Eye on Lithium: EU needs a LOT more midstream, raw material supply to meet battery demand

Mining

Mining

All your lithium news, Monday October 24.

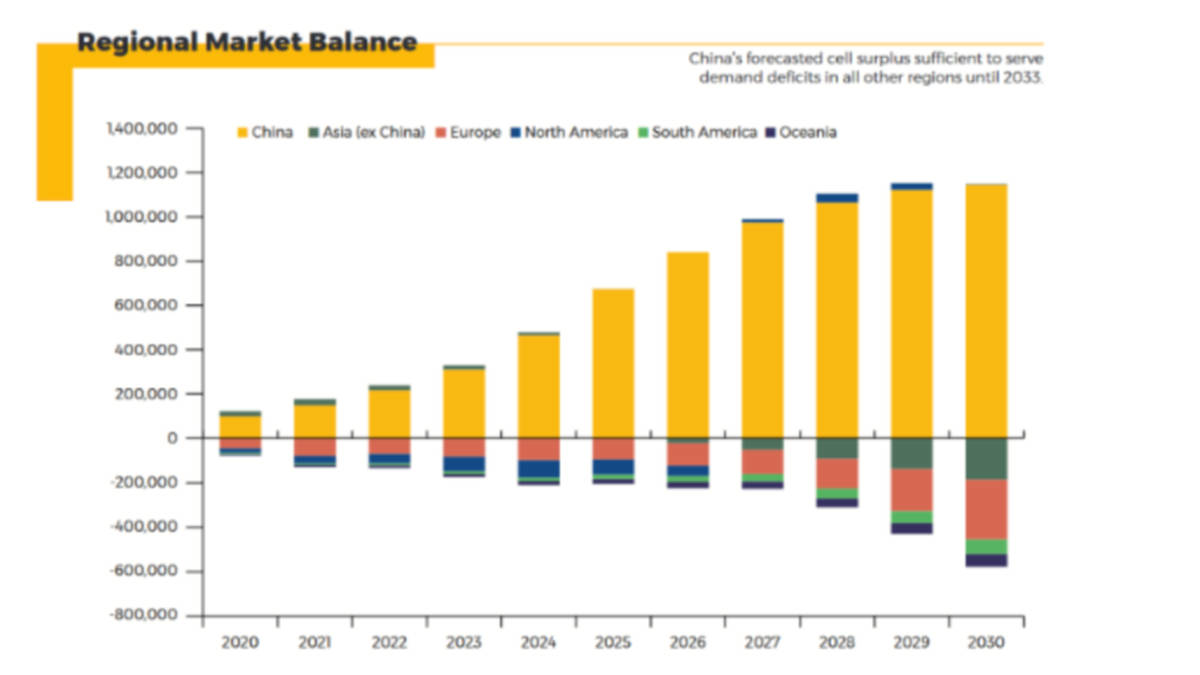

According to Benchmark Mineral Intelligence, Europe’s looking at a supply deficit this decade which could grow from 66 GWh in 2022 to almost 270 GWh in 2030 thanks to a lack in midstream capacity and raw materials.

The European battery industry will struggle to keep pace with rising demand for EVs, falling behind the US – which is expected to reach cell surplus from 2027 to 2050, and Asia – as China continues to maintain the largest battery surplus of all regions until 2033.

BMI’s latest data highlights how Europe needs to accelerate the build-out of a battery supply chain, whilst the US and China rapidly expand capacity to meet their own demand.

“There are investments coming in Europe at cell capacity level, but the issue is that there’s no point building these gigafactories if you’ve not got the supply chain to feed them,” said Aran Waid, analyst at Benchmark.

“The biggest issue for them is building that midstream capacity and sourcing that raw material.”

European battery demand for electric vehicles is set to grow by 600% by the end of the decade to over 735 GWh, according to Benchmark.

That compares to 436 GWh of battery EV demand for the US.

“Europe is leading in battery development outside of China but it still retains a deficit because we expect the demand to be much higher as it has such high EV penetration rates as well,” Waid said.

At the same time, the North American market has already seen $13 billion announced for domestic EV manufacturing and $24 billion in batteries after the passing of the Inflation Reduction Act with 16 gigafactories set to come online by 2025.

