Leigh Creek Energy is ahead of the fertiliser pack with plans to be carbon neutral by 2022

News

News

In the last 50 years global crop production exploded. And with it, so has the fertiliser industry, because certain nutrients are essential to increase farm productivity to feed the world.

And nitrogen-based fertilisers like granular urea (46% nitrogen) is in high demand from soon-to-be producers like Leigh Creek Energy (ASX:LCK).

The company is developing low-cost nitrogen-based fertiliser project in South Australia which will initially produce 1Mtpa (with potential to increase to 2Mtpa) of zero carbon urea.

So not only will LCK have a huge project, they’ve said it will be the first large-scale fertiliser project in the world to be carbon neutral.

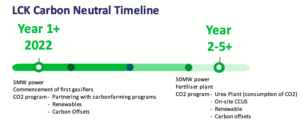

Executive chairman Justyn Peters said the company is at the forefront of carbon capture, utilisation and storage (CCUS) and that the project will be carbon neutral by 2022, eight years earlier than planned.

“We’ve always been aware as a company that to get your social licence and go ahead with major projects of this size that you have to deal with the carbon issue, it something that isn’t going to go away,” he said.

“If you look at what’s happened over the last couple of weeks, and particularly the sort of pressures being put on the Prime Minister about carbon targets and issues about directors’ responsibility, it’s just become clearer and clearer and clearer that unless you have a solution to your CO2 footprint, then you’re going to run into either financial penalties through a carbon tax, or social problems – you’re going to have too many people objecting to what you’re doing.

“So, we’ve been working hard on this, and looking at the different ways we could deal with our carbon footprint.”

And it doesn’t hurt that the company’s carbon neutral plans will be a drawcard for ESG conscious potential offtake, strategic and equity/debt partners.

The key to the company’s plans is the fact that the actual process of producing ammonia and urea from syngas uses up a lot of the CO2 in the system, so the company worked on a solution for anything outside of what was being used in manufacturing process.

“Until we get into full production in 2024, our footprint will actually be very small, so we’ll be looking at offsetting that either using renewables or purchasing carbon credits,” Peters said.

“But then when we get to actual production, if we don’t deal with it properly, the footprint will be much larger.

“And for that we have several solutions, the first that the majority of the CO2 gets used in the process – but the second is that we’re in a unique position where we can sequester that carbon into the coal deep down underneath us at the site.”

The company said they worked with several universities and have the data to prove it works.

“We’re very comfortable in saying that we will be zero carbon because we can sequester any of the balance of our CO2,” Peters said.

“From a company point of view it’s incredibly important and from a social point of view it’s incredibly important – because the tide has turned and if you don’t deal with it then you’re not going to get your social licence.”

The global demand for fertiliser is around 200 Mtpa, and around 110 Mt of that is urea.

Plus, in Australia and Southeast Asia region, the demand for urea annual is approximately 2 Mt and 24 Mt respectively.

Peters said Australia relies heavily on imports, so from a food security point of view, being able to manufacture urea in the country is “incredibly important.”

“The advantage that we have that no one else has, is that we have the ability to be a fully integrated process, we have our own gas, our own feedstock for ammonia and urea onsite, we don’t have to transport it from a distant location through pipelines,” he said.

“Secondly, we produce the ammonia and urea at site, and the infrastructure is already in place – and the demand is there.

“It’s a commodity that’s blowing up in demand, and that’s forecast to continue to grow.

“And we are the only fully integrated company in the world that will actually produce its own feedstock, its own ammonia and urea, and have the transport facilities in place to actually use within Australia.”

The initial work is underway on upstream (Stage 1) gas production and the company has engaged Daelim for the feasibility and front-end engineering design (FEED) as its works towards the final investment decision process in the middle of next year.