Power Up: O&G and uranium feel the Kazakhstan political heat, coal slips under the radar

Energy

Energy

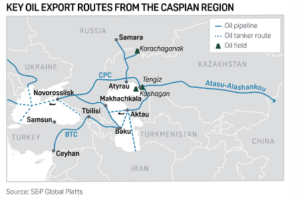

It’s been a tense week for the oil sector, with Kazakhstan’s Tengiz oil field disrupted by protests over a spike in LPG prices.

Tengiz has a nameplate capacity of 600,000 b/d, which is expected to reach 850,000 b/d from around 2024, but Argus reports that the Chevron-led Tengizchevroil (TCO) consortium is gradually restoring production after it was forced to reduce output by an ‘unspecified amount’.

“Public unrest in Kazakhstan provides just the latest example of the political sensitivity of fuel prices, a dynamic which provides a tailwind to oil demand and influences energy policies throughout the world,” S&P chief geopolitical advisor Paul Sheldon said.

It boils down to the company’s geographic position near Asian markets and its resources – it has gas reserves of more than 2 trillion cubic metres and accounts for around 40% of the world’s uranium supply.

A new government is expected to be appointed soon – which might go some way towards easing tensions.

S&P Global Platts reckons the crude oil supply-demand situation will remain supportive even though rising COVID-19 cases worldwide continued to present a near-term risk.

And there’s reports of an impending return in Libyan supply which – along with Omicron – have weighed on prices.

Libyan oil output is poised to recover to about 1.2 million b/d after state-owned National Oil Corp. reached an agreement with the Petroleum Facilities Guards, paving the reopening of the oil fields of Sharara, El Feel, Wafa and Hamada and the 300,000 b/d Zawiya oil terminal.

On the plus side, inventory levels are still tight and global demand looks set to recover further.

“The oil market will likely remain very tight as the world learns to live with COVID. Travel bans will continue to be lifted as the focus will go to testing and that should do wonders for international travel once test makers have a better handle of the situation,” OANDA senior market analyst Edward Moya said.

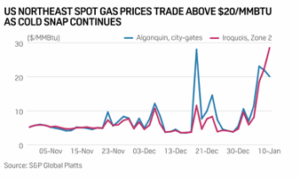

S&P also flagged that US Northeast power and natural gas prices have increased with the region expecting some of its coldest weather this winter. Temps are expected to hit a low of 15 degrees Fahrenheit – or around -9°C.

And ‘cos no one wants to freeze their butt off, this has of course boosted electricity and heating demand.

“The grid operator’s peak winter demand forecast is 24,025 MW under normal weather and the extreme winter weather scenario showed that peak demand could increase to as much as 26,230 MW,” S&P said.

The New York Independent System Operator peakload averaged 19,660 MW in December 2021 and 20,361 in January 2021.

And as temperatures in Boston are expected to bottom out at 8 degrees Fahrenheit (-13°C) the ISO New England peakload is forecast to reach 20,200 MW.

S&P said several regional locations had spot gas prices trading between $20-$30/MMBtu on January 10, but with the cold snap set to be short-lived, prices could ease in the coming days.

S&P projects that Asia’s oil product demand is set to rise by 1.7 million b/d in 2022, reaching 103% of pre-pandemic levels – with the full impact of Omicron still being assessed.

The maiden decision in 2022 by OPEC and its Russia-led partners to approve another hike in production quotas — betting the market can absorb more oil in the coming months despite surging COVID-19 infections — will be music to the ears of Asian oil importers witnessing a fragile economic revival.

“Apart from China with zero-COVID policy, most countries in the region are moving toward reopening of economies despite seeing a rise in Omicron cases,” Platts Analytics advisor for Asia-Pacific oil markets Lim Jit Yang said.

“Any lockdowns are likely to be localised and more targeted, with less impact on oil demand than in the past.”

Platts Analytics says that China and India will resume their place at the front of the pack as engines of growth in 2022, but Southeast Asia will also contribute – especially in countries with high vaccination rates.

