The Secret Broker: The next revolution is on its way

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

This COVID-19 lurgy thing has managed to expose a few industry models that have been idling along quite nicely thank you very much, until now.

They have been shown to have old outdated models and guardians at the gates who have been hanging around too long, clinging to the teat of milk and honey.

The first one that comes to mind, that you would not have associated with the virus until someone pointed it out to you, is the creaking old electricity generating model.

What has happened over in the UK is that demand has collapsed.

While everyone has been sitting at home, fiddling with their Zoom dashboard icons and getting their background bookshelf filled up with intelligent looking titles, UK heavy industry factories have been shuttered, and with this the demand for energy has completely fallen off the cliff.

For the first time in 200 years in the UK, not one burning of a lump of coal was required to satisfy the nation’s energy needs.

This did not last for just one day but it went on for 60 days in a row. Something that the Greenies have been trying to achieve has actually happened because of COVID and not some emission target signed off on 10 years earlier.

Who will now want to fund the building of new coal fired power stations, with their 30-to-40 year payback schedule, when you can basically harness the same energy for (almost) free?

The UK’s investment in windfarms, solar and energy efficient battery storage seems to have paid off, whereas in Australia — where the sun shines more than most other countries — the politicians still have to fly the coal export banner because of the income generated and jobs involved.

Just look at this as a pointer to any coal-based investments that you may hold.

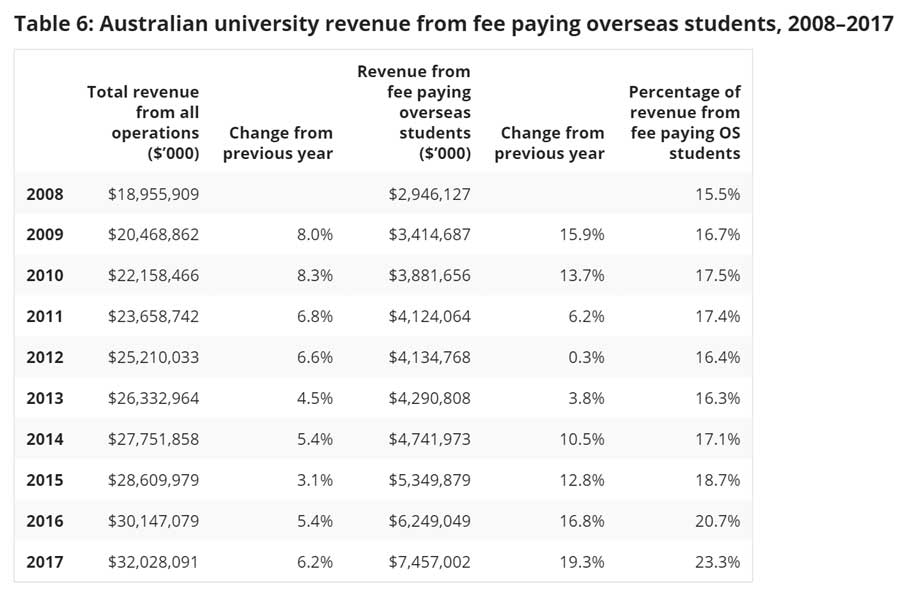

The other industry ripe for a real COVID slap is university education, and some of the numbers that have become exposed due to their income smash are just mind boggling.

A good example is Adelaide University. In 2018, they had an income of over $900m and produced a surplus of under $15m.

Can you imagine bringing in that kind of money and just stumbling across the year-end finish line at barely breakeven?

Each of their Chinese students paid around $60,000 and represented 40 per cent of all the students that enrolled. This brought in $270m.

If they had a ratio of one lecturer for every 50 students, they would need 86 of them and even if you paid them $200,000 a year each, it would come to just $17m. No one has ever worried about where all the money had gone, until now.

Someone somewhere is getting very fat from all of the rorts that must be going on.

We always knew that these academic types had no concept of how the real world works as shown here is this tweet of an economics professor demonstrating how to open a carton of milk.

And now, an econ professor opens a carton of milk… pic.twitter.com/8S8BWlYmtt

— Rudy Havenstein A Mind Is A Terrible Thing To Lose (@RudyHavenstein) June 9, 2020

The Apples and the Googles of the world will be looking at these numbers and salivating at the rorting that has been going on.

If Google is looking to employ certain kinds of skills, then they could offer courses that match their criteria and guarantee a job at the end via their own university.

Apple could do the same, but somehow I don’t feel a Facebook or Twitter degree would look good on anyone’s CV.

The university system over here has pushed through 2.7 million Australians and has collectively earned $54bn, which the government has funded and passed on in HECS loans.

And now, I feel sorry for all the ones who have been forced to start and finish their degrees online.

Not only will they start out their working life in debt, they have become stuck in their bedroom with mummy bringing in cups of tea and toasted sandwiches and have managed to miss out on all the fun of meeting new people, discovering new loves and all those drinking games that come with the rite of passage of living on campus.

Now who wants to start an online university with me, where we can allow a Chinese student to come and live over here for three years, in a little dorm with a computer and internet connection and we could pocket the $270m in fees ourselves?

Maybe Alan Bond was ahead of his time!

Who knows?

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

READ MORE from The Secret Broker:

Zip-a-Dee-Doo-Dah, Zip-a-Dee-ay

Noughts and Crosses

How to become a professional poker player!

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.