Closing Bell: Australia’s tiny tech sector lost 3.4pc today, there may be nothing left tomorrow

News

News

Watching Aussie markets struggle on Thursday was difficult. Not a rout by any means but just tepid trade, with the bleeding on the Nasdaq overnight upsetting local tech.

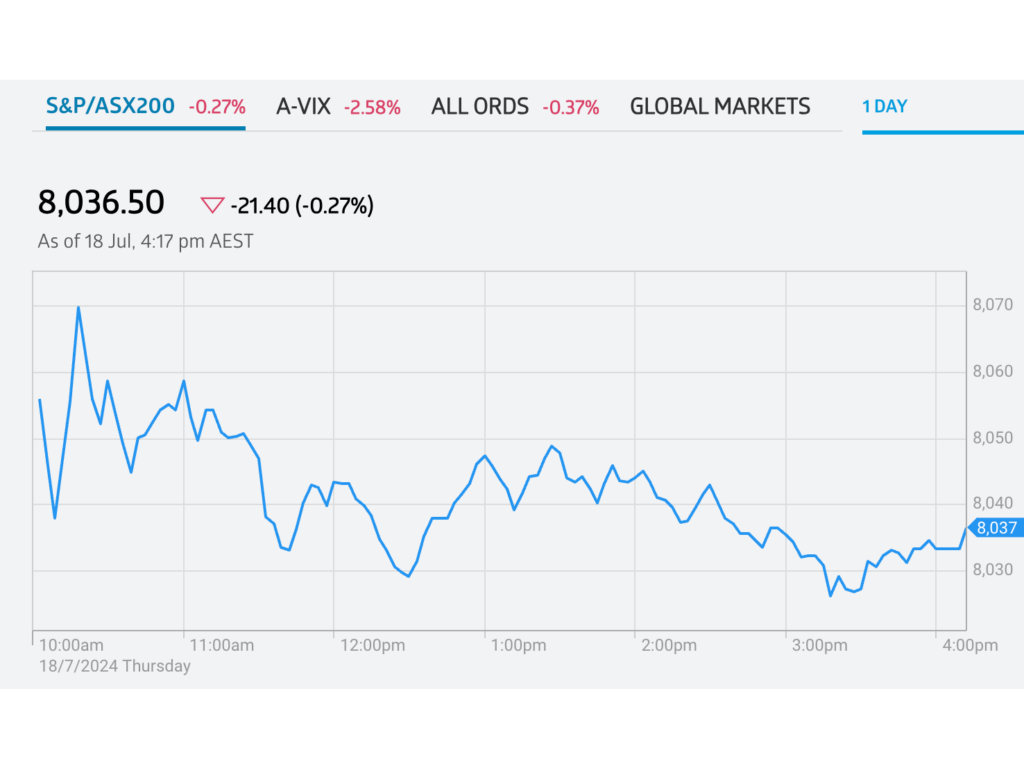

The S&P/ASX200 ended lower on Thursday, dropping 21.40 points or 0.27% to 8,036.50

Over the past five tempestuous days of trade, the uptown benchmark index is still ahead by about 1.85% and is about 0.6% off of its recent all-time high.

Overnight on Wall St it was a bit of a rude shock to see the tech-heavy index in such desperate decline.

The home of the Magnificent Six +Tesla (jokes) had a shocker of a session, hot bothered by the market rotation and stunned by the prospect of more punitive US export restrictions on chip tech to China.

AI-related names tumbled and the Nasdaq copped its worst day in 18 months.

Meanwhile, big names at home in Tech – Xero (ASX:XRO) , WiseTech Global (ASX:WTC) and NextDC (ASX:NXT) – were first on the chopping block. A tough one for WTC after some solid gains over the previous weeks, shedding 6%.

No single sector was on song, though. I guess Utilities snatched about 0.3%. But that’s a highlight.

The rate-sensitive winners of late got the earth turned on them with property, the REITs, the recently rampant telcos and IT getting thwacked.

Consumer stocks of all shades found the going tough, but ended above parity.

Except for Domino’s Pizza Enterprises (ASX:DMP), that is.

DMP picked the wrong day to shutter up outlets in Japan and Europe while also lowering estimates of store openings for the next decade. Really. Stores in 2034. That probably could’ve waited, Mr Meiji.

Miners on this bourse are just pretty useless – they fell again and may not even be trying.

BHP (ASX:BHP) and Rio Tinto (ASX:RIO) were weaker, and Fortescue fired everyone but not even that won it favour.