But of all the regions, China has consistently been ramping up its capabilities ranging from refining to manufacturing and all aspects of the EV supply chain.

Its battery production is looking to grow from 562 GWh in 2022 to 2.2TWh by 2030.

Experts say China EV/ plug-in sales are up 100pc year-on-year, reaching a record 29.4pc share of all passenger vehicle sales in August.

| CODE | COMPANY | PRICE | % TODAY | % WEEK | % MONTH | % YEAR | MARKET CAP |

|---|---|---|---|---|---|---|---|

| SHH | Shree Minerals Ltd | 0.009 | 20% | 13% | 0% | -18% | $9,288,652 |

| GLN | Galan Lithium Ltd | 1.5 | 18% | 24% | 12% | 36% | $386,803,749 |

| FRS | Forrestaniaresources | 0.205 | 14% | 8% | 3% | -47% | $9,075,568 |

| VUL | Vulcan Energy | 6.87 | 14% | 5% | -12% | -49% | $865,745,218 |

| ESS | Essential Metals Ltd | 0.58 | 14% | 16% | 22% | 190% | $126,664,968 |

| DRE | Dreadnought Resources Ltd | 0.1125 | 13% | 18% | -2% | 188% | $304,253,355 |

| AUN | Aurumin | 0.094 | 12% | 13% | -6% | -53% | $10,525,800 |

| MMC | Mitremining | 0.19 | 12% | 9% | 6% | -17% | $4,604,467 |

| NWM | Norwest Minerals | 0.03 | 11% | 7% | -30% | -63% | $5,996,899 |

| MM1 | Midasmineralsltd | 0.2 | 11% | 5% | 3% | 0% | $10,283,718 |

| PLL | Piedmont Lithium Inc | 0.9375 | 10% | 13% | 1% | 16% | $1,491,438,468 |

| NMT | Neometals Ltd | 1.155 | 10% | 13% | -3% | 29% | $579,963,833 |

| LRS | Latin Resources Ltd | 0.11 | 10% | 12% | 0% | 156% | $197,209,329 |

| SCN | Scorpion Minerals | 0.077 | 10% | 10% | -4% | 1% | $23,359,433 |

| BMM | Balkanminingandmin | 0.28 | 10% | 8% | -20% | -58% | $10,967,743 |

| RMX | Red Mount Min Ltd | 0.006 | 9% | 0% | 0% | -33% | $9,033,001 |

| LSR | Lodestar Minerals | 0.006 | 9% | 20% | -14% | -33% | $9,561,405 |

| INR | Ioneer Ltd | 0.565 | 9% | 8% | -16% | -19% | $1,091,029,720 |

| QXR | Qx Resources Limited | 0.071 | 8% | -8% | 109% | 238% | $58,202,913 |

| CZL | Cons Zinc Ltd | 0.03 | 7% | 11% | 36% | -27% | $12,961,801 |

| PLS | Pilbara Min Ltd | 5.385 | 6% | 15% | 9% | 152% | $15,132,607,094 |

| MNS | Magnis Energy Tech | 0.37 | 6% | 6% | -15% | -1% | $339,616,019 |

| WCN | White Cliff Min Ltd | 0.02 | 5% | 5% | -5% | 33% | $14,204,464 |

| ASN | Anson Resources Ltd | 0.305 | 5% | 7% | -16% | 243% | $340,687,332 |

| JRL | Jindalee Resources | 2.24 | 5% | -3% | -10% | -9% | $122,217,198 |

| AGY | Argosy Minerals Ltd | 0.5625 | 5% | 18% | -5% | 121% | $738,577,304 |

| RDT | Red Dirt Metals Ltd | 0.535 | 5% | -7% | -12% | -25% | $169,317,870 |

| LRD | Lordresourceslimited | 0.325 | 5% | 8% | 12% | 0% | $10,318,233 |

| INF | Infinity Lithium | 0.225 | 5% | 13% | 18% | 18% | $89,590,451 |

