The Secret Broker: Bundaberg Rum turns into Bundaberg Run!

Pic: DKosig / iStock / Getty Images Plus via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

The historic sugar cane city of Bundaberg is a four-hour drive north of Brisbane and the southernmost gateway to the Great Barrier Reef, or so an online travel guide tells me.

Never stayed there but have driven through there, past vast fields of sugar cane, and if they had been recently burnt off you could smell the sweet wafts of treacle syrup flowing through the air.

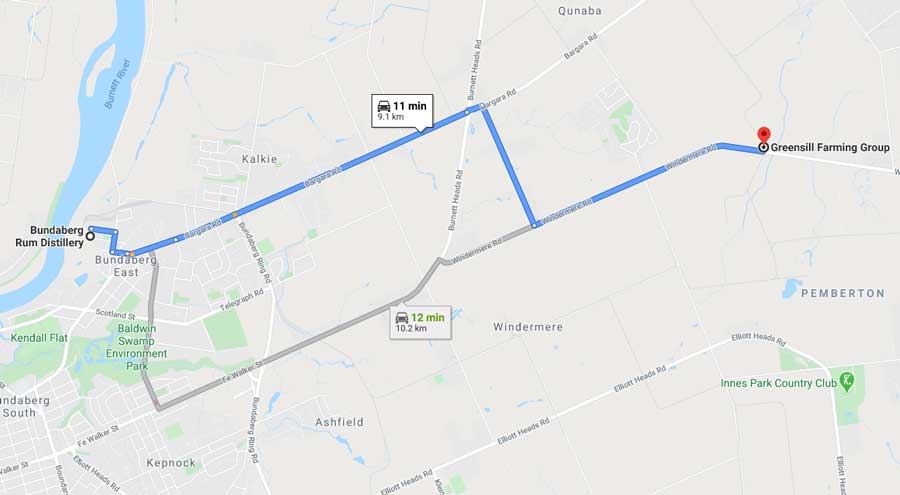

I remember visiting the Bundaberg Rum distillery in the 80s but don’t remember leaving it (now you are probably limited to one tasting thimble per visit).

One wise sugar cane farmer told all three of his sons, that he wanted them to become educated and find a career away from the farm, as he was never able to.

One of them took this advice by the (wether) horns and went and got himself educated and then started a career in the world of merchant banking. He ended up creating a business that spans the globe and generates billions of dollars a year in revenue.

BNPL for multinationals

What he created was a business model, (a bit like how the Buy Now, Pay Later works for a shop owner) but for multinational companies, that have a balance sheet chock full of material things that it has to finance, before selling.

It all started out brilliantly well and turned the cane farmers son into a billionaire, but recently things have started to go pear shaped. And just like the damage that sugar can do to a tooth, some rot has started to appear and some deep root canal therapy is needed to right the issue.

Lex Greensill, the cane farmer’s son from Bundaberg, set up Greensill Capital in 2011 as a solution for businesses and to finance some of the unavoidable costs involved when carrying out their business.

It works very well for everyone involved unless a company uses his method as a way of shoring up a damaged, and on life support, balance sheet.

Then things started to unfold in ways which are now causing more than just a few teeth to fall out.

What Lex does, is he arranges finance for a company and then takes over their billing payments as a way to repay his finance.

Whatever arrangements are made between the parties is then bundled up and put into a bond and sold off to professional investors.

The billing payments cover off the repayment of the bond plus some interest, and for this service Lex generates a very handsome commission and gets to constantly roll over his capital.

Brilliant stuff.

The big telco loving it

Telstra used his services to help fund their purchase of new iPhones ahead of Apple launching them in Australia.

Under Telstra’s model, they would bundle a new iPhone with a phone plan and the end user would sign up for a two-year contract, that included monthly payments to pay off their iPhone purchase.

So, if Telstra needed 100,000 iPhones worth $1,000 each, they would have $100m tied up and this was then drip fed back to them every month over the next two years. This is where Lex stepped in and helped their cashflow.

He gave Telstra the $100m (less his fees) and took over the billing of their customers, taking the phone finance portion before passing on the balance to Telstra. He then bundled all of this up and created a $100m bond and got his money back.

This bond was then listed and on sold to professional buyers with the knowledge that they got a priority payment ahead of Telstra, and with Telstra being an A-rated company they felt safe and secure.

Now, this is where it gets really interesting.

As Telstra had paid for the iPhones and Lex had now paid them back their $100m (less fees) for the same iPhones, where should that payment have been shown on Telstra’s balance sheet?

They were still liable for a customer defaulting but now had nearly all their cash outlay back into their bank account.

So, they paid out $100m for iPhones, then got back say $85m in cash and enjoyed the same cash flow, for providing the exact same telco services and only a 15 per cent outlay required.

At some point in 2019, Telstra was using $600m of Greensill’s money in this way.

‘Crack Cocaine Financing’

This explosion of financing by Telstra and other companies earnt the nickname of ‘Crack Cocaine Financing’, as it became so addictive to company CFOs as a way of filling balance sheet gaps or earning a bonus for coming up with this clever bit of financial engineering.

If they then used that cash as working capital and they were a company that was losing money, they would be able to keep the doors open for longer than under their previous financing model.

Only Greensill Capital knew who their clients were and how much exposure was involved, until that is, some got into financial strife.

It was how Lex’s money was handled in the company’s accounts that has become everyone’s problem.

This was a new way of solving finance issues and as Lex got his money back by selling the bonds, it was left to the company on how they handled their side of the transaction.

The UK’s Financial Times has been very critical of Greensill Capital recently and has been writing about some of their clients and their current situations.

Three international clients — NMC Health, BrightHouse and Agritrade — have all managed to blow themselves up. Meanwhile, Softbank, which invested over $2bn into Greensill Capital, has been accused of pushing some of those funds towards some of the companies that they are already shareholders in.

Major political ties

Ex-British Prime Minister David Cameron is listed as an advisor, and one very prominent UK fund manager got sacked after a whistle-blower exposed him as being too close.

So close, that in one issue of a Greensill bond, his fund took 100 per cent of the issue, which was against the funds charter.

All of this mayhem and financial power coming from a normal kid from Bundaberg is refreshingly interesting enough to follow from the comfort of an armchair and is worthy of a subscription to the FT, just to follow the shenanigans of all of these goings on.

And as Greensill will extend more than $US225bn ($316bn) to companies in 165 countries in 2020, it’s time to strap yourself in.

Now, if you happen to be at a presentation and the CFO is sipping on a ‘Bundy and Coke’ at the after party, or you see or hear the term ‘Reverse Factoring’ mentioned, allow the same natural reactions that you would incur, when coming across a polar bear in the wild – panic and run!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.