Weekly Small Cap and IPO Wrap: Welcome to the weakest weeks; but like AW1 and DTM they’re not all ordinary

News

News

The S&P/ASX Emerging Companies (XEC) index fell 1.1% on Friday and 3.6% over the past week. The benchmark ASX 200 is about 1% down for the day and 3% for what was the first of several usually tricky September weeks – an historically ordinary time for local markets.

The last week took a toll on the fragile hearts of US investors, the losses set in motion by hawkish Jackson Hole chatter only found rich momentum on the back of continuing mostly hawkish comments from the Fed and ECB and ongoing concerns about recession.

Australian shares put on a glimpse of that resilience our parents oft spoke of. August was a fairly strong month for the All Ords et al, despite 10 out of 11 sectors coming in lower along with the ASX200.

The red part came at the end of August, following Wall Street’s plunge on US Fed’s Jerome Powell frank assessment that the Fed must maintain the rage to gut inflation like a pike, lest it breed and multiply around the US economy.

Wall Street is looking as vulnerable as (insert first spring cricket joke) to ongoing Fed hawkishness and they have shown it.

But a damn resilient showing for Aussie stocks in August, certainly better than most global indices, was helped by a steady run of not as appalling and even positive earnings reports.

This week however stocks came under some of that real pressure. Volatility came back to the fore, wild swings from Wall St to global energy prices led to falls in energy, mining, utilities, industrials and tech stocks. Bond yields rose sharply as traders did the math on higher-for-longer interest rates.

Oil, I mean why bother (sigh, gimme a moment). Oil is down sharply this week, but only after sharply gaining. The West Texas sort and the Nymex sort were both well back under $US100 when I last looked, but these 5% swings are getting real old.

Iron ore prices have been hit by fears around new lockdowns in China. Chengdu is the latest city to fall foul of the zero-COVID game.

Dr Shane Oliver at AMP Capital warns that equity markets remain at high risk of further falls in the short-term.

“Share markets ran ahead of themselves in the rally from their June lows into their mid-August highs recovering just over half of their earlier decline helped by mostly good earnings reporting seasons in the US and Australia.”

He said, US data was mostly a bit stronger in the past week with consumer confidence up, job openings up, jobless claims down again, the ISM manufacturing index remaining resilient but home price gains slowing down and construction down.

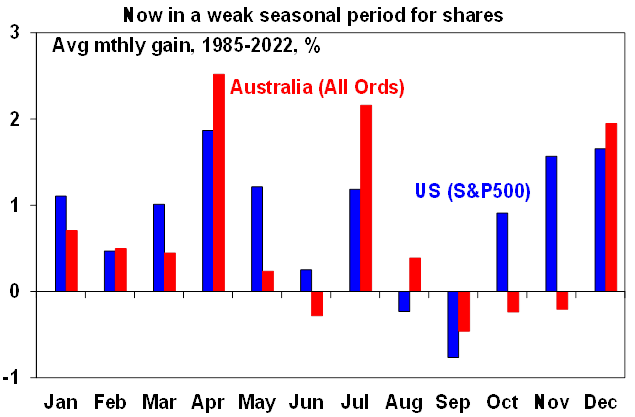

“September has been the weakest month of the year for US and Australian shares particularly when markets are already in a downtrend; and geopolitical risks remain high over Taiwan, Ukraine and the US mid-terms,” Dr Oliver added.

Source: Bloomberg, AMP

According to the ASX, these two stocks will make their debut listing next week (subject to last minute change, always without notice):

Atlantic Lithium (ASX:AI1)

Listing: 8 September

IPO: $13.25m at $0.58

With an existing market cap of around $350m, Atlantic’s main game is the 30Mt Ewoyaa lithium project in Ghana, where it is funded through to production via a co-production agreement with fellow mine developer Piedmont Lithium.