| GT1 | Greentechnology | 0.865 | 4% | 14% | 11% | 0% | $158,312,866 |

| EMS | Eastern Metals | 0.125 | 4% | -11% | -14% | 0% | $4,638,750 |

| ARN | Aldoro Resources | 0.26 | 4% | 16% | 18% | -39% | $24,896,829 |

| BNR | Bulletin Res Ltd | 0.13 | 4% | 4% | 0% | 71% | $36,573,888 |

| KAI | Kairos Minerals Ltd | 0.029 | 4% | 4% | -24% | -6% | $54,994,618 |

| LPI | Lithium Pwr Int Ltd | 0.595 | 3% | 10% | 0% | 38% | $224,940,647 |

| MIN | Mineral Resources. | 76.64 | 3% | 8% | 10% | 87% | $14,062,720,230 |

| SYA | Sayona Mining Ltd | 0.2325 | 3% | 6% | -7% | 50% | $1,869,863,193 |

| MQR | Marquee Resource Ltd | 0.065 | 3% | 12% | 0% | -21% | $20,009,908 |

| AZL | Arizona Lithium Ltd | 0.0815 | 3% | 6% | -4% | 22% | $190,384,119 |

| NVA | Nova Minerals Ltd | 0.67 | 3% | 2% | -11% | -58% | $119,379,829 |

| WR1 | Winsome Resources | 0.39 | 3% | 11% | 22% | 0% | $51,343,318 |

| MLS | Metals Australia | 0.042 | 2% | -5% | -13% | 5% | $24,888,484 |

| LKE | Lake Resources | 1.075 | 2% | 10% | 1% | 40% | $1,459,708,644 |

| IGO | IGO Limited | 16.185 | 2% | 6% | 10% | 65% | $11,979,976,802 |

| CAI | Calidus Resources | 0.3575 | 2% | -2% | -34% | -40% | $153,223,597 |

| CHR | Charger Metals | 0.495 | 2% | 5% | -11% | 18% | $21,148,927 |

| PAM | Pan Asia Metals | 0.39 | 2% | 4% | -9% | -28% | $56,172,263 |

| ALY | Alchemy Resource Ltd | 0.0265 | 2% | 6% | 26% | 89% | $30,499,983 |

| RAS | Ragusa Minerals Ltd | 0.285 | 2% | 4% | -11% | 171% | $36,683,536 |

| WES | Wesfarmers Limited | 44.06 | 2% | -2% | -2% | -18% | $49,083,944,076 |

| PGD | Peregrine Gold | 0.59 | 2% | 4% | -2% | 31% | $22,458,502 |

| AM7 | Arcadia Minerals | 0.315 | 2% | 9% | 2% | 43% | $14,476,347 |

| QPM | Queensland Pacific | 0.1675 | 2% | 5% | 8% | -32% | $285,493,958 |

| LTR | Liontown Resources | 1.88 | 1% | 15% | 14% | 16% | $4,074,387,574 |

| RIO | Rio Tinto Limited | 92.64 | 1% | -4% | 2% | -4% | $33,966,283,581 |

| CXO | Core Lithium | 1.39 | 1% | 20% | -1% | 142% | $2,522,465,964 |

| LIT | Lithium Australia | 0.0515 | 1% | -5% | -12% | -59% | $62,280,265 |

| LLL | Leolithiumlimited | 0.59 | 1% | -2% | -17% | 0% | $577,194,294 |

| AKE | Allkem Limited | 14.76 | 1% | 1% | -6% | 64% | $9,341,690,960 |

| LEL | Lithenergy | 1.205 | 0% | 8% | 22% | 80% | $114,487,050 |

| ADV | Ardiden Ltd | 0.0075 | 0% | 7% | -6% | -32% | $20,012,515 |

| 1MC | Morella Corporation | 0.022 | 0% | 5% | -8% | -65% | $127,634,227 |

| AML | Aeon Metals Ltd. | 0.026 | 0% | -7% | -13% | -54% | $28,429,200 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | 136% | $2,752,409,203 |

