construction once financing has been bedded down, and all permits and approvals have been received.

There are also whispers the company could merge with neighbouring, and equally advanced, project developer Australian Vanadium (ASX:AVL).

Speculation of merger of vanadium developers @TechnologyMetal $TMT and $AVL, reported in @FinancialReview👇. They share on ore body but have very different development plans. Exciting times! #vanadium #batterymetals

Disclosure: speculative, DYOR, I own $TMT pic.twitter.com/rqrxuueDbC— Alex Sundich (@AlexSundich) June 27, 2023

The $80m capped stock is down 13% year-to-date.

(Up on no news)

Another near-term producer.

KGL’s main game is the Jervois copper project in NT, where the plan is to churn out 30,000 tonnes of copper per year, plus silver and gold.

A feasibility study (FS) released late last year outlined “one of the highest-grade copper developments in Australia”, which KGL hopes to bring into production from 2025.

Here are some of the key FS takeaways:

Those metrics are based on a long-term copper price of US$9,326/t.

If prices hit +US$13,000/t, as some experts predict, NPV and IRR jump to $701m and 40.1%, respectively.

The focus in 2023 will be project financing and growing the high-grade 23.8Mt at 2.02% copper, 25.3g/t silver and 0.25g/t gold resource, KGL says.

Drilling is ongoing, with two rigs currently on site.

“We are looking forward to making the necessary progress to start construction in 2023, subject to achieving some normalisation in market conditions – more specifically, the availability of labour, pricing of key inputs and supportive macroeconomic conditions,” it says.

Interest in a recent $13.5m cap raise was less than hoped (target was +$20m) but the company says it was “well in excess of the minimum the board considered necessary”.

The $100m capped stock is down 20% in 2023.