Fortescue (ASX:FMG) has declined enough for Fairmont Equities’ Micheal Gable to tell Stockhead on Thursday that the underperformer looks a lot like a buying opportunity, and damn the price of iron ore.

Commonwealth Bank (ASX:CBA) hit another record high, before everyone trimmed.

Bigger than BHP.

Should be CBA’s motto now.

The Australian dollar is also failing to get up and about despite the change in atmosphere around US interest rates – steady and fetching US67.30¢.

The punters are waiting to see if anything stimulatory comes crawling out of Beijing and the officious Third Plenum, which wraps up later today.

Only something really juicy will steel the resolve of traders or even move the dial of squalid investor sentiment out that way.

Chinese President Xi Jinping will say something tedious. He’s already told everyone the way forward is hard and it must be galling to wait on this turnaround which everyone else is rotating like a night with Elvis.

On Wednesday, Xi offered little in detail but wanted everything and everyone from the Party to give his agenda “unwavering faith and commitment”. He also emphasised Beijing’s dedication to prioritising technology, advanced manufacturing, and other critical sectors essential for China’s sustained long-term strength. As the Third Plenum wraps up, the stakes are high amid worsening economic data.

Meanwhile, US futures started rising at around lunchtime in Sydney, as Wall Street licked its lips following losses overnight for the S&P 500 and tech heavy Nasdaq after the latest rotation session sucked a little more out of US megatech.

The game is afoot.

Here are the best-performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GCR | Golden Cross | 0.002 | 100% | 1,500,000 | $1,097,256 |

| M2R | Miramar | 0.014 | 75% | 77,588,728 | $1,579,118 |

| PKO | Peako Limited | 0.007 | 75% | 9,513,371 | $2,108,339 |

| ME1 | Melodiol Glb Health | 0.003 | 50% | 3,849,502 | $612,527 |

| ENL | Enlitic Inc. | 0.175 | 35% | 12,654 | $10,232,902 |

| LNR | Lanthanein Resources | 0.004 | 33% | 14,943,377 | $7,330,908 |

| TMK | TMK Energy Limited | 0.004 | 33% | 5,210,012 | $20,764,836 |

| DSK | Dusk Group | 0.770 | 31% | 1,124,252 | $36,738,040 |

| DUN | Dundasminerals | 0.027 | 23% | 1,153,720 | $1,861,817 |

| PSL | Paterson Resources | 0.022 | 22% | 1,100,243 | $8,208,682 |

| LCY | Legacy Iron Ore | 0.017 | 21% | 4,654,562 | $107,989,676 |

| CHW | Chilwaminerals | 0.540 | 21% | 34,900 | $20,414,375 |

| NRX | Noronex Limited | 0.015 | 20% | 28,226,247 | $6,108,639 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 1,672,353 | $6,856,357 |

| HLX | Helix Resources | 0.003 | 20% | 8,647,712 | $8,160,484 |

| LML | Lincoln Minerals | 0.006 | 20% | 152,000 | $10,281,298 |

| MCL | Mighty Craft Ltd | 0.006 | 20% | 204,288 | $1,844,546 |

| HTA | Hutchison | 0.034 | 20% | 15,301 | $380,030,240 |

| KLI | Killiresources | 0.135 | 17% | 2,978,743 | $13,825,730 |

| PAM | Pan Asia Metals | 0.090 | 17% | 57,023 | $14,284,912 |

| FGL | Frugl Group Limited | 0.049 | 17% | 53,931 | $4,406,162 |

| PUR | Pursuit Minerals | 0.004 | 17% | 2,218,954 | $10,906,200 |

| SRN | Surefire Rescs NL | 0.007 | 17% | 1,319,123 | $11,917,847 |

| CTQ | Careteq Limited | 0.015 | 15% | 53,333 | $3,082,543 |

| AME | Alto Metals Limited | 0.038 | 15% | 537,496 | $23,810,265 |

Dusk Group (ASX:DSK) reports that sales surged during the last five weeks of the fiscal year following a website relaunch and a bunch of strategic initiatives appear to have paid off. 2H24, total sales were 5.8% lower on pcp, compared to a fall of 9.7% in 1H FY24.

DSK says sales run rate numbers continued to improve with unaudited sales growth of 0.4%, vs the same time last year.

The ‘specialty retailer of dusk-branded quality home fragrance products, at competitive prices’ told the ASX it’s likely got its groove back because of “diligen(ce) in maintaining gross margin through focused promotional activity and supply chain management.”

Other strategic initiatives being: “product rejuvenation and enhanced execution.”

