Surefire moves to build Perenjori’s resource as iron ore price strengthens

Mining

Mining

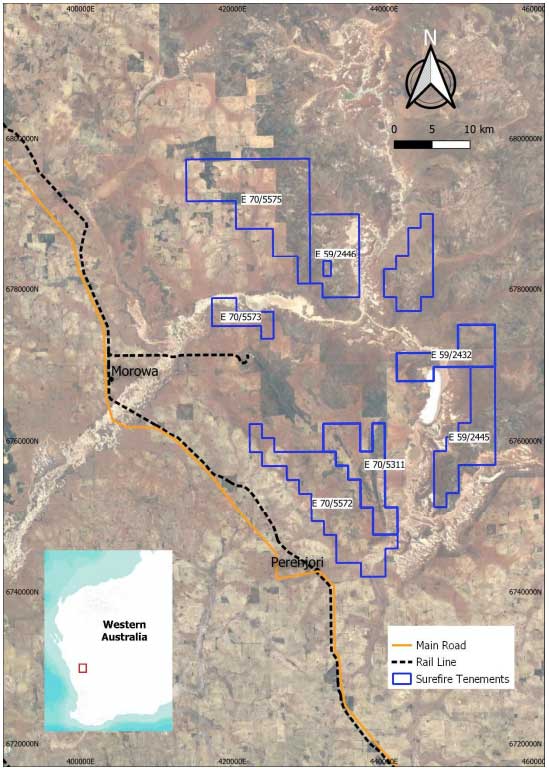

Surefire plans to get cracking on a resource upgrade followed by a feasibility study at its Perenjori iron ore project at the same time the price of the steelmaking commodity is heading back towards $US170 ($213) a tonne.

A recent review of the project has indicated the potential to expand the resource beyond 500 million tonnes, with Perenjori well placed to become a future producer located near essential road, rail and port infrastructure.

Perenjori currently hosts a resource of 192 million tonnes at 36.6 per cent iron.

Surefire says the Perenjori project has significant iron ore potential associated with the “V-shaped”, tightly folded and thrust stacked greenstone belt located within the project.

The project hosts the iron ore rich Koolanooka Greenstone Belt that forms part of the highly prospective and fertile Yilgarn Craton.

The eastern thrust belt contains two main banded iron formation (BIF) units. The Core BIF zone spans 3.7km in length and 55m wide, while the western limb also contains a significant BIF unit measuring 80m thick and 2.8km long.

Metallurgical testwork done during a previous scoping study demonstrated Perenjori could produce a high-grade and acceptably clean magnetite concentrate of up to 70 per cent with an 86 per cent yield.

There are two main types of iron ores – hematite and magnetite. Haematite is a higher grade in the ground, while magnetite deposits are large and quite low grade – but produce very high-grade products.

With the depleting direct shipping ore — the stuff that you can just dig up and ship — in WA’s Pilbara, end-users like steelmakers in China are increasingly demanding more processed ores like magnetite.

About a third of the world’s steel is made from processed or magnetite-rich ores and globally there’s a bunch of big successful mines that have been producing for years.

Surefire now plans to upgrade the current resource and follow-up with a feasibility study, with the company in a strong position to take advantage of the current iron ore market and record high prices.

This article was developed in collaboration with Surefire Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.