The Secret Broker: Zip-a-Dee-Doo-Dah, Zip-a-Dee-ay

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

If you are out and about and enjoying some post coronavirus lockdown freedom and you happen to hear someone singing or whistling the tune to ‘Zip-a-dee-doo-dah, zip-a-dee-ay, my, oh, my, what a wonderful day’, then you are probably socially distancing yourself from a happily hodling (sic) shareholder in the listed company Zip Pay (ASX:Z1P).

The company Z1P, has just this week completed a cracker of a deal, that was extremely well organised and thought out, just like Scotty’s masterstroke in eventually shutting down Australia’s borders.

I have to take my hat off to the managers and advisors of the deal, as it was something of a masterpiece in its organisation and execution and well worthy of recording it in an article.

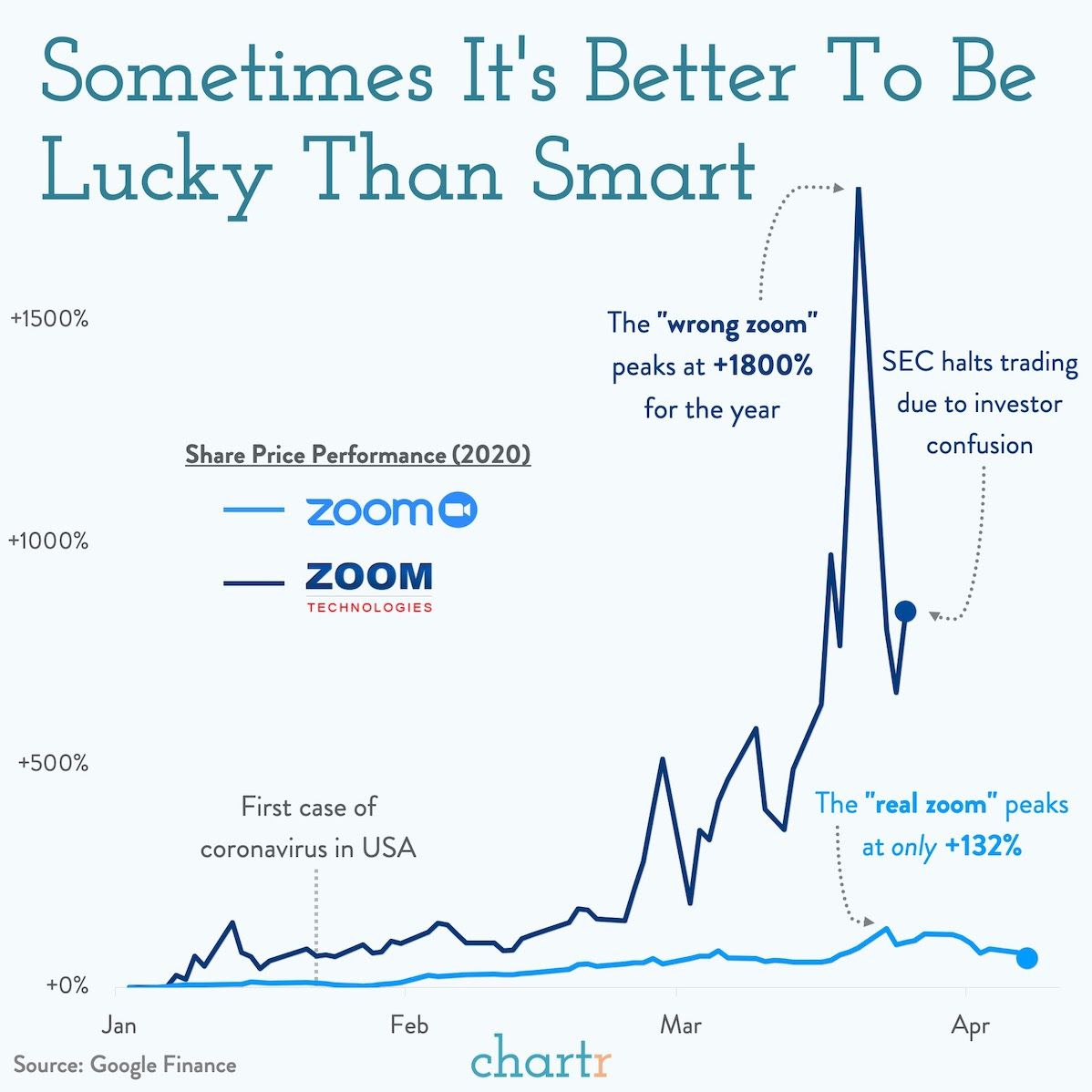

Luckily for market players, the other ASX company of almost the same ticker (ASX:ZIP) is suspended. So there was no chance in buying the wrong stock, unlike over in America, where the stock Zoom went on a rampant run, even though it had nothing to do with the Zoom video conferencing software company, other than sharing the same name.