The upshot is gross margins or FY24 are expected to be broadly in line with last year at 64.1%, despite headwinds from freight and distribution costs.

Meanwhile, Noronex (ASX:NRX) has risen on news it has entered into an Earn-in Agreement and Strategic Alliance with a wholly-owned subsidiary of South32 Ltd (South32) to accelerate copper exploration in Namibia.

The agreement means South32 has committed to fund A$15 million of exploration expenditure over five years at Noronex’s Humpback-Damara Project in Namibia, giving South32 the right to subscribe for a 60% interest in Noronex’s wholly owned subsidiary Noronex Exploration and Mining Company.

Miramar Resources (ASX:M2R), says it’s clocked up to 5.48% copper, 54.5% lead and 73.48g/t silver following the initial sampling program at its new Chain Pool project in the Gascoyne part of WA.

M2R executive chairman Allan Kelly reckons the Gascoyne region projects have the potential for all sorts of commodities but no-one’s had a really good look yet.

“For example, there has not been any modern and/or systematic exploration or drilling at the Joy Helen Prospect despite the presence of high-grade base metal mineralisation,” he said.

Macro Metals (ASX:M4M) owns a portfolio of multiple iron ore projects situated within the well-established Pilbara and Midwest regions of WA. One of its flagship exploration projects includes Goldsworthy East, where M4M’s field team has completed a mapping and sampling program, 100km east of Port Hedland, while they were on site demarking the area to be covered by the heritage survey, which completed today.

Arizona Lithium (ASX:AZL) has announced that it has been conditionally approved for an investment incentive of up to $21.6m under the Saskatchewan government’s Oil & Gas Processing Investment Incentive Program. The funds are provided as transferable royalty credits, and can be claimed at a rate of 20% in the first calendar year of operations, 30% in the second calendar year, and 50% in the third calendar year against government royalties.

Easing off this arvo, but still up is One Click Group (ASX:1CG) after the company hit the milestone of 150,000 users, with that figure representing a significant 57% on the same time last year.

1CG says it has seen a major uptick in users through the start of this years tax season, with around 1,000 users per day signing up for its One Click Life fintech platform.

Also making gains, Resouro Strategic Metals (ASX:RAU) which owns the Tiros rare earths elements (REE) and titanium project in the mineral-rich and pro-mining Minas Gerais state of Brazil.

While it is a Canadian-based exploration and development company, RAU kicked off trading on the ASX in June after raising $8m in a public offering.

Today, news is out that the stock has unveiled a maiden 1.7Bt at 3900ppm total rare earth oxide (TREO) for 1100ppm magnet rare earth oxides (MREO) and 12% titanium dioxide at Tiros.

Of the 1.7Bt, the deposit contains a high-grade domain of 120Mt at 9000 ppm TREO containing 2400 ppm of MREO and TiO2 of 23%, placing the Tiros project in the category of ‘one of the largest undeveloped titanium and rare earth resources globally’.

The combined measured and indicated resources represent 1Bt at 4050ppm TREO containing 1120 ppm MREO and 12% TiO.

“We consider that the average resource grades of 3900 ppm TREO 1100 ppm MREO and 12% of TiO2 are well above average for this style of deposit,” RAU CEO Chris Eager says.

“We have defined a very substantial resource over just 7% of the land area of the project.”

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ATH | Alterity Therap Ltd | 0.005 | -36% | 93,602,994 | $36,715,807 |

| APC | Aust Potash Ltd | 0.001 | -33% | 42,037 | $6,030,284 |

| BNL | Blue Star Helium Ltd | 0.005 | -29% | 186,596 | $13,614,197 |

| DOU | Douugh Limited | 0.003 | -25% | 26,975 | $4,328,276 |

| JAV | Javelin Minerals Ltd | 0.002 | -25% | 52,281 | $6,250,885 |

| RIE | Riedel Resources Ltd | 0.002 | -25% | 1,500,000 | $4,447,671 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | 1,010,757 | $1,929,431 |

| LGM | Legacy Minerals | 0.250 | -21% | 555,698 | $33,218,324 |

| ZLD | Zelira Therapeutics | 0.800 | -20% | 31,000 | $11,347,155 |

| BCT | Bluechiip Limited | 0.004 | -20% | 1,214,898 | $5,910,198 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 1 | $15,000,000 |

