Resources Top 5: Lincoln up extraordinary +800pc since relisting, uranium junior enters $US6bn enrichment space

Mining

Mining

Here are the biggest small cap resources winners in early trade, Wednesday January 25.

(Up on no news)

Another big +100% gain in early trade for this resurgent graphite hopeful, which is now up 825% since relisting on the ASX late last week.

You can read the interesting background here.

In 2022, LML received an unsolicited takeover offer from fellow South Australian project developer Quantum Graphite (ASX:QGL).

The initial all share offer (1 QGL share for every 40 LML Shares held) was rejected by the board and substantial shareholders in the company, but QGL yesterday extended its offer again for the third time.

The potential takeover target now has a market cap of $42m — well above QGL’s ~$6m valuation, even taking into account QGL’s substantial share price rise since October last year.

LML’s main game is the advanced Kookaburra Gully project in South Australia, which has a 3.88Mt resource grading 12.6% TGC for 489,360t of contained graphite.

The company is currently defining targets for drilling in 2023.

“The 2023 drilling program will be finalised over the coming weeks and high priority targets will be considered first for drilling, taking into consideration the logistics, planning and permitting lead times,” LML said 16 December.

North American uranium play OKR is entering the enrichment sector with a cornerstone $3.1m investment for a 19.9% stake in private Australian company Ubayron.

The deal is well-timed, with reports of potential sanctions against Russia’s dominant uranium enrichment industry.

Boom!💥🪖 In light of #Russia‘s state-owned enriched #Uranium exporter having been caught offering military goods to circumvent US/EU sanctions, recommended sanctions against #Russia, Rosatom and their #Nuclear industry were placed on the table today in Washington, DC🇷🇺⚛️⛏️⛔️🇺🇸👍 https://t.co/tA84mcacej

— John Quakes (@quakes99) January 24, 2023

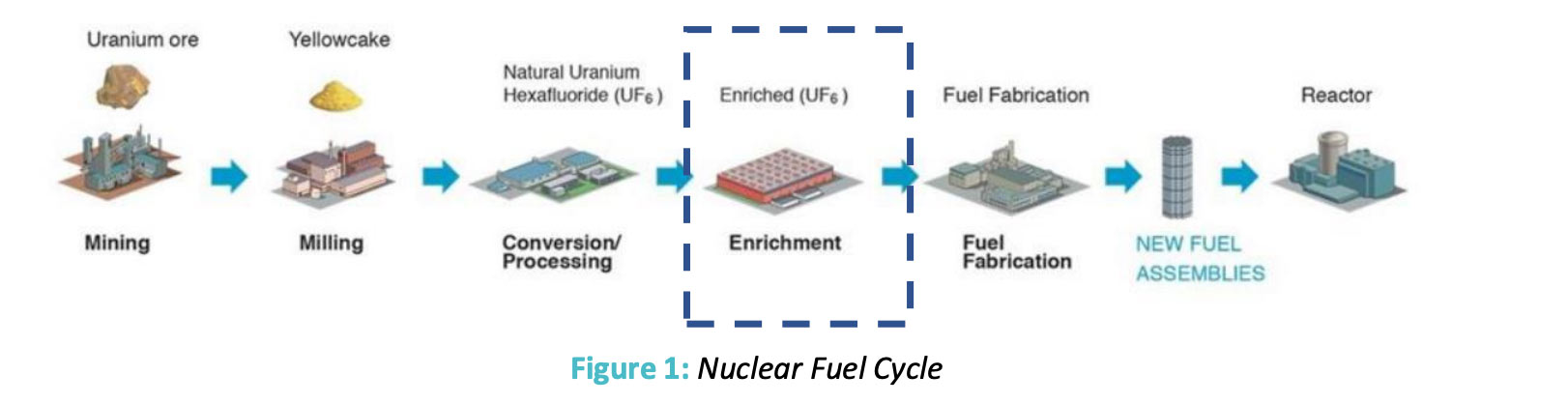

Here’s a basic look at the nuclear fuel cycle.