Seven middle distillate marketers and distribution managers at five major South Korean and Japanese refiners surveyed by Platts — including Cosmo Oil, S-Oil Corp, and ENOES — indicated that Asia’s jet fuel demand could recover to at least 70% of the pre-pandemic 2019 levels this year, which would ultimately lead to higher refinery runs, crude imports, as well as oil products output.

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Company | Price | % Year | % Six Months | % Month | % Week | Market Cap |

|---|---|---|---|---|---|---|---|

| PCL | Pancontinental Energ | 0.0025 | 67% | 150% | 25% | 150% | $14,308,445.62 |

| RNU | Renascor Res Ltd | 0.195 | 1400% | 195% | 70% | 30% | $397,016,234.79 |

| VMY | Vimy Resources Ltd | 0.245 | 182% | 133% | 9% | 26% | $253,169,278.08 |

| AEE | Aura Energy | 0.33 | 849% | 849% | 40% | 22% | $130,471,478.78 |

| TOE | Toro Energy Limited | 0.026 | 44% | 37% | 13% | 18% | $93,536,212.32 |

| WGO | Warrego Energy Ltd | 0.13 | -45% | -45% | 11% | 18% | $152,890,290.75 |

| BKY | Berkeley Energia Ltd | 0.265 | -60% | -55% | 83% | 18% | $115,907,145.90 |

| ERA | Energy Resources | 0.4 | 31% | 48% | 21% | 18% | $1,513,467,111.18 |

| PRM | Prominence Energy | 0.01 | 43% | -33% | 25% | 18% | $11,561,479.37 |

| GLV | Global Oil & Gas | 0.027 | 125% | 35% | 50% | 17% | $46,657,393.93 |

| AGE | Alligator Energy | 0.064 | 357% | 73% | 12% | 16% | $184,025,454.78 |

| 88E | 88 Energy Ltd | 0.029 | 222% | -9% | 16% | 16% | $444,332,285.88 |

| HCD | Hydrocarbon Dynamic | 0.015 | -50% | -12% | 15% | 15% | $5,723,771.38 |

| GRV | Greenvale Mining Ltd | 0.38 | 192% | -1% | 4% | 15% | $146,869,585.62 |

| PEN | Peninsula Energy Ltd | 0.23 | 70% | 48% | 2% | 15% | $229,378,123.93 |

| BMN | Bannerman Energy Ltd | 0.31 | 138% | 94% | 9% | 15% | $388,004,904.95 |

| ACB | A-Cap Energy Ltd | 0.165 | 379% | 183% | 50% | 14% | $183,856,972.80 |

| SMR | Stanmore Resources | 1.17 | 49% | 73% | 17% | 13% | $302,855,101.92 |

| AUH | Austchina Holdings | 0.009 | 29% | -10% | 13% | 13% | $16,177,719.25 |

| ADD | Adavale Resource Ltd | 0.055 | -11% | -35% | 57% | 12% | $18,604,015.43 |

