Closing Bell: Local markets suck, Iceni Gold finds real nuggets you can touch & AGL is back from hell and doing well

News

News

Local markets were ill-suited to Monday trade.

The heavyweight miners are bleeding out, led by Fortescue’s gaping 4.6% hole. The healthcare sector is shot.

Healius won’t talk to media about rumours of a day hospital sale to Queensland Investment Corporation (QIC), while Woodside and Santos are lower as are energy prices.

But wait on… is that AGL (ASX:AGL) actually doing pretty good on a random Monday? Ahead by almost 4%, the energy company which may or may not be about gas has been upgraded to Buy by the brokers at UBS, apparently on a ‘rapidly improving’ outlook and a ‘compelling’ valuation.

In other words, things can’t get worse and it’s just the right shade of cheap.

Treasurer Jim Chalmers was just telling reporters that Labor under Marrickvillian PM Albo will find a way to get on top of supercharged energy costs before New Year, giving his party a less than six-week window before the party.

UBS doesn’t believe this guff one bit.

They expect wholesale electricity prices to jump by as much as 67% over the next 24 months – thanks to war, plague and Putin pushing higher coal and gas costs. The investment bank sees this translating to somewhere between a 20% to 25% retail price lift over 2023-24.

AGL meanwhile, strongest of the mid-to-decently-sized caps on Monday, gets a UBS upgrade to Buy from Neutral with the price target bumped up to $8.70 a pop from $8.15, “recognising its strong earnings leverage to rising electricity prices”.

UBS reckons AGL’s earnings per share (EPS) to near double over FY23-24 and the dividend yield rising to 7% in FY24 and then to a stonking 11% in FY25.

Cop25 that!

Elsewhere on this breaking bad Monday, the Canaccord Genuity brokers downgraded the headline medical devices maker Nanosonics to Hold, from Buy, and then trimmed the nails on the target to $4.86, from $4.96.

“While we fundamentally like Nanosonics’ product, pipeline and long-term growth opportunity, near-term growth prospects from current share price levels are elusive, especially given the recent run in share price,” CG said in a gentle hardly break up style note.

But in a quality over-reaction the share price fell almost 10% before lunchtime, taking losses to over 35%.

Around the hood, Asia-Pacific indices fell on Monday with a weekend of doubt white-anting a slightly positive previous session in New York.

South Korea’s Kospi dropped 1.3%, while in Japan equities were largely flat.

However, the profoundly volatile Hang Seng fell sharply at the open of business in Hong Kong, down almost 3%.

On the mainland, China’s central bank – the People Bank of China – surprised no-one by holding the benchmark lending rates (the PBoC’s loan prime rates) steady. By lunchtime in Beijing, the Shanghai Composite and the Shenzhen Component had both given away 1%.

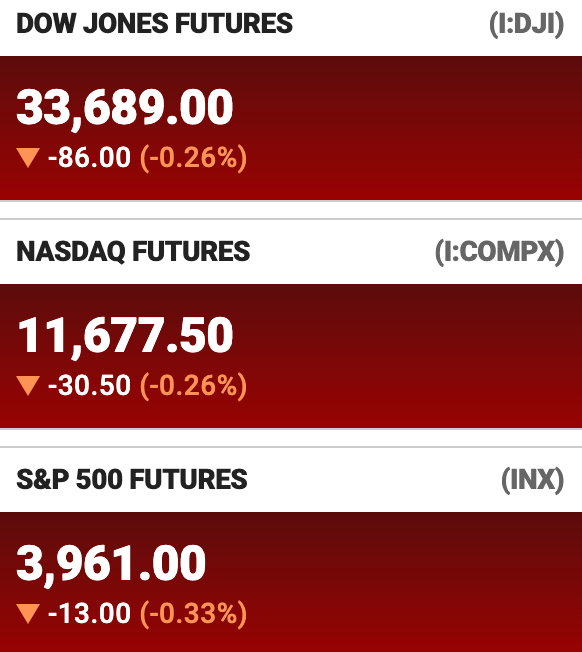

As of 3pm in Sydney, US Futures were all between 0.25% and 0.35% lower ahead of what is expected to be a lighter week of trade on Wall Street, ahead of Thursday’s Thanksgiving holiday.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ICL | Iceni Gold | 0.155 | 142% | 17,785,553 | $8,204,571 |