According to the World Nuclear Council, most of the about 500 commercial nuclear power reactors operating or under construction in the world today require uranium ‘enriched’ in the U-235 isotope for their fuel.

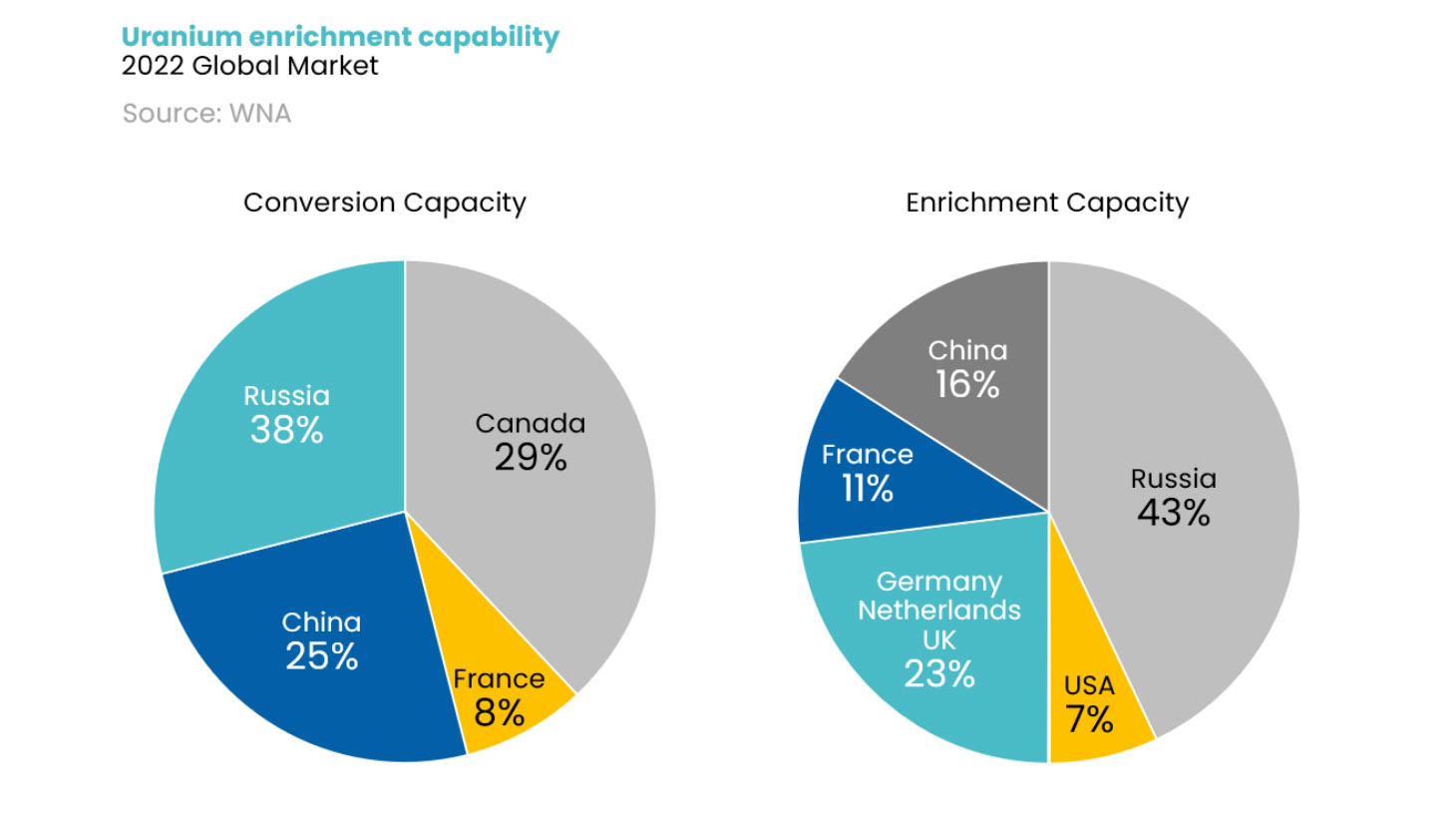

It is a $US6bn industry, and Russia owns a big chunk of it.

