Lithium: Alliance pokes a sleeping giant under Bald Hill

Mining

Mining

Alliance Mineral Assets (ASX:A40) is a quick mover.

It took the WA lithium miner just 16 months from first drill hole to first production at its Bald Hill mine near Kalgoorlie.

But moving so quickly also means there are a few loose threads to tie up — like off-take or the size of its resource, for example.

While other WA hard rock producers have most, if not all, of their production tied up in longer term contracts, Alliance still has to finalise off-take for its big chunk.

Alliance isn’t worried; it’s producing a highly sought after, premium product, it says, with “long term off-take negotiations underway”.

The company has also just signed a low risk deal to cash in on downstream lithium chemical production with the off-take partner it currently has, which sounds promising.

Another perceived issue has been the size of the Bald Hill resource. At 26.5Mt grading 1 per cent Li2O, it’s pretty small compared to some of the other WA hard rock producers, but a big 60,000m drilling program is underway to change all that.

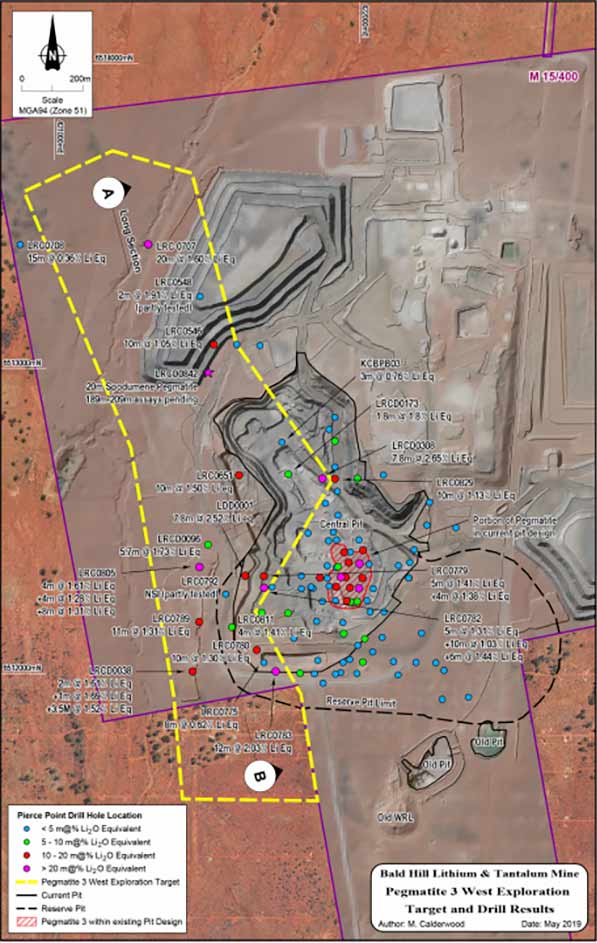

The company is drilling a recently identified exploration target at Bald Hill, called Pegmatite 3 West, which is below and to the west of the current pit design.

Here it is, in yellow:

Alliance has estimated a has a substantial exploration target of up to 24 million tonnes grading 1.4 per cent Li2O at the 2km long by 500m wide Peg 3 West.

In the coming months, systematic drilling of the target will be undertaken as part of an ongoing 60,000m drill program, the company says.

And Alliance managing director Mark Calderwood says Peg 3 West doesn’t include the overlying 13.5Mt inferred mineral resource, which is currently the main focus of infill and extensional drilling.

“Only 20 per cent of the 8.8km2 prospective Southern Mineralised Area (SMA) has been drill tested for lithium to date,” he says.

“And the SMA itself represents only 1.1 per cent of the entire Bald Hill tenure.”