Palladium demand accelerates on tighter emissions standards

Mining

Mining

Palladium prices keep climbing, defying forecasts that a correction is long overdue.

The spot price for palladium – mainly used in car exhausts to reduce polluting emissions — is a now $US1534 per ounce ($2135 per ounce), according to Kitco data.

Prices have soared as car makers demand more of the precious metal and supplies dwindle after mine closures.

This isn’t a surprise to some.

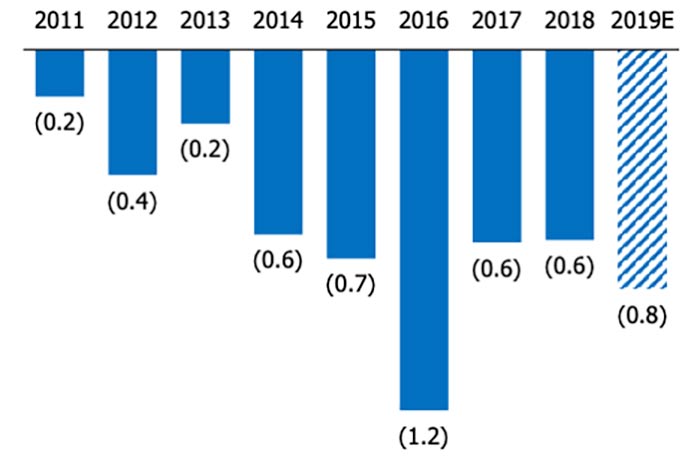

2018 was the ninth consecutive year that the market had been in a structural deficit, says Norilsk Nickel, the world’s largest palladium producer.

That’s nine years where consumption was higher that production.

But it’s only been the last two years that this apparent market deficit has started to translate into “real physical tightness” on the spot market.

Norlisk expects this trend to continue in 2019, driven by strong demand on the back of tighter vehicle emission regulations “in all major markets”.

“In 2019, we expect the palladium consumption to grow 500,000 ounces to 11.2 million ounces, owing to strong demand from autocatalyst producers,” Norilsk says.

“In spite of slowing auto sales in China, we believe that the launch of China’s 6 emission standard by July 2020 will provide additional demand for PGMs already in 2019, as the industry will have to restock these metals across the entire fabrication value chain.

“Moreover, the introduction of real driving emission tests coupled with rising hybridization of the light vehicles will put additional requirements on the car emission systems implying additional demand for palladium.”

READ: Palladium is at 26-year highs – is it time to call the top?

There’s a common belief that palladium can be substituted for the lower-cost platinum by car makers.

Norilsk, which also produces platinum, says this is incorrect.

“In 2018 and year-to-date 2019, there has been no indications from the industry of the substitution of palladium with platinum in gasoline vehicles despite a substantial price difference,” the company says.

“Palladium has better thermal durability and better NOx reduction properties than platinum, and therefore, it is more efficient in contemporary gasoline vehicles.”

Gas, diesel, and hybrid vehicles use between two and six grams pf palladium each, according to company estimates.

Primary supply is expected to grow by 280,000 ounces to 7.1 million ounces, and recycled supply by 80,000 ounces to 3.3 million ounces in 2019.

It’s not enough, Norilisk says.

“Increase of gross supply, in our opinion, will not be able to match rising demand and thus we are forecasting that the structural deficit will persist in 2019 and will reach approximately 800,000 ounces.”

Longer term, the biggest risk to demand is electric vehicle uptake, because they don’t require palladium at all.

But if hydrogen fuel cells take off palladium producers could be swimming in cash – they use between 25 to 35 grams each.