The Secret Broker: When things are never quite what they seem

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Mrs Broker was messing around on Facebook the other day and she showed me something that someone had posted. It was a list of 20 images of packaging tricks that companies use to fool people into buying something that actually may not be true in their look or discription. Some are very subtle and some are just straight in your face.

Here’s one of our favourite samples from the post:

Outstanding. We had a real laugh at them – the full list is here.

Just before she was showing me all of this, I was reading more about the pickle that Lex Greensill has got himself into. I had written about him last year, as he was the kid from Bundaberg who had made good but the storm clouds have started to roll in and rumble right above Lex’s HQ.

As a farmer he would have welcomed them but as a financier no, no, no.

I called the article Bundaberg Run because if a company was using his services, nine times out of ten, they were in financial difficulties.

And now Lex is in the same trouble as some of his bankrupted ex-clients and is in the corner, on the ropes, with both hands tied behind his back, coping left and right hooks, one after another. I’m just waiting for Conor McGregor to step into the ring before calling the undertaker.

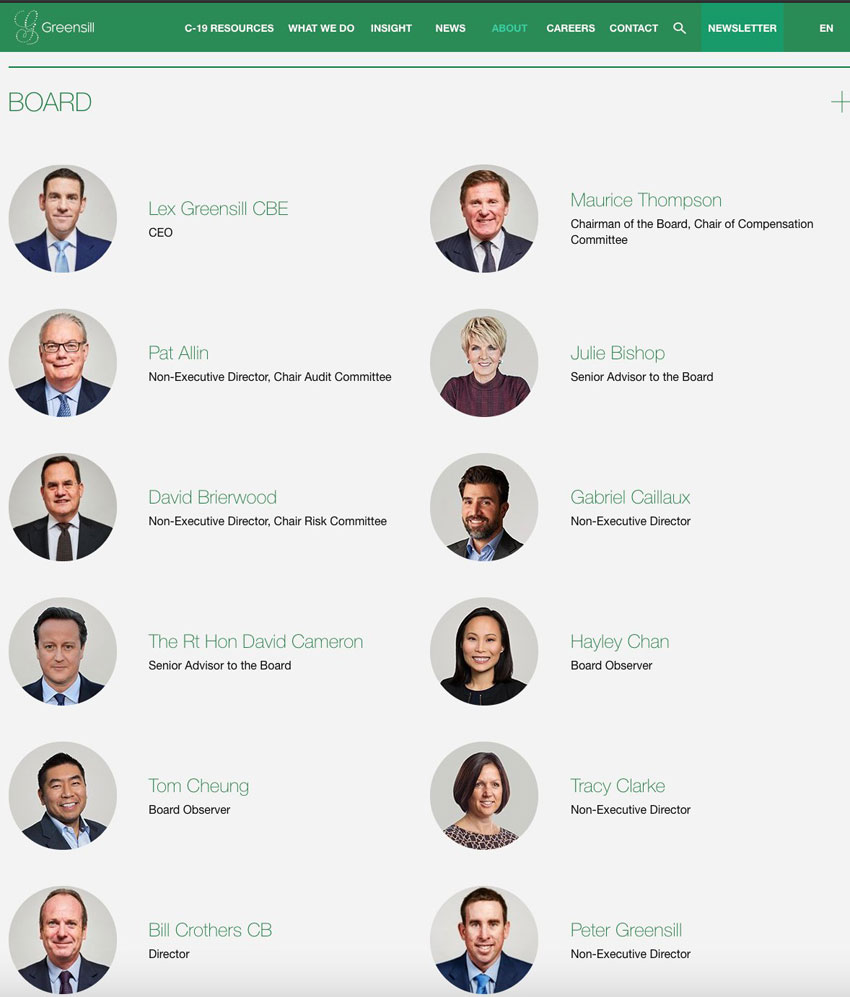

This is so bad that back at the HQ, that he has taken down the link to his board of directors and advisors. The link is here.

But do not fear, as I managed to capture a screenshot of them all:

And there you have it.

We used to always shy away from companies which employed ex MPs (as directors/consultants, it always ends in tears) and Lex has gone even further than most and managed to get an ex-British Prime Minister to pony up.

In 2014 Lex and the Rt Hon were waving at each other during a press conference as Lex was a consultant to his government and in true politician after death style, kindly returned the favour. This ex-Rt Hon was even mentioned in the Panama Papers scandal, so maybe that is where he can add his tuppence.

As for Julie, we don’t know what she can add but if you wish to also engage her this is her website, which is unsecure. Let’s hope she is not in charge of cybersecurity.

The knock on effect of Lex’s demise will ripple on for many months and years. Being an outlier banker when free reddit love and money is sloshing around, it’s all OK until the music stops.

This is going to hurt the Australian BNPL mob as they are going to see their margins squeezed from two sides.

Their cost of borrowings are going to rise on one side and on the other side the banks are starting to fight back.

Banks don’t care about competition as if you are successful, they will either buy you out or crush you by pulling your funding at the slightest whiff of trouble. The GFC taught us banks can’t fail… but wannabes can.

Lex was lining up an IPO, with Credit Suisse as advisors and also lenders via investment trusts, until a new head of banking came along and stomped on the party cake and candles for Lex and his motley crew.

Bang!

In one go, the revolving credit he was using was turned off, as no one was prepared to insure the losses he created anymore.

Going from a $7bn IPO to a $100m firesale in three months is pretty impressive, even by Australian standards.

On their website, all news articles and updates stopped in December 2020 and this article sums up the team’s pre-IPO mood.

By using Lex’s services, a company’s CFO could disguise the financial strain that they were under because of the accounting rules that applied to his magical financing.

The CFO could, in one go, wipe out old aged debtors, start to push out the date on outgoing payments, plus add cash to the balance sheet. As a balance sheet is only a snapshot of a company’s position, Lex’s services were only called upon to shore things up, as the time to produce the accounts loomed.

Again, if you were not an insider to all of this, it’s just like the packet of prawns. You would never know how the company’s financial situation was until you opened the packet and realise not all is as it would seem. Or that the contents were on the nose.

But wait, there’s more.

The British and Australian steel tycoon Sanjeev Gupta – to whom Greensill is his biggest funder – is the director of 150 UK-based companies and his father sits on the boards of 50 of them. That’s a lot of curry takeout and boardroom meetings to sit through and sign paperwork for in a year.

In my book, that many companies under one person always rings alarm bells and lots of magic circle book balancing and shuffling, so that no one can follow the paper and money trail.

The introduction of a legal register of Australian company directorships comes into force in the middle of this year, when each individual will receive an individual ID reference so we can trace their performance, past and present. It will be interesting how many Australian company boards he appears on.

No wonder he can’t remember what day it is.

"OH IT'S THURSDAY!" https://t.co/lMOFv6uH5F

— Robert Smith (@BondHack) March 4, 2021

Even Bundy Bear is feeling it, with more to come over the weekend.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.