| RDS | Redstone Resources | 0.013 | 136% | 73,868,661 | $4,052,578 |

| GGX | Gas2Grid Limited | 0.0015 | 50% | 63,867 | $4,058,102 |

| MEB | Medibio Limited | 0.0015 | 50% | 85,175 | $3,320,594 |

| WBE | Whitebark Energy | 0.0015 | 50% | 21,009,062 | $6,464,886 |

| AQS | Aquis Ent Ltd | 0.18 | 38% | 88,816 | $4,643,493 |

| NZS | New Zealand Coastal | 0.004 | 33% | 5,575,955 | $3,381,015 |

| XST | Xstate Resources | 0.002 | 33% | 1,501,000 | $4,822,772 |

| LME | Limeade Inc. | 0.17 | 26% | 218,818 | $34,544,692 |

| LSA | Lachlan Star Ltd | 0.015 | 25% | 4,994,949 | $15,828,153 |

| AQX | Alice Queen Ltd | 0.0025 | 25% | 1,026,000 | $4,400,500 |

| GLV | Global Oil & Gas | 0.0025 | 25% | 8,138,361 | $3,746,709 |

| SIH | Sihayo Gold Limited | 0.0025 | 25% | 337,013 | $12,204,256 |

| OD6 | Od6Metalsltd | 0.545 | 21% | 2,690,487 | $22,203,223 |

| BPH | BPH Energy Ltd | 0.025 | 19% | 29,098,094 | $18,124,359 |

| NOR | Norwood Systems Ltd. | 0.025 | 19% | 2,760,561 | $7,973,229 |

| 1VG | Victory Goldfields | 0.285 | 19% | 2,262,430 | $11,935,235 |

| SW1 | Swift Networks Group | 0.019 | 19% | 545,619 | $9,484,747 |

| EXL | Elixinol Wellness | 0.034 | 17% | 467,952 | $9,171,702 |

| ERL | Empire Resources | 0.007 | 17% | 492,778 | $6,231,433 |

| FGL | Frugl Group Limited | 0.014 | 17% | 35,717 | $3,178,195 |

| JTL | Jayex Technology Ltd | 0.007 | 17% | 223,864 | $1,495,371 |

| NES | Nelson Resources. | 0.007 | 17% | 7,230,159 | $3,531,566 |

| RFA | Rare Foods Australia | 0.09 | 15% | 25,407 | $15,657,937 |

| RB6 | Rubixresources | 0.19 | 15% | 40,000 | $4,463,250 |

I can’t claim to have insight into what these REE diggers are up to. Certainly in the latter part of CY22 they don’t appear to be as rare as first thought.

Point in case: OD6 Metals (ASX:OD6) is cruising on Monday, ahead by 20%, on no discernable news. They did put out an updated investor presso on the 11th and maybe a few traders found this page:

Limeade (ASX: LME), you may or may not know, is “an immersive employee well-being company that creates healthy employee experiences.”

Be that accurate I cannot judge, being an employee immersed in my work and aside from the occasional beveragerather healthy. But, today LME reports of a thumping new enterprise contract with UPMC Health Plan, a Pennsylvania-based insurer.

Under the terms of the contract, Limeade will get circa US$10.5 million over3 years, representing Contracted Annual Recurring Revenue (CARR) of US$3.5 million.

The platform is slated to launch in January 2023 and be available to nearly two million UPMC Health Plan members, including those covered by fully insured and self-insured plans, as well as those covered by UPMC Health Plan’s Medicare products.

“Through serving a large portion of UPMC Health Plan members, this agreement will be one of Limeade’s top 5 customers,” said Henry Albrecht, Limeade CEO. “Our entire company is focused on innovating, serving customers and converting our late-stage pipeline to high quality contracts so that we can deliver organic CARR growth in FY22 and drive adjusted EBITDA breakeven in FY23,” CEO Henry Albrecht says.

And among the diggers:

Iceni Gold (ASX:ICL) is wandering about picking up gorgeous gold nuggies over several kilometres at its Guyer prospect, part of the ICL flagship 14 Mile Well project in WA.

They’re so cool!

