Canada Unearthed: The 1990s – when brokers were dodgy, FOMO ruled, and explorers gained 1000pc in a month

Picture: Getty Images

- Relatively low interest rates, low inflation and rising corporate earnings led to global stock market boom in the 90s

- A mania in junior exploration investment also driven by 3 ‘discovery’ stories: Diamond Fields, Arequipa, Bre-X

- Junior stocks like Cartaway gained +1000% in less than a month, then lost it all

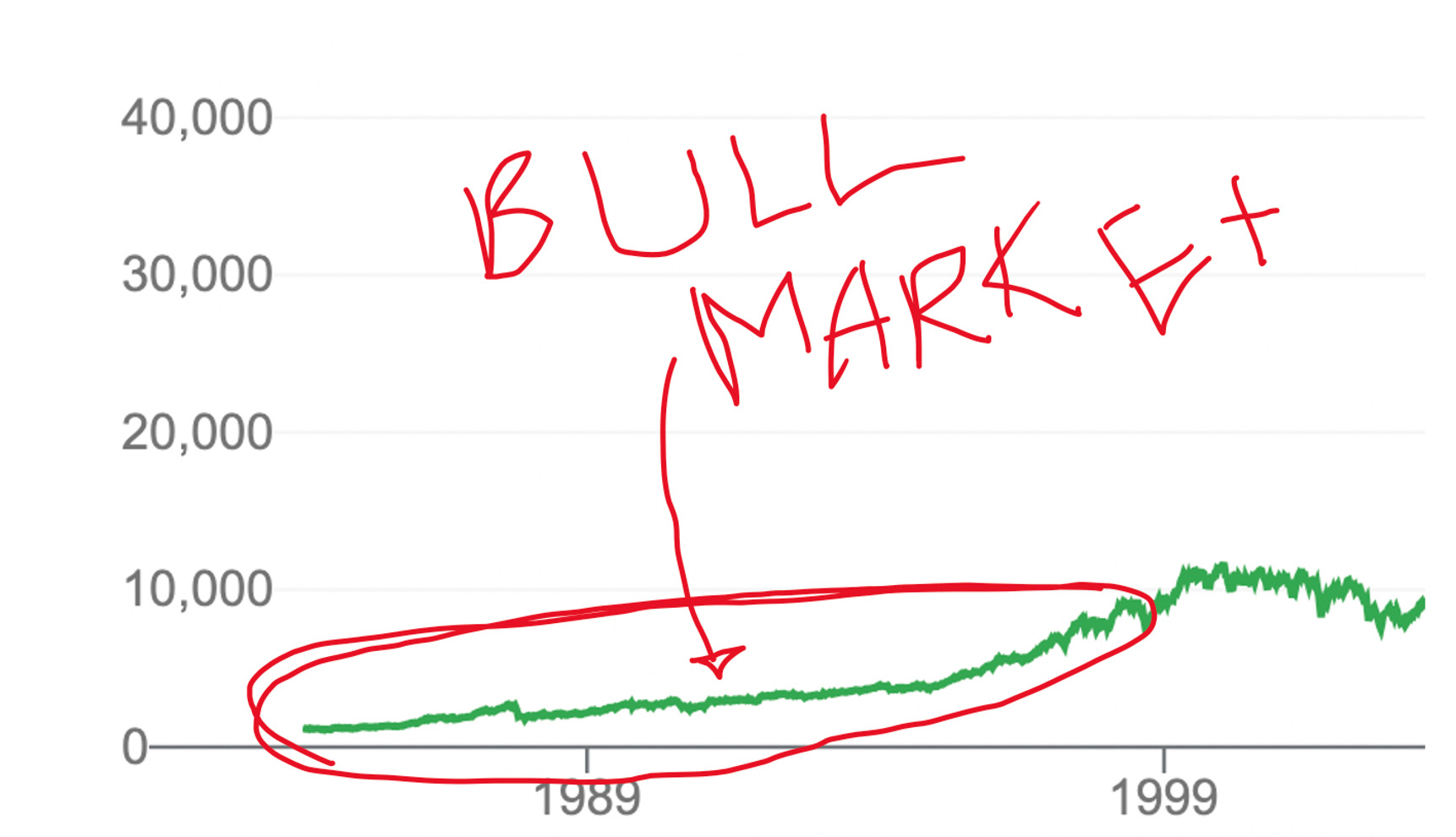

The global equities bull market prior to the October 1997 Asian Financial Crisis “was exceptional”, says the US Securities and Exchange Commission (SEC), “by almost any measure”.