| EUR | European Lithium Ltd | 0.09 | 0% | 14% | 7% | -10% | $126,021,526 |

| RLC | Reedy Lagoon Corp. | 0.013 | 0% | 0% | -13% | -48% | $7,246,550 |

| TKL | Traka Resources | 0.006 | 0% | -14% | -25% | -57% | $4,132,647 |

| AAJ | Aruma Resources Ltd | 0.073 | 0% | 4% | 14% | -15% | $11,458,190 |

| AX8 | Accelerate Resources | 0.033 | 0% | -3% | -20% | -20% | $8,925,144 |

| AS2 | Askarimetalslimited | 0.47 | 0% | 24% | 38% | 129% | $21,375,187 |

| BYH | Bryah Resources Ltd | 0.025 | 0% | 9% | -11% | -55% | $6,981,337 |

| DTM | Dart Mining NL | 0.083 | 0% | 5% | -8% | -34% | $12,886,593 |

| FG1 | Flynngold | 0.11 | 0% | 5% | -8% | -29% | $7,046,716 |

| LRV | Larvottoresources | 0.21 | 0% | -5% | -2% | 0% | $8,721,825 |

| TSC | Twenty Seven Co. Ltd | 0.002 | 0% | -20% | 0% | -43% | $10,643,256 |

| KGD | Kula Gold Limited | 0.041 | 0% | 5% | 32% | -19% | $13,784,689 |

| PNN | Power Minerals Ltd | 0.485 | 0% | 10% | -10% | 24% | $34,996,161 |

| AZI | Altamin Limited | 0.085 | 0% | 6% | 4% | 4% | $33,295,924 |

| ENT | Enterprise Metals | 0.009 | 0% | -18% | -36% | -43% | $5,876,826 |

| AVW | Avira Resources Ltd | 0.003 | 0% | -14% | -25% | -57% | $6,401,370 |

| MRR | Minrex Resources Ltd | 0.045 | 0% | -17% | -10% | 150% | $48,744,717 |

| EFE | Eastern Resources | 0.039 | 0% | -7% | 34% | -13% | $43,671,848 |

| VKA | Viking Mines Ltd | 0.008 | 0% | 14% | -11% | -62% | $8,202,067 |

| SRI | Sipa Resources Ltd | 0.053 | 0% | 18% | 13% | -4% | $10,866,315 |

| EPM | Eclipse Metals | 0.02 | 0% | -5% | -9% | -64% | $40,485,137 |

| WC8 | Wildcat Resources | 0.032 | 0% | -9% | -11% | -37% | $20,856,727 |

| M2R | Miramar | 0.105 | 0% | 6% | 0% | -42% | $6,739,600 |

| XTC | Xantippe Res Ltd | 0.008 | 0% | 14% | -11% | 167% | $65,161,839 |

| MMG | Monger Gold Ltd | 0.48 | 0% | 23% | 5% | 68% | $19,219,200 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | -77% | $74,238,031 |