In Australia, the main player is $950m capped R&D firm Silex Systems (ASX:SLX), which owns 51% of the Silex Laser Enrichment Technology in JV with one of the world’s largest uranium producers, Cameco Corporation (NYSE: CCJ, TSX: CCO) (49% ownership). It is yet to be commercialised.

OKR says Ubayron’s next generation enrichment tech uses a unique process that does not require significant temperature or pressure and significantly reduces technical risk and cost.

OKR now has exposure to multiple components of the nuclear fuel cycle, says OKR managing director Andrew Ferrier, who will join the Ubaryon board to help with development and commercialisation.

“The US currently imports 95% of its uranium yellowcake requirements and 70% of its SWU (enriched uranium) requirements at a time when a significant geopolitical shift is underway within the nuclear fuel industry as international utilities seek to diversify away from Russia which is currently the largest global producer of enriched uranium,” he says.

Upcoming milestones for Ubaryon include regulatory approvals to negotiate with major multinationals, further validation of enrichment performance, and the construction and operation of continuous operation at bench scale.

SKY has re-assayed a bunch of old drill core for rare earths, uncovering thick, widespread REEs at all three tin deposits at the Doradilla project in NSW.

Drilling highlights like 33m @ 4981ppm (0.50%) TREO from 15m — including 12m @ 8781ppm (0.88%) TREO from 25m – remain open in multiple directions.

The results suggest that there are multiple kilometres of shallow REE mineralisation over the total 16km strike length of the so-called DMK system – the majority of which remains untested for REE.

Further REE assaying of samples from historic drilling at Doradilla will be completed to develop and evaluate the extent of the REE mineralisation rapidly and cost-effectively.

Drill planning is being expedited and preliminary metallurgical testwork has commenced.

“The discovery of REE mineralisation at Doradilla further demonstrates what an extraordinary and unique system SKY is exploring at Doradilla,” SKY CEO Oliver Davies says.

“The scale of mineralisation of the DMK system is already remarkable, at over 16km long, it has the potential to develop into an extremely large source of REE, particularly with the valuable Nd + Pr + Dy + Tb representing over 20% of the TREO on average and up to over 40% in some intervals.”

The advanced project developer is embarking on a major resource expansion program at its flagship 1Mt Paradox lithium brines project in Utah.

The plan is to convert the existing inferred resource and exploration target in the Western area of the project to indicated and inferred resources.

The exploration target in the Western area is 2.10–2.56Bt of brine grading 108–200ppm lithium and 2,000–3,000ppm bromine.

Drilling is expected to start in the current quarter.

In September, the high-flying lithium project developer released its project definitive feasibility study (DFS).

The headline numbers for Phase 1 development are as follows:

ASN assumed a long-term price assumption of ~US$19,000 per tonne of battery grade lithium carbonate for the DFS.

At current lithium carbonate spot prices of above US$70,000 per tonne, pre-tax NPV and IRR jump to $5,149m and 98%, respectively.

That’s super profits territory.

(Up on no news)

The advanced iron ore explorer has recovered after stumbling late in 2022.

Spun out from Jupiter Mines (ASX:JMS), JNO owns the Mt Mason hematite project and the Mt Ida magnetite project in WA’s Yilgarn region.

Mt Mason is a near-term development opportunity. Mt Ida is a larger, longer-dated proposition, hosting a resource of 1.85 billion tonnes at 29.5% iron on a granted mining lease.

With iron prices looking solid, JNO is getting close to pushing the button on Mt Mason, a high-grade DSO project.

It has all development approvals in the bag, with work ongoing to to complete the logistics supply chain to export DSO out through the Port of Esperance.

A financial investment decision will follow, it said late October.