| MEL | Metgasco Ltd | 0.004 | -20% | 15,000 | $7,237,934 |

| ROG | Red Sky Energy. | 0.004 | -20% | 1,525,000 | $27,111,136 |

| REC | Rechargemetals | 0.025 | -19% | 168,170 | $4,330,389 |

| NOV | Novatti Group Ltd | 0.055 | -19% | 749,105 | $24,191,030 |

| AHK | Ark Mines Limited | 0.200 | -18% | 82,721 | $13,584,371 |

| AOA | Ausmon Resorces | 0.003 | -17% | 110 | $3,176,998 |

| AUK | Aumake Limited | 0.003 | -17% | 750,000 | $5,743,220 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 113,990 | $9,507,891 |

| BPP | Babylon Pump & Power | 0.005 | -17% | 1 | $14,997,294 |

| ID8 | Identitii Limited | 0.010 | -17% | 967,981 | $7,214,190 |

| PRX | Prodigy Gold NL | 0.003 | -17% | 620,002 | $6,353,323 |

| PLG | Pearlgullironlimited | 0.017 | -15% | 245,785 | $4,090,836 |

| AD1 | AD1 Holdings Limited | 0.006 | -14% | 709,000 | $6,290,539 |

Auking Mining (ASX:AKN) – pending an announcement regarding a proposed material acquisition of an exploration project and an associated capital raising.

AMA Group (ASX:AMA) – for the purposes of undertaking a proposed equity raising.

CuFe (ASX:CUF) has entered a binding agreement to acquire another exploration licence in one of WA’s critical mineral hotspots, expanding its position in the West Arunta to over 281km². Two prospective targets have already been identified through a review of 3D inversion modelling magnetic data.

HyTerra (ASX:HYT) has appointed former Shell chief scientist Dr Dirk Smit as its chief geophysicist. His expertise will be help guide the company’s white – or natural – hydrogen exploration efforts.

Iltani Resources (ASX:ILT) has defined an exploration target of 74-100Mt at 55-65g/t on a silver equivalent basis for its Orient West prospect in Queensland. This includes a high-grade core at an 80g/t AgEq cut-off of 20-24Mt at 110-120AgEq.

Legacy Minerals (ASX:LGM) regional rock chip sampling has identified new gold-silver prospects along a 30km strike at its Black Range project with assays of up to 1,440g/t silver and 2.06g/t gold.

Miramar Resources (ASX:M2R) has reported up to 5.48% copper, 54.5% lead and 73.48g/t silver from the initial sampling program at its new Chain Pool project in WA’s Gascoyne region. The area remains prospective for various commodities and deposit types including uranium and/or REE mineralisation – and potentially nickel-copper-PGE mineralisation.

MONEYME (ASX:MME) has priced a $178 million asset-backed securities (ABS) deal scheduled to settle today, July 18. This is the first public transaction that integrates assets from both MME and SocietyOne loans.

Neurotech (ASX:NTI) has reported additional positive secondary endpoint data analysis from its Phase 2/3 trial of autism spectrum disorder paediatric patients participating in its world-first broad-spectrum cannabinoid drug therapy NTI164.

QMines (ASX:QML) has found bonanza grade gold rock chip samples of up to 256g/t at the Cawarral and Mt Wheeler goldfield near its Mt Chalmers project in Queensland following a review of historical data.

Tesoro Gold (ASX:TSO) has received binding commitments to raise circa $9.7 million at 3c per share as it looks to advance the El Zorro Gold Project in Chile. Proceeds will be used to grow resources at the 1.3Moz Ternera deposit through exploration drilling, project studies and regional target generation.

Western Yilgarn (ASX:WYX) has completed auger geochemistry sampling over two prospects and a helicopter-borne versatile time domain electromagnetic (VTEM) survey at its Ida Holmes Junction project in WA’s Yilgarn Craton.

Portable XRF analysis of samples collected at Hells Gate and Ida Holmes Junction and a detailed interrogation of the airborne VTEM is currently underway.

This data will be used to validate the recently derived vandium-titanium and nickel-copper-PGE layered intrusive model at the Hells Gate prospect. Examples of this mineralisation style can be seen at Nebo-Babel, Windimurra and the Bushveld.

White Cliff Minerals’ (ASX:WCN) fieldwork has visually identified four large IOCG hydrothermal systems at Great Bear Lake. Groundwork at Spud Bay (north) has also identified widespread copper mineralisation along a new north-south structural corridor that can be traced for 450m.

At Stockhead, we tell it like it is. While Arizona Lithium, CuFe, HyTerra, Iltani Resources, Legacy Minerals, Miramar Resources, MONEYME, Neurotech, QMines, Tesoro Gold, Western Yilgarn and White Cliff Minerals are Stockhead advertisers, they did not sponsor this article.