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PRM | Prominence Energy | 0.001 | -50% | 395,461 | $4,849,218 |

| ANL | Amani Gold Ltd | 0.001 | -33% | 1,793,224 | $35,540,162 |

| DW8 | DW8 Limited | 0.002 | -33% | 51,724,244 | $9,304,568 |

| RAS | Ragusa Minerals Ltd | 0.13 | -28% | 9,782,023 | $23,799,267 |

| CSF | Catalanoseafoodltd | 0.07 | -26% | 40,000 | $3,091,566 |

| GMN | Gold Mountain Ltd | 0.01 | -23% | 37,568,959 | $19,280,939 |

| W2V | Way2Vatltd | 0.021 | -22% | 122,439 | $4,801,793 |

| PLG | Pearlgullironlimited | 0.02 | -20% | 821,545 | $1,372,558 |

| GNM | Great Northern | 0.004 | -20% | 2,631,981 | $8,545,255 |

| MTH | Mithril Resources | 0.004 | -20% | 126,169 | $14,701,165 |

| RMX | Red Mount Min Ltd | 0.004 | -20% | 717,324 | $8,211,819 |

| BUR | Burleyminerals | 0.25 | -19% | 713,787 | $10,640,145 |

| GCR | Golden Cross | 0.009 | -18% | 5,136,444 | $12,069,817 |

| HFY | Hubify Ltd | 0.023 | -18% | 90,000 | $13,891,816 |

| PGO | Pacgold | 0.37 | -18% | 372,612 | $24,732,817 |

| SMN | Structural Monitor. | 0.39 | -17% | 252,214 | $63,064,424 |

| AFL | Af Legal Group Ltd | 0.125 | -17% | 551,849 | $11,480,463 |

| TG1 | Techgen Metals Ltd | 0.092 | -16% | 653,686 | $6,022,385 |

| QUE | Queste Communication | 0.031 | -16% | 641,183 | $1,001,676 |

| FFF | Forbidden Foods | 0.055 | -15% | 308,929 | $6,721,202 |

| DDT | DataDot Technology | 0.006 | -14% | 190,196 | $8,707,086 |

| ESR | Estrella Res Ltd | 0.012 | -14% | 14,761,429 | $20,684,516 |

| ICN | Icon Energy Limited | 0.006 | -14% | 4,000,261 | $5,376,096 |

| MBK | Metal Bank Ltd | 0.003 | -14% | 559,638 | $9,153,367 |

| AYA | Artryalimited | 0.5 | -14% | 31,609 | $36,420,243 |

Poseidon Nickel (ASX:POS) says it’s delivered positive results in a bankable feasibility study (BFS) that demonstrate its Black Swan project in Western Australia can produce a high-grade nickel sulphide concentrate and be a profitable operation.

The study envisages the operation will process 5 million tonnes of feed over four years to produce 200,000 tonnes of high-grade concentrate containing about 30,000 tonnes of nickel.

This scenario is forecast to deliver free cash flows of $333m with a pre-tax net present value of $248m and an internal rate of return of 103% at the current Australian dollar nickel price.

Black Swan can produce a high-grade nickel concentrate with ~15% nickel, less than 6% magnesium oxide (MgO) and an iron to magnesium oxide ratio of 5:1 – which is highly desirable for conventional nickel smelters.

“We have received indicative offtake terms from a number of groups which confirm this is a sought-after concentrate with excellent nickel payability,” managing director Peter Harold said.

Fledgling gold miner Tombola Gold (ASX:TBA) says a single diamond hole drill has returned high-grade gold and confirmed the potential for the Mt Scheelite target to feed into its forecast gold production schedule.

The hole, which follows a successful reverse circulation drill program, returned a 15m intersection grading 6.96 grams per tonne (g/t) gold from a down-hole depth of 28m including 5m at 11.2g/t gold from 37.5m.

It comes as moves to start gold production from its Golden Mile project in Cloncurry, Queensland, before the end of this year with ore sourced from Comstock, Shamrock / Falcon and Mt Freda.

RC drilling at Mt Scheelite had previously returned results such classics as:

Up about 5% is Centrex Limited (ASX: CXM) which says its 100% owned subsidiary Agriflex Pty Ltd has shipped its first international export with 5,000 tonnes currently on route to New Zealand ag co-op Ravensdown.

Back in April CXM sold a 5,000 wet tonne trial shipment to Ravensdown on a free on board basis – the beneficiated phosphate rock to be loaded at Townsville for the Kiwi’s to make fertiliser such as super phosphate.

Australia and New Zealand, combined, import a million tonnes of high-grade phosphate rock each year, mainly from Africa.

“Like Australia, New Zealand requires surety of supply because domestic food security is not something to be gambled with,” managing director Robert Mencel says. “Agriculture is the largest sector in New Zealand’s tradable economy and its produce not only sustains the nation but is renowned for its quality all over the world.”