The wrong stock went up 1800 per cent before the SEC stepped in and halted the trading in the wrong stock, with the correct stock only going up 132 per cent in the same timeframe.

The company over here with the wrong ticker of ZIP and not Z1P, is Ziptel Ltd, a past market darling who has now ended up abandoned, unloved and all alone and on the wrong side of the tracks.

The all-time high of the wrong ZIP is $1.14, compared to their current suspension price of 1.7c. Whereas, the right Z1P has an all-time low of 4c (June 2014) and an all-time high of $6.79 (June 2020).

A lucky escape for some of our newly arrived and wet behind the ears day traders, me thinks.

The correct company is part of the ASX Buy Now, Pay Later (BNPL) rat pack, who have all enjoyed some spectacular returns, with the USA being their Holy Grail, even though the short-term riots have opened up a new reversal and short-term segment called (LNSL) or Loot Now, Sell Later!

What the directors of Zip Co have managed to put together is a deal that fulfils their Holy Grail ambitions, plus the potential to bank $200m in expansion capital at a 50 per cent premium to their pre deal share price.

On top of this they have acquired some IP, which takes a new offering to their target demographic, with something which no one else in this sector can currently do.

This little bit of IP, tucked away in their announcement, allows any merchant in the world (online or off line) to become part of their network, without even knowing it or needing to be directly signed up.

The clever founders of the company that Z1P are acquiring, have created a system that allows its 1.5 million millennium customers to pay for anything they choose on a four-week interest free payment plan, at any shop they happen to choose.

They are able to do this as they are the pioneers behind something called a Virtual Credit Card (VCC) and this bit of technology allows for its customers to choose at the time of checkout a direct and normal payment or a four-week interest free payment schedule.

Each customer has a pre-worked out spending limit, so when they do pay for something, the Virtual Credit Card seamlessly comes into play.

The credit card details swapped between the buyer and seller are electronically created on the fly and last for only three seconds.

This little step is how a Z1P client can get to choose their preferred option and then tap and pay in the normal way. If the customer chooses to pay in a normal way, then the Virtual Credit Card is directed to debit their normal bank account/credit/debit card.

However, if they choose to pay over four-weeks, then the payment is debited out of the Z1P account and nothing is physically debited out of their traditional bank account/credit/debit card.

If you think of Flight Centre, when you walk in to buy a trip on a Qantas flight for $6,000, you pay Flight Centre the $6,000 and they pay Qantas directly an amount less their commission. So say they pay $5,800, then the $200 becomes net income before expenses etc.

The technical term for the $6,000 payment is Total Transaction Value or TTV.

When you take this step into account you get to appreciate how the founders managed to create a TTV of $900m, with a staff count of only 91 people needed to service a customer base of 1.5 million people and create a net income of $70m, before expenses.

These types of facts and figure ratios are something that I love to hone into.

91 employees bringing in a (TTV) average of $9.8m each is just orgasmic to the bits of my brain that still control the remaining and non-abused ‘little grey stockbroking experienced cells’ (as Poirot would say).

Now compare the $23.7bn TTV produced in the 2019 full year by Flight Centre with a total head count of 20,000 employees and they produce an average TTV of $118,500.

So, the combined Z1P group going forward will have 468 employees, 3.5 million customers, a TTV of $2.975bn and a net income before expenses of $250m, with an average TTV of $6.3m each.

Now, who is going to join me in doing the conga to ‘Zip-a-dee-doo-dah,’ upon all of this being voted through at their next meeting?

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

READ MORE from The Secret Broker:

Noughts and Crosses

How to become a professional poker player!

Ch-ch-ch-ch-changes

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.