| KAR | Karoon Energy Ltd | 1.885 | 68% | 38% | 11% | 12% | $1,031,727,140.99 |

| IKW | Ikwezi Mining Ltd | 0.74 | 48% | 289% | 10% | 12% | $30,080,980.76 |

| LIO | Lion Energy Limited | 0.074 | 85% | 72% | 7% | 12% | $27,529,936.06 |

| CE1 | Calima Energy | 0.235 | 68% | 18% | 31% | 12% | $113,098,530.16 |

| GAS | State GAS Limited | 0.33 | -41% | -32% | 10% | 12% | $65,944,660.65 |

| ALM | Alma Metals Ltd | 0.033 | 74% | 38% | -20% | 10% | $25,142,056.74 |

| YAL | Yancoal Aust Ltd | 2.86 | 15% | 36% | 17% | 10% | $3,789,661,184.19 |

| WHC | Whitehaven Coal | 2.87 | 82% | 42% | 20% | 10% | $2,984,341,830.48 |

| EL8 | Elevate Uranium Ltd | 0.51 | 209% | 70% | 17% | 10% | $135,467,358.00 |

| BLZ | Blaze Minerals Ltd | 0.024 | -27% | -20% | -4% | 9% | $8,580,002.66 |

| FME | Future Metals NL | 0.185 | 29% | -10% | 0% | 9% | $50,752,681.28 |

| BYE | Byron Energy Ltd | 0.125 | -22% | 14% | 4% | 9% | $124,835,412.24 |

| IEC | Intra Energy Corp | 0.014 | 75% | 56% | 17% | 8% | $6,838,239.53 |

| SAN | Sagalio Energy Ltd | 0.014 | 8% | -48% | 8% | 8% | $2,660,581.69 |

| TEG | Triangle Energy Ltd | 0.014 | -48% | -36% | 8% | 8% | $15,054,325.10 |

| REY | REY Resources Ltd | 0.15 | -42% | -42% | 7% | 7% | $31,789,130.85 |

| BOE | Boss Energy Ltd | 2.41 | 174% | 88% | 5% | 7% | $673,734,732.84 |

| DYL | Deep Yellow Limited | 0.92 | 43% | 31% | 2% | 7% | $367,686,209.25 |

| WEC | White Energy Company | 0.155 | 3% | 15% | 3% | 7% | $116,171,807.85 |

| STO | Santos Ltd | 6.74 | -3% | -5% | 4% | 7% | |

| MRM | MMAOffShor | 0.395 | 23% | 0% | 14% | 7% | $143,731,294.40 |

| WPL | Woodside Petroleum | 23.39 | -6% | 0% | 6% | 7% | |

| AJQ | Armour Energy Ltd | 0.021 | -63% | -30% | 11% | 5% | $43,292,813.76 |

| ORG | Origin Energy | 5.49 | 7% | 21% | 10% | 5% | $9,704,273,001.21 |

| MEU | Marmota Limited | 0.045 | -13% | -6% | 2% | 5% | $42,143,496.59 |

| PDN | Paladin Energy Ltd | 0.92 | 203% | 88% | 12% | 5% | $2,518,109,573.68 |

| ATS | Australis Oil & Gas | 0.05 | -17% | -2% | 4% | 4% | $61,923,182.45 |

| BPT | Beach Energy Limited | 1.31 | -32% | 4% | 10% | 4% | $2,988,547,089.36 |

| DOR | Doriemus PLC | 0.135 | 232% | -3% | 23% | 4% | $16,248,074.18 |

| SGC | Sacgasco Ltd | 0.027 | -63% | -33% | 4% | 4% | $12,511,166.56 |

| MEL | Metgasco Ltd | 0.029 | 16% | 12% | -3% | 4% | $21,986,919.48 |

| KLR | Kaili Resources Ltd | 0.035 | 35% | 40% | 21% | 3% | $5,159,012.71 |

| IPD | Impedimed Limited | 0.18 | 38% | 71% | 3% | 3% | $319,841,210.52 |

| TER | Terracom Ltd | 0.185 | 16% | 42% | 0% | 3% | $143,185,449.70 |

| JPR | Jupiter Energy | 0.041 | -15% | 0% | 3% | 3% | $7,055,373.88 |

| VEN | Vintage Energy | 0.086 | 34% | 25% | -12% | 2% | $60,656,302.84 |

| HZN | Horizon Oil Limited | 0.094 | 99% | 21% | 4% | 2% | $148,420,638.43 |