| ZEO | Zeotech Limited | 0.038 | 0% | -3% | -21% | -56% | $61,352,248 |

| GW1 | Greenwing Resources | 0.35 | 0% | -5% | 23% | 21% | $44,171,912 |

| DAF | Discovery Alaska Ltd | 0.037 | 0% | 6% | -54% | -8% | $8,296,684 |

| IR1 | Irismetals | 1.78 | 0% | 5% | -4% | 439% | $111,659,400 |

| DAL | Dalaroometalsltd | 0.13 | 0% | -4% | 0% | -47% | $3,883,750 |

| TKM | Trek Metals Ltd | 0.06 | 0% | -10% | -10% | -50% | $18,636,609 |

| CY5 | Cygnus Gold Limited | 0.46 | 0% | -3% | 84% | 241% | $67,705,245 |

| TUL | Tulla Resources | 0.45 | 0% | 0% | -3% | -11% | $72,097,592 |

| AOU | Auroch Minerals Ltd | 0.061 | -1% | 0% | -18% | -65% | $22,823,376 |

| GL1 | Globallith | 2.63 | -1% | 9% | 4% | 534% | $423,724,344 |

| TEM | Tempest Minerals | 0.03 | -2% | -6% | -17% | 50% | $15,395,368 |

| ZNC | Zenith Minerals Ltd | 0.295 | -2% | -6% | -2% | 13% | $103,428,684 |

| A8G | Australasian Metals | 0.245 | -2% | -13% | -17% | -66% | $10,292,624 |

| OCN | Oceanalithiumlimited | 0.475 | -2% | -2% | -17% | 0% | $16,259,625 |

| IMI | Infinitymining | 0.22 | -2% | 2% | -2% | 0% | $14,201,719 |

| RGL | Riversgold | 0.043 | -2% | -7% | 8% | 98% | $34,157,246 |

| LIS | Lisenergylimited | 0.42 | -2% | -18% | -26% | -82% | $71,343,100 |

| WML | Woomera Mining Ltd | 0.0135 | -2% | -2% | -15% | -38% | $10,831,371 |

| EMH | European Metals Hldg | 0.785 | -2% | 15% | -13% | -41% | $96,350,198 |

| FTL | Firetail Resources | 0.19 | -3% | -10% | -24% | 0% | $12,047,588 |

| KZR | Kalamazoo Resources | 0.185 | -3% | 0% | -21% | -54% | $28,275,681 |

| CRR | Critical Resources | 0.072 | -3% | 18% | -13% | 132% | $110,273,886 |

| LNR | Lanthanein Resources | 0.036 | -3% | -3% | -27% | 89% | $35,624,546 |

| KTA | Krakatoa Resources | 0.061 | -3% | 9% | -5% | 3% | $21,716,725 |

| A11 | Atlantic Lithium | 0.595 | -3% | -3% | 0% | 0% | $372,531,121 |

| STM | Sunstone Metals Ltd | 0.029 | -3% | -12% | -26% | -56% | $77,893,393 |

| TMB | Tambourahmetals | 0.135 | -4% | -7% | -16% | -36% | $5,766,964 |

| SRZ | Stellar Resources | 0.013 | -4% | 0% | -7% | -66% | $13,562,517 |

| G88 | Golden Mile Res Ltd | 0.026 | -4% | -4% | -19% | -50% | $5,523,923 |

| TON | Triton Min Ltd | 0.025 | -4% | 9% | 14% | -22% | $35,952,389 |

| RAG | Ragnar Metals Ltd | 0.024 | -4% | -14% | -38% | -44% | $9,479,622 |

| EVR | Ev Resources Ltd | 0.024 | -4% | -4% | -14% | -23% | $23,149,602 |

| MXR | Maximus Resources | 0.042 | -5% | -7% | -16% | -51% | $14,031,854 |

| PSC | Prospect Res Ltd | 0.1 | -5% | 4% | 16% | 334% | $48,537,244 |

| TYX | Tyranna Res Ltd | 0.046 | -6% | 18% | -18% | 475% | $117,547,341 |

| GSM | Golden State Mining | 0.036 | -8% | -10% | -22% | -66% | $4,563,554 |

| IPT | Impact Minerals | 0.006 | -8% | -14% | -14% | -59% | $16,128,909 |

| MTM | Mtmongerresources | 0.115 | -8% | -8% | -18% | -28% | $4,688,754 |

| LPD | Lepidico Ltd | 0.02 | -9% | 11% | -23% | -23% | $144,808,757 |

| THR | Thor Mining PLC | 0.008 | -11% | -11% | -20% | -58% | $9,916,186 |

| AOA | Ausmon Resorces | 0.007 | -13% | -7% | -13% | 0% | $6,858,315 |

| VMC | Venus Metals Cor Ltd | 0.12 | -14% | -14% | -27% | -35% | $22,411,016 |

| CMD | Cassius Mining Ltd | 0.03 | -14% | -14% | -14% | 76% | $14,130,932 |

The ASX 200 is a field of green today as it closed +1.48pc higher, following the rally that took place over in New York thanks to reports stating the Fed would soon be ready to debate on how to slow the pace of rate hikes from December.

A total of 59 lithium stocks finished in the green, 39 fell flat and 35 tumbled into the red zone.

Galan steps it up a notch at the Hombre Muerto West Project after more than doubling resources to 5.8Mt of contained lithium carbonate equivalent.

What’s more, the vast majority of the resource or 4.4Mt of contained lithium carbonate equivalent at a grade of 883mg/l lithium, is within the very high confidence Measured category.

“Even the Galan team has been amazed by the scale of this updated resource,” managing director Juan Pablo Vargas de la Vega says.

“The outcome is game changing in terms of the step-up in the overall technical and economic potential of this world-class lithium brine asset.”

The outcome is now set to be incorporated into the ongoing definitive feasibility study work, on track for completion during Q1 2023.

