Thred still hasn’t seen any cash from the sale of its only asset

Pic: gorodenkoff / iStock / Getty Images Plus via Getty Images

Believe it or not, Thred actually made some money in the last six months — but not apparently from the sale of its only asset in September.

The company (ASX:THD) made $5453 in sales revenue in the last six months, a whole $5453 more than it did in the same period in 2017.

The rest came from interest payments on the $2.4m in cash it has left.

The asset-less company is now looking for yet another project to spend its pile of cash on, and the board gave itself a six month deadline to do so.

That means they have to come up with a new project by the end of April.

12 months from start to sale

Thred tried and failed to be a social media tech company before a 12 month stint seeing if augmented reality might work out — it didn’t because they sold that, the “core business” Sweep app, in September.

They sold it to a 20 per cent-owned subsidiary called Artech for $550,000 plus expenses of about $160,000, to be paid over three tranches to start “on completion” of the deal.

It’s not clear if the deal has completed, four months after it was announced and two months after it was approved by shareholders at the end of November.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Artech is chaired by former Thred director Robyn Foyster, who is also the principal shareholder in the Artech subsidiary set up to hold the Sweep business.

Other major shareholders in Artech include Thred company secretary Damon Sweeny, corporate advisor Rob Antulov, and a company associated with Jason Peterson, a director of Perth-based financial services firm CPS Capital Group.

CPS has a major stake in Thred after underwriting a $2.4m capital raising that was sorely under-supported in April last year.

It is the source of the $2.4m in cash on Thred’s full year books.

Stockhead is seeking comment from both Thred and Artech.

Never really got anything going

Thred’s efforts to get an augmented reality app off the ground never really worked out.

It underwent a capital reorganisation in mid-2016, when it transitioned from base metals to online messaging.

They tried to sell a Schoolies app last summer to third parties, featuring sponsored venues, in-app purchases and sponsored posts via its Agent Reality brand.

They thought about a blockchain-backed version, so uni students could win rewards during orientation weeks and they even managed to sign up Vivid, the company that runs Sydney’s light show, as a partner.

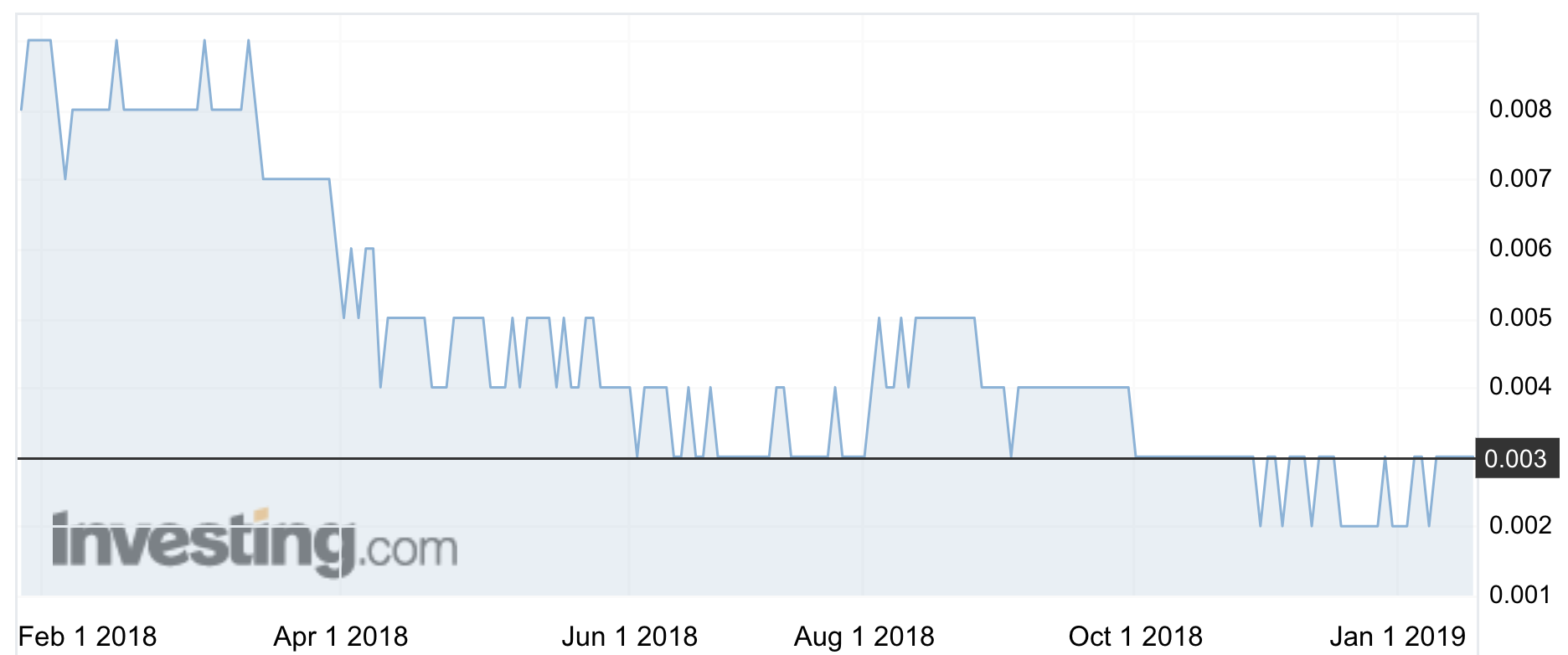

Thred shares were flat at 0.3c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.