| COE | Cooper Energy Ltd | 0.285 | -28% | 14% | 0% | 2% | $473,493,034.00 |

| CUE | CUE Energy Resource | 0.07 | -8% | 1% | 6% | 1% | $47,472,140.96 |

| ENX | Enegex Limited | 0.08 | 33% | -41% | 1% | 1% | $11,850,406.69 |

| ZEL | Z Energy Ltd. | 3.38 | 14% | 30% | 2% | 1% | $1,759,211,763.14 |

| ALD | Ampol Limited | 29.84 | 4% | 3% | 6% | 1% | $7,151,445,990.99 |

| BRK | Brookside Energy Ltd | 0.02 | 122% | -20% | 11% | 0% | $74,336,688.14 |

| CCJ | County International | 0.04712 | 0% | 0% | 0% | 0% | $960,006.29 |

| CRM | Carbon Minerals Ltd | 0.31 | -18% | 24% | 0% | 0% | $5,829,082.83 |

| CTP | Central Petroleum | 0.105 | -19% | -9% | 0% | 0% | $76,214,805.87 |

| E2E | Eon Nrg Ltd | 0.001 | 0% | 0% | 0% | 0% | $769,888.93 |

| EDE | Eden Inv Ltd | 0.021 | -30% | -13% | 11% | 0% | $47,446,039.91 |

| EEG | Empire Energy Ltd | 0.34 | -4% | 10% | -3% | 0% | $217,286,391.06 |

| EER | East Energy Resource | 0.036 | 0% | 0% | 0% | 0% | $115,235,533.26 |

| EPM | Eclipse Metals | 0.05 | 163% | 138% | -2% | 0% | $93,783,886.39 |

| GGE | Grand Gulf Energy | 0.024 | 118% | 118% | -11% | 0% | $29,511,545.30 |

| GGX | Gas2Grid Limited | 0.003 | 37% | 20% | 0% | 0% | $12,174,306.23 |

| LKO | Lakes Blue Energy | 0.0015 | 0% | 0% | 0% | 0% | $53,282,113.44 |

| MAY | Melbana Energy Ltd | 0.022 | 86% | -11% | 5% | 0% | $58,812,810.12 |

| MMR | Mec Resources | 0.004 | 0% | 0% | 0% | 0% | $3,236,653.34 |

| NGY | Nuenergy Gas Ltd | 0.026 | 117% | -33% | -7% | 0% | $38,504,842.92 |

| NSE | New Standard Energy | 0.004 | 0% | 0% | 0% | 0% | $3,554,995.46 |

| OEX | Oilex Ltd | 0.004 | 100% | -11% | 14% | 0% | $21,916,580.07 |

| PNL | Paringa Resources | 0.041 | 0% | 0% | 0% | 0% | $25,944,078.11 |

| POW | Protean Energy Ltd | 0.01 | -23% | -9% | 11% | 0% | $6,506,129.63 |

| PSA | Petsec Energy | 0.021 | 0% | 0% | 0% | 0% | $10,260,346.40 |

| PVE | Po Valley Energy Ltd | 0.025 | -11% | -17% | 0% | 0% | $25,166,085.98 |

| RES | Resource Generation | 0.064 | 0% | 0% | 0% | 0% | $37,208,341.63 |

| TMK | Tamaska Oil Gas Ltd | 0.009 | 0% | 0% | 13% | 0% | $8,865,000.00 |

| TNP | Triple Energy Ltd | 0.025 | 0% | 0% | 0% | 0% | $1,799,901.35 |

| TPD | Talon Energy Ltd | 0.008 | 100% | -11% | 0% | 0% | $54,297,516.20 |

| WEL | Winchester Energy | 0.014 | -39% | -7% | 8% | 0% | $14,114,971.01 |

| XST | Xstate Resources | 0.004 | -50% | -20% | 0% | 0% | $12,860,726.60 |

| ZEU | Zeus Resources Ltd | 0.089 | 287% | -2% | 0% | 0% | $19,504,350.00 |

| TEK | Thorney Tech Ltd | 0.41 | 3% | -5% | -5% | -1% | $176,392,058.16 |

| CVN | Carnarvon Energy Ltd | 0.335 | 8% | 18% | 10% | -1% | $547,882,970.95 |

| VEA | Viva Energy Group | 2.31 | 28% | 11% | 9% | -2% | $3,602,922,685.12 |

| DEV | Devex Resources Ltd | 0.48 | 96% | 55% | -11% | -2% | $146,095,545.59 |