Piedmont has the right to earn up to 50% at the project level for 50% SC6 spodumene concentrate offtake at market rates by solely funding US$17m towards studies and exploration and US$70m towards mine capex.

Atlantic completed a scoping study for Ewoyaa in December 2021 based upon a JORC 2012 resource of 21.3Mt at 1.31% Li2O and assuming US$900/t SC6 pricing and an 11.4-year mine life.

Plus, in March, Atlantic updated the mineral resource estimate at Ewoyaa by a massive 42%. The project hosts an MRE of 30.1 million metric tonnes at 1.26% lithium, including indicated resources of 20.5 million tonnes at 1.29%.

Listing: 8 September

IPO: $7.5m at $0.20

The company holds three owned projects – the HawkRock, Parker Lake and Pasfield Lake – covering 775sqkm in the Athabasca Basin, Canada, which contains the world’s largest and highest-grade uranium deposits.

“We are targeting greenfield discovery and brownfield developments close to existing production infrastructure to play a role in a clean carbon free economy,” executive chairman Andrew Vigar says.

The plan is to explore and develop the projects as well as seek out further complementary mineral exploration and resource opportunities.

Here are the best performing ASX small cap stocks for August 29 – September 2:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| KFM | Kingfisher Mining | 0.6 | 107% | $19,519,651 |

