Carnarvon still can’t say exactly how much oil is in Dorado but it’s ‘a major resource’

Energy

Energy

It’s still raining black gold up on the North West Shelf, says explorer Carnarvon (ASX:CVN) and its big brother Santos (ASX:STO), as they confirm there is oil in one of their target reservoirs.

What they haven’t revealed yet is how much.

The companies said today that wireline logging, when a probe is lowered down a well at the bottom of a wire, “confirmed pre-drill expectations of a major oil and gas resource” in the Dorado-2 well.

Carnarvon shares bounced 16 per cent to 62.5c, close to the 69.5c it hit after revealing the Dorado find last year.

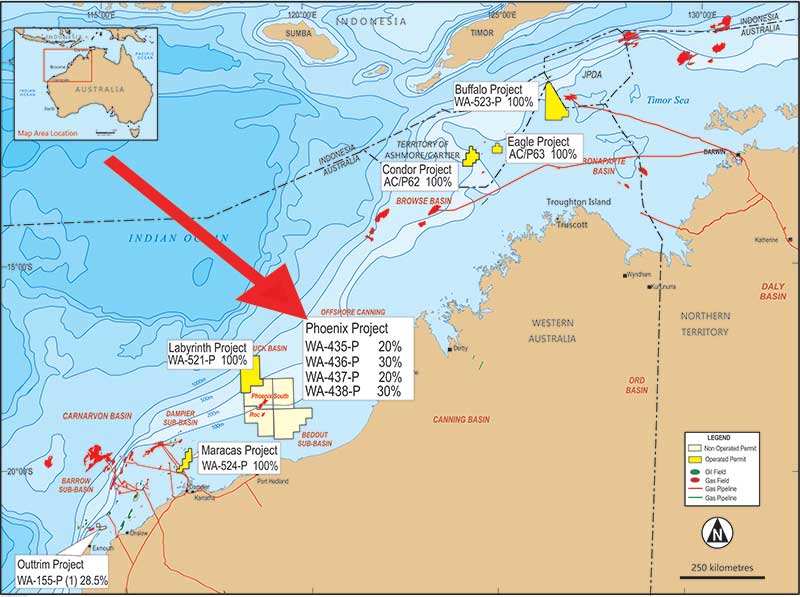

The Dorado discovery in July last year is held to be the largest oil find ever on Australia’s North-West Shelf, and is part of Carnarvon’s broader Phoenix project in the Bedout sub-basin, which is about 250km north of Port Hedland.

Carnarvon and Santos have been drip-feeding anxious investors with news, with the last update coming at the end of May when the duo said they’d hit oil.

The Dorado-2 well is 2km from the initial Dorado-1 well.

Carnarvon is the operator of the field, meaning it manages the exploration, and owns 20 per cent of the project. Santos owns the other 80 per cent. They are looking at four different “members”, or oil columns within the field, the Caley, Baxter, Crespin and Milne.

The Caley member is alone is estimated to contain a recoverable prospective resource of 545bn standard cubic feet of gas and 30m barrels of condensate — a kind of heavy gas.

Pressure data for the Caley and Baxter members indicates there is a continuous reservoir between the first well Dorado-1 and the second Dorado-2.

In the Caley the net productive thickness where oil was found was about 40 metres, as well as another 11m of gas in the upper sands, and for the Baxter it was about 13m.

No oil or gas was found in the Crespin member, but Carnarvon had already flagged that it didn’t expect to find anything from this well.

Data from the Milne member suggested it held very light oil and a lot of gas.

Japan electricity giant J-Power is buying $25m worth of wind, solar and hydro storage company Genex (ASX:GNX). The cash will give them 15-19.9 per cent of Genex and go towards the equity funding for the 250MW pumped hydro part of the Kidston power project in Queensland.

EnergyAustralia is also to provide equity funding, but the commercial close to the binding term sheet announced in December 2018 is still under negotiation.

Genex is working on getting the remainder of the cash together in order to start building in June.

Gas developer NuEnergy (ASX:NGY) has canned a funding deal with a Malaysian investor, after said investor failed to deliver on any of the promised cash.

They entered a $38.5m deal with Saujana E&P Sdn Bhd in early April with $7m due as a deposit within 14 days. But the Malaysian company couldn’t even come up with $US250,000 to pay for an extension to pay the deposit, so NuEnergy bailed out.