| HE8 | Helios Energy Ltd | 0.092 | -39% | -44% | -12% | -2% | $173,067,492.51 |

| BRU | Buru Energy | 0.225 | 88% | 55% | 7% | -2% | $115,765,243.07 |

| STX | Strike Energy Ltd | 0.2 | -38% | -38% | 11% | -2% | $425,272,059.45 |

| FAR | FAR Ltd | 0.375 | -26% | -26% | -51% | -3% | $37,920,386.96 |

| KKO | Kinetiko Energy Ltd | 0.089 | -39% | -9% | 0% | -3% | $55,498,563.45 |

| KKO | Kinetiko Energy Ltd | 0.089 | -39% | -9% | 0% | -3% | $55,498,563.45 |

| CXU | Cauldron Energy Ltd | 0.028 | -42% | -18% | 4% | -3% | $13,756,221.64 |

| OEL | Otto Energy Limited | 0.0135 | 35% | 35% | 23% | -4% | $62,335,127.05 |

| PGY | Pilot Energy Ltd | 0.053 | 51% | -35% | -13% | -4% | $26,083,288.45 |

| EME | Energy Metals Ltd | 0.26 | 86% | 53% | 11% | -4% | $55,566,077.68 |

| NWE | Norwest Energy NL | 0.026 | 225% | 160% | 18% | -4% | $143,261,278.55 |

| FZR | Fitzroy River Corp | 0.125 | -12% | -17% | -4% | -4% | $13,494,281.38 |

| GLL | Galilee Energy Ltd | 0.365 | -43% | -27% | -4% | -4% | $106,337,000.16 |

| IVZ | Invictus Energy Ltd | 0.12 | 122% | -27% | -4% | -4% | $77,509,673.38 |

| MCM | Mc Mining Ltd | 0.09 | -44% | -22% | 3% | -4% | $14,515,438.17 |

| HHR | Hartshead Resources | 0.021 | -42% | 31% | 11% | -5% | $40,694,986.77 |

| GEV | Global Ene Ven Ltd | 0.105 | 33% | 54% | 0% | -5% | $57,117,948.83 |

| 92E | 92Energy | 0.645 | 0% | 115% | 11% | -5% | $35,057,037.09 |

| TDO | 3D Oil Limited | 0.05 | -12% | -4% | 9% | -6% | $13,259,418.60 |

| MCE | Matrix C & E Ltd | 0.16 | 0% | 10% | -6% | -6% | $18,827,142.88 |

| LCK | Leigh Crk Energy Ltd | 0.15 | -12% | 0% | -12% | -6% | $138,593,985.60 |

| PH2 | Pure Hydrogen Corp | 0.515 | 499% | 164% | -3% | -6% | $177,797,192.48 |

| HPR | High Peak Royalties | 0.05 | -37% | -17% | -17% | -9% | $10,656,776.35 |

| ADX | ADX Energy Ltd | 0.009 | 50% | 29% | 0% | -10% | $29,744,372.02 |

| BUY | Bounty Oil & Gas NL | 0.008 | -50% | -56% | -20% | -11% | $10,964,007.86 |

| AXP | AXP Energy Ltd | 0.008 | 100% | 100% | 0% | -11% | $52,309,626.06 |

| BNL | Blue Star Helium Ltd | 0.055 | 20% | 57% | 6% | -11% | $93,584,033.42 |

| LAM | Laramide Res Ltd | 0.75 | 114% | 43% | -6% | -12% | $955,409.37 |

| EXR | Elixir Energy Ltd | 0.18 | 3% | -27% | -12% | -12% | $160,512,007.68 |

| ROG | Red Sky Energy. | 0.007 | 250% | -13% | -13% | -13% | $42,417,817.58 |

| WBE | Whitebark Energy | 0.0035 | 0% | -13% | -13% | -13% | $15,305,939.43 |

| TOU | Tlou Energy Ltd | 0.048 | -13% | 33% | -4% | -13% | $29,409,752.91 |

| COI | Comet Ridge Limited | 0.1 | 23% | 15% | -9% | -13% | $90,303,616.73 |

| ICN | Icon Energy Limited | 0.011 | -22% | -17% | -27% | -15% | $7,233,676.32 |

| KEY | KEY Petroleum | 0.002 | -67% | -33% | -20% | -20% | $3,935,856.25 |

| TSC | Twenty Seven Co. Ltd | 0.004 | -38% | -11% | 0% | -20% | $10,643,255.62 |