| AW1 | Americanwestmetals | 0.275 | 104% | $28,312,077 |

| KKO | Kinetiko Energy Ltd | 0.11 | 90% | $49,937,400 |

| DM1 | Desert Metals | 0.39 | 77% | $20,876,441 |

| WC1 | Westcobarmetals | 0.195 | 70% | $5,996,265 |

| RR1 | Reach Resources Ltd | 0.0065 | 63% | $11,460,304 |

| AD1 | AD1 Holdings Limited | 0.026 | 53% | $18,919,745 |

| PBL | Parabellumresources | 0.4 | 51% | $15,407,725 |

| MEB | Medibio Limited | 0.0015 | 50% | $4,980,891 |

| NTL | New Talisman Gold | 0.003 | 50% | $9,381,676 |

| SIH | Sihayo Gold Limited | 0.003 | 50% | $18,306,384 |

| BYI | Beyond International | 0.46 | 48% | $28,215,005 |

| AHI | Adv Human Imag Ltd | 0.185 | 48% | $41,221,099 |

| AJQ | Armour Energy Ltd | 0.008 | 45% | $15,809,156 |

| BIR | BIR Financial Ltd | 0.043 | 43% | $8,661,755 |

| DTM | Dart Mining NL | 0.11 | 41% | $16,907,520 |

| PG1 | Pearl Global Ltd | 0.031 | 41% | $28,062,925 |

| EMT | Emetals Limited | 0.014 | 40% | $10,200,000 |

| CAU | Cronos Australia | 0.49 | 40% | $237,575,823 |

| DRE | Dreadnought Resources Ltd | 0.14 | 40% | $425,744,697 |

| NYM | Narryermetalslimited | 0.16 | 39% | $4,605,563 |

| MRL | Mayur Resources Ltd | 0.12 | 38% | $28,985,240 |

| PNM | Pacific Nickel Mines | 0.105 | 36% | $27,127,586 |

| FDR | Finder | 0.12 | 35% | $9,000,000 |

| NTO | Nitro Software Ltd | 1.61 | 34% | $387,175,672 |

| ADX | ADX Energy Ltd | 0.008 | 33% | $24,535,208 |

| LNR | Lanthanein Resources | 0.056 | 33% | $47,178,453 |

| BRI | Big Riv Indust Ltd | 2.46 | 33% | $197,346,264 |

| GGE | Grand Gulf Energy | 0.0345 | 33% | $49,491,541 |

| MOH | Moho Resources | 0.034 | 31% | $5,814,542 |

| PIL | Peppermint Inv Ltd | 0.017 | 31% | $30,567,853 |

| CMD | Cassius Mining Ltd | 0.03 | 30% | $10,497,263 |

| TG1 | Techgen Metals Ltd | 0.215 | 30% | $8,399,599 |

| DOR | Doriemus PLC | 0.065 | 30% | $7,462,079 |

| DUN | Dundasminerals | 0.2 | 29% | $7,166,078 |

| TPC | TPC Consolidated Ltd | 2.45 | 29% | $32,420,497 |

| SI6 | SI6 Metals Limited | 0.009 | 29% | $13,393,702 |

| TMX | Terrain Minerals | 0.009 | 29% | $6,846,849 |

| FCT | Firstwave Cloud Tech | 0.063 | 29% | $98,078,881 |

| INF | Infinity Lithium | 0.18 | 29% | $68,477,156 |

| PO3 | Purifloh Ltd | 0.5 | 28% | $15,761,749 |

| BEZ | Besragoldinc | 0.046 | 28% | $7,733,248 |

| COI | Comet Ridge Limited | 0.2225 | 27% | $176,307,061 |

| CY5 | Cygnus Gold Limited | 0.33 | 27% | $41,211,888 |

| FLX | Felix Group | 0.195 | 26% | $21,245,404 |

| HAS | Hastings Tech Met | 5.38 | 25% | $526,518,364 |

| AFW | Applyflow Limited | 0.0025 | 25% | $7,394,020 |

| REZ | Resourc & En Grp Ltd | 0.025 | 25% | $11,495,533 |

| ROG | Red Sky Energy. | 0.005 | 25% | $26,511,136 |

| ROO | Roots Sustainable | 0.005 | 25% | $3,748,163 |

Copper really is the new copper.

And American West Metals (ASX:AW1) has made buds with a brace of brilliant copper hits at its Storm Copper Project in Canada, led by a headline 41m at 4.18% copper.

The first assays at Somerset Island in Canada’s sunny (no, just kidding) northern Nunuvut territory, unearthed that thick, high-grade strike in ST22-05 coming from just 38m downhole.

It contains intervals with even higher copper grades, including 15m at 10.05% Cu from 47m downhole, and which includes 5m at 24.28% Cu from 48m in a thick zone of massive bornite and chalcopyrite.

It follows a rich vein of form at 2750N, which is looking to advance to a maiden resource with every drill hole completed to date intersecting thick zones of breccia and or massive copper sulphides, the kind of mineralisation that tends to host high grade copper deposits.

Of 1534m drilled during American West’s (ASX:AW1) 2022 program 997m has been completed at the shallow, high grade 2750N Zone.

The mineralisation at the 2750N Zone is over 200m in strike and remains open to the east, west and at depth, with strong copper anomalism in soils and rock chips for over 1km from the defined mineralised zone suggesting there is strong potential for further extensions.

Gossan rock chips on the western margin of the 2750N Zone include a float of up to 62% copper.

Dart Mining (ASX:DTM) hass got a placement up its sleeve, with details in the post. This is hardly surprising since it went through the roof already this week.

Finally, below is an email from Mike, whose earned his anonymity but isn’t (I’ve checked) either Bob Peppermint Innovations or Mike PIL.

This is his response to yesterday’s Peppermint Innovation call out, in full, which I appreciate and admire.

For those just catching up, Peppermint Innovation (ASX:PIL) put out a preliminary FY report, with revenue is down 32% and its net loss is up 26%. The fintech jumped 41% and i said something like:

Thanks for that Mike, accurate or not, it’s a bloody big Newtowner for you!