“If August 1982 is used as a starting point, the [Dow Jones Industrial Average] DJIA had gained 963% when prices peaked on August 6, 1997,” writes the regulator in a October 1997 post-mortem.

“Indeed, the period from 1995 to 1997 represents the first time in history that the DJIA had experienced three back-to-back annual gains of over 20%.”

An environment of relatively low interest rates, coupled with indications of continuing low inflation and rising corporate earnings, sparked similar gains on the TSX, as measured by the S&P/TSX Composite index.

Adding fuel to the fire was a mania in junior exploration investment, arguably driven by three multi-billion dollar ‘discovery’ stories: Diamond Fields, Arequipa, and the now-infamous Bre-X.

A colossal nickel discovery by Robert Friedland-backed TSX speccy Diamond Fields Resources sparked a nearology rush to the Voisey’s Bay region of Canada.

It culminated in an April 1996 takeover of Diamond Fields by Inco (now Vale) worth US$4.5bn.

Great story. There’s even a book about it:

The Big Scorehttps://t.co/r4aYE2rOjR

“One of the most intriguing elements was the takeover battle for Diamond Fields that pitted the conservative management team at the world’s largest nickel company, Inco Ltd., against free-wheeling stock promoter Robert Friedland.”

— The Standard Model (@quasar_dn) July 26, 2020

In the same month, former penny stock Arequipa was bought out by Barrick Gold for CAD$1.1 billion on the strength of drill results from its Pierina gold deposit in Peru.

It stirred the junior investing cohort into a frenzy.

Then came Bre-X Minerals, which went from penny stock to peak at CAD$6bn in May 1996 when it reported it was sitting on a +70Moz gold deposit in East Kalimantan, Indonesia.

Bre-X turned out to be scam “without precedent in mining history”, and its failure in 1997 arguably brought a whole sector down with it.

During this era of crazy speculative mania and FOMO some people made fortunes, while others were left holding the bag.

Just check out this collection on junior mining charts from 1995-1997:

Off topic…Remember when resource stocks were on fire, and FOMO was real? Well, Cartaway stock pulled a 12x magic trick in a month – back in 1996! Will we see these markets again?

The of the : pic.twitter.com/0k6ATAa6Hx— DrillAlert X (@DrillAlertX) January 19, 2024

Wild stories, all of them.

The headline act was small garbage bin supplier turned Voisey Bay explorer Cartaway, which gained +1000% in a month — then lost it all just as quickly.

In 1995, a group of brokers at firm First Marathon bought control of Cartaway and vended in a group of Voisey Bay claims during the major staking rush sparked by Diamond Fields’ discovery.

On May 8, 1996, Cartaway announced that it had hit paydirt on the claims based on a visual inspection of drilling samples.

The share price jumped dramatically from the mid $2/sh range to $26, but soon fell below $1 when an analysis of the samples failed to confirm these findings.

First Marathon was subsequently fined $4m for dodgy dealings, but trading reports show that brokers Johnson and Hartvikson personally made more than $5.1 million by trading in Cartaway shares.

Pacific Amber Resources was one of the many Canadian explorers which flocked to Indonesia for some of that sweet Bre-X Minerals nearology.

As one Indonesian mining executive said: “All these Canadian companies have the idea that if Bre-X can find gold reserves, why can’t they find them also.”

Except Bre-X hadn’t found anything. Lead geologist Mike de Guzman was salting drill samples with bits of gold, and when found out allegedly committed suicide by ‘jumping’ out of a helicopter over Borneo.

The fraud took down an entire cohort of Indo explorers, with Pacific Amber Resources – which went from 20c to ~$9/sh at its peak — soon plunging back where it came from.

“The Vancouver Composite Index fell by over 25% in less than six weeks during spring 1997 as the junior mining sector collapsed,” write William Brown Jr and Richard Burdekin.

“We argue that this market collapse was triggered by the failure of Bre-X Minerals when that company’s Indonesian claims, previously believed to contain the world’s largest gold deposit, were shown to be pure fraud.”

The Brown Jr & Burdekin study, based on market returns for the Vancouver Composite Index and for a portfolio of 59 gold stocks, showed the effects of the Bre-X scandal to be both sizeable and significant.

There is also some evidence that smaller exploration companies were hardest hit.

“On March 20, 1997, just prior to the first reports that independent tests did not confirm Bre-X company claims, the Vancouver Composite Index stood at 1307.99,” they say.

“By May 5, 1997, when Strathcona Mining Services Ltd. — an independent consulting firm hired to assess the veracity of Bre-X’s findings — issued its final report concluding that the Bre-X claims were a fraud ‘without precedent in mining history’, the index had fallen to 1003.53.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.