| BAS | Bass Oil Ltd | 0.0015 | 0% | -25% | -25% | -25% | $6,919,022.19 |

| ABL | Abilene Oil & Gas | 0 | -100% | -100% | -100% | -100% | $397,614.35 |

| FDM | Freedom Oil Gas | 0 | -100% | -100% | -100% | -100% | $11,847,248.07 |

| OSH | Oil Search Ltd | 0 | -100% | -100% | -100% | -100% | $8,394,516,682.56 |

| VMX | Valmec Limited | 0 | -100% | -100% | -100% | -100% | $52,370,713.31 |

Last week Jupiter shut down production in Kazakhstan because access roads to and from the oilfield had been subject to blockades by protestors.

But oil production kicked back off again on Monday at the company’s Akkar North (East Block) and Akkar East oilfields – with the local oil traders’ trucks able to access the field to transport oil to a nearby storage location, for shipment to the refinery.

“The city of Aktau has returned to a state of calm, however Jupiter Energy employees are still being asked to stay at home for the time being,” the company says.

Fair enough.

On the plus side, Jupiter doesn’t think the shutdown will have a material impact on revenues.

On home soil, Armour Energy has kicked off work in the Surat Basin in Queensland, after delays in the commencement of the Warroon-1 fracture re-stimulation due to travel restriction delays between Westralia and the rest of the country.

The fracture re-stimulation program will target an unproduced gas-bearing interval in the Basal Rewan formation sandstone which has previously not been commercially produced in the Warroon Field, with first stabilised gas flows expected within two to three weeks.

The company has also kicked off a workover program on Myall Creek-2, and CEO Brad Lingo is pretty excited about it.

“A successful outcome in both the Warroon and Myall Creek programs will provide further endorsement of the production potential of two different play intervals that span a large part of Armour’s eastern exploration acreage,” he said.

In Canada, Calima has confirmed that the Pisces #3 Glauconitic well at Brooks has reached total depth (~2,600m) and the rig has been released – and the company’s 3-well Pisces Brooks Alberta drilling program is now complete.

The well was spudded on 2 January, with multi-stage fracturing estimated to start early February with flow testing to follow.

Plus, the company expects to start flow testing of Pisces #1 & #2 horizontal in the last week of January.

The coal player has enjoyed a productive December quarter, achieving revenue of A$219 per tonne, December 2021 total equity coal sales of 342kt and year to date annualised equity coal sales total 5.4Mt per annum.

And who said coal was dead?

The company says its South Australian Blair Athol operations remain on track for coal sales in FY22 of approximately 2.3 million tonnes.

In South Africa, coal sales increased by 21kt or 15% compared to the prior month, although total coal sales were below the results achieved in November 2021 due to reduced domestic sales – which TerraCom says is normal this time of year.

Last year Stanmore made a deal with BHP (ASX:BHP) to acquire its 80% interest in BHP Mitsui Coal Pty Ltd (BMC) by purchasing all of the shares in Dampier Coal.

Part of the consideration was to be funded by a US$625 million 5-year debt facility, which has now been executed.

BMC has high quality metallurgical coal assets with mineral resources of 2,245 million tonnes and total coal reserves of 171 million tonnes (100% basis & JORC compliant estimate) based on open cut operations.

And for the 12 months to 30 September 2021, BMC achieved EBITDA of US$174 million on an 80% basis (US$217 million on a 100% basis), with annualised revenue in excess of US$1.5 billion and EBITDA of US$696 million on a 100% basis.

Plus, the acquisition includes port and rail agreements to support at least 10.5 million tonnes per annum through the DBCT facility at Hay Point and the NQXT facility at Abbot Point.

Uranium (and nickel) player Adavale has bumped up non-executive director David Riekie to executive director, and is zeroing in on exploration at its Lake Surprise uranium project in South Australia after ‘significant’ gamma results in 2021.

Chairman Grant Pierce said the company is well positioned “with exploration projects in commodities that will continue to benefit from zero carbon and electric vehicle macro thematics”.

And he’s not alone in his enthusiasm.

“I share the board, management and exploration team’s strong conviction around the prospectivity of both our nickel and uranium prospects,” Riekie said.