Australia has a ‘once in a generation opportunity’ to become a major battery hub

Mining

Mining

Booming global demand for lithium-ion batteries gives Australia a “once in a generation” opportunity to become a major battery processing, manufacturing and trading hub – but it needs to get a move on.

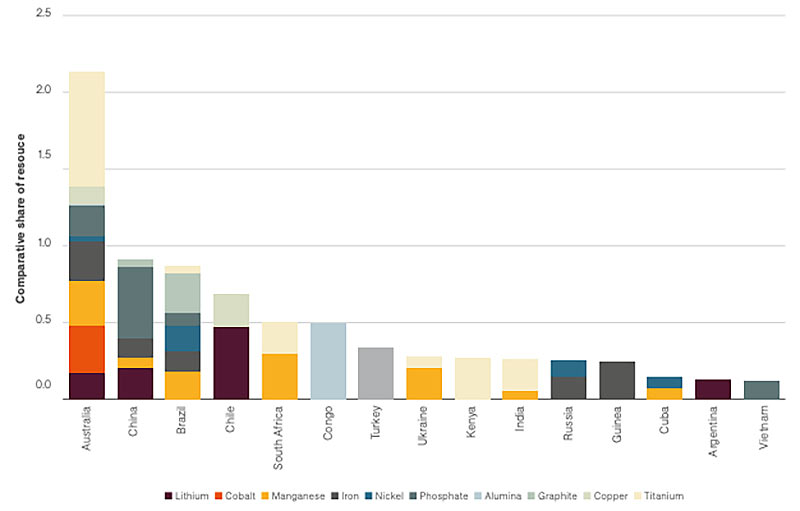

A new Australian Trade and Investment Commission (Austrade) report adds to the growing stack of analysis which shows Australia has all the raw materials needed to produce batteries.

This potentially gives the country “significant global supply-chain advantages”, the report says.

According to Future Smart Strategies, Australia earns only $1.13 billion, or 0.53 per cent of ultimate value of its exported lithium ore.

An estimated $213 billion of value is added overseas through electro-chemical processing, battery cell production, and product assembly.

The Austrade report says critical components in advanced battery production — precursor, anode, cathode, electrolyte — can be made here.

But the critical gap in the supply chain is Australia’s lack of battery manufacturing technology – which is why we need one of the world’s big battery cell manufacturers to set up shop Down Under.

AMEC chief Warren Pearce says Austrade will play a crucial role in attracting international companies with battery technology in order to support a move down the battery minerals value chain.

“If we were to realise this opportunity it could reshape the entire Australian economy, providing jobs, economic diversification and leadership in a critical future technology,” he says.

“It is a timely report and a call to action for Australia. It clearly spells out the opportunity and Australia can seize it.”

Attracting investment from the big battery makers

Austrade believes Australia needs to attract investment and technology transfer from existing lithium-ion battery manufacturers to develop “the required level of capability”.

It reckons we need to do this through incentives.

South Korean, Japanese, and now Chinese companies – such as Panasonic, BYD, LG Chem, and Samsung SDI — dominate the lithium-ion battery manufacturing space.

The US and several European countries have recently started to upscale their lithium-ion battery manufacturing capacity in response to increased demand for EVs.

Austrade says the Tesla/Panasonic integrated ‘Gigafactory’ in Reno, Nevada was secured in 2014 through incentives worth $US1.3 billion.

These included multi-year exemptions on various taxes, transferable tax credits up to $US195 million, discounts on power, and infrastructure support.

In 2016, LG Chem’s $US700 million investment in a Polish gigafactory was secured through dollar-for-dollar government funding of $US350 million, tax exemptions, employer incentives and land.

Federal minister for Trade, Tourism and Investment Simon Birmingham says it’s time to accelerate the development of a high-tech lithium manufacturing sector in Australia.

“Through Austrade’s Resources team we are ramping up our activities overseas to attract investment and highlight our significant comparative advantage such as our strong economic conditions, skilled workforce and well-established resources infrastructure network,” he says.

And it’s a bipartisan issue, with Federal Labor – who, let’s face it, will probably be in charge soon — already committing to more battery manufacturing in Australia.

“At the moment there are a few companies investing around Australia to refine battery metals and establish battery manufacturing facilities,” shadow minister for Trade and Investment Jason Clare said in October.

“This includes investments like BHP’s nickel refinery and Tianqi’s lithium processing plant in Kwinana, as well as the Sonnen battery plant in Adelaide and Energy Renaissance’s battery plant planned for Darwin.

“We want to support them to take the next step move further down the supply chain.”

>>>High Voltage: All The News Driving Battery Metals Stocks

Who’s taking charge?

Companies are beginning to move up the battery supply chain so they can make more money selling their products.

In Western Australia, major global lithium companies such as Albemarle, Tianqi, and Covalent Lithium are refining lithium into battery grade hydroxide, which fetches a massive price premium compared with lithium concentrate exports.

There are also Australian lithium-ion battery plants currently being built, but they will probably need to import critical battery components from overseas.

In Queensland, the state government has committed $3.1 million towards a feasibility study for a 15GWh gigafactory in Townsville.

This $2 billion project is being developed by an international consortium called Imperium3, led by Boston Energy and Innovation, graphite company Magnis Resources (ASX:MNS), and US company Charge CCCV.

The facility will produce either EV batteries, home storage battery units or micro grids to power small towns. First production is expected by 2020.

Energy Renaissance is planning to build a 1GWh manufacturing facility in the Northern Territory to produce low cost lithium-ion batteries, optimised for warm climates.

Brian Craighead, development director at Energy Renaissance, told Stockhead that it was the responsiveness of the Northern Territory Government and the proximity to export markets which made Darwin a compelling candidate for its battery plant.

He says there is an opportunity to develop a vertically integrated battery market in Australia, but it needs strong government support.

“It’s true that Australia is unique in its ability to establish a ‘walled garden’ for the raw materials required in the most common chemistries – but there’s a catch,” Mr Craighead says.

“While the resources are all here, they’re currently shipped overseas to be processed.”

Strong, sustainable demand for locally manufactured batteries, encouraged and supported by government, will put Australia in great shape to compete.

“It’ll also create a series of upstream and downstream economic benefits,” Mr Craighead says.

“Indeed, our first factory in Darwin will deliver around $800 million in GDP benefit to the NT economy.

“And that’s a pretty small facility in the grand scheme of things.”

He also says local manufacturers also need to fill a niche to be successful.

“Scale markets aren’t really a good fit for an Australian manufacturer – despite high levels of automation it’s still cheaper to manufacture at scale elsewhere,” Mr Craighead says.

“However, there are a great many existing and emerging battery niche markets that Australian manufacturers could do very well in. In our case, its super-safe, low-cost batteries explicitly designed for hot climates.

“But there’s many, many more verticals that seem attractive with the right approach.”