Emerge Gaming douses excited shareholders after forum frenzy fuels 71pc stock rise

Emerge Gaming, the company promising to deliver the ‘Netflix of gaming’, has had to douse over-excited shareholders.

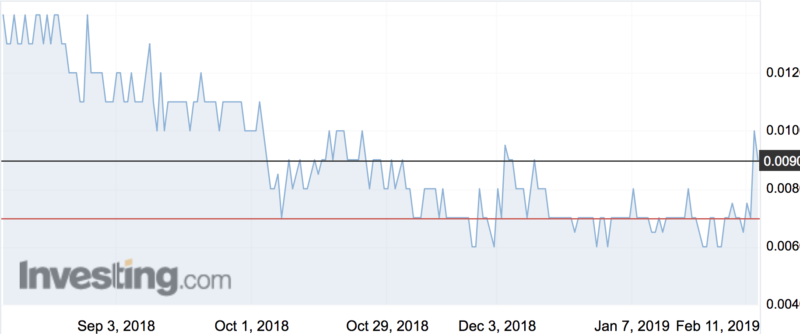

The company (ASX:EM1) was forced to suspend its shares this morning when they rose 71 per cent to a five-month high of 1.2c.

That was due to a media article which opened with the line “the company is targeting one million monthly subscribers in these regions which would generate in excess of A$10 million per month”.

That resulted in a hyperbolic thread posted to stock trading gossip forum HotCopper entitled “$10 million monthly revenues, $3 million MC”, which got posters in a right lather.

“$10milion monthly revenue on a small 1 million take up. Of course they are targeting a market of 2 billion, so just on the 1 million take up, there is $120 million annual revenue. Given EM1 have a current mc of $3 million, (they have nearly that in cash), then IMO it is very clear EM1 is grossly undervalued. How many zeros can be added to the current $3 million market cap??? Well on a bare minimum 1 million take up, you would have to think $300 million mc is not out of the question,” wrote poster ‘drifta’.

Except those figures were not mentioned in Emerge Gaming’s announcement yesterday outlining its roadmap for the video game streaming platform with GameCloud technology developed in conjunction with Singaporean company Cloudzen.

The company went into a trading halt shortly before lunch after the mammoth run, and then released an announcement saying there was “no basis” for the information.

“The company advises that the article was not commissioned by the company. References to targeted monthly subscribers and revenue projections in the article have not been made or provided by the company. The company made no reference to such information in the announcement. There is no basis for this information and it should not be relied on by investors,” it said.

Shares were sitting at 0.9c shortly before market close.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.