GTI has executed a binding agreement with ADV to purchase the residual 20% free-carried interest in the Ontario Lithium Projects (Seymour, Root and Wisa JV tenure) held by Ardiden.

The consideration for the purchase is comprised of A$16 million cash, payable upon completion, and a milestone payment of a further A$2.5 million cash, payable upon JORC-compliant mineral resources of more than 20 million tonnes being defined across the Ontario lithium projects.

“It is full steam ahead at GT1,” Green Technology CEO Luke Cox says.

“We are drilling intensively at both Seymour and our Root Project and undertaking multiple metallurgical testwork programs, alongside all our environmental and permitting baseline work, as we rapidly progress the requisite PEA workstreams for Seymour.

“Finally, we remain attuned to potential further project and/or strategic transactional opportunities within Ontario, and more broadly.”

Vulcan has produced the highest grade, lowest impurity lithium hydroxide to date from its pilot plant with the Zero Carbon Lithium Project.

The latest material produced graded 57.1% LiOH, easily exceeding the best-on-the-market battery grade specification of 56.5% LiOH required from offtake customers with impurities well below market specification minimums.

VUL says the lithium chloride extracted by the sorbent in the pilot plant was recovered with water and sent offsite, where it was purified and concentrated by a third-party provider to prepare the lithium chloride for electrolysis to produce lithium hydroxide solution.

The solution was then crystalised to produce battery grade lithium hydroxide monohydrate.

While the plant has been operating since April 2021, the company says it has produced sufficient data to complete the phase-I definitive feasibility study set for Q1 2023.

Pilbara Minerals has broken another sales contract record for an additional 5,000dmt cargo following completion of the BMX pre-auction sale process.

The contract is for 5,000dmt SC5.5 FOB Port Hedland priced at US$7,255/dmt, which is the equivalent of ~US$8,000/dmt on a benchmark 6% basis inclusive of freight costs.

A 5% deposit is required by early this week, with delivery expected from mid-November 2022.

Around 9 rock chip samples taken from four pegmatites indicate a highly fertile (fractionated) pegmatite for rare elements such as tantalum, lithium and cesium at the Mt Edon Project, TSC says.

The average LCT grade of the latest rock chip samples taken is 1.0% Li2O; 1106ppm Cs2 O and 211ppm Ta2O5 which might reflect on the general mineralised nature of some zones in the pegmatites.

While the average mineralisation of the pegmatites has to be confirmed through detailed drilling and resource assessment, the results provide a good indication of the geological setting with reconnaissance drilling set to take place next week.

A program of works (PoW) has been approved and SHH is now set to undertake RAB drilling, which will test lithium pegmatite potential and gold anomalies in the southern portion of tenement E63/2046.

The company will also infill the historical 1km space sample traverses in E63/2048 with a powered auger to define and prioritise targets for RAB and RC drilling.

A reverse circulation drill program has kicked off at the Karonie Lithium-Gold Project in WA’s Goldfields region.

The drilling will consist of 33 RC holes for ~3,000-5,000m and will target 1,200m of strike length of the extensive system of pegmatites that have been identified by field mapping and from detailed soil sampling completed recently.

“This initial phase of lithium focussed drilling is a major milestone as we move toward testing these high priority targets for the first time,” ALY CEO James Wilson says.

An “exceptional” intersection with 18.45m at 2.06% Li2O within the Mavis Lake Lithium Project has been hit during the current diamond core drilling program.

The latest assays illustrate the continuity of high-grade lithium mineralisation within the main zone of Mavis Lake, CRR says.

All results will be incorporated into the maiden mineral resource estimate in Q1, 2023.

Following the outstanding results, a further 2,500m drilling extension has been approved, taking the planned program to 17,500m.

Results from rock-chip, soil sampling and associated geological mapping have “substantially increased” the exploration potential at the Bang I Tum Lithium Prospect (Bang I Tum or BIT) in southern Thailand.

High Li2O grades reported in rock-chip samples from the Bang I Tum prospect include 44 of 64 samples average 1.56% Li2O at a 0.30% Li2O cut off.

Another 35 samples returned >1.00% Li2O, 12 hit >2.00% Li2O while the maximum grade retuned included 2.62% Li2O.