Here are the least performing ASX small cap stocks for August 29 – September 2:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MOB | Mobilicom Ltd | 0.021 | -53% | $26,625,593 |

| VMG | VDM Group Limited | 0.001 | -50% | $6,927,661 |

| DGL | DGL Group Limited | 1.495 | -48% | $432,831,102 |

| GRR | Grange Resources. | 0.755 | -45% | $989,524,587 |

| AMS | Atomos | 0.185 | -41% | $41,135,043 |

| NRX | Noronex Limited | 0.04 | -40% | $6,818,391 |

| PNV | Polynovo Limited | 1.29 | -36% | $883,353,539 |

| ADN | Andromeda Metals Ltd | 0.061 | -34% | $177,270,481 |

| CCE | Carnegie Cln Energy | 0.002 | -33% | $30,205,147 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | $9,454,153 |

| KEY | KEY Petroleum | 0.002 | -33% | $3,935,856 |

| T3D | 333D Limited | 0.001 | -33% | $4,566,445 |

| YPB | YPB Group Ltd | 0.006 | -33% | $2,439,277 |

| MME | Moneyme Limited | 0.475 | -33% | $118,923,613 |

| RAS | Ragusa Minerals Ltd | 0.2275 | -32% | $30,874,576 |

| 1ST | 1St Group Ltd | 0.007 | -30% | $11,593,564 |

| JTL | Jayex Technology Ltd | 0.007 | -30% | $1,744,600 |

| PBH | Pointsbet Holdings | 2.37 | -30% | $745,751,003 |

| VAR | Variscan Mines Ltd | 0.032 | -29% | $8,535,425 |

| TD1 | Tali Digital Limited | 0.005 | -29% | $7,395,783 |

| BDG | Black Dragon Gold | 0.04 | -27% | $8,026,802 |

| HPC | Thehydration | 0.12 | -27% | $17,262,703 |

| ICN | Icon Energy Limited | 0.016 | -27% | $12,076,320 |

| SPT | Splitit | 0.15 | -27% | $75,426,717 |

| WFL | Wellfully Limited | 0.025 | -26% | $7,803,522 |

| WGX | Westgold Resources. | 0.865 | -26% | $416,788,002 |

| SIV | SIV Capital Limited | 0.205 | -25% | $8,049,923 |

| ALM | Alma Metals Ltd | 0.009 | -25% | $6,655,250 |

| HLX | Helix Resources | 0.006 | -25% | $16,262,021 |

| MGG | Mogul Games Grp Ltd | 0.0015 | -25% | $6,526,882 |

| VOL | Victory Offices Ltd | 0.024 | -25% | $3,788,352 |

| CNJ | Conico Ltd | 0.048 | -25% | $79,877,789 |

| MEK | Meeka Metals Limited | 0.069 | -24% | $70,915,632 |

| NGY | Nuenergy Gas Ltd | 0.023 | -23% | $34,061,976 |

| EMU | EMU NL | 0.01 | -23% | $6,047,959 |

| TGH | Terragen | 0.1 | -23% | $22,312,212 |

| GFN | Gefen Int | 0.081 | -23% | $5,503,150 |

| EPN | Epsilon Healthcare | 0.028 | -22% | $7,931,682 |

| ERL | Empire Resources | 0.007 | -22% | $8,308,577 |

| CCX | City Chic Collective | 1.545 | -22% | $368,752,937 |

| AM7 | Arcadia Minerals | 0.26 | -21% | $11,907,962 |

| MBX | Myfoodieboxlimited | 0.071 | -21% | $2,244,500 |

| RAG | Ragnar Metals Ltd | 0.035 | -20% | $15,167,396 |

| TTB | Total Brain Ltd | 0.039 | -20% | $5,215,124 |

| RMS | Ramelius Resources | 0.7325 | -20% | $637,528,055 |

| 8VI | 8Vi Holdings Limited | 1.03 | -20% | $45,136,214 |

| MHK | Metalhawk. | 0.16 | -20% | $9,146,771 |

| OPN | Oppenneg | 0.12 | -20% | $21,349,526 |

| PCL | Pancontinental Energ | 0.004 | -20% | $30,216,891 |

| RDN | Raiden Resources Ltd | 0.008 | -20% | $11,876,415 |

No losers